Table Of Contents

What Is Market To Book Ratio?

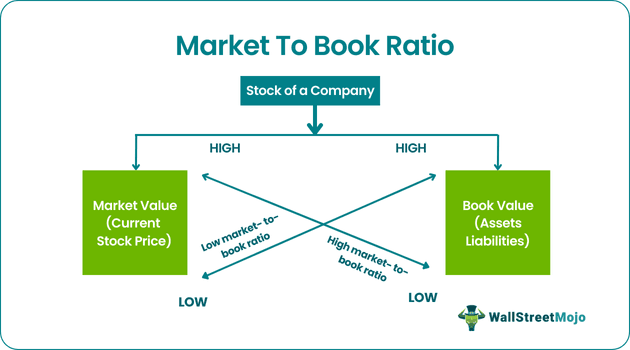

The term "Market to Book ratio" is a financial valuation metric utilized to evaluate the current market value of a company relative to its book value. It shows an investor how the market values the stocks of that company.

The market value of a company stock refers to the current stock price of all its outstanding shares.

On the other hand, a company’s book value is the net amount left if the company liquidates all of its assets and repays all of its liabilities. Thus it compares the stock price with book value to show if it is expensive or cheap as compared to the value as per books of accounts.

Key Takeaways

- The market-to-book ratio is a financial metric to measure a company's current market worth compared to its book value.

- This metric is calculated using two ways:

- Market to book ratio = market value of share/ book value per share

- Market to book ratio = market capitalization/ total book value

- It can be interpreted in two ways: if the ratio is less than one, it refers to an undervalued stock which is a good investment as the stock's price increases.

- If the ratio is more than one, the stock price can be deemed overpriced, indicating gaps in its current price determination. It can be a bad investment as the stock price might come down.

Market To Book Ratio Explained

Market to book ratio shows the how much price investors are ready to pay for a stock in comparison to the book value of the company. It signifies whether the stock is overpriced or underpriced and accordingly investors can make their decisions.

It is a good criteria to compare peer companies and judge their performance within the same sector. It gives an idea whether the stock has potential to grow even though being undervalued. But market to book ratio analysis cannot be the only factor for investment decision because a stock may have a high ratio not only due to high market price but also due to low tangible assets. In this case the ratio is misleading.

Overall, a high market to book ratio indicates a an expensive stock and low ratio shows a cheap stock, which may be profitable to buy due to low price relative to the company’s assets.

Formula

The calculation can be done in two ways –

This ratio can be calculated by dividing the stock's market value by the book value per share of the company. Mathematically, it is represented as,

1) Market to Book Ratio formula = Market value of stock / Book value per share

On the other hand, it can also be calculated by dividing the market capitalization by the company's total book value or tangible net worth.

The Formula is represented as,

2) Market to Book Ratio Formula = Market Capitalization / Total Book Value

Calculation

Let us see how to calculate market to book ratio.

Step 1: Firstly, collect the stock's current market value, which is easily available from the stock market. Now, collect the number of outstanding shares of the company and determine the market capitalization by multiplying the current stock price and the number of outstanding shares.

Market capitalization = Current stock price * Number of outstanding shares.

Step 2: Next, determine the total book value or the company's net worth from its balance sheet. Net worth can be computed by deducting total liabilities, preferred stock, and intangible assets from the company's total assets.

Total book value = Total assets – Total liabilities - Preferred stock - Intangible assets

Step 3: Finally, the calculation can be completed by dividing the market capitalization by the company's total book value, as shown below.

Market to Book ratio = Market capitalization / Total book value

Investors can use the below Formula Calculator to calculate the ratio.

Examples

Let's see some simple to advanced examples to understand it better.

Example#1

Let us take the example of David, who intends to invest in the furniture company ABC Ltd, which is a publicly-traded company. ABC Ltd has 10,000 outstanding shares trading at $50 per share. The company reported a net worth of $300,000 on its balance sheet on the last day of the previous accounting period. The ratio for ABC Ltd.

Given, Total book value = $300,000

Below is the data for the calculation of ABC Ltd.

Therefore, market capitalization can be calculated as

Market Capitalization = Current stock price * Number of outstanding shares

= $50 * 10,000

Market Capitalization = $500,000

Therefore, the ratio for ABC Ltd can be calculated as,

= $500,000 / $300,000

= 1.67

A ratio of more than one indicates that the investors value the company more than its book value, which is a good market to book ratio.

Example#2

Let us now take the example of Apple Inc. As of March 1, 2019, the current market value of each share of Apple Inc. stood at $174.97 and 4,745,398,000 outstanding shares. The latest reported net worth of the company stood at $118,255,318,160. Calculate the market to book ratio for Apple Inc.

Given, Total book value = $118,255,318,160

Below is data for the calculation of Apple Inc.

Therefore, market capitalization can be calculated as

Market capitalization = Current stock price * Number of outstanding shares

= $174.97 * 4,745,398,000

Market Capitalization = $830,302,288,060

Therefore, the ratio for Apple Inc. can be calculated as,

= $830,302,288,060 / $118,255,318,160

= 7.02

A high ratio justifies the investors' confidence in the brand of Apple Inc. and its future growth prospects.

Interpretation

From the perspective of investors, a market to book ratio analysis is a very important because it helps to decide whether a stock is overvalued or undervalued –

- If the ratio is less than one, then it could indicate that the stock is undervalued, in which case it can be seen as a good investment because the stock price is expected to bounce back.

- I In case of high market to book ratio is greater than one, then it could mean that the stock is overvalued, in which case it might not be a very good investment because the high price might not be backed by a strong company perspective, although it might not always be true.

However, a good market to book ratio also has limitations, like most other financial metrics. One of the primary issues with the ratio is that it overlooks the value of a company's intangible assets (such as brand equity, goodwill, patent, etc.), which in today's world are accepted to be valuable. As such, the ratio is rarely useful for the valuation of a company with a significant portion of its assets in intangible assets. Examples of such companies can be IT companies or other knowledge-based companies.