Table Of Contents

What Is Middle Market?

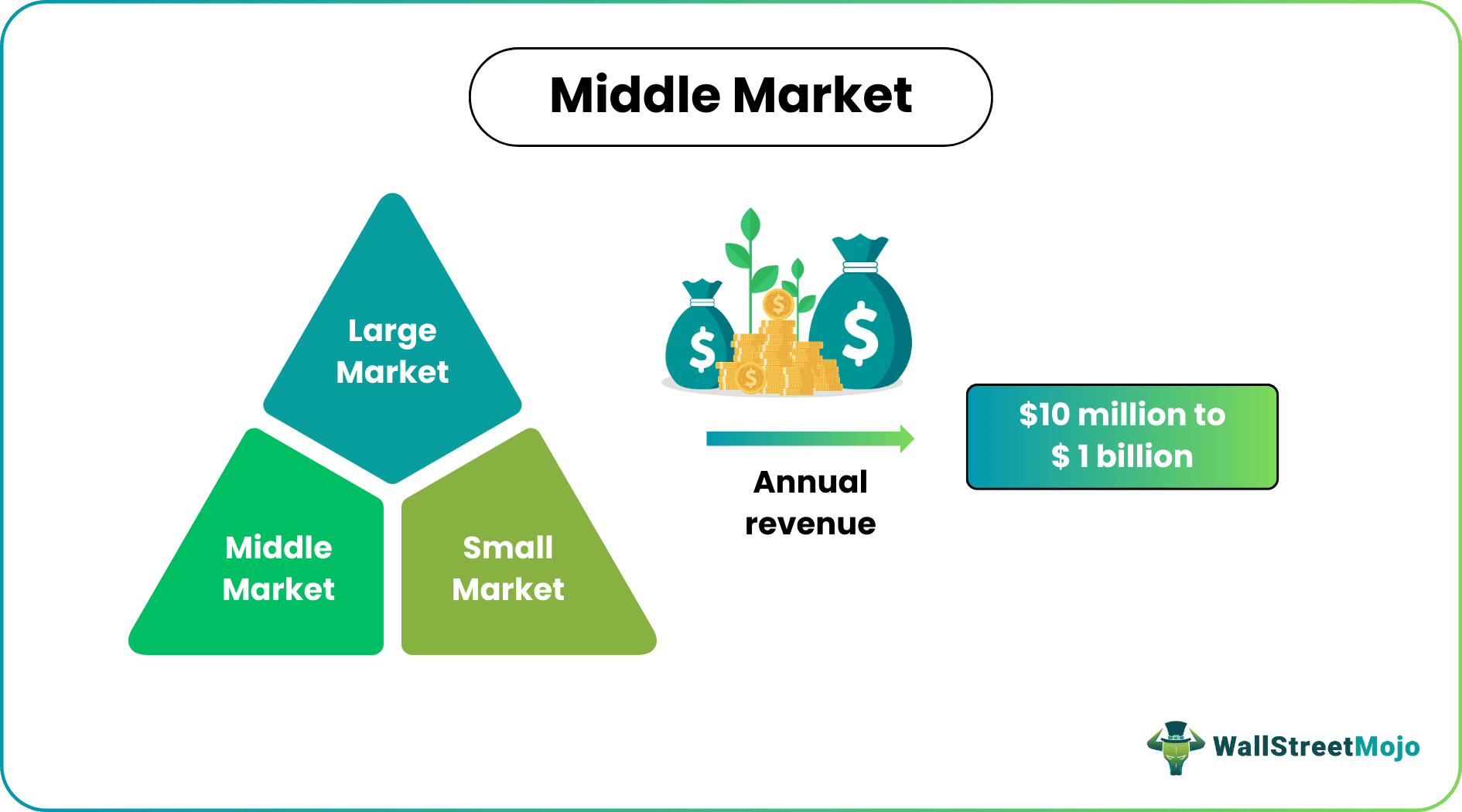

Middle Market refers to the business segment comprising companies between large and small markets with annual revenue of $10 million to $1 billion. The primary goal of this market is to drive the economy and create jobs. In addition, these firms serve as a bridge between small businesses and giant corporations.

In the financial industry, the middle market segment is critical. It is a crucial metric or indicator of the American market. Furthermore, this market has a distinct, competitive environment in which to operate. However, the middle market requires greater transparency, making it difficult to make sound investment decisions. In addition, they have different needs and challenges than smaller or larger businesses.

Table of contents

- What Is Middle Market?

- The middle market definition refers to the market segment that comprises companies that earn annual revenue of $10 million to as high as $1 billion. It is usually seen in American businesses.

- These firms avail financing from various financial institutions and BDCs (Business Development Companies) on a low-collateral basis.

- Bulge bracket and these markets differ where bulge bracket firms are the largest and most prestigious investment banks that operate globally. And on the other hand, mid-market firms are smaller companies with a minimal global market.

- Moreover, middle-market insurance policies are customized to meet the specific needs of the mid-sized business.

Middle Market Explained

The middle market is part of the United States market, including firms earning $10 million to $1 billion annually. These firms usually lie between large and small firms in the hierarchy of the market pyramid. However, the middle market business has moderate risk compared to others. Moreover, this market segment comprises diverse companies operating across various industries, including manufacturing, retail, healthcare, technology, and more.

In the American market, middle market companies are crucial in creating jobs. It comprises almost 2,00,000 firms under this section. They represent 3% or 1/3rd of the U.S. GDP (Gross Domestic Product) and contribute 2.3% towards employment since they are invested more in the service-related sector. Therefore, this rate has been on the rise since the pre-pandemic level. In a 2022 report, 58% of middle market companies reported 10.8% growth.

However, these private equity firms need enough funding from lenders to conduct operations. Thus, firms in this market reach out to financial institutions or BDC (Business Development Companies) for funds. Furthermore, these firms use funds for pursuing growth, mergers, acquisitions, or some significant transition in the future. Several reasons contribute to middle market growth, such as product and service innovation, geographic expansion, operational efficiency, talent acquisition, and development.

According to U.S. regulations, BDCs must invest in either private or public firms with revenue of $250 million. So, they invest in a high-potential middle market business to earn high dividend yields in the future. In addition, since these firms are less volatile compared to larger enterprises, BDCs adopt a debt-equity ratio of 2:1, which provides a win-win situation for them.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Although most of the firms in this market are privately owned, some are also a part of the stock market. In short, it also comprises publicly held companies.

Let us look at the examples of these markets to understand the concept better:

Example #1

Suppose a grocery delivery firm named "Insta-pick" was launched in 2015. Within seven years of operations, the company saw a massive rise in revenue from $20 million to $100 million. However, the major problem the management was facing was financing. Since the internet era brought new opportunities, there was a need for funds. In addition, the company wanted to expand its current operations into different states and boost efficiency. Soon after the investor's round, along with mezzanine financing, they could hire new staff. As a result, it positively impacts the U.S. employment rate.

Example #2

According to a 2022 report, the Golub Capital Altman Index of U.S. middle market private companies saw earnings growth of 9% revenue growth of 11% in the first two months of the fourth quarter. Furthermore, Lawrence E Golub, CEO of Golub Capital, stated that the tremendous growth in the quarter results was utterly unexpected. Besides that, earnings and profit growth have outpaced inflation by a small margin. He says the positive results reflect more vital US economic conditions than many analysts anticipate.

The consumer sector contributed the most revenue (12.3%), followed by healthcare, industrials, and technology. Moreover, earnings increased by 2% yearly as inflation weighed on the financials.

Middle Market Insurance

Middle-market insurance refers to products and services designed for mid-sized firms. The primary purpose of it is to protect- mid-sized companies from the risks and liabilities they face in their daily operations. Besides, these may include a range of insurance products, such as property and casualty insurance, liability insurance, directors and officers insurance, and employee benefits insurance. Furthermore, this insurance may include higher limits of coverage and more complex policy structures than standard insurance policies.

Below are the pros and cons of these market insurance:

Pros

- Tailored coverage: These insurance providers provide more customized coverage options for mid-sized companies.

- Cost savings: They offer more competitive pricing than larger insurers due to their specialized focus and lower head costs.

- Flexibility: The insurance provider can often be more flexible in terms of coverage and underwriting guidelines, allowing them to adapt to the changing needs of their clients.

Cons

- Limited resource: The insurers need more help than larger insurers, impacting their ability to provide specific coverage or handle large claims.

- Less established: These insurance providers may have a different level of brand recognition than larger insurers, which makes it difficult for them to win new business.

- Higher risk: Mid-sized firms may face more complex threats than smaller businesses, making it more difficult for the insurance provider to price the policies accurately.

Middle Market vs Bulge Bracket

Although the middle market and bulge bracket are correlated to each other, they have a considerable difference between them. Let us look at them:

| Aspects | Middle Market | Bulge Bracket |

|---|---|---|

| Meaning | It refers to a market segment with annual revenue of $10 million to $1 billion. | Bulge brackets, or BB, are the most significant investment banks in various securities. |

| Purpose | To comprise the firms lying between large and small markets. | To provide various financial and investment banking services along with issuing any securities. |

| Market Size | More than $10 million and less than $1 billion. | More than $100 billion |

| Market Presence | Utmost regional presence, with a smaller footprint in the global market | A dominant presence in the global financial market. |

| Deal Size | Smaller, more tailored to the specific needs of each client | Very large and complex |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Although middle and boutique markets fall under the category of service-based firms, they differ in their working model. The former concentrates on those firms earning between $10 million to $1 billion. In contrast, the boutique market comprises investment firms that provide customized deals to a narrow client base.

It refers to those private equity firms with a revenue calculation of $50 million to $500 million. Companies in this category are well-set up and established compared to other startups and small businesses. These companies provide capital to support growth, acquisitions, and other strategic initiatives in exchange for an ownership stake.

These investment banks are financial firms that provide various investment banking services to mid-sized companies. The services may include capital raising, mergers and acquisitions advice, restructuring, and other financial advisory services. They target those clients and deals that fall in the middle range, which is reasonable and affordable.