Table Of Contents

Key Takeaways

- Market share may be the proportion of a market's overall revenue or industry that a particular company will generate over a given period.

- A large percentage of market share is a significant predictor of corporate success, significantly if that market share is increasing.

- When a company gains a significant market share, it may be subject to rules and regulations, including anti-competition legislation.

- According to the regulations, the government may only allow them to complete the planned mergers if they have a substantial market share. As a result, a decrease in competition in that industry.

How To Calculate?

To calculate the market share using the relative market share formula, follow the below steps.

To calculate a firm’s market share using the revenue market share formula, one needs to be clear about the period, which shall be either a year, fiscal quarter, or several years. Then the next step is to calculate the firm's total revenue over that period.

The second last step would be to find out the total revenue of the firm’s industry. And finally, divide the firm’s total sales by its industry’s total revenue.

Investors or any financial analyst can obtain the market share data from several independent sources, like the regulatory bodies or the trade groups, and sometimes from the firm itself.

Thus, the above steps are used for the calculation of market share for facilitating the decision making process of management regarding position of the business in the sector and what are the future prospects for expansion and improvement.

Examples

Let us try to understand the concept with the help of some suitable examples.

Example #1

JBL has reported its gross revenue of US$ 30 million, and the industry in which JBL operates has total gross revenue of US $ 500 million. You are required to calculate the market share of JBL inc.

Solution:

Use the below-given data for the calculation of the market share.

- Company's Total Share: 30

- Industry Sales: 500

Given the company's sales and market share, we can use the above equation to calculate the company's market share using the sales or the revenue market share formula.

Calculation of market share can be done as follows:

Market Share = US$ 30 million / US$ 500 million

Market Share will be -

Market Share = 6%

Hence, the market share of the JBL is 6%.

Example #2

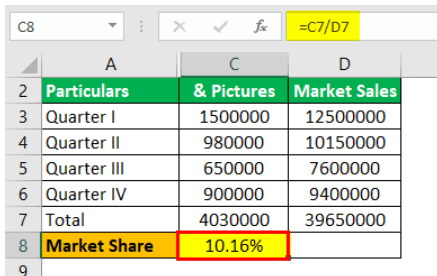

SAB tv operates in many different locations and is currently under review for a hostile takeover from Star Network. The reason being Star thinks that SAB tv’s market share is increasing. However, the finance research department had a different story to tell. They were of the opening that & pictures are capturing the market share more than SAB tv and & pictures should be the target company to be taken over. The company's CFO has asked to develop market share for both of these targets, and whoever share percentage is bigger will be targeted.

| Particulars | SAB TV | & Pictures | Market Sales |

|---|---|---|---|

| Quarter I | 10,00,000 | 15,00,000 | 1,25,00,000 |

| Quarter II | 10,50,000 | 9,80,000 | 1,01,50,000 |

| Quarter III | 8,70,000 | 6,50,000 | 76,00,000 |

| Quarter IV | 9,80,000 | 9,00,000 | 94,00,000 |

You are required to calculate yearly revenue for SAB tv, & pictures, and Market sales, along with percentage.

Solution:

We shall first calculate the total sales of both SAB tv and & pictures and Market sales below:

Now, we can use the above equation to calculate the market Share for SAB TV using the potential market share formula:

Market Share = 3900000 / 39650000

Market Share for Sab TV will be -

Market Share = 9.84%

Calculation of market Share using the potential market share formula for & Pictures can be done as follows:

Market Share = 4030000 / 39650000

Market Share for & Pictures will be -

Market Share = 10.16%

Hence, it appears that the statement made by the finance research department is correct as the market share of & pictures is more than SAB tv. It is advisable to target & pictures for a hostile takeover.

Example #3

A street analyst is trying to conduct top-down research, and he wants to select the company which has a market share of at least 20% in its industry. Below are some of the top performer's stocks in their industries:

| Particulars | Revenue | Industry Sales |

|---|---|---|

| Stock A | 23,45,678 | 3,00,40,078 |

| Stock B | 3,34,488 | 15,34,988 |

| Stock C | 13,34,567 | 3,35,26,771 |

| Stock D | 44,55,990 | 10,07,86,541 |

| Stock E | 1,10,11,011 | 5,07,81,109 |

| Stock F | 8,67,459 | 86,75,700 |

You must find out the stock that can be shortlisted based on the abovementioned criteria.

Solution:

Calculation of Market Share for Stock A can be done as follows:

Market Share = 2345678 / 30040078

Market Share for Stock A will be -

Market Share = 7.81

Now, we can calculate market share using the above formula and arrive at the percentage respectively for all the stocks.

From the above table, it is clear that the street analyst will shortlist stocks B and E, and the rest of the stocks will be dropped down at this stage of screening.

Relevance And Uses

The total market share formula, which is big in percentage, is a strong indicator of business success, especially if that market share is trending upwards.

A big market share can boost business and lead to price leadership in the market, whereas the competitors will be more likely to follow the company in terms of price points that the leading firm shall establish. This situation mostly arises when the firm is the low-cost leader in that industry. However, a firm that offers goods at a lower price point may not necessarily be the most successful one in finance of that industry. A smaller firm shall reap more profits by taking over a more profitable niche within that market.

The company can use this formula for analysing the performance and track its progress on a year-to-year basis. If the market share grows, it is a sign that it is gaining more customers and proceeding in the right direction.

It can be used to design sales strategies. If market share is low it means that the business needs to invest more in advertising, marketing and product improvement to gain more customers. This will also lead to identifying more investment opportunities, which might be useful for increasing sales.

It can also be used as a benchmark to assess whether to identify areas for improvement or operations that are not adding much value to the business in terms of revenue generation and should be discontinued.

However, if a firm attains quite a larger market share, it can be subject to rules and regulations, including anti-competition laws. Under these regulations, the government might not allow them to complete the proposed mergers because they may have excessive-high market share and, subsequently, a downfall in the competition in that industry. Overall the formula is a good indicator of the company’s position but should be used along with other factors like profitability and market trends to get a comprehensive view of the business performance.