Table of Contents

Materiality Threshold Meaning

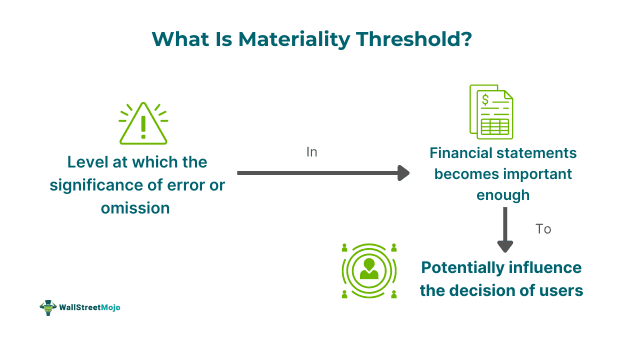

The materiality threshold refers to a financial reporting concept that gauges the extent to which misstatement or omission of any item could affect the economic decisions of the financial statement users. Thus, it determines a company's financial statements' reliability, credibility, accuracy, and transparency.

It is the central concern in auditing a firm's financial accounts since even a minor discrepancy can significantly impact the financial reports. Thus, it not only ensures that the company adheres to the Financial Accounting Standards Board (FASB) and US Securities and Exchange Commission (SEC) regulations but also assures the disclosure of the company's true financial position to various stakeholders, including investors and creditors.

Key Takeaways

- The materiality threshold is the degree of misstatements and omissions in the financial statements that can further reflect the company's unreal financial position in front of the stakeholders, prominently impacting their economic decisions.

- It is an inevitable part of financial report auditing to ensure that the company's financial statements are relevant, reliable, transparent, credible, and accurate.

- Regulatory bodies like the FASB and SEC mandate that companies comply with the regulations regarding the materiality threshold to safeguard the interests of investors and other stakeholders.

- However, FASB suggests the consideration of both quantitative and qualitative factors for such assessment.

Materiality Threshold In Audits Explained

The materiality threshold in audits can be understood as the percentage of omissions or misstatements in a company's financial reporting that could further interfere with the economic decisions of the various stakeholders. It aims to maintain the reliability, relevance, accuracy, transparency, and credibility of the financial statements, ensuring that the items so recorded reflect the true financial position of the company.

The old method was based upon the 5% rule for verifying the materiality in accounting. According to the SEC materiality threshold, the items were considered material by distinguishing them based on the following criteria:

- Upto 5% - Immaterial;

- 5-10% - Items require further assessment or judgment; and

- Above 10% - Material.

Most of the time, the items fall in the first category, requiring extensive professional judgment by the auditors.

However, the recent updates from the Financial Accounting Standards Board (FASB) in the US Generally Accepted Accounting Principles (GAAP) have suggested that the management should follow a mixed approach of quantitative and qualitative aspects to reflect the proper financial health of the company. Now, the four critical areas of materiality concerns include:

- Internal control deficiencies

- Accounting estimates

- Financial misstatements or errors

- Fraudulent activities and manipulation

Frequent review and effective management can help businesses reduce the chances of errors, deficiencies, and fraud, maintain proper financial statements that comply with all regulations, and serve the purpose of investors and stakeholders.

How To Determine?

Auditors need to follow a defined set of principles and use their expertise for materiality threshold audits of a company's financial transactions. The idea is to figure out the type and amount of misstatement. Although the old approach governs the use of the 5% rule for quantifying this threshold, the Financial Accounting Standards Board (FASB) has suggested considering it subjective and avoiding the use of quantitative parameters, formulas, or benchmarks for evaluating the financial statements' materiality.

Thus, the FASB prioritizes using both quantitative and qualitative factors to determine such materiality to get a clear picture of the company's position. Even a tiny error in the financial transactions can distort the reliability and relevance of the financial statements.

Further, the auditors need to employ their professional expertise and judgment to analyze the materiality in terms of:

- The nature, type, impact, and amount of misstatement;

- The financial impact of such discrepancy on compensation plan profitability and

- The effect of this error on investor's decisions.

Thus, the auditors need to assess the absolute and relative impact of such materiality in financial statements. The materiality threshold is simply the percentage of misstatement out of a company's overall revenue during the given period.

Examples

Materiality in financial accounts can result in significant discrepancies when reporting the actual financial position to the stakeholders. Let us take some examples.

Example #1

Suppose, during the audit of two companies, A and B, with revenue of $25 million and $42 million, respectively, it was found that there were misstatements of $2 million each. The percentage of misstatement relative to revenue for each company was calculated as follows:

Company A

Materiality Threshold = ($2 million/$25 million)*100 = 8%

Company B

Materiality Threshold = ($2 million/$42 million)*100 = 4.76%

In this scenario, Company A's misstatement percentage is 8%, which may be considered material based on common thresholds (typically around 5% of revenue or other relevant financial metrics). Therefore, this misstatement would likely require further investigation and adjustments.

For Company B, the misstatement percentage is approximately 4.76%, which is slightly below the 5% threshold. While this percentage might be considered immaterial in some contexts, auditors would still need to use professional judgment to determine whether the misstatement is material, considering both qualitative and quantitative factors.

Example #2

Assume that ABC Ltd. made $10 million in the last financial year. The auditor, Jennifer, found that the accounts have an omission of $0.2 million of stocks, which is just a 2% materiality threshold. However, she suspects that this is manipulative practice since the inventory was missing from the warehouse. Hence, this materiality was noticed and needed further inspection.

Importance

The significance of the accounting materiality threshold can be understood during financial auditing. It is a critical part of a company's financial reporting for the following reasons:

- Gauges reliability: Sticking to the acceptable materiality threshold helps management ensure that the financial statements are reliable and depict the company's true financial position.

- Ascertains transparency: It further checks whether all the transactions are recorded with sufficient transparency in the books of accounts without much materiality.

- Detects frauds and errors: A materiality check is essential for spotting misstatements, fraudulent entries, or errors in a company's financial reports.

- Auditing accuracy assures that the auditor has properly analyzed the company's financial accounts while ensuring a desired level of immateriality.

- Ensures usability: It is essential for maintaining the trust and confidence of the stakeholders, especially the investors, in using the company's financial reports for economic decision-making.

- Regulatory compliance: Bodies like the FASB and SEC require companies to have a minimum materiality threshold for efficient financial reporting.

Challenges

While determining the materiality threshold is necessary for assessing the reliability of the financial reports, at the same time, such an analysis possesses the following limitations:

- Qualitative plus quantitative aspect: The auditors must use all their professional knowledge and judgment to determine the materiality of the books since it cannot be evaluated solely through a quantitative measure but requires a qualitative assessment as well.

- Global regulations: The auditors may encounter difficulties in following the global rules of materiality in financial auditing.

- Difficult to gauge risk: With such a subjective approach, accurately measuring the risk of a misstated item becomes challenging for auditors. Management needs to emphasize global environmental concerns along with company-specific insights while determining climate change risk.

- Restrictive time frame: Climate-related risk affects the business over a certain time bracket. Therefore, management must consider or report the impact of such uncertainties in the short, medium, or long term.

- Information users' needs: When making materiality judgments, the auditors have to centralize the requirements and expectations of the respective financial statement users, like investors with a long-term investment perspective, short-term investors, creditors, suppliers, etc.

- Ascertaining threshold: The materiality threshold varies from company to company. Therefore, management needs to consider the firm's size, stakeholders' needs, and industry type when setting a limit.

- Excluding immaterial information: Management also faces difficulty in segregating immaterial information from the financial statements to draw a clear and true picture of the company's finances. Such immaterial information is separately stated in a different statement.

- Selection of relevant KPIs and metrics: Companies should choose key performance indicators (KPIs), metrics, and benchmarks that show their unique materiality assessments rather than just complying with the set of rules and regulations.