Here's a comparison between Minority Discount and Control Premium:

Table Of Contents

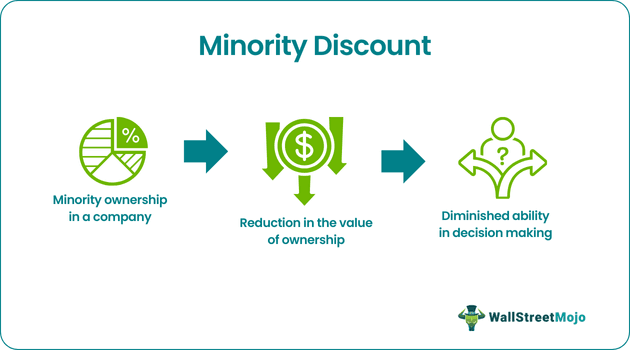

A minority discount is a reduction in the value of an ownership interest in a company or asset held by a minority shareholder or partner. It aims to account for the limited control and decision-making power associated with minority ownership positions. It recognizes that minority shareholders have less influence over strategic decisions, management appointments, and other critical corporate actions.

By applying a minority discount, the valuation acknowledges the diminished ability of minority shareholders to shape the company's operations, policies, and direction. It recognizes their influence and impact on day-to-day business. It also considers the reduced marketability and liquidity of minority ownership interests. The aim is to acknowledge that minority shareholders may face challenges finding buyers for their shares and may have difficulty in transferability.

Key Takeaways

A minority discount reduces the value of a minority ownership stake in a company or asset. Imagine someone owns a small portion of a company, let's say 10%, while another person holds the remaining 90%. The minority owner has less control and influence over important decisions than the majority owner. This lack of control makes the first person's ownership stake less valuable.

To account for this reduced value, a minority discount is applicable while determining the worth of the ownership stake. The discount represents the hypothetical reduction in value due to the limited control and influence as a minority shareholder. It is a way to reflect the fact that majority owners have more power and can make important decisions that may affect the company's future.

The concept gained prominence as financial professionals sought to determine the fair value of company ownership interests. The idea originated from observations that buyers would typically pay less for minority stakes because of the limited control associated with them.

Different methods and approaches assess the magnitude of the minority discount. These methods consider various factors, such as the company's financial performance, market conditions, industry norms, and the rights granted to minority shareholders by the company's governing documents.

Here are some critical considerations while applying a minority discount:

While there is no standardized formula, here are some common approaches and methodologies used by valuation professionals to estimate the minority discount:

Let us understand it with the help of examples:

Imagine a fictional company called ABC Corp, where the majority shareholder owns 80% of the company, and a minority shareholder owns the remaining 20%. Due to the control and influence associated with the minority position, a minority discount is applicable to determine the value of the minority stake. If the fair market value of the entire company is $10 million, the minority discount could be at 20%, resulting in a valuation of the minority stake at $2 million (20% of $10 million minus the discount of 20%).

One notable real-world example involving a minority discount is the case of Dell Inc. In 2013, Michael Dell, the company's founder, and CEO, proposed a plan to take the company private. To do so, he needed to buy out the minority shareholders. The company's valuation was a contention, as the minority shareholders argued that the initial offer undervalued their stake.

The court-appointed independent appraiser determined the company's fair value and applied a minority discount to reflect the limited control and lack of marketability associated with the minority shares. The application of the minority discount played a significant role in determining the final value paid to the minority shareholders in the buyout transaction.