Table Of Contents

What Is A Minimum Variance Portfolio?

A minimum variance portfolio is an investing strategy that uses diversification to minimize risk and maximize profits. The investor combines stock holdings in such a manner that the price volatility of the entire portfolio is brought down.

Volatility refers to the price movement of an investment. In this method, high-risk stocks complement each other but do not correlate. That is, investors deliberately pick securities from a variety of sectors. As a result, massive loss in one particular sector will not affect minimum variance stock bundles in an effective manner.

Table of contents

- What is Minimum Variance Portfolio?

- A minimum variance portfolio is an investing technique that combines high-risk stocks to offset each other. Ultimately the volatility of the entire portfolio is brought down.

- This approach is influenced by the modern portfolio theory given by Harry Markowitz. In 1952. Markowitz stated that portfolio variance could be minimized if stocks are selected using negative correlation.

- If the correlation between assets within a portfolio is less, variance is also less. Here, variance refers to price movement.

- The minimum variance method considers the investment weight and the variance of each investment.

Minimum Variance Portfolio Explained

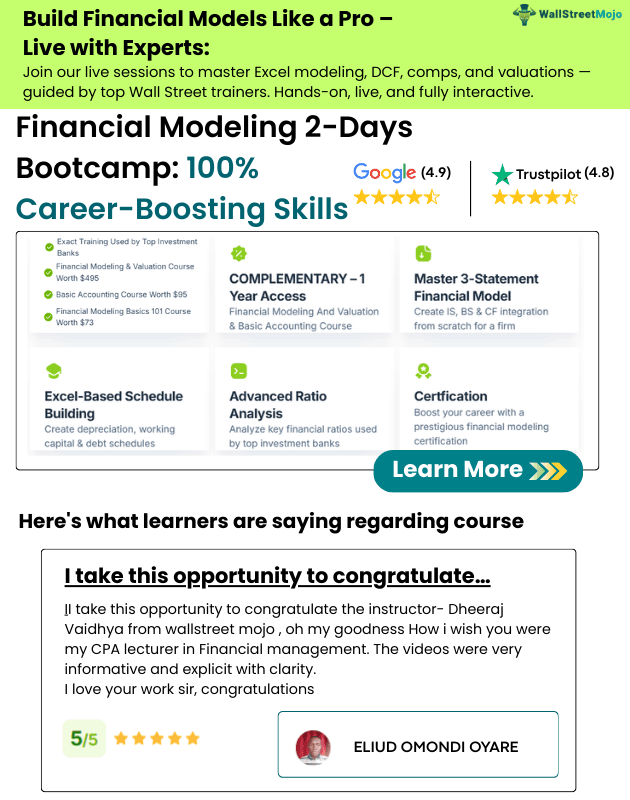

The minimum variance portfolio minimizes investment risks and maximizes returns. In this method, investors determine the variance to reduce the portfolio's volatility. Therefore, to ensure minimum variance, investors diversify their investments.

A competent investor might already have taken calculated measures to ensure good returns. Even so, volatility associated with market risks cannot be eliminated. For example, in a regular portfolio, multiple securities are prone to high volatility. In such a scenario, the minimum variance approach combines the risky securities to derive the variance of the securities bundle. Simply put, variance refers to price movement.

A diversified portfolio comprises stocks from different sectors and companies of different sizes. The stock market presents two types of risks—systemic and specific risks (unsystematic). Systemic risks affect all sectors; hence, they are inevitable. But, a diversification strategy can significantly reduce unsystematic risks.

If a portfolio has a high variance, the likelihood of facing a massive loss in the foreseeable future is increased. Therefore, variance is used as a metric to judge portfolios.

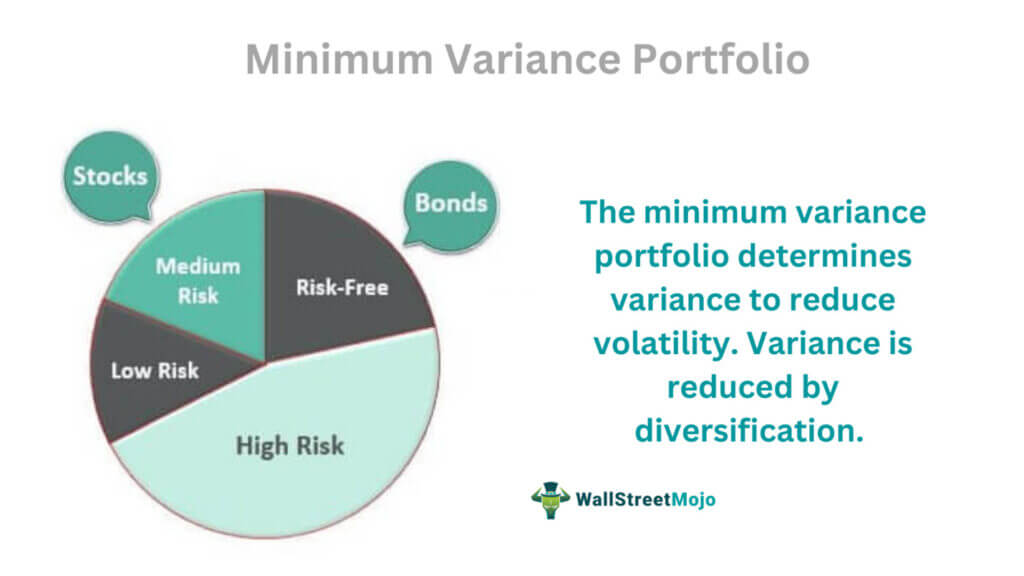

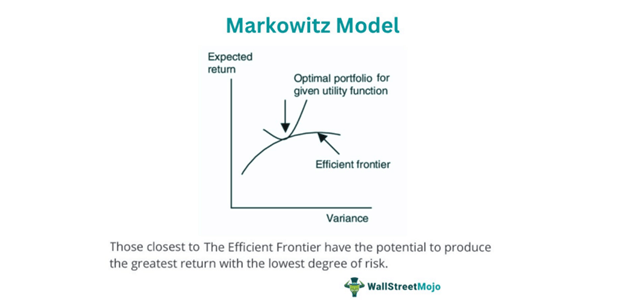

The modern portfolio theory, given by Harry Markowitz, influenced the low variance approach in 1952. Markowitz was an American economist. He stated that portfolio variance could be minimized if stocks are selected using a negative correlation. If the correlation between assets within a portfolio is less, variance is also less.

For example, the correlation is high if an investor holds a portfolio of 30 different technology stocks. Instead, the correlation is less if an investor possesses a 30-stock portfolio covering a range of industries, bonds, and real estate.

In the minimum variance approach, investors combine diversification with hedging. Hedging is an investment strategy that protects traders against potential losses due to unforeseen price fluctuations.

To hedge risks, investors hold stock in one financial market and then take another position in a different market to offset potential losses caused by the first position. To hedge risks traders invest in stocks, derivatives, swaps, options, futures contracts, and ETFs.

Formula

Portfolio variance is computed as the collective weightage of individual variances associated with each underlying security. Each variance is further adjusted with its covariance. Ultimately, investors ensure that overall portfolio variance is lower than the weighted average of individual variances.

The minimum variance portfolio formula is as follows

Minimum Variance Portfolio = W12σ12 + W22σ22 + 2W1W2Cov1,2

Here,

- W1 - First asset's portfolio weight.

- W2 - Second asset's portfolio weight.

- σ1- First asset's standard deviation.

- σ2 - Second asset's standard deviation.

- Cov1,2 - The covariance of the two assets, expressed as p (1,2) σ1σ2.

Further, p (1,2) represents the correlation coefficient between the two assets.

Calculation Example

Let us look at a minimum variance portfolio example to understand the method better.

Louis has a portfolio of two stocks. One is worth $45000, and the other is worth $90000. The first stock has a standard deviation of 18%; the second stock has a standard deviation of 9%.

If the correlation between the stocks is 0.72, the portfolio weightage of the first and second stocks is 33.3% and 66.7%.

Now, to calculate minimum variance, we apply the given values to the formula:

- Minimum Variance = W12σ12 + W22σ22 + 2W1W2Cov1,2

- Minimum Variance = (33.3%2 x 18%2) + (66.7%2 x 9%2) + (2 x 33.3% x 18% x 66.7% x 9% x 0.72)

- Minimum Variance = 0.012 or 1.2%

Thus, Louis’ portfolio exhibits a variance of 1.2%.

Minimum Variance Portfolio vs Tangency Portfolio

Let us look at minimum variance portfolio vs tangency portfolio comparisons to distinguish between the two.

- The minimum variance approach is based on the variance percentage. In contrast, the tangency portfolio relies on the Sharpe ratio.

- Using standard deviation, the diversified portfolio includes assets with the lowest variance levels. In comparison, the tangency portfolio chooses assets with the highest Sharpe ratio.

- The minimum variance method is simple. In contrast, compiling a tangency portfolio is a complex process.

Advantages And Disadvantages

The advantages are as follows:

- The portfolio becomes resistant to systematic risk. As a result, underperforming and high-risk assets (concerning returns) can be scrutinized and replaced.

- Diversification helps investors understand different sectors.

- Such portfolios suit both long-term wealth creation and short-term profits.

- A variety of financial instruments fit this investment strategy.

The disadvantages are as follows:

- It is more inclined towards variance and tends to overlook potential risks.

- It does not guarantee good returns and is only based on historical data. Moreover, this method is too reliant on past performances. As a result, investors overlook new factors that significantly affect asset prices.

- The minimum variance method does not account for associated costs like broker commissions, taxes, and other charges.

Frequently Asked Questions (FAQs)

How do you find the minimum variance of a portfolio?

To determine the variance of a portfolio, we multiply each security's squared weights and then add twice the weighted average. Finally, the result is multiplied by the covariance of all individual security pairs.

How do you calculate the minimum variance for a portfolio of two assets?

The formula for minimum variance remains the same. To calculate, investors can add or reduce the number of assets:

Minimum Variance = W12σ12 + W22σ22 + 2W1W2Cov1,2

What is a minimum variance efficient portfolio?

It refers to the portfolio with the lowest possible variance (also referred to as standard deviation) compared to other riskier portfolios. A healthy portfolio reduces variance as much as possible. Thus, risks are also minimal.