Table Of Contents

What Is Media Effect?

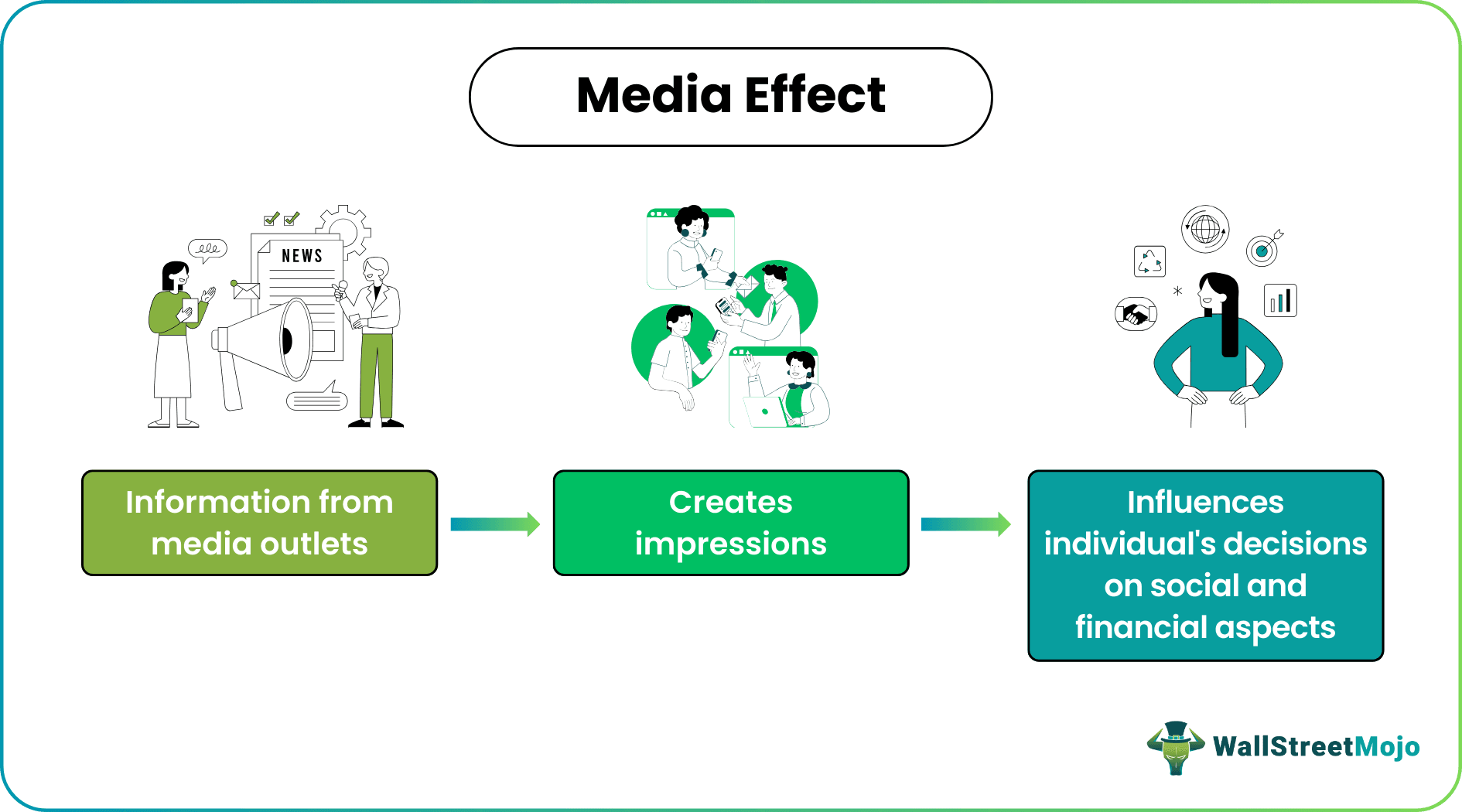

Media effect is the impact of information disseminated by the media on individuals, particularly in relation to financial markets. The information relayed by media outlets holds the power to shape decisions made by market participants, exerting either a negative or positive influence.

Media effects significantly influence financial market participants and the economic landscape by shaping individuals' perceptions and decisions. Information disseminated through media outlets can sway investor sentiment, impacting trading behaviors and market trends. This influence extends to the broader economic field, as media narratives contribute to public opinion, influencing consumer confidence, corporate strategies, and overall economic stability.

Table of contents

- What Is Media Effect?

- Media effects involve social or psychological reactions in individuals or communities resulting from exposure to media that affects financial decision-making. Understanding these effects is, therefore, crucial.

- Media outlets serve as major sources of market information and represent financial risk, emphasizing the significance of comprehending their effects.

- The key theories associated with media effects include Cultivation theory, Agenda Setting Theory, Diffusion of Innovation (DOI) Theory, Uses and gratification theory, and Media dependence theory.

- Its types include reinforcing, altering, triggering, and acquiring.

Media Effect Explained

Media effects refer to the changes in financial decision-making influenced by exposure to media. The information put forth has varied effects across all fields. The information influences financial market fluctuations; the trends set are, in fact, a reaction of the investors and traders to that information. Internet or social media rumors often have a domino effect on the market. It can lead to the loss of investor confidence and the further spread of financial risks, which can harm the financial system and even cause social unrest.

Media outlets are a major source of market information and a financial risk. Newspapers, TV, and other information intermediaries only present the information they deem relevant to investors. However, each person's interpretation of the same information can vary depending on their beliefs and the potential existence of personal cognitive biases.

Decisions regarding investments and trading in securities are usually made after a clear understanding of the fundamentals and prevailing circumstances. The understanding of the current market situation is gathered from various sources; however, this has only made it more complicated as there is always a large influx of information available through the media.

Social media has gained acceptance over the past few years as a component of modern corporate intelligence systems. It is used by financial institutions like banks, stockbrokers, insurers, and governments to combat fraud, adjust financial products, advertise services, and assess market sentiment to improve investment decisions. Others use social media primarily to discover new financial products available through social media platforms. Some financial service organizations also use the social media effect to rebuild lost confidence and reputation.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Theories

Some of the theories associated with the media's effect are given below:

- Cultivation Theory: George Gerbner conceptualized the cultivation theory in the 1960s and 1970s. The cultivation theory addresses the long-term impacts of television on viewers (mass media effect). According to the argument, television is risky since it can influence people's moral standards and belief systems rather than a particular point of view on a single topic.

- Agenda-Setting Theory: The agenda-setting theory examines how the media shapes public opinion by dictating what and how people believe. This is accomplished by repeatedly emphasizing certain news.

- Diffusion of Innovation (DOI) Theory: E.M. Rogers created the Diffusion of Innovation (DOI) theory. It was initially proposed to describe how an idea or product gathers momentum and diffuses (or spreads) within a particular population or social system over time. Due to this dissemination, people eventually adopt a new idea, habit, or product as a part of a social system. When someone adopts, they do something different from what they previously did (i.e., use or purchase a new product, perform a new behavior, etc.).

- Uses and Gratification Theory: According to Blumler and Katz's uses and gratification theory, media consumers actively select and utilize the media. It emphasizes the audience's free choice and is deterministic since media can be employed in various ways and for various objectives. Users utilize media with a purpose and participate actively in the communication process.

- Media Dependence Theory: Media dependence theory is a systematic approach to researching how audiences are affected by mass media (mass media effect) and how media, viewers, and social systems interact. The American communication researchers Sandra Ball-Rokeach and Melvin DeFleur first presented it in 1976. According to this theory, the media will take on greater significance for a person as they become more dependent on it to meet these demands.

Types

The different types of media effects are:

- Acquiring: Individuals acquire and retain elements of messages contained in the media. These elements may be facts, images, statistical data, sounds, etc. The media implant ideas in people's minds that weren't there before exposure. People acquire information, store it in their memories, and use it differently.

- Triggering: A media message may prompt the memory of knowledge already learned. It could be a recall of a preexisting attitude or belief, an emotion, a physical reaction, or a learned behavioral sequence. The media may also spark a reconstruction process.

- Altering: Media has the power to alter the existing attitudes of human beings. They can alter the individual's knowledge structure by exposing certain information and revealing that their beliefs were faulty. The change may manifest immediately (during or after exposure to the media message) or take a long time. The modification can also be long-lasting or momentary (disappearing after a brief period).

- Reinforcing: It is repeatedly enforcing the same idea again and again through exposure. This makes ideas and the opinions formed there hard to change. An individual's knowledge structures about those people and events grow more inflexible and less prone to changes later when the media repeatedly covers the same people and events. Individuals' comfort levels with certain views and attitudes become so ingrained that they cannot change them when the media perpetuates those beliefs and attitudes.

Examples

Let's look into a few media effect examples:

Example #1

Consider Dan, who was always curious about investments. From a young age, he keenly listened to advertisements on the TV and paid attention to fine prints in newspaper advertisements. From childhood, he was familiar with the phrase "Investments are subject to market risks" regarding stock markets. Every time he saw the news on stock market crashes, he became more skeptical about it.

Every time he hears or sees the phrase, it brings up an unpleasant feeling, and he refrains from making such decisions. Even after becoming old, he never trusted the stock market and would invest only in safe options such as fixed deposits (FD) or physical assets such as real estate or gold. Investments in any form carry an element of risk. Buildings can depreciate, and FD may not give the desired interest. However, conditioning from a young age invariably developed a negative attitude in him toward stock market investments that continued till old age.

Example #2

The famous tech giant Apple witnessed its stock prices fall on Jan 28, 2021, even after recording high earnings. Despite showing more profit than expected, the news of low sales harmed the company's stock price. The news portrayed the company in a bad light. The public felt that it would not be able to generate cash flows in the future. The variation in expectations negatively impacted the prices.

Frequently Asked Questions (FAQs)

Understanding media effects is crucial due to the vast range of influences the media can wield. These influences can be positive, foster awareness, or exhibit a hostile media effect, contributing to negative societal outcomes such as poverty, crime, violence, and adverse mental and physical health.

There are four overarching models of media effects: Direct effects, conditional effects, cumulative effects, and automatic cognitive effects. These models provide frameworks for understanding the various ways in which media can impact individuals and society.

Media effects pose risks such as misinformation, biased reporting, and manipulation of public opinion. Negative portrayals can impact mental health, fostering issues like anxiety and body image concerns. Exposure to violence may desensitize individuals, while biased content contributes to political polarization. Privacy concerns arise with increased digital media usage, and the normalization of risky behaviors can result from media portrayal. Addressing these risks requires promoting media literacy, critical thinking, and responsible media consumption practices.

Recommended Articles

This article has been a guide to what is Media Effect. Here, we explain the topic in detail, including its theories, examples, and types. You may also find some useful articles here -