Table Of Contents

Master Limited Partnership (MLP) Meaning

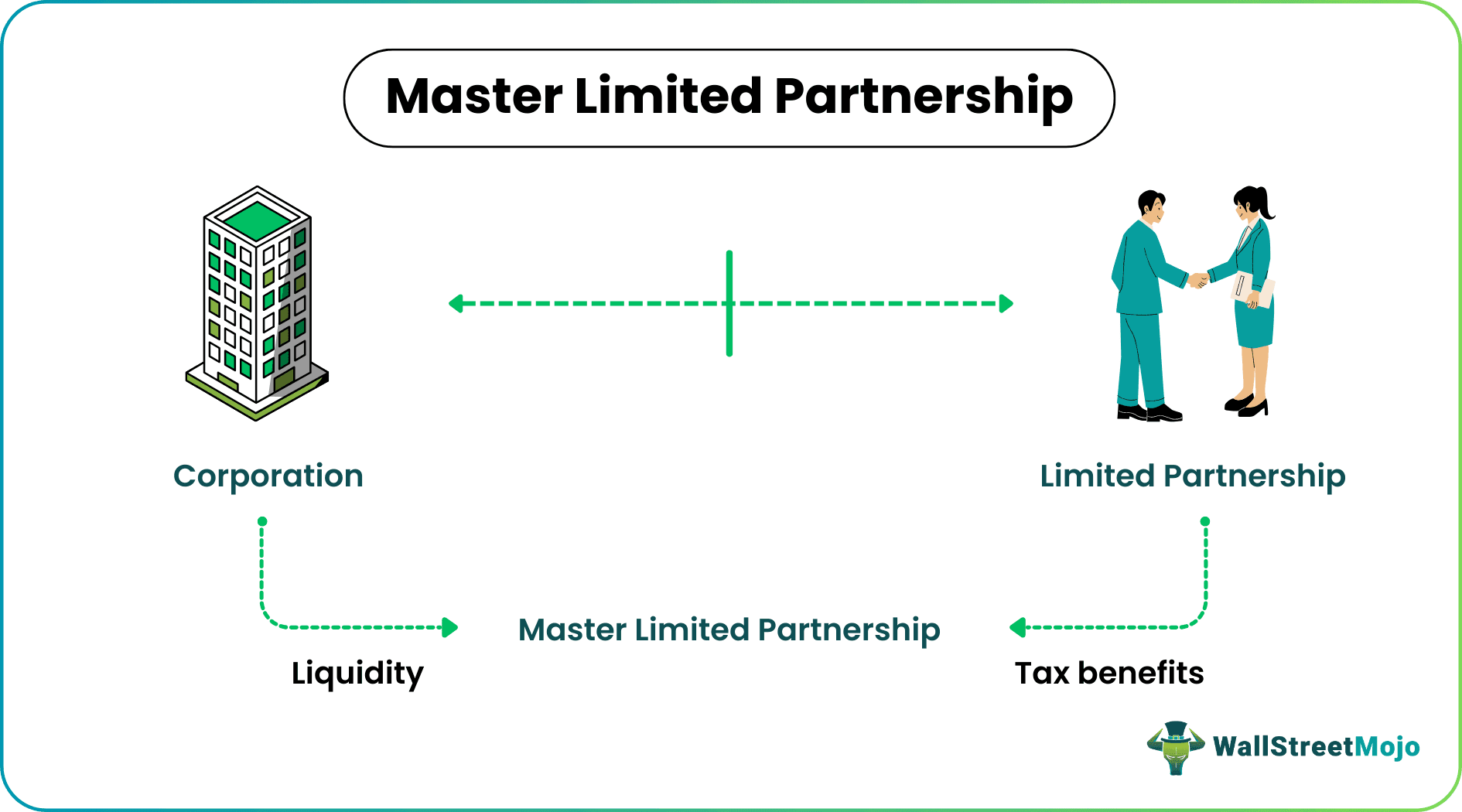

Master limited partnerships refer to business entities that function as publicly traded limited partnerships. They are the middle ground between a corporation and a partnership, providing the firm with the advantages of both. MLPs are currently popular in the natural resources and real estate sectors.

MLPs receive tax benefits like other limited partnerships. Still, tax treatment can vary depending on various factors, such as the type of MLP, the partners' residency, and the jurisdiction where the MLP is established. They also have the liquidity of a corporation, as they can issue stocks via national exchanges to raise capital. MLPs comprise two types of partners – general and limited. The former are the owners, whereas the latter are the unitholders or shareholders.

Key Takeaways

- A Master Limited Partnership (MLP) is a type of business entity that combines the features of a partnership and a corporation, often found in the natural resources and real estate sectors.

- Examples include Goldman Sachs Energy Renaissance Fund, Mackenzie Master LP, Brookfield Infrastructure Partners LP., EPD., etc.

- The primary benefit of a Master Limited Partnership (MLP) is the tax advantage it provides to the owners compared to a corporation.

- MLPs may have higher complexity and administrative costs than corporations and face regulatory hurdles and limitations on their business activities.

How Does Master Limited Partnerships (MLP) Work?

Master limited partnerships are business ventures born from a limited partnership and a corporation. It allows the firm to receive tax benefits and issue shares to raise capital. The first MLP, Apache Petroleum Company, was introduced in 1981. However, after this, many MLPs came up owing to their vast benefits, which eventually led to decreased tax revenue for the government. Thus, in 1987, Congress limited MLPs to sectors such as transportation, natural resources, processing, etc.

Three aspects need to be understood regarding MLPs – liquidity, structure, and taxation. Furthermore, MLPs can raise capital by issuing units via national stock exchanges. It increases their liquidity positions as compared to traditional partnerships. MLPs are usually associated with steady but low-risk returns and not necessarily slow returns.

There are two types of partners in MLPs – limited and general. Limited partners are the unitholders who invest in these entities. Also known as silent partners, they do not have any voting or decision-making rights in the company, unlike a normal listed company. However, they are paid a share of the entity's profits regularly. General partners are the owners or the original partners. They have at least a 2% stake in the venture. Also, they make important decisions regarding the firm and manage its day-to-day operations. They are paid based on the entity's financial performance.

MLPs are taxed, similar to limited partnerships. That is, the entity, as such, doesn't owe any tax, but the owners (general partners) pay the business tax as part of their income tax. Further, all the partners can claim any deductions, such as depreciation, etc., on their taxable income. However, the entity should generate at least 90% qualified income to obtain the pass-through status. Qualified income implies the revenue from activities such as transportation, storage, natural resources exploration, etc.

Examples

Here are some examples of MLPs.

Example #1

A simple example of a Master Limited Partnership (MLP) is a pipeline company that transports oil and gas from production sites to refineries. The MLP structure allows the company to raise capital from investors (limited partners) who provide funding for the construction and operation of the pipelines. The limited partners receive a share of the company's profits through regular distributions, which are taxed as passive income.

Meanwhile, the company (the general partner) operates and manages the pipelines and earns a management fee for these services. The income generated by the pipeline operation is passed through to the limited partners and is only taxed at the partner level rather than at the entity level.

Example #2

Goldman Sachs MLP and Energy Renaissance Fund is managed by Goldman Sachs Asset Management's Energy and Infrastructure Team. It started trading in September 2014. Since then, it has grown to become one of the industry's top MLP investments. Recently, the entity announced its quarterly distribution. The $0.2 per unit distribution is a 14% increase over the previous quarterly distribution and will be payable by November 30, 2022. Also, the Fund's Board has launched a repurchase program aiming to repurchase $10 million worth of outstanding shares. It will be effective from November 10, 2022, to November 10, 2023. The repurchase program seeks to enhance unitholder value.

Advantages & Disadvantages

Master limited partnerships (MLPs) offer several advantages, including:

- Tax benefits: MLPs are pass-through entities, meaning they do not pay corporate income taxes at the entity level.

- High yield: MLPs typically pay higher dividends than traditional corporations, making them attractive to income-focused investors.

- Diversification: Investing in MLPs can benefit diversification, as they often operate in different sectors and regions than traditional stocks and bonds.

- Long-term growth potential: MLPs typically engage in activities related to natural resources, such as oil and gas production, pipelines, and other infrastructure, which can provide long-term growth potential as demand increases.

- Limited liability: MLP investors typically have limited liability, meaning they are only responsible for the amount they have invested in the partnership and not for any additional debt or obligations.

Here are some of its negative points.

- Complex taxation: MLPs are subject to a complex tax system, making it difficult for investors to understand the implications of their investments.

- Dependence on commodity prices: MLPs often operate in industries such as oil and gas that are subject to significant price volatility, which can impact the financial performance and stability of the partnership.

- Distributions not guaranteed: MLP distributions are not guaranteed and can be changed or suspended by the partnership at any time.

- Limited voting rights: MLP units typically offer limited voting rights, which means that unit holders have limited control over the partnership's decisions.

- Limited transferability: MLP units may have restrictions on transferability, which can make it difficult for unit holders to sell their units.

Master Limited Partnership vs Limited Partnership

Master Limited Partnership (MLP) and Limited Partnership (LP) are both types of partnerships, but there are some key differences between the two:

| Parameters | Master Limited Partnership (MLP) | Limited Partnership (LP) |

| Taxation | MLPs are taxed as partnerships, meaning the partnership does not pay taxes on its income; instead, the income is passed through to the unit holders. | LPs are taxed similarly to MLPs. |

| Publicly Traded | They are publicly traded, which makes them more accessible to individual investors. | They are typically private investments. |

| Ownership Structure | MLPs issue units that are similar to stocks and are owned by individual investors. | LPs issue partnership interests owned by partners, individuals, or corporations. |

| Distributions | They typically pay higher distributions than LPs due to their focus on the energy sector and their publicly traded structure. | Distributions are smaller than MLPs. |

| Management Structure | MLPs have a more centralized management structure, with decisions made by the general partner. | While LPs can have a more decentralized structure, with partners having more control over the partnership's decisions. |