Table Of Contents

What Is Mileage Tax Deduction?

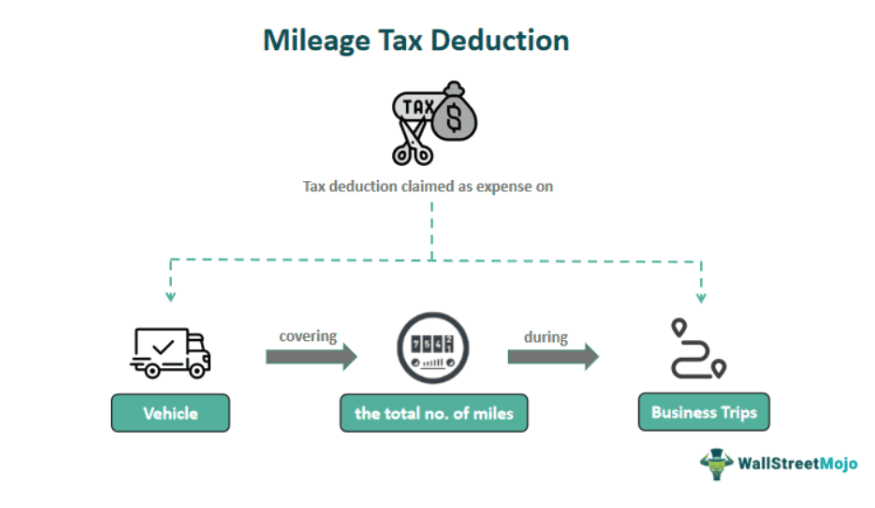

Mileage Tax Deduction is a tax incentive available to taxpayers in the United States through which they can claim a deduction on the expenditure a business incurs on operating vehicles for business purposes. This is computed using the miles covered by such vehicles purely for business. It acts as a tax relief to entities and promotes commerce in the US.

The car mileage tax deduction was introduced in the early 1900s in the US. Mileage was originally recorded only to track vehicle operating expenses a company incurred for business. The introduction of this rule provided a special tax incentive to vehicle owners, resulting in tax savings for the business. Individuals must maintain accurate accounting records to claim this deduction since business mileage tax deduction is governed by certain transportation rules.

Key Takeaways

- The mileage tax deduction is a tax benefit offered by the US government where individuals using vehicles for business purposes can claim a deduction on the business mileage covered.

- If individuals use the same vehicle for business and personal travel, they will be required to separate the business mileage from personal use before computing the mileage deduction.

- The Standard Mileage Rate and Actual Expenses Method are the two methods used to calculate the deduction amounts.

- If the standard mileage rate is applied, individual costs of operating, running, and maintaining a vehicle cannot be claimed separately. They can only be added and claimed separately under the actual expenses method.

How Does Mileage Tax Deduction Work?

Mileage Tax Deduction is a tax benefit available on vehicles used by businesses in the US. For this, they calculate the mileage covered by the vehicles when used exclusively for business purposes. Maintaining accurate records is of great importance if individuals wish to claim mileage deductions on their vehicles.

If a common vehicle is used for business and personal work, individuals must identify and specify mileage applicable to business use before calculating the deduction amount. A mileage tracker or mileage logbook for work can help in such cases. Based on this calculation, they can claim a certain percentage of the deduction from the total taxes payable.

Certain computation methods have been defined for calculating the business mileage deduction amount. It is important to correctly calculate the amount to claim a mileage tax deduction. There are two methods, namely, Standard Mileage Rate and Actual Expenses Method.

These methods help determine the rate applicable for a particular business activity. Each method helps determine the maximum deductible amount a business can claim. Let us study them.

#1 - Standard Mileage Rate

The Standard Mileage Rate is fixed by the Internal Revenue Service (IRS). It is calculated by multiplying business miles with the mileage tax deduction rate.

Mileage Tax Deduction = Total miles covered X Applicable/current standard mileage rate

The amount so obtained can now be deducted from the tax payable by a business. This rate is updated yearly.

It is based on the expenses a business is expected to incur, given the cost of gas, insurance, repairs, depreciation, and other expenses. However, if an individual has already applied for this deduction, they are not allowed to calculate these costs separately. If they do, they cannot take the federal mileage tax deduction.

The standard mileage rate for mileage tax deduction 2023 is 65.5 cents per mile.

#2 - Actual Expenses Method

This method takes actual costs incurred while driving the vehicle into account. It includes gas, maintenance charges, depreciation, oil, toll charges, parking expenses, etc. To claim deduction under this method, business owners must keep accurate records of each expense and add them up to arrive at the final cost of operating a vehicle for business purposes.

Since this method considers each expense individually, it typically offers a larger deduction than the standard mileage rate method. To compute the claim amount, individuals or entities must divide the total cost by the total miles covered by the given vehicle for business.

Mileage Tax Deduction = Total cost / Total business miles

Rules

Individuals can claim car mileage tax deductions based on certain rules stipulated by the IRS. These rules, taxpayer eligibility, and other requirements have been discussed below.

#1 - Taxpayer category and eligibility

Before the Tax Cuts and Jobs Act (TCJA) of 2017, the federal government allowed employees to make claims on mileage and associated expenses. They could deduct unreimbursed business expenses, including mileage, from their taxable income.

However, this act was abolished later. Hence, employees using their vehicles for business purposes were no longer eligible for this deduction. Today, the deduction is available only to certain categories of taxpayers. These include:

- Business owners

- Self-employed individuals

- Charitable trusts

- Medical-owned businesses

- Other employees such as individuals employed in the US Armed Forces, performing artists, government officials, etc.

However, these entities must use vehicles as their primary transport medium for business if they wish to claim this deduction.

#2 - Requirements

An individual who wishes to claim mileage deduction on their business mileage must fulfill the following conditions:

- They must be a US taxpayer using a vehicle for business purposes.

- They must prove that the mileage recorded on their vehicle was for business only; personal travel or transportation is not allowed. Also, they must be able to validate that the business trip/s took place in the vehicle for which they wish to claim a mileage deduction. For this, toll and parking receipts are useful.

- They are required to select a method of computing deduction (from those mentioned above).

How To Claim?

The reporting system and the steps involved in claiming the mileage tax deduction are as follows:

#1 - Record-keeping

Keeping accurate and up-to-date records of vehicle costs and mileage covered is crucial to ensure the right deduction amount. This data helps calculate the total miles driven in a certain period and compute the deduction based on the method an individual chooses to apply.

#2 - Claim Calculation

Taxpayers can use the standard mileage method or the actual expense method to determine the amount they can claim while filing their taxes. Once the amount has been computed and the individual has all the relevant information to file their taxes, they must fill out the prescribed forms to claim this deduction.

#3 - Filing and Claiming the Deduction

Self-employed individuals or business owners can claim vehicle mileage in line with Schedule C, Part II, Line 9 (Car & Truck Expenses). They must file for an Income Tax return under Form 1040.

Under this section, they are required to enter the actual expenses incurred or the standard mileage tax deduction amount, depending on the deduction computation method chosen. It also includes parking and toll charges. Similarly, government employees and personnel of the US Armed Forces must fill out Form 2106 for reporting purposes.

Examples

Let us study some examples in this section.

Example #1

Suppose Jessy owns a bakery in Texas. She delivers orders to her customers as part of her regular services. For this, Jessy drives a van carrying the baked goods that need to be delivered to the customers. She covers around 2,000 miles in a specific tax year. Jessy is eligible for a federal mileage tax deduction because she is a self-employed individual.

Her driving period was July 2022 to December 2022, and the mileage tax deduction rate applicable then was 62.5 cents per mile. Hence, the claim amount will be:

Business Mileage Claim = Total mileage covered by vehicle x Standard Mileage Rate

= 2000 * 62.5

= $1,25,000 deductible amount

Jessy can claim $1,25,000 as a mileage deduction. It is important to note that she cannot claim the individual costs incurred while driving her van or the amount spent for its upkeep, as the standard rate is a blanket figure that covers all related/possible expenses of using a vehicle for business purposes.

Example #2

In January 2023, Fed Manager reported that the mileage tax deduction rate 2023 was increased to 65.5 cents per mile. This was an increase of 3 cents per mile from the 2022 figure. The government signed off on this number to offer taxpayers some relief from the incessant increase in gas prices and to enable them to accommodate rising vehicle maintenance and service charges.

The consistent rise in inflation was one of the key reasons for the tax deduction rate change. The report outlined how various categories of taxpayers were considered while finalizing the deduction rate and rules to ensure uniformity across groups.

This indicates that the mileage deduction is a crucial tax measure that the government uses to promote the growth of industry and commerce in the US.