Table Of Contents

What Is Markup Percentage?

Markup Percentage is a percentage mark-up over the cost price to get the selling price and is calculated as a ratio of gross profit to the cost of the unit. In many cases, the companies that sell their products, during the process of decision making for selling price, take the cost price and use a mark-up, which, in general, is a small factor or a percentage of the cost price, and use that as the profit margin and decide the selling price.

Thus, it is basically the difference between the selling price of the product and the services and its cost. Using this method, the business can determine the minimum amount that they can add to the product’s cost to determine its selling price, which will help in earning maximum profit.

Table of contents

- What Is Markup Percentage?

- Markup percentage refers to the percentage added to the cost price to determine the selling price. It's calculated as the gross profit ratio to the unit cost.

- Many companies consider the cost price and apply a markup or a percentage of the cost price during the decision-making process for the sale price of their products.

- The markup can vary between industries, as it is not static or standardized. Instead, it depends on factors such as the firm's reputation, customer loyalty to its brand, and the changing costs for a customer from the company's product to the substitute product.

Markup Percentage Explained

Markup percentage is the cost of the item and the price that the seller will charge from the end user. It can be said to be the ratio of the gross profit of the product to its cost price. It is very useful measure for businesses that sell physical products. But is it not fixed for all companies producing similar products and varies as per the company policies, production method, raw materials, etc.

It is helpful for products with discrete marginal costs because the calculation can be determined better. However, the higher the percentage, the better. So the entity must try to find markup percentage that is higher and try to maintain it. This can be done using two methods, the first is to reduce the cost of the products, and the second is to increase the price.

A business that manufactures its products incurs less cost than the ones that buys its raw materials from retailers because the retailers will sell products after adding their profit. But, again, entities with a lot of competition must keep their prices down to avoid losing customers. Thus, their percentage will be less. They must continuously innovate and grow to keep their place in the competitive market.

Formula

From the below mentioned formula, let us understand how to calculate markup percentage.

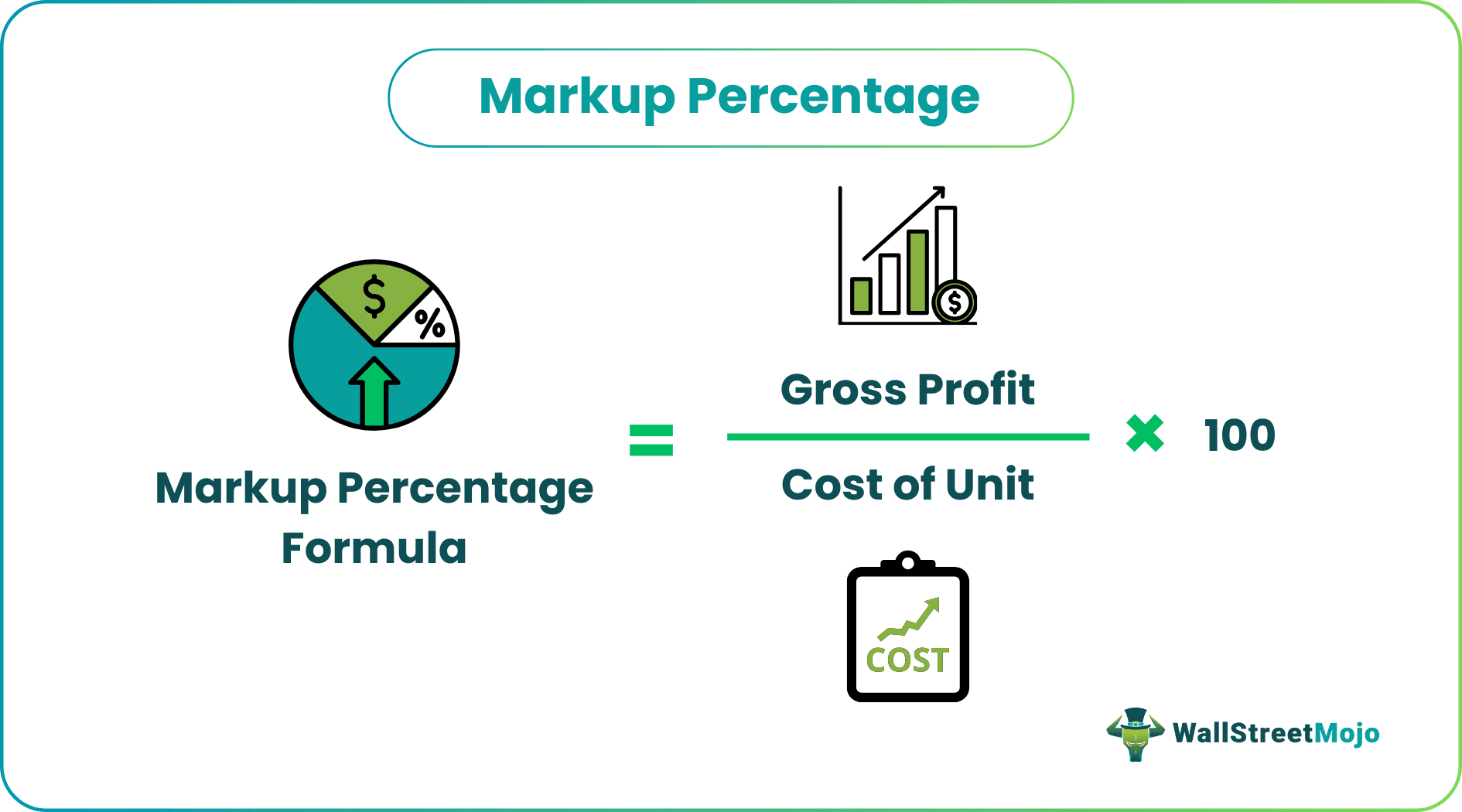

Markup Percentage can be calculated as the gross profit in terms of percentage which would be of the cost of the unit and can be represented using the below formula:

Markup Percentage: Gross Profit / Cost of Unit x 100

Hence, it can state that markup is a difference between the selling price and the cost of service or goods. And when this difference is taken as a percentage of the cost, it will be the markup percentage.

The numerator part of the formula is the margin desired by the business to maximize its profit and stay with competitors' margin; otherwise, the customer will switch to a competitor who charges less. Therefore, the first step is to calculate the gross margin, which is nothing but the difference between the sales revenue or the selling price and the cost of goods sold or the cost price per unit.

The second step is to divide the margin or the gross profit by the cost of goods sold, which shall give us the markup percentage. Thus, from the above formula and explanation, we come to know how to calculate markup percentage.

Examples

Let’s see some simple to advanced examples to understand them better.

Example#1

Consider the selling price of a bike is 200,000, and the cost price of the bike is 150,000. You are required to calculate the markup on the bike and markup percentage that the dealer is trying to implement on the same.

Solution:

Use the following data to find markup percentage.

Calculation of markup can be done as follows –

Markup = 200000 - 150000

Markup = 50000

So, the calculation of markup percentage can be done as follows –

Markup percentage = 50,000 / 150,000 * 100

Example#2

McDonald's is one of the famous brands in the world that makes hamburgers. Mr. Wyatt, who eats a lot of these hamburgers, is interested in knowing what markup they apply and hence decided to review their income statement. Reviewing its income statement for the quarter ended December 2018, one can observe that for that quarter ended December 2018, it has reported revenue of $5.163 billion. Further, it has reported $2.697 billion as the gross profit. You must calculate the Markup Percentage that McDonald's is applying to earn and the cost of the goods sold.

Solution:

Use the following data for the calculation of markup percentage.

Calculation of cost of goods sold can be done as follows –

Cost of Goods Sold = 5.163 - 2.697

Cost of Goods Sold = 2.466

So, the calculation of markup percentage can be done as follows –

Markup Percentage = 2.697 / 2.466 * 100

Example#3

Ankit industries are based out of Surat from Gujarat in India and are operating under the textile business. Simula and the company have been appointed as the Ankit Industries stock auditors. Ankit industries need funds to expand the business and have applied for an overdraft facility with the State Bank. State Bank has gone through the application and was surprised to know that it reported a 78% markup margin. Hence, it asked Simula and the company to investigate the number and if a found right bank will fund the 80% of the loan requirement subject to fulfillment of other terms and conditions.

Solution:

Use the following data for the calculation of markup percentage on cost.

Calculation of cost of goods sold can be done as follows –

Cost of Goods Sold = 20000000 + 15000000 + 30000000 + 60000000 + 4000000

Cost of Goods Sold = 129000000

Calculation of gross profit can be done as follows –

Gross Profit = 229620000 - 129000000

Gross Profit = 100620000

So, the calculation of markup percentage on cost can be done as follows –

Markup percentage = 100620000 / 129000000

Calculator

You can use the following calculator to find out the best markup percentage.

Benefits

Let us look at the benefits of calculating the best markup percentage.

- Understanding the markup is crucial for the firm or the business. For example, establishing the strategy for pricing will be one of the key parts of strategic pricing.

- The markup of a service or good should be enough to offset or say, in order words, to cover up all the business expenses, and it should also be able to generate a profit for the firm or the business.

- Markup can be different for various industries, as the same cannot be static or normal. It would depend upon how good the firm's reputation is, how loyal their customers are to their brand, switching costs for a customer from the company's product to the supplement product.

- Further, the company's pricing power also helps determine the markup that they desire.

You can download this Excel Template here - Markup Percentage Formula Excel Template

Limitations

The method has some limitations as given below:

- Competitive pricing may not be achieved. The method may suggest a good price for the product but if it is much higher than its competitors then the business will lose customers, bringing down profits.

- The external factors like economic conditions, the demand of the good in the market, change in technology, competition, etc is ignored in this method. These factors are very important while pricing a product because they influence the sales considerably.

- The cost estimation may not be made in an accurate way. This will mislead the entity and the ultimate result will be prices that are either too high or too low for the market to accept.

- The process can become complex if the company has various range of goods and services. It can become difficult to manage and calculate. This will result in incorrect calculation.

- The perception of the customers may vary. They may not be able to link the markup percentage with the cost of producing the good or the market price of the product and service. They may find it unreasonable.

Markup Percentage Vs Margin Percentage

Let us look at the differences between the two topics.

- The markup is based on the product’s cost price whereas the marin is based in the product’s selling price.

- The former is used to calculate how much is to be added to the cost of the goods or services so that the sales is profitable, whereas the margin helps in determining how much profit has been earned from the sale of the product.

- The formula for markup takes in to account the cost in the denominator whereas the formula for margin takes into account the selling price in the denominator.

- The margin percentage is considered to be more dependable and accurate when the profitability of the business is measured.

Thus, the above gives us the details of the differences between the two calculations.

Frequently Asked Questions (FAQs)

The initial markup percentage refers to the markup applied to a product when a retailer receives it. This markup is intended to cover the retailer's overhead costs and generate a profit on the product's sale. The initial markup percentage can vary depending on factors such as the type of product, the retailer's pricing strategy, and the market competition level.

The wholesale markup percentage refers to the amount added to the cost price of a product by a wholesaler before it is sold to a retailer. This markup is intended to cover the wholesaler's overhead costs and generate a profit on the product's sale.

The average markup percentage varies widely depending on the industry and the product or service sold. In general, the markup percentage is calculated by dividing the difference between the selling price and the cost price by the cost price and then multiplying the result by 100.

Recommended Articles

This has been a guide to what is Markup Percentage. We explain it with a calculator, formula along with example, & differences with margin percentage. You can learn more about financial analysis from the following articles –