Table Of Contents

Relevance And Use

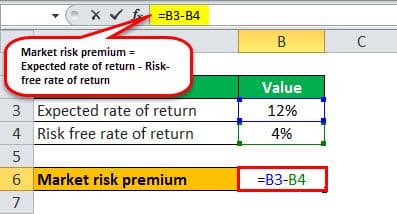

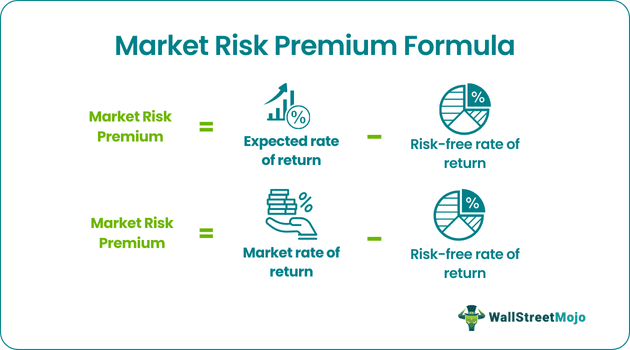

An analyst or an intended investor needs to understand the concept of market risk premium because it revolves around the relationship between risk and reward. It represents how the returns of an equity market portfolio differ from that of the lower risk treasury bond yields owing to the additional risk that the investor bears. The risk premium covers expected returns and historical returns. The expected market premium usually differs from one investor to another based on risk appetite and investment styles.

On the other hand, the historical market risk premium (based on the market rate of return) is the same for all the investors as the value is based on past results. Further, it forms an integral cog of the CAPM, which has already been mentioned above. In the CAPM, the required rate of return of an asset is calculated as the product of market risk premium and beta plus the risk-free rate of return.