Table Of Contents

What Is Mid-Price?

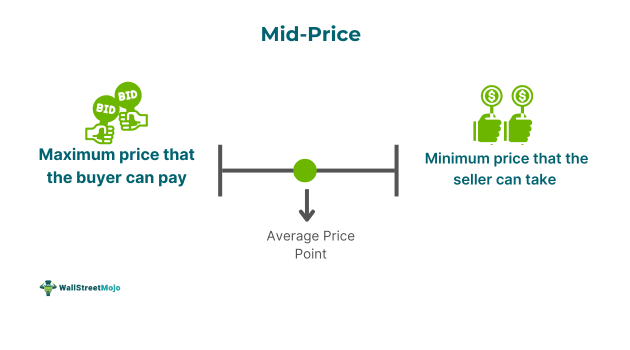

Mid-price or mid-market price refers to a middle price point between a security's bid price and offer or ask price. It is the average of the maximum price that the buyer intends to pay and the lowest price that the seller is ready to assume for financial security.

Such prices keep fluctuating since the bid prices can decline while the ask prices can surge to create a greater price difference. It is a critical trading tool that helps investors analyze whether the securities prices are fair, overvalued, or undervalued. Hence, they may consider mid-price over the last price to make their buy or sell decisions.

Key Takeaways

- The mid-price is the value between the quoted bid price and the ask or offer price of the financial security.

- The mid-market price is the average bid-ask price point, evaluated as (Bid Price + Ask Price) / 2.

- The mid-price of financial securities serves as an essential trading tool for market participants, helping them make informed trading decisions based on the security's actual valuation.

- This includes assessing whether the security is fairly priced, overpriced, or underpriced.

- It aids in analyzing market pressures, liquidity, and other constraints, providing a clearer picture of market conditions and improving the decision-making process.

Mid-Price Explained

The mid-price or the mid-market price is the average or mean of the bid and ask prices of financial securities. It serves as a fair value of the security. Investors consider it to be the approximate actual price. At the same time, some investors analyze mid-price stocks instead of the last price of securities, as in the quote. We usually find the quoted security price in the newspapers; this is the mid-market price. Thus, it is a common practice to quote a single price point for financial security. However, market participants get a close-by-middle price point due to the rounding off of the average value.

It is also helpful in the foreign exchange market or currency trading since bankers widely consider the mid-market rate to determine their preferred buy or sell price. However, unrealistic bid prices in a matched bargain system for trading illiquid financial securities can result in a vague mid-price. Thus, the most suitable quote in such a condition is the last price of the securities. Also, the mid-market price may significantly vary from the securities’ last price.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

How To Calculate?

A mid-price is the average of the quoted bid and ask prices. The quoted bid price is the highest that security buyers can pay, while the ask price is the lowest that sellers can accept for financial securities.

The formula for the evaluation of the mid-market price is as follows:

Mid-Price = (Bid Price + Ask Price) / 2

Examples

Mid-priced stock is neither cheap nor expensive, but it shows the fair price of the given financial security. Now let us consider some examples to understand the concept:

Example #1

Suppose financial security has a bid price of $74 while its ask price is $78, then its mid-market price is computed as follows:

Given:

- Bid Price = $74

- Ask Price = $78

- Mid-Price = (Bid Price + Ask Price) / 2

- Mid-Price = ($74 + $78) / 2 = $76

Hence, the average price point of the bid-ask price is $76.

Example #2

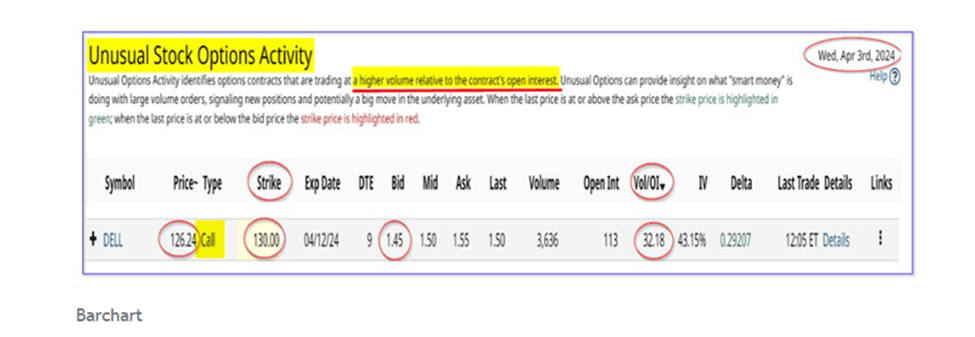

On April 03, 2024, there was a significant increase in activity for Dell Technologies' (DELL) near-term call options. Specifically, over 3,600 call options with a $130 strike price, expiring in 9 days on April 12, 2024, were traded. Since DELL stock was priced at $126.75 per share, these calls were $3.25 out-of-the-money (2.56%). The premium on these options was $1.45 on the bid side and $1.50 at the mid-price.

Moreover, the covered call investors were somewhat bullish, anticipating a notable rise in DELL stock within the next nine days, aiming for a yield of 1.18% ($1.50/$126.75). Conversely, short-sellers of these calls were betting on an assumed flat price or minimal rise, less than 2.56%, potentially earning them a yield of 1.115% ($1.45/$130). The volume of calls traded was over 32 times the previous number of outstanding contracts. This hints at significant bullish activity, likely initiated by major trading desks.

Dell Technologies announced a 20% increase in its quarterly dividend, surging its shares from $1.48 to $1.78 per share, alongside reporting an increase in free cash flow from $1.533 billion to over $5.7 billion in 2023. The company also plans to return more than 80% of its adjusted free cash flow to shareholders, suggesting substantial future share repurchases. Further, an analysis suggested that DELL stock could be valued at over $106 billion based on its strong free cash flow, which would imply a stock price of at least $142 per share, a 25% increase from its current market cap of $84.5 billion. Thus, this potential value increase might explain the surge in call option activity.

Importance

The question arises: when we can use the last price as a quote, what is the relevance of the mid-price? However, the following significance of the mid-market price in trading makes it useful for the market participants:

- Effective Trading Tool: Mid-market price is an essential tool for investors, traders, analysts, and other market participants to determine the value and liquidity of security.

- Aid Market Decision-Making: It acts as a reference point for analyzing the prevailing market scenario and dynamics, aiding the various market players in making sound trading and investment decisions.

- Security Valuation helps market participants determine the actual value of financial securities and whether they are fairly priced, overpriced, or underpriced.

- Gauge Market Sentiments: By examining mid-price stocks, traders, investors, and market analysts can effectively understand whether the pressure is on the buy-side or sell-side.

- Ascertain Security's Liquidity: This pricing reference point is the perfect gauge for market liquidity since a high bid-ask spread indicates an illiquid market. In contrast, a lower spread indicates greater liquidity.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.