Table Of Contents

What Are The Types Of Mergers And Acquisitions?

Merger and acquisition are defined as the business transaction where the control and ownership rights of companies, business units, and business organizations are either acquired by a target company or merged with the target company.

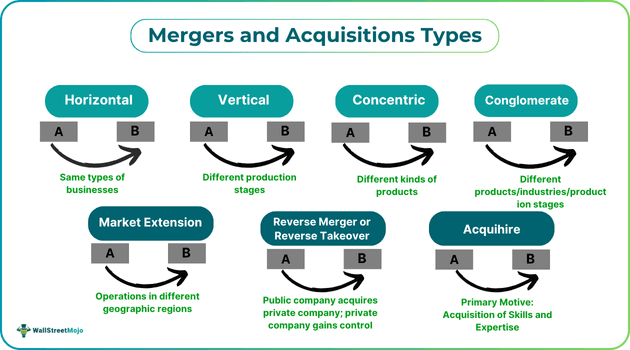

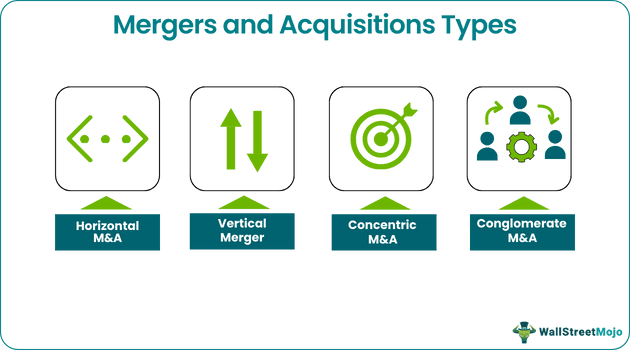

Four types of mergers and acquisitions exist Horizontal, Vertical, Concentric, and Conglomerate M&A. In each case, two companies come together to form a single entity. But, which type will be best will depend on the type and business of both entities, which will help in the newly formed entity’s growth and expansion.

Key Takeaways

- Mergers and acquisitions refer to business transactions in which companies consolidate, or one business acquires another organization.

- Some of the popular mergers and acquisitions types include vertical, concentric, conglomerate, and horizontal M&A.

- Concentric M&As take place between companies that have similar client bases and operate within the same industry. That said, the companies provide different kinds of products and services. Note that the products can be complementary but not the same.

- In the case of conglomerate M&As, the target-seeking and target companies have different product offerings and operate in different industries. Moreover, they are different with respect to product stages.

Types Of Mergers And Acquisitions Explained

Different types of mergers and acquisitions play a very important role in today’s business operating environment, and we often see this happening. It has many benefits to both the target company and the target-seeking company and brings about synergetic growth.

Depending upon the vision and purpose, a company generally decides to either get merged or acquired chosen by the board of directors. Merger and acquisition though it sounds simple and easy, can take a long time to happen as it involves a lot of formalities and due procedures. It is interesting to learn what are the types of mergers and acquisitions in business.

Let us discuss the what are the types of mergers and acquisitions (M&A) in detail.

#1 - Horizontal M&A

- A Horizontal Merger generally happens when the target company and target-seeking company both occur in the same industry and have the same or equivalent product or product lines or offer similar services to the final consumer.

- It also means the companies operate in the same industry and are in the same or similar production stage. To cite an example, we can say that the two companies are both producing laptops. Still, the target company has a specialty in producing gaming laptops, so the target-seeking company to increase its line of products and customer bases by either acquiring or merging with the target company.

- This type of merger also kills competition to increase its share in the market and increase revenue or profit. Also, increased production leads to higher economies of scale, which further leads to a reduced average cost of production. This type of merger and acquisition also increases cost efficiency since repeated and non-productive activities are eliminated from production. A study of types of mergers and acquisitions with examples in business will help in understanding the concept.

#2 - Vertical Merger

- A Vertical Merger is pretty much like horizontal mergers with only a small difference related to the production stage. This kind of merger and acquisition is done between companies operating in the same value chain producing similar goods and services but vary in the stage of production.

- One example to cite can be a car or automobile manufacturer merging or acquiring another company manufacturing tires. Here we see both companies are operating in the same industry, but the stage of production is different. One firm is operating in the complement firm to the other. This kind of merger and acquisition is primarily done to provide essential supply to the target-seeking company and avoid any shortage in the supply of essential goods.

- In the above example, by merging or acquiring a company producing tires, the car manufacturers reduce the cost of tires, which it initially had to spend and expand the business to supply the tire to other competitive automobile manufacturers.

- This kind of merger and acquisition is done to limit the supply of essential goods to competitors, possess a greater market share, and generate higher revenues and profits. They must also provide cost savings because the essential goods are produced in-house by the company instead of paying more to another company.

#3 - Concentric M&A

- Concentric mergers and acquisitions occur when two companies operate in the same industry and have similar customer bases but offer different types of products and services. The product can complement one, but in no manner will it be identical.

- To cite an example, let us take a case where a company producing laptops merges with a company producing laptop bags. The laptop bag is an essential requirement of every laptop, but we see the products differently. Thus when this kind of merger or acquisition occurs, it is called a concentric merger.

- This kind of merger and acquisition generally occurs to support customers in buying the product as a bundle offering instead of buying it in a different assembly. Also, it helps the company to diversify its offerings and thus generate higher returns.

- Here the sales of one product will drive the sales of others as we see people who generally buy laptops will also be requiring a bag to carry it on the move. Thus, this leads to the generation of more profits for the company. The company turns out to be a one-stop destination for consumers where the company offers products linked in some way or the other.

- Usually, these companies have similar production processes and business markets. This type of merger also has to offer an extended product line. Finally, this kind of merger helps the company reduce the risk of doing business by diversifying the product line.

#4 - Conglomerate M&A

- This type of merger and acquisition occurs when both the target company and the target-seeking company are different in terms of industry, product offering, and production stage.

- To cite an example, we can say a merger between a laptop-producing company and an electric vehicle-producing company. Thus, this kind of merger and acquisition occurs to completely explore new business areas by diversifying the product offerings, reducing the risk of doing business.

#5 - Market Extension M&A

- These transactions involve organizations that carry out operations in distinct geographic markets using similar offerings. They help companies expand their customer base and improve their market reach.

- Both organizations need to operate within the exact space and offer similar products and services. These M&As usually take place in the retail banking and food retail spaces.

#6 - Reverse Merger (Reverse Takeover)

- In this case, a private company that has growth prospects and desires to go public takes over an inactive or dormant publicly traded organization that has limited assets and little to no operations.

- With this takeover, the private company is able to access the public market. On the basis of the deal’s structure, this transaction can also involve a public company taking over a private company. That said, ultimately, the aim of the transaction is to ensure that the private company gets control of the newly formed company following the takeover or merger and is able to access the public market.

Thus, the above are the different types of mergers and acquisitions that can happen in the market.

#7 - Acquihire

- As the name suggests, this involves combining acquisition and hiring. In this case, a company is predominantly interested in acquiring the expertise and skills of the employees working in another organization instead of taking over the assets, services, or products.

- Simply put, an acquihire involves a company taking over a smaller organization, for example, a startup, with the purpose of adding the latter’s employees to the former’s existing workforce.

- This approach enables the acquiring organization to onboard a team of employees with specialized skills.

Determining the viability of any merger acquisition deal requires individuals to have knowledge of financial planning and analysis (FP&A). Without FP&A, one cannot have the insights that indicate the potential risks of the transaction. Moreover, if individuals do not have such insights, they cannot ensure that the deal is in line with the strategic goals of the acquiring company. If a person is looking to understand the significance of FP&A in M&A, they can consider taking this Financial Planning & Analysis Course.

Video Explanation of Mergers and Acquisitions Types

Examples

Let us try to understand the types of mergers and acquisitions with examples.

- Horizontal merger - An example of a horizontal merger is the merger of Facebook and Instagram that took place in 2012. Both of them belong to the same industry and similar types of business.

- Vertical merger - An example of a vertical merger is the merger of Paypal and eBay in 2002 in which eBay got the different types of synergies in mergers and acquisitions in the form of an online payment facility and Paypal got a platform to expand further.

- Concentric Merger - An example of a concentric merger is the merger of Heinz and Kraft, which took place in 2015, and is considered to be the largest merger of this kind in history.

- Conglomerate Merger - An example of a conglomerate merger is the merger of Berkshire Hathaway and Precision Castparts merger in 2015.

- Market Extension Acquisition - An example of this type of acquisition is the takeover of the US-based brewing company Anheuser-Busch by a Belgium-headquartered brewing company, InBev, in 2008.

- Reverse Merger - An example of a reverse merger transaction is the reverse merger involving a special purpose acquisition company, VectolQ and a private company named Nikola in 20202. Following the public listing, Nikola managed to raise $700 million for increasing hydrogen fuel vehicles and electric battery production.

- Acquihire - In July 2021, Twitter announced the acquihire of Brief, a news aggregator application founded by ex-Google employees. The team joined Twitter and worked on areas that provide support to the public conversations taking place on the social medial platform, including Explore and Twitter Spaces.

In all the above cases, each entity got different types of synergies in mergers and acquisitions.