Table Of Contents

What Is Martingale System?

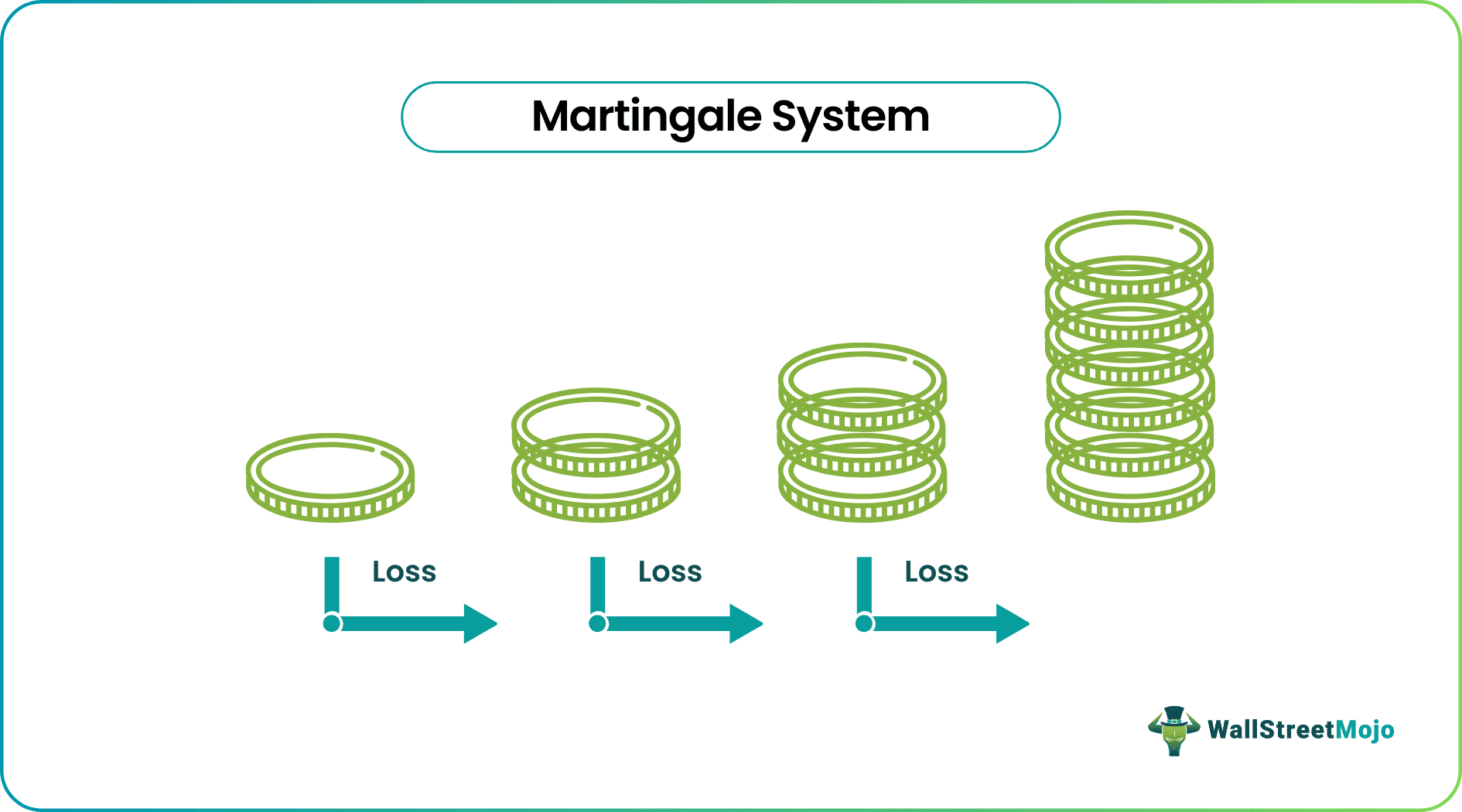

The Martingale System is a bet big, win big investment strategy. The gambler doubles up on the next trade for each loss. The investor earns the difference between profit and loss. This strategy is very common in casinos, online games, and gambling.

The strategy is founded on the idea that it takes only one good hand to make a fortune. It is also called the zero-expectation scenario. The strategy seems probable only in theory. Historical data suggest that such an approach can work only for short durations. Also, this approach comes with high-risk stakes attached to it.

Table of contents

- What is Martingale System?

- The Martingale System is a strategy where participants double the amount of trade they lost. These gamblers look for one good hand that can make all the difference. The participant earns the difference between net profit and net loss.

- Along with casinos, online games, and gambling, the Martingale System trading is also common among investors and traders.

- The reverse strategy is called the anti-martingale system or reverse martingale system, where traders double up on winning and cut the bet into halves if they lose. Both approaches are witnessed in capital markets.

Martingale System Explained

The Martingale System is an investment strategy, especially applied by those who bet in casinos and gambling. However, it is common among Forex traders and investors who seek immediate returns. Paul Pierre Levy first introduced the martingale approach in the 18th century. Levy was a French mathematician.

Based on this strategy, the gambler doubles up their trades, looking for that one good hand or big win to cancel out losses. If successful, the bettor can take home the difference. Alternatively, the investor could take a bigger risk by repeating the strategy for a prolonged period.

It is often referred to as the Martingale System Roulette or the Grand Martingale System. However, this approach has a huge drawback—short-term mindedness. In the long run, It is highly unlikely that this strategy would work.

Many studies analyze graphical martingale data and have observed that the strategy does increase the chances of winning in the short term but fails drastically in the long term.

Another obvious drawback behind the approach is the high risk associated with it. Inexperienced individuals with low capital may lose a large amount of money by repeating this process too many times. Therefore, it is only recommended for short-term gains; for example, in the short-term, an individual can win many hands at the casino, but if they keep playing, the casino is more likely to win major bets. Otherwise, a simple Martingale System calculator can significantly reveal how people with the urge to win big.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Let us look at some examples to understand the martingale approach better.

Example #1

Frank has a gambling problem. He visits a casino and starts gambling small with $20. Let us assume that Frank loses the first $20. He then doubles his trade and bets $40; he loses again.

But Frank does not give up; he doubles up again; betting $80 this time. Luckily for Frank, the third time was the charm.

So technically, Frank lost the following amount:

$20 + $40 = $60.

But, at the same time, he also won $80 on his third hand. So, he made the following net profit:

$80 - $60 = $20.

Frank can either cut his losses and go home with the $20 or keep doubling. In the real world, however, it is a huge gamble; the bettor risks losing.

Example #2

Alternatively, let us assume that Frank bets only the half in his next trade upon incurring a loss and doubles up when he wins; it would be called an anti-martingale system. It reverses the martingale strategy.

By following the anti-martingale, Frank bets $20 and wins; for the second trade, he bets $40 and wins again. Then, Frank bets $80 on his third bet; he loses. After his loss, he bets only $40.

So Frank may decide to leave the game earning from the difference or keep playing. Continuing would be highly risky.

Martingale Strategy in Forex

In Forex, the Martingale System is very common. Investors bet on different currencies and rely on the volatile nature of foreign exchanges. In the forex market, the outcome is always a variable; it does not run parallel to a simple win-or-lose outcome.

Instead, in Forex, traders can set the exact price at which they would like to exit—irrespective of the profit-loss. The trader can limit the amount (potential profit or loss).

The martingale approach is popular among currency traders because the price of currencies rarely drops to zero. This is the distinction between Forex and the stock market. Thus Forex attracts traders with substantial capital.

Let us assume that a trader with a positive carry direction employs the martingale method on a currency pair. In such a scenario, the trader might as well borrow low-interest currencies and buy a different currency with a higher interest.

Then there is the Double Martingale System. Let us again assume that Frank buys a single lot anticipating an upward trend. Simultaneously, Frank sells one lot at the same price; if the price goes down when one martingale stops, the other takes over.

This technique can earn pips during periods when the price varies. However, Frank's winning transactions only require an additional lot, and there isn't a wide relative difference between the two martingales. In this strategy, risks associated with the first martingale are mitigated by the pips Frank earns from the second martingale.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The Grand Martingale System is allowed in online casinos, roulette, and offline gambling. However, historical data suggests that the casino or playmakers end up netting cash from players long-term. But a well-planned gambler can make a profit short-term and take the winnings home.

The martingale approach is profitable only in short-term plays; small profits often induce players with emotional confidence to play a bigger hand. But, eventually, players who keep playing for long periods lose enormous amounts of money.

There is a critical problem with the martingale strategy. Many gamblers do not understand that a single wrong play can cost them a lot of money. So instead, they bet all the available cash to bankroll the bets. In theory, everything sounds plausible, but it is dangerous when applied to real-world scenarios and real games. Also, not everyone possesses the necessary capital to double down consecutively.