Table Of Contents

Meme Stocks Meaning

Meme stocks attract retail investors through social media debates, leading to a surge in prices and trading volumes. These stocks go viral online through internet memes, regardless of how well the company performs in the market. The fear of missing out (FOMO) makes investors invest in such stocks.

Small and short-term investors seek to invest in stocks that can generate significant returns in a short period. The hype about particular stocks on online forums and social media platforms convinces them of investing. This sudden interest from individual investors skyrockets the meme stocks price within hours or days. However, these overvalued stocks are subject to price volatility due to a lack of business fundamentals.

Table of contents

- Meme Stocks Meaning

- Meme stocks attract individual investors through social media forums, internet memes, and online hype, causing their prices and trading volumes to skyrocket.

- A traditional stock's price can rise by 30% to 50% in a year, whereas meme stocks' prices can increase by the same amount within hours or days. Investors buy such stocks because of the fear of missing out (FOMO).

- Due to a lack of business fundamentals, performance, or prospects, these overvalued stocks are vulnerable to extreme market volatility.

- Meme stocks became popular in early 2021 when the slow-moving GameStop stock unexpectedly soared in price.

How Does Meme Stock Work?

Meme stock's popularity is solely due to the online hype. It has little to do with the business fundamentals, performance, or prospects, such as profitability or leadership. Its goal is to entice and engage a large audience with memes relating to the stocks of distinct firms.

The value of shares rises in proportion to how well a community interacts with and responds to Internet memes. When a stock interests online audiences more and more and reaches a determined attention threshold, it automatically rises in value, becoming a meme stock. It, thus, attracts investors who buy them right away out of fear of missing out.

The price of a conventional stock can increase by 30% to 50% in a year, while meme stocks can witness an equal hike in prices overnight. Furthermore, these create a buzz in the investment community, leading to panic buying even if the market is not doing well. However, this short-lived price increase immediately reverses, making meme stocks far more volatile and eventually crashing.

Investors can assess a stock's volatility and learn about its association with the U.S. stock indices and other popular meme stocks. Because these stocks have a high level of risk, there are meme ETFs available for those who do not wish to invest in a single stock.

Such stocks became popular when GameStop stock unexpectedly soared in price in early 2021. For example, before becoming top meme stocks, GameStop and AMC had a correlation coefficient of 0.08, but it jumped to 0.45 once they crossed the attention threshold.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

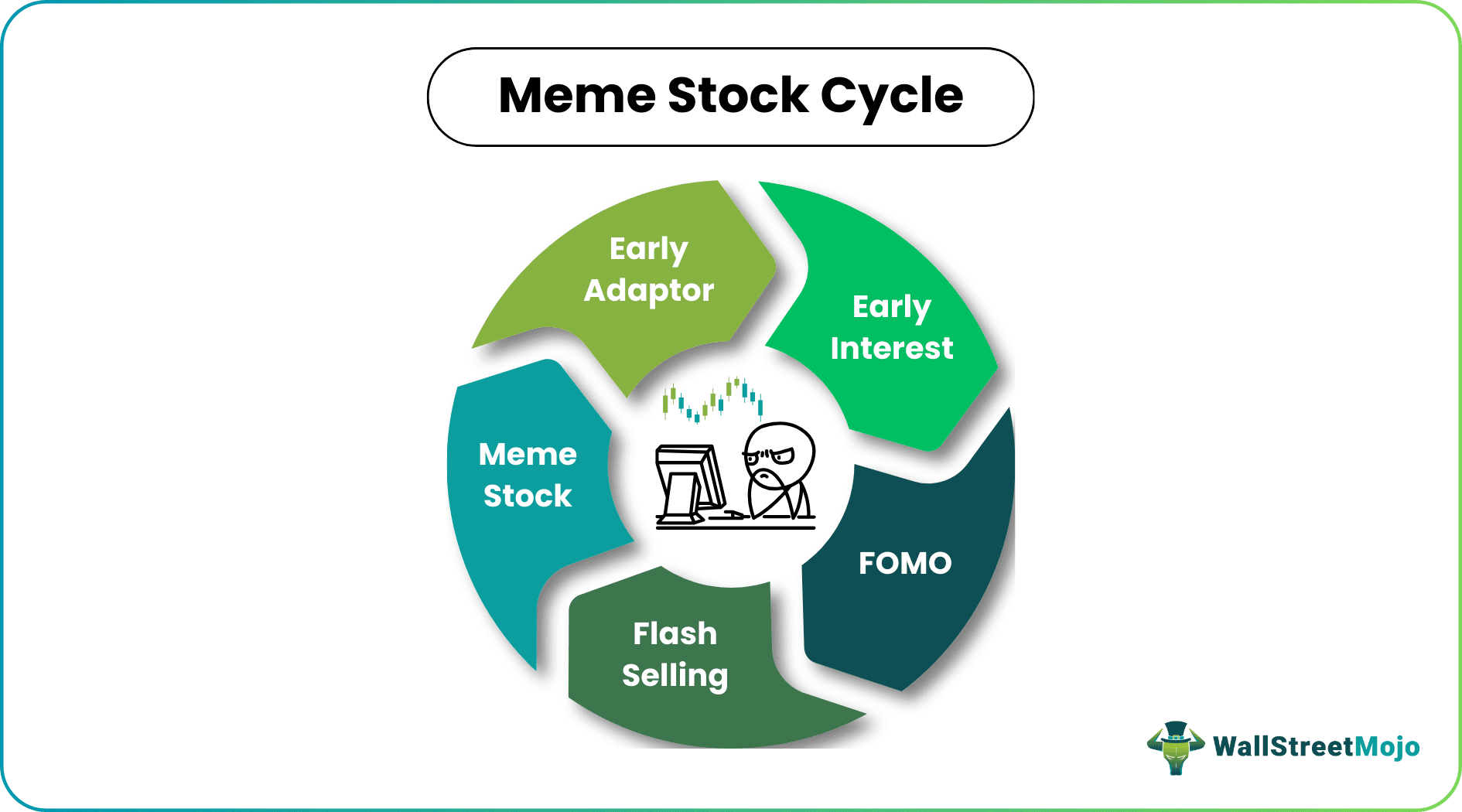

Meme Stock Cycle

The meme stocks cycle comprises four phases describing how investors evaluate, invest in, and use them:

- Early Adopter: It is when traders think that stocks are undervalued and begin buying them. It increases the trading volume dramatically.

- Early Interest: It occurs when investors notice a rise in the trading volume of stocks and start to buy them. It increases the meme stocks price significantly.

- FOMO: It is when investors fear missing out on the opportunity of buying stocks at a time when their prices are surging. As a result, they purchase equities based on the attention they receive online.

- Flash Selling: It occurs when investors start selling their stocks at their peak prices to maximize profits. It is the point at which the price begins to fall.

Popular Meme Stocks Examples

Here are a few meme stocks examples that show how the concept works:

Example #1 - GameStop

One of the cases of meme stocks 2021 was that of the gaming merchandise retailer GameStop. The stocks of the slow-moving venture hiked in value from $17.25 to $147.98 in just a few weeks, further doubling to $347.51 before hitting $483. Retail investors collaborated and liquidated prominent short positions held by a hedge fund in less than 15 trading sessions. The stock's value and volume increased not because of business fundamentals or goodwill but the people interested in it.

Example #2 - AMC Entertainment

In January 2021, the movie theatre company AMC witnessed a stock price rise from $2 to over $20 in just a few days. The occurrence coincided with a spike in the stock prices of GameStop. Later in May 2021, flash selling occurred, in which interested buyers purchased shares, pushing prices by more than 500% in a week of trading.

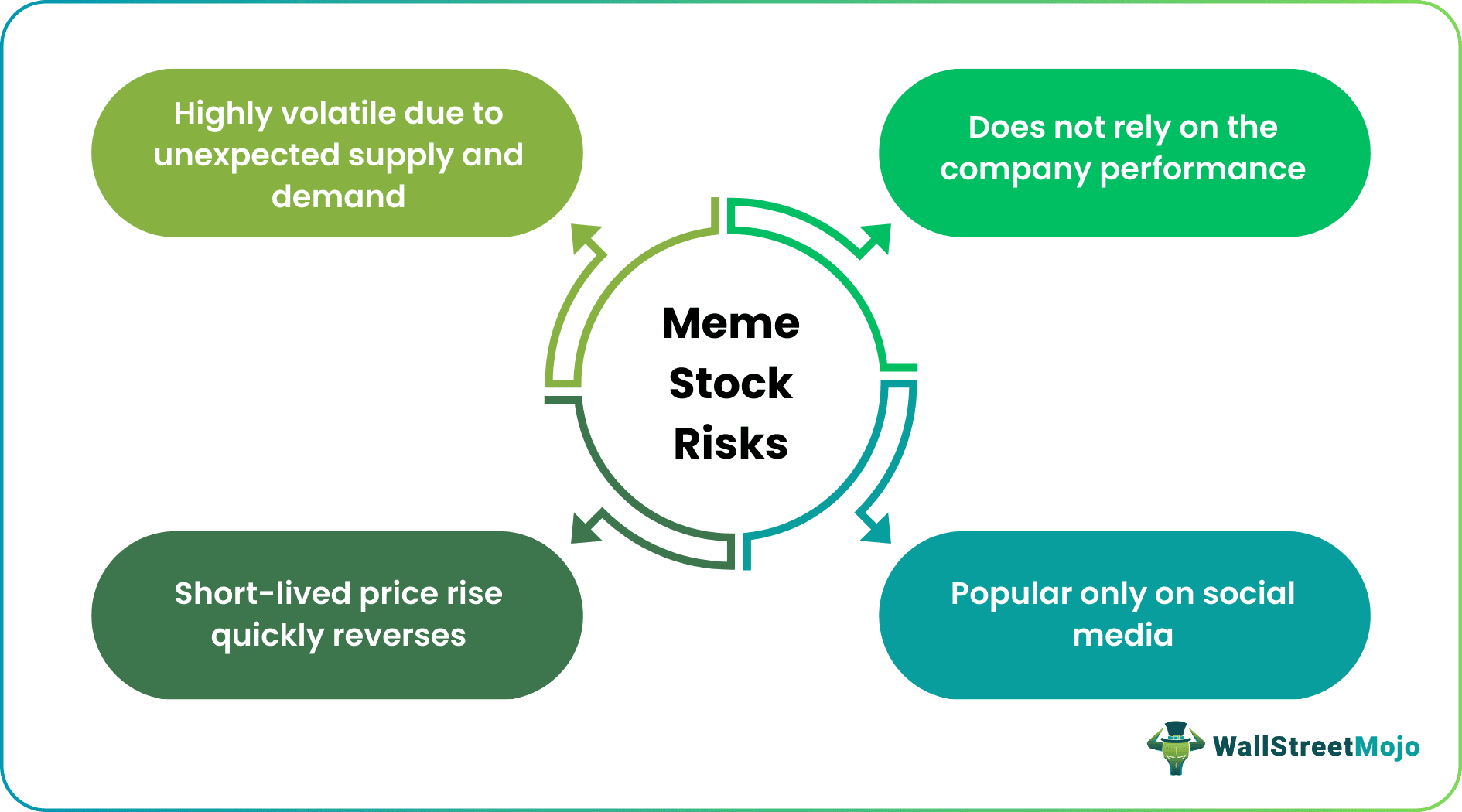

Risks

Meme stocks are risky investments due to their tremendous volatility. The price fluctuates based on online forum discussions and the amount of excitement that the stocks generate. As a result, investors must adopt a cautious investing strategy. The risks associated with meme stocks are as follows:

- The meme stocks price does not rely on company fundamentals and performance, making the selling moment uncertain.

- The meme stocks gain popularity on social media. If investors' attention switches from one meme stock to another, the value of the former will inevitably decline. In such a circumstance, investors may lose a significant amount of money by selling expensive equities at lower prices.

- This temporary price rise quickly reverses, making meme stocks even more volatile and ultimately collapse.

- Price fluctuations due to unexpected supply and demand may result in significant losses.

Frequently Asked Questions (FAQs)

Meme stocks gain popularity among individual investors through social media forums, internet memes, and online hype, causing prices and trading volumes to soar. The price of a regular stock can increase by 30% to 50% in a year. But meme stocks may rise by the same amount in hours or days. These expensive stocks are subject to high market volatility due to a lack of business fundamentals, performance, or prospects.

Some of the top meme stocks list are:

#1 - AMC Entertainment Holdings Inc.

#2 - Bed Bath & Beyond Inc.

#3 - Blackberry Ltd.

#4 - GameStop Corp.

#5 - Koss Corp.

#6 - National Beverage Corp.

#7 - Robinhood Markets Inc.

#8 - Virgin Galactic

Stocks that go viral as internet memes, regardless of how well the firm performs in the market, are called meme stocks. These stocks captivate internet audiences and keep them engaged through posts to persuade them to invest in them. Also, these stocks generate excitement in the investment community, which can lead to panic buying even when the market is not performing well.

Recommended Articles

This has been a guide to meme stocks and their meaning. Here we discuss how does meme stock work, along with cycle, examples, and risks. You may learn more about financing from the following articles -