Table Of Contents

What Are Material Participation Tests?

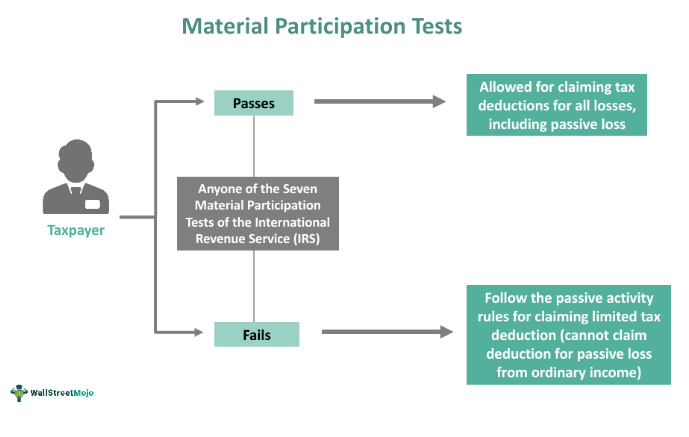

Material Participation Tests are guidelines defined by the Internal Revenue Service (IRS) to ascertain a taxpayer's substantial, regular, and continuous participation in income-generating activities, including business, trade, and rental activities. A taxpayer’s involvement is assessed through seven tests, and their material participation is confirmed if they fall under any of these tests.

A materially participating taxpayer can claim a tax deduction of all their losses. However, if a taxpayer is not classified under any of the seven material participation tests, they are allowed the limited deduction of passive losses according to the passive activity rules. Taxpayers should maintain records and present written evidence to prove their substantial involvement in income-generating activities.

Key Takeaways

- Material Participation Tests are seven IRS-devised criteria for determining an individual's eligibility as a regular, substantial, and continuous participant in an income-producing activity such as a business, trade, or rental activity.

- These tests are used to ascertain if a taxpayer can deduct losses or claim specific tax benefits associated with the activity in question.

- A taxpayer should qualify for at least one of these tests to be recognized as a material participant;

- otherwise, the passive activity rule is applicable, where they can claim a passive losses deduction only against the passive income under tax treatment.

Material Participation Tests Explained

Material participation tests are used by tax authorities to determine whether a taxpayer actively participated in a business or investment activity. These tests help verify a taxpayer's eligibility for specific tax deductions or tax credits related to that activity.

The Internal Revenue Service (IRS) employs material participation tests to check if a taxpayer in the US qualifies under a specific category as a Material Participant, i.e., whether they meet the criteria for being categorized as a Material Participant in that activity.

IRS material participation tests aim to ensure that taxpayers are genuinely involved in managing and operating the business or investment rather than being passive investors or solely providing financial support. Satisfying the material participation requirements allows taxpayers to treat their involvement as non-passive, potentially resulting in additional tax benefits. Moreover, these tests are based on two crucial factors:

- Number of hours or periods of regular, substantial, and continuous working in the business, trade, or rental activity;

- Work type, i.e., the regular business management of everyday operations evident through work calendars, appointment diaries, etc.

The IRS performs such tests for every tax year. If taxpayers are found to be materially participating in the money-making activity, they can claim a tax deduction for all their losses. However, after the Tax Reform Act of 1976, the Internal Revenue Code (IRC) devised at-risk rules, limiting the number of deductions for financial losses claimed by taxpayers participating in at-risk activities. Moreover, passive activity rules apply if taxpayers fail to prove material participation.

Taxpayers are precluded from claiming passive loss deduction from ordinary income and active income generated from money-making activities. Thus, it allows taxpayers to claim deductions of passive losses only from passive incomes.

Types

The IRS uses material participation tests to determine whether an individual qualifies as a material participant in a business, trade, or rental activity. Below are the seven material participation tests:

Test 1: 500-Hour Test

Taxpayers must participate in the activity for more than 500 hours during the tax year. This involvement can be in any form, such as attending meetings, handling administrative tasks, or making management decisions.

Test 2: Regular, Continuous, and Substantial Activity Test

This test evaluates the regularity, continuity, and substantiality of an individual's involvement in the activity. To qualify, taxpayers must demonstrate that their participation is regular, continuous, and substantial compared to others/employees.

Test 3: Maximum Participation Test

It gauges whether a taxpayer's involvement in the business, trade, or rental activity exceeds 100 hours in the prevailing tax period. Also, such participation in the activity in question should be greater than the involvement of other individuals like non-interest owners.

Test 4: The Significant Participation Activity (SPA) Test

Under this test, taxpayers must prove their involvement in Significant Participation Activities for more than 500 hours in the given tax year. Their involvement in these significant activities was 100 hours or more each. However, they must not qualify for any previous material participation tests. It means except for this test, they failed every previous test that proves material participation.

Test 5: Historical Participation Test

A taxpayer’s material participation is considered valid if they have materially participated for at least five years in the activity in question in the preceding ten tax years, whether subsequent or not.

Test 6: Personal Service Activity Test

This test specifically applies to individuals engaged in personal service activities, such as law, medicine, accounting, consulting, or the performing arts. If an individual materially participates in a personal service activity for three of the past five tax years, they qualify under this rule.

Test 7: Facts and Circumstances Test

When the tests above do not apply, taxpayers can still qualify as material participants by demonstrating their regular, continuous, and substantial involvement in an activity for a minimum of 100 hours in the given tax year. It is valid only when other individuals have not contributed as much and are not compensated for managing the activity. This test considers the taxpayer's expertise, time devoted to the activity, and their role in decision-making.

Examples

Let us look at some examples to understand the concept better:

Example #1: Rental Activity

Mr. A is a member of a Real Estate Investment Trust (REIT). He is responsible for the upkeep of various rental properties, their repairs, maintenance, cleaning, and security. He maintains a work calendar, timesheet, and appointment diary to record the time he spares for the activity. In the seven material participation tests, he failed the 500 hours test. However, he passed the regular, continuous, and substantial activity test of the IRS and had sufficient written proof to verify it (calendar, timesheets, etc.).

Example #2: Business Activity

Ms. B is an investor in PQR Ltd. but appears as a partner in the books. IRS conducted the seven material participation tests, which she failed. Thus, she could not prove her material participation in the business activity and hence could not claim tax deductions for the passive losses from ordinary income.

Pros And Cons

The material participation tests are crucial for strengthening the tax system and discouraging taxpayers from taking undue advantage of potential loopholes in tax procedures and regulations. However, it also poses various challenges and limitations. Let us discuss the advantages and disadvantages of these tests to the authority and taxpayers:

| Pros | Cons |

|---|---|

| Material participation tests enable individuals to qualify for tax deductions for the total losses incurred in a tax period from business, trade, or rental activities, thus, lowering their tax liabilities. | It is slightly challenging and requires individuals to navigate detailed IRS guidelines and regulations. Thus, it becomes challenging to comply with such rules, especially for individuals with multiple activities or complex business structures. |

| Active participation allows individuals to offset income from passive activities with losses incurred in those activities, providing valuable tax advantages. | Some material participation tests, like the 500-hour test, demand a significant engagement of time and effort in the activity. |

| It provides flexibility as individuals can aim to pass any of the seven tests, as only one must be cleared to enjoy the relevant tax benefits. | Proper record-keeping results in administrative hassles and may require individuals to develop effective systems for tracking their involvement, which is time-consuming and resource-intensive. |

| It encourages, recognizes, and motivates individuals who actively manage their businesses through appropriate tax treatment. | Failing to meet the tests can classify participation in an activity as passive. |

| It builds a fair and robust tax system by separating active participants from passive investors. | This classification restricts individuals from availing tax deductions for losses from passive activities against other forms of income, potentially reducing immediate tax benefits. |