Table Of Contents

What Is a Medallion Signature Guarantee (MSG)?

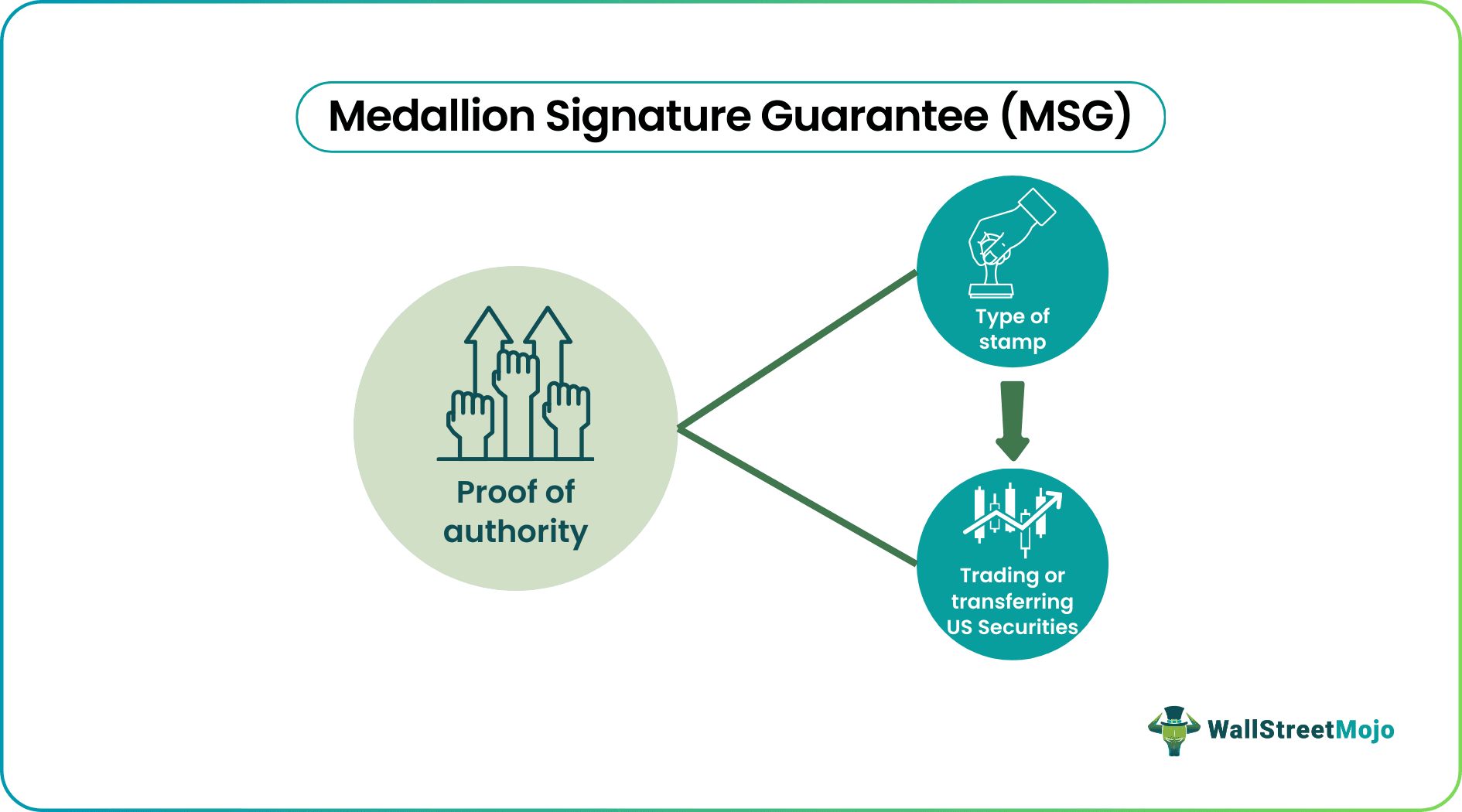

A medallion signature guarantee (MSG) stamp is required for trading or transferring US securities. The stamp acts as proof; it indicates that the person signing the document is authorized personnel. Every MSG stamp has an alpha prefix; it automatically rejects transactions if the sale value exceeds the limit.

MSG Stamps protect stocks, bonds, and other securities from theft and forgery. In case of a forgery, the authorized entity accepts liability through the Medallion program for the associated coverage limit. Investors can acquire MSG stamps from banks and credit unions. For signing MSG, banks charge a specific fee.

Table of contents

- What Is a Medallion Signature Guarantee (MSG)?

- A medallion signature guarantee is a stamp; it indicates the transfer or sale of securities. It is issued by banks and credit unions situated in the United States.

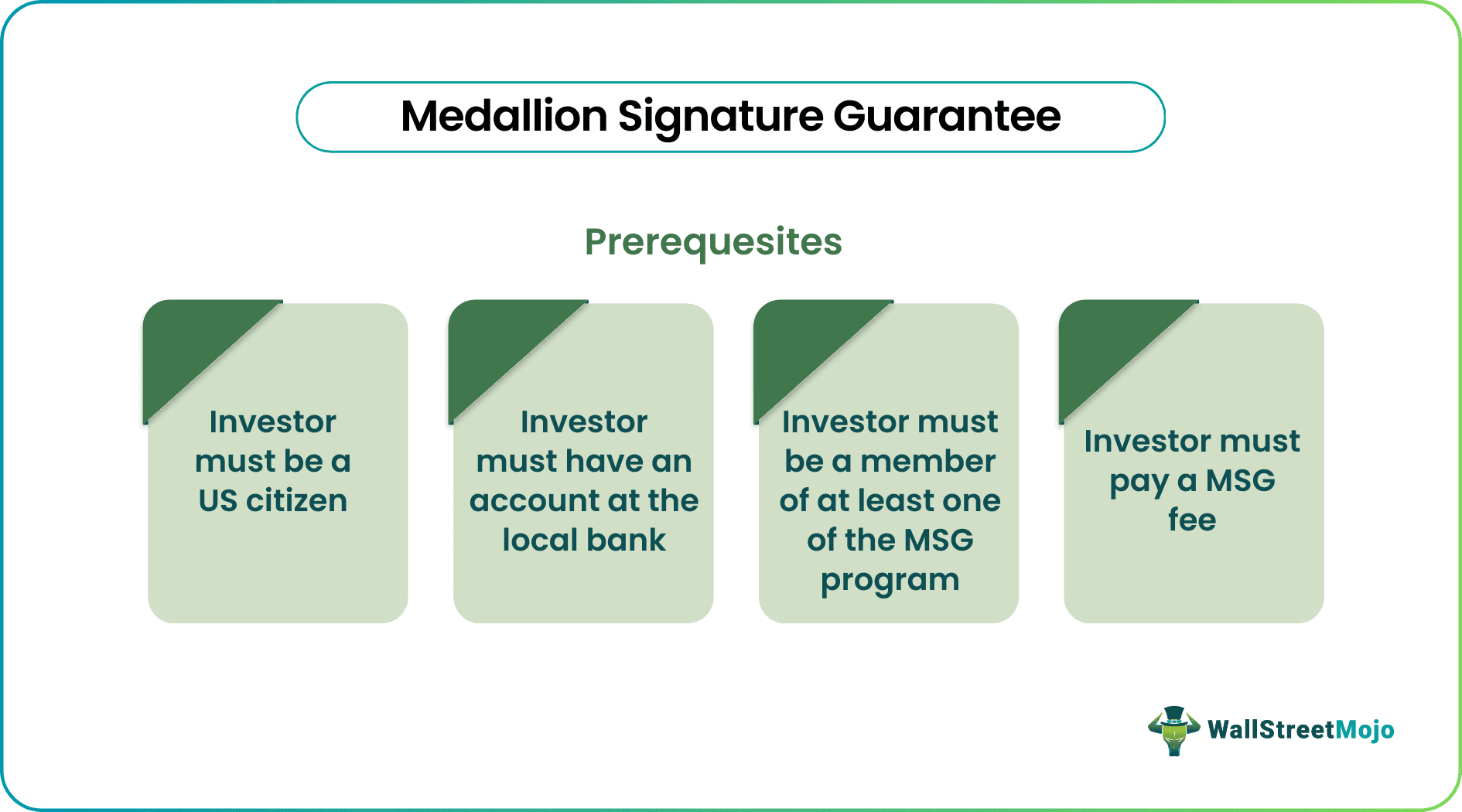

- An investor must be a member of at least one of the MSG programs. There are three MSG programs, and only some banks or credit unions can authorize them. MSGs are not issued to people outside the United States.

- MSG stamping expense ranges from $50 to $75 for a transaction of $100,000.

Medallion Signature Guarantee Explained

A medallion signature guarantee (MSG) is a specific stamp that authorizes the trade or transfer of a security. This includes bonds, stocks, and financial assets in a physical form. For acquiring an MSG stamp, traders follow Securities and Exchange Commission (SEC) guidelines.

MSG stamps can only be acquired in the United States. The SEC prohibits non-US citizens from acquiring MSG stamps. But there are online non-US alternatives like Computershare Guarantee Alternative Program or GAP.

Therefore, if someone holds a security in physical form and has to either sell it or transfer it to someone, this document of medallion signature guarantee stamp has to be signed separately in order to assign or transfer the ownership to another entity or individual. In this manner, the signature is verified, and then the agent will arrange for the transfer.

An individual can only use this facility if they are the customer of the financial institutions given in the list below. In case of any query, the individual should directly contact the transfer agent or the issuer of the same. Sometimes the issuer and the transfer agent may be one and the same. The issuer website granting the medallion signature guarantee online often specifies the names of the transfer agents along with their details. If the financial institution has stamps that can be issued on-site, then they will provide guarantee on that very same day, provided there is no problem or error in the documentation. However, it is not an easy process.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

How To Get?

There are three MSG programs:

- The New York Stock Exchange Medallion Signature Program.

- The Securities Transfer Agent’s Medallion Program.

- The Stock Exchange Medallion Program.

These stamps are issued by banks and credit unions either physically or through medallion signature guarantee website. But in order to acquire them, the investor must be a member of at least one of the MSG programs. If they do, the investor can visit a bank (where they have an account) or a credit union and apply for the medallion by filling out an MSG stamp form.

MSG stamps protect stocks, bonds, and other securities from theft and forgery. Every stamp comes with a coded prefix which varies depending on the value of the security. For example, the prefix C is used for a transaction of $500,000, and the prefix B is used for securities worth $750,000. If the transaction size is unsuitable, the stamp rejects it automatically.

Purchasing stamps from local banks is easier for known customers. For unknown users, the process takes longer. Alternatively, an investor can purchase a stamp online. To authorize stamps, banks charge a specific fee from account holders. The guarantor must imprint each stamp with the phrase, "Signature Guaranteed." In addition, the stamp must contain the guarantor’s full name, signature, and alphanumeric signing number.

Physical stock certificates can get stolen or destroyed, therefore transfer agents provide an MSG stamp which signifies the investor’s right to sell or transfer security.

Purposes

There are various purpose of common reasons for obtaining this medallion signature guarantee stamp.

- This document makes it tough for anyone to take away the securities in an unauthorized manner through forging of signature or through any other unfair means. There is a compulsory matching of signature on the document related to the securities and the file to prevent any problem.

- The transfer agents widely encourage the use of this document so that their liability or loss becomes limited in case there is some kind of forgery.

- It also helps comply with the rules and regulations and industry standards of financial institutions. It is a way of verification of documents and source of assurance that the ducuments are correct, authentic and as per guidelines.

- This document plays an important role while transferring of securities to their beneficiaries in future or making any financial changes, especially if the document is of high value and requires protection of parties.

However, an individual should contact the institution or medallion signature guarantee online to make sure of their eligibility and cost before applying for the document.

Cost

It is to be noted that the cost of the document will vary and will depend on the issuer or financial institution who have the authority to issue the same either physically or through medallion signature guarantee website. But it is commonly issued by large banks and if the customer has a good relationship with these banks then the fees or cost may be waivered. However, the applicable fees may range from as less as $50 upto $100,000.

These guarantees put the financial institutions into huge risks and high liabilities. Thus, they issue these documents only after a lot of scrutiny and not to anyone who ask for it. Established and long-time customers have a greater chance of getting them at low cost.

Examples

Let us look at some medallion signature guarantee examples to understand its practical application.

Example #1

Rutherford is an investor. He possesses all his securities and financial assets in a physical form. If he decides to sell his securities, he needs a legal document. First, he needs to sign a security power.

Security power is a legal document; investors use security power to transfer security ownership. This document is separate from the securities certificate. A security certificate is a legal document that declares the holder's ownership of shares in the mentioned company.

A security certificate or stock certificate contains information pertaining to the name of the holder, issuing date, the total number of shares issued to the holder, and the separate identification number. It is accompanied by the corporate seal and signature.

Also, Rutherford has to sign all these documents in the presence of a transfer agent. Otherwise, the transaction will not be accepted. The MSG program will protect Rutherford's stocks and bonds from forgery and theft. Transfer agents insist on MSG stamps as it limits their liability in cases an investor attempts forgery.

Thus, Rutherford visits the local bank where he has his account. For the transaction, the bank charges an MSG fee. The bank charges $50 for every $100,000. Since Rutherford holds securities worth $900.000, he pays $450 to get his securities signed.

Example #2

Now let us assume that Rutherford wants to sell the security.

Rutherford tries to transfer his securities and assets to his daughter Rachel. This time he visits a credit union, instead of a bank. Credit unions charge $75 for every $100,000. Thus, Rutherford pays $675 to obtain MSG stamps.

Medallion Signature Guarantee Vs Notary

Now, let us look at medallion signature guarantee program vs notary comparisons to distinguish between the terms.

- MSG stamps require strict verification and authentication—performed by a legal authority. Only then, the investor can transfer assets or securities. In contrast, a notary only requires a passport or other government-issued photo ID (say a driver's license).

- Unlike MSG, notarization is quick and easy; the name on the document to be notarized should match the name on the photo ID.

- MSG stamping is used for stocks, bonds, and financial instruments. In contrast, a notary is a public official serving as proof of impartial witness for legal documents like vehicle ownership, lien notice, life insurance policies, etc.

- Medallion signature guarantee program stamping services are offered by banks and credit unions. On the contrary, notary-related activities can be performed by anyone with an active notary public commission from the state.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Banks and credit union brokers offer MSG stamps. But the investor needs to fulfill certain prerequisites—the investor must be a member of at least one of the MSG programs. Also, the investor should have an account with the bank; they must call in advance to specify a particular branch. In the US, Bank of America, Citi, Chase, BNP Paribas, HSBC, US Bank, Northeast Credit Union, Merrill Lynch, etc. banks issue MSG stamps.

An MSG stamp is obtained from a bank, credit union, or broker. First, the individual must contact the bank and inquire about the institutions that offer stamping services. Not all bank branches offer MSG services.

MSG stamping expense ranges from $50 for $100,000 from a bank to $75 from a credit union. To transfer stocks worth 900,000, an investor must pay $450 for stamping.