Table Of Contents

What Is Mezzanine Financing?

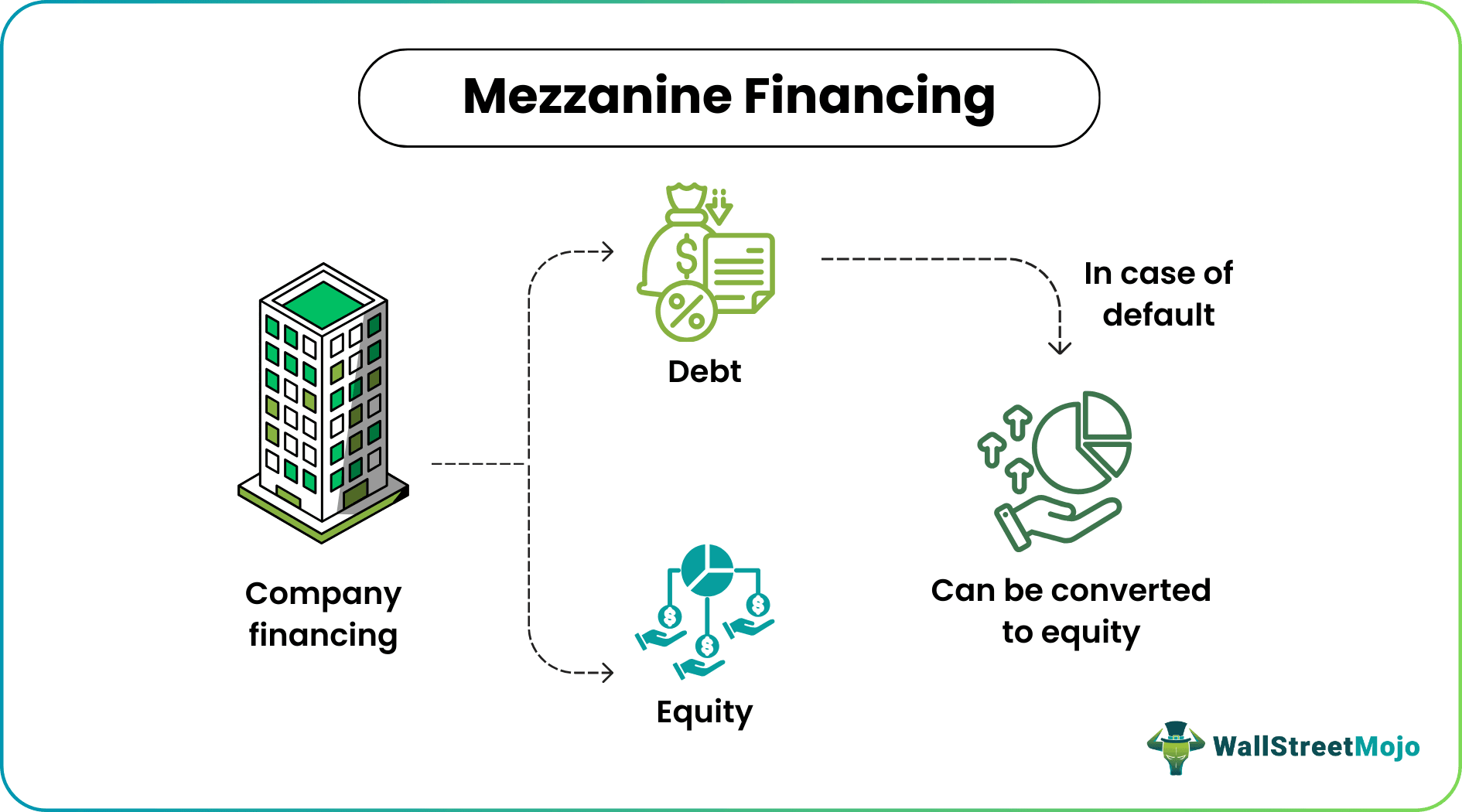

Mezzanine financing is a kind of financing that has both features of debt and equity financing that provides lenders the right to convert their loan into equity in case of a default (only after other senior debts are paid off)

It is a hybrid form of financing. This provides a flexible payment procedure to the borrower and is better than simply debt financing. The value of subordinated debt increase. The overall returns are good and is commonly used in during the expansion of big companies.

Source: reuters.com

Key Takeaways

- Mezzanine financing is a form with debt and equity financing characteristics. In a default, lenders can convert their loans into equity, but senior lenders and companies are paid after venture capital.

- Usually, private equity is a mediator. In this, either they buy the company themselves or help its management acquire the target company.

- The advantages of Mezzanine financing are easy-to-get funds, flexible loan structure, and tax-deductible interest on the Mezzanine debt.

- The disadvantages of Mezzanine financing are prohibitive covenants and high-interest rates.

Mezzanine Financing Explained

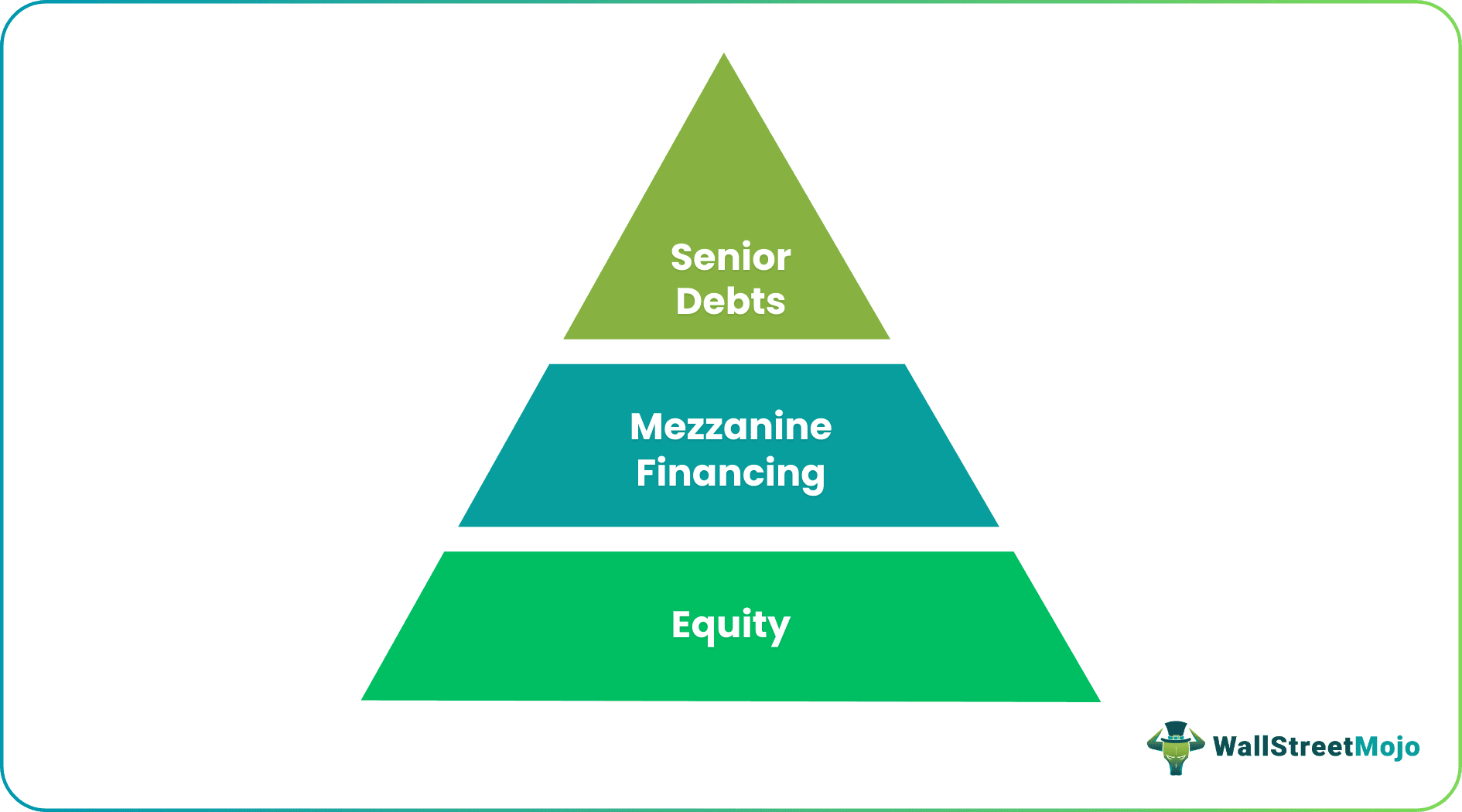

Mezzanine financing is a form of acquiring funds between equity and debt. It is higher than total equity but lower in seniority than debt. But it gives a good return, better than complete debt financing.

It is cheaper than raising shareholders' needs to bear. However, it is costlier than complete debt financing because the cost of debt is much less due to the guaranteed payment terms. Thus, its cot falls between total debt and total equity financing.

Since it involves debt and equity, there is less dilution of the share capital of the organization. Established companies often use it to finance for acquisition or mergers, which can be completed within a limited time. This mezzanine financing structure helps the company keep its financial resources free for using them in some other useful and productive purpose.

Video Explanation of Mezzanine Financing

Structure

Have you ever bought a house?

If yes, you would know that most of the house owners would go for a down payment. This down payment is the money he has saved for himself. And the rest of the amount is mortgaged through a mezzanine financing lenders, meaning that the remaining amount is taken as a loan.

In the case of Mezzanine Funds, it works just like that.

Since Mezzanine Funds is not about buying houses, but buying companies; it happens like the following –

The firm that has been purchasing the company uses its cash. Then the remaining portion is taken as a debt from different banks.

Generally, private equity acts as a mediator here. Either they buy the company themselves, or they help the company's management buy the target company.

Now Mezzanine Financing Definition can be of different types –

- Usually, a portion is given from own savings by private equity. And they take loans from multiple investors for funding the purchase.

- Another type is the private equity company using its savings to take debt from the company itself and thus arrange for the funding.

As a result, the Mezzanine Fund isn’t something everyone would go to. The risk is much higher, and the expectation of benefits is also quite high.

Characteristics

Here are the top-most important characteristics of Mezzanine Funding –

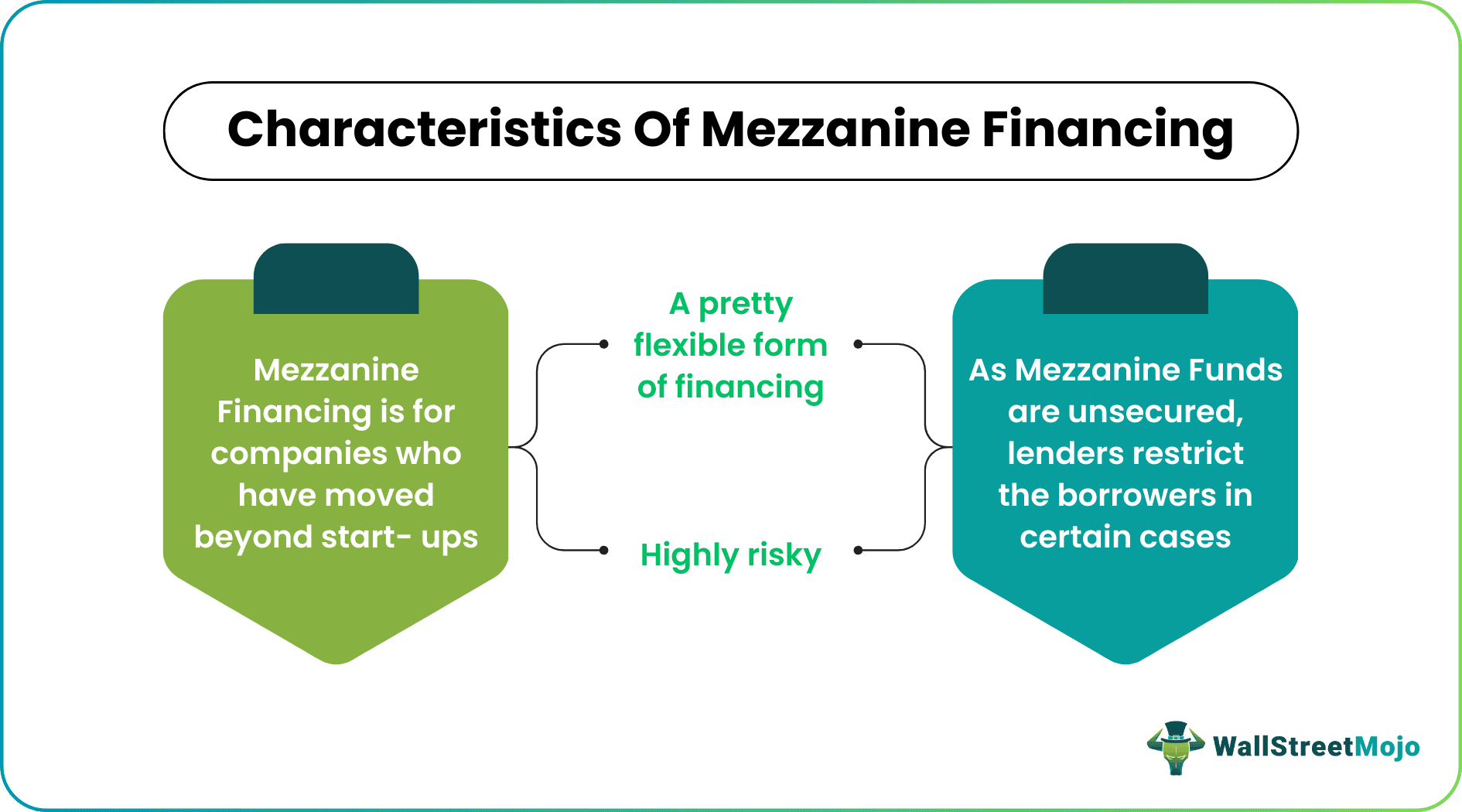

- Mezzanine Financing is for companies who have moved beyond start-ups: Mezzanine Funding isn’t for start-ups. It is for those who are yet to put their foot forward for an IPO but still need a boost in their growth capital to expand. Since, in the beginning, start-ups don't have enough cash flow, it's difficult to take up this highly risky investment..

- A pretty flexible form of financing: Mezzanine is called subordinated debts. And it is particularly useful for small business owners who aren't yet ready to pay a huge cost of capital on equity financing. Since mezzanine funds are offered with a tailor-made approach, it suits the small business owners quite well. Another reason it's quite flexible is that it is considered an unsecured loan; that means the borrower doesn't need to provide an asset to take the loan. And as small amounts are borrowed from multiple sources like private investors, mutual funds, insurance companies, banks, etc., no one runs after the borrower immediately.

- Highly risky: Mezzanine Funds are pretty risky. On one side, it helps the small business owners to boost their growth capital; but on another side, it turns out to be so risky. If the small business owners cannot generate enough revenue (or cash flow), it would be impossible for them to pay off the debt on time because the interest rate of mezzanine financing is quite high. That’s why it is always recommended that mezzanine debt should not be more than double the company's cash flow. For example, if a company generates around $100,000 in cash flow, it should take $200,000 as mezzanine financing and not more than $500,000 as total debt (including the mezzanine debt)

- As Mezzanine Funds are unsecured, lenders restrict the borrowers in certain cases: This is not good news for borrowers, but since mezzanine debts are unsecured, the mezzanine financing companies should have some hold on the loans. That’s why they often incorporate restrictive conditions that the borrowers need to adhere to. For example, the mezzanine financing lenders may ask for the warrants or the option of ownership if the borrower defaults to pay off the amount, or the borrower may be asked not to borrow an additional loan, or else a few financial ratios the borrowers must meet.

Examples

Let us try to understand the concept with the help of come examples.

Example #1

Mezzanine funds can be used to buy a company or expand one's own business without going for an IPO.

Let’s say that Mr. Richard has an ice-cream parlor. He wants to expand his business. But he doesn't want to go for conventional equity financing. Rather he decides to go for mezzanine financing.

He goes to mezzanine financiers and asks for mezzanine loans. The lenders mention that they need warrants or options for mezzanine loans. Since the loans are unsecured, Mr. Richard has to agree to the terms set by the mezzanine lenders.

So Mr. Richard takes $100,000 by showing that he has a cash flow of $60,000 every year. He takes the loans and unfortunately defaults at the time of payment since his ice-cream parlor couldn’t generate enough cash flow. The mezzanine financing companies take a portion of his ice-cream parlor and sell off to get back their money.

Example #2

source: prnewswire.com

As we see from above, Federal Capital Partners (a Private Equity firm) has provided $6.5 million in the mezzanine fund to The Altman Companies to develop Altis Grand Central.

Advantages

- Can get loans easily: Small business owners need funds to expand. Mezzanine funds are easy to get, and one doesn’t need to provide any asset as a mortgage. This helps small businesses access such funds easily for their own growth and expansion.

- The loan structure is quite flexible: The structure of mezzanine debt is quite flexible. The borrowers take loans from multiple sources, and as a result, the amount from each is smaller. This leads to accumulation of greater amount of fund.

- Interest on the mezzanine debt is tax-deductible: This is the main advantage of the mezzanine financing structure. One of the reasons small business owners go for mezzanine debt is that the interest they pay on the debt reduces the tax they need to pay to the government. Thus, this fact helps the company to save money for internal usage or for investment and expansion.

Disadvantages

- Restrictive covenants: Since the loans are unsecured, the lenders incorporate restrictive conditions on the borrowers like warrants, options of partial ownership, not to borrow additional loans from a lender, etc.

- High-interest rates: Since mezzanine loans are unsecured, the borrowers need to pay quite a high-interest rate and if you have not been earning half of what you intend to borrow, stay away from taking mezzanine loans.

- It ranks lower than senior debt: Since the ranking is lower than debt financing, the risk is higher because their priority in receiving the payment in case of dissolution or bankruptcy goes down.

- Owner control is partly reduced: Since the process involved part debt and part equity, there is some amount of ownership being transferred to outsiders, This leads to dilution of capital to some extent.

- Time-consuming: Since there is equity and debt, the entire process of raising capital may become time-consuming and tedious.

Mezzanine Financing Vs Convertible Bonds

- Mezzanine financing means raising funds through use of equity and debt, whereas convertible bonds and the ones that has the option to be converted into cash.

- The former has higher interest payments whereas the latter has lower interest payments.

- The former is riskier than the latter.

- The equity dilution is more in case of convertible bonds rather than mezzanine finance.