Table Of Contents

What Is the McClellan Oscillator?

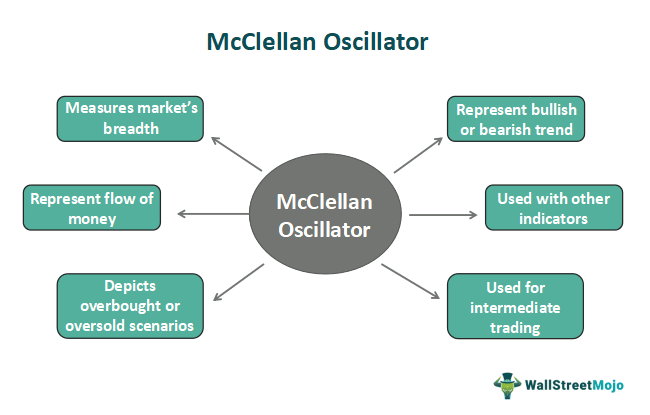

The McClellan Oscillator is a technical indicator used in stock market analysis to assess market breadth. It measures the number of advancing and declining securities. Developed and tested by Sherman and Marian McClellan, experts in economics and mathematics, it originated on the New York Stock Exchange and the NASDAQ in 1969.

The oscillator's readings are dynamic and can vary from day to day. It is widely used across various stock exchanges and is not limited to the NYSE (New York Stock Exchange). The oscillator is similar to other breadth indicators but stands out with its exponential moving averages calculation method. It provides insights into trend strength, identifies market rallies, and aids in predicting continuity.

Table of contents

- What is the Mcclellan Oscillator?

- The McClellan Oscillator is a market breadth indicator that can be applied to any stock exchange or group of stocks to determine trend shift movements.

- The indicator was developed by Sherman and Marian McClellan in 1969 and is utilized as both an oscillator and summation index.

- The daily values of the McClellan Oscillator can be summed up to form the summation index, which is widely used in financial markets.

- One limitation of the McClellan Oscillator is that it is specifically designed for the stock market and may not directly apply to other markets, such as currencies and commodities.

McClellan Oscillator Explained

The McClellan Oscillator indicates market breadth that can help predict shift movements. It offers three key outcomes: it reveals how money flows in the market, identifies overbought and oversold market conditions, and signals market trend reversals. It is particularly useful for short-term and intermediate trading. A positive or green reading indicates money flowing into the market, suggesting a bullish sign.

Conversely, a negative reading indicates money flowing out of the market, signaling bearish conditions. For a comprehensive analysis, traders should combine the McClellan Oscillator with other technical indicators such as ADX, MACD (Moving Average Convergence Divergence), or Relative Strength Index.

The McClellan Oscillator is a valuable tool for traders and analysts seeking insights into market breadth and potential turning points. Its ability to capture advancing and declining issues provides a broader perspective on market sentiment and underlying trends. By incorporating exponential moving averages, the oscillator offers a smoothed representation of market dynamics, allowing for more accurate assessments of trend strength and potential market reversals. With its widespread use and versatility across different stock exchanges, the McClellan Oscillator remains an essential component of technical analysis for traders aiming to make informed decisions in the ever-changing financial landscape.

Formula

The Mcclellan Oscillator formula is as follows:

Ratio-Adjusted Net Advances (RANA) = (Advances - Declines)/(Advances + Declines)

McClellan Oscillator: 19-day EMA of RANA - 39-day EMA of RANA

19-day EMA = (Current Day RANA - Previous Day EMA) x .10 + Previous Day EMA)

39-day EMA = (Current Day RANA - Previous Day EMA) x .05 + Previous Day EMA)

How To Use It?

The following steps point to the application process for the McClellan Oscillator:

- When the McClellan Oscillator is positive, indicating that the 19-day EMA is higher than the 39-day EMA, it suggests that advancing securities are dominating declining securities.

- Conversely, when the oscillator is negative, it suggests the opposite scenario.

- A positive reading on the McClellan Oscillator stock charts signals a bullish market, while a negative reading indicates bearish market trends.

- Price divergences spotted by analysts may indicate an impending thrust or potential market reversal.

- Depending on the thrust observed, it may indicate higher or lower long-term variations.

- Interpreting the charts and MO indicators requires expertise and regular monitoring to ensure accurate information is obtained.

- Analysts can utilize color coding and direction on McClellan Oscillator stock charts.

- When the indicator is red, it suggests an oversold market and a buying decision should be considered when the indicator starts to rise.

- It's important to note that movements in the oscillator can sometimes be insignificant and not add significant value.

- Various McClellan Oscillator websites may provide key information for traders to utilize, adding to the available resources for analysis.

Chart

The following chart of Apple Inc. can help traders understand the concept of the McClellan Oscillator:

As noted above, this oscillator can enable traders to identify oversold and overbought levels. When its value moves above +70, it is an indication of overbought conditions, which means a potential downtrend is on the horizon. On the other hand, if the value drops below -70, it indicates a potential bullish reversal.

For example, traders can observe that on March 20, 2020, the value was more than -85, indicating oversold conditions. After a few days, the bulls started dominating the market and driving the price up. If traders utilized this indicator to spot the oversold conditions before the uptrend materialized, they could make significant gains.

That said, experts advise not to rely solely on this indicator. One must use the tool with other indicators and chart patterns to maximize the chances of success in the market. G the McClellan Oscillator

One can find similar charts on TradingView to improve their understanding of the McClellan Oscillator.

Examples

Check out these examples for a better idea:

Example #1

In October 2022, the McClellan Oscillator depicted an extreme back signal, and it has been offering the same result over the last three decades more than a hundred times. The MO notified traders to turn bullish on their investments as the bear market will likely end, confirming how the money invested today will reap the most return within the next 12 months.

The McClellan Oscillator NYSE could be different, but the last time MO for NASDAQ was negative was way back in March 2020, just before the pandemic shut the entire world economy down. As per the study, the MO is shown to have a 100% track record and is most likely to give big returns.

Example #2

In December 2022, the McClellan Oscillator shifted to a bullish trend complementing a better chance that a higher low for the S&P 500 Index was only in its beginning phase. The regular advancing and declining issues as data form confirm the number of stocks closed up or down in one trading day. The advantageous factor comes from daily readings of data accumulated from the oscillator. When the indicator is above zero, the conditions are bullish, and vice versa.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

It is read by analyzing its values. Positive values indicate a bullish market, while negative values suggest a bearish market. Crosses above or below zero indicate potential trend reversals. Traders also look for divergences between the summation and underlying market indexes for possible trading signals.

The main difference between MACD (Moving Average Convergence Divergence) and the McClellan Oscillator is their focus. MACD analyzes the convergence and divergence of moving averages to identify trend changes. In contrast, the McClellan Oscillator measures market breadth by comparing advancing and declining stocks. Both indicators are used to assess market conditions, but they provide different perspectives on price and breadth dynamics.

The technique has some limitations to consider. It is primarily designed for the stock market and may not be directly applicable to other markets. Additionally, it relies on advancing and declining stocks, which may not accurately reflect the overall market sentiment. Traders should be aware that the McClellan Oscillator is a lagging indicator and should be used with other technical analysis tools for comprehensive market analysis.

Recommended Articles

This article has been a guide to what is Mcclellan Oscillator. Here, we explain the topic in detail, including its chart, formula, how to use it, and examples. You may also find some useful articles here -