Table Of Contents

Market-On-Open Order (MOO) Definition

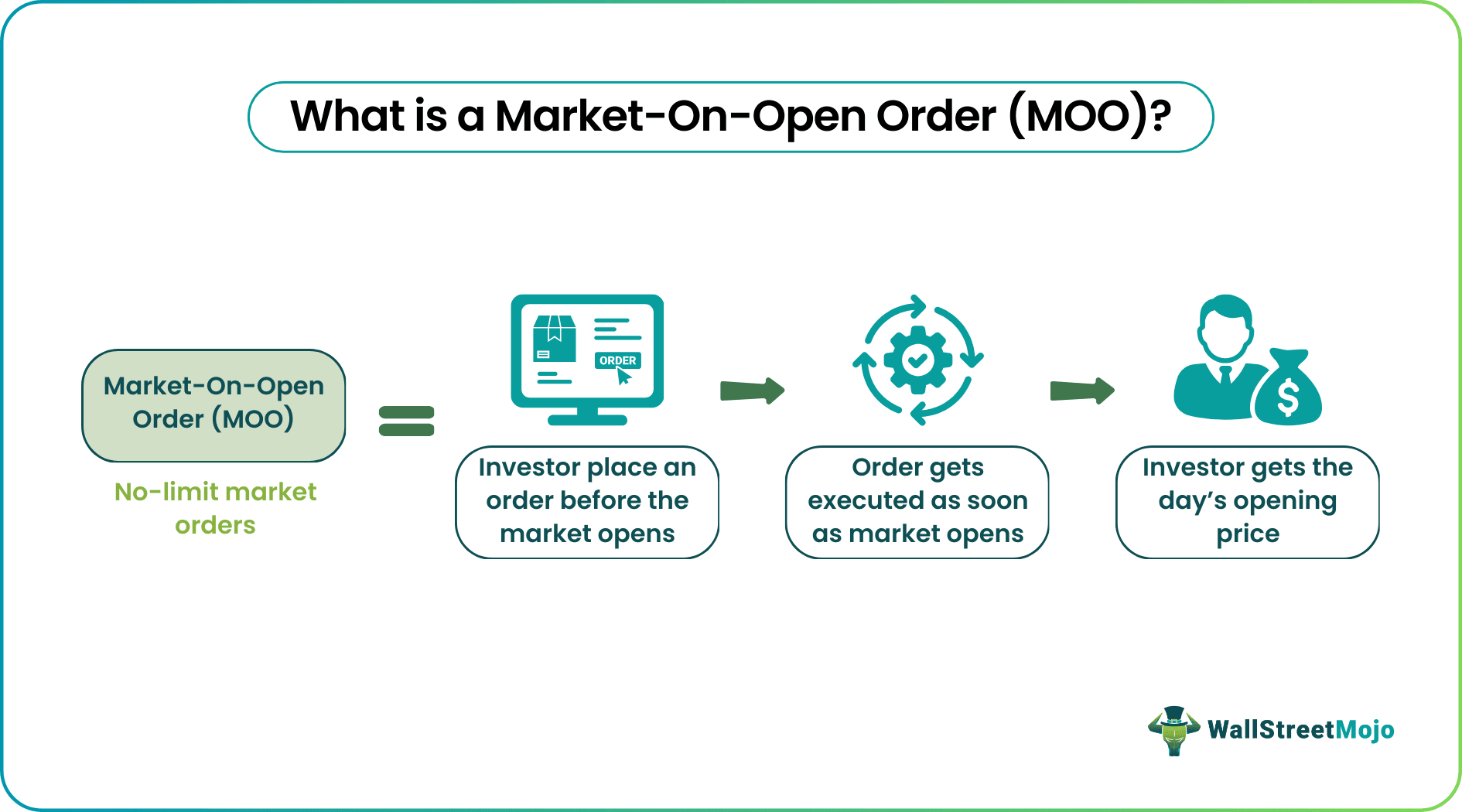

Market-on-open orders are trading orders executed at the opening price of the underlying security as soon as the market opens or shortly after the market opens for trading. It is a non-limit order with its execution price matching the security's opening price.

Each stock exchange opens and closes as per the geographical standard time under different time zones for a period for which the market remains active for trading. The MOO orders are placed before the market opens during a specific time bracket. They get executed when the market becomes active and the securities open for trading.

Table of contents

- Market-On-Open Order (MOO) Definition

- Market-on-open orders refer to those trading orders executed just when the market opens or shortly after that to match the first printed price of the day.

- Many investors do it with the anticipation of making a profit from the fluctuating prices throughout the day's active market session.

- For NASDAQ, the time bracket to place MOO orders is between 7:00 am and 9:28 am EST from Monday to Friday.

- The opening price can fluctuate dramatically depending on the number of MOO orders. If the buy orders are more than the opening price can be higher than the previous day's closing price.

How Does Market-On-Open Order Work?

Market-on-open orders are trading orders placed before a stock exchange opens for trading and the securities become active. It is a facility that allows investors to place orders before the market opens to get their trading orders executed with the market's opening price, also called the first printed price of the day.

All MOO orders are assessed in the morning before the trading starts with the market opening. It is because the amount of MOO orders regulates and influences the market regarding buying and selling imbalances. In NASDAQ, the MOO orders can be placed between 7:30 am to 9:28 am EST every Monday to Friday. The market makers use the last two-minute period between 9:28 am to 9:30 am to check and derive the imbalance based on the orders, and thus, the security's first print price is observed at 9:30 am.

There are often imbalances identified in some market securities occurring due to a mismatch of the number of buy orders to the number of sell orders. To avoid this, market makers can temporarily induce a reserve stock to hike the market's liquidity until the trading returns to even levels. In extreme scenarios, it can also halt trading activities in the market.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

When To Use?

Investors can use MOO orders:

- When an investor wants to place an early order and avail of the first printed price of the day.

- If there is a prediction of high fluctuation and anticipated price movement of an underlying stock as the market opens.

- Investors often do it to exit the market as soon as possible, inclined to a market rumor, stock news, report, or global event influencing the market.

- Day traders use MOO orders to take the first moving advantage and register a profit from high fluctuating stock prices as soon as the market opens.

Examples

Here are two hypothetical scenarios elaborating the examples of the concept.

Example #1

Joseph is an amateur investor, trading in NASDAQ for only one year but is quick in learning and studying new investing strategies. On Wednesday, when the market was about to close, the quarterly stock reports were released, which recorded huge profits and revenue for the company. Joseph knows the company's stock price will likely increase with this news tomorrow.

Joseph observes it to be a good opportunity and, therefore, places a MOO buy order between 7:30 am to 9:28 am on Thursday so that when the market opens, his trade order gets executed immediately at the first print price of the stock and from then on it will increase throughout the day.

As expected, the stock rallied during the whole market session, and Joseph earned good returns on his investment. It is again a simple market on open-order example, but in real-world trading, there are other factors also that an investor must consider before making the final decision.

Example #2

Emily, an experienced investor, closely follows the technology sector. On Wednesday, she receives insider information about a major cybersecurity company facing a cybersecurity breach. Emily believes this news will negatively impact the company's stock price when the market opens on Thursday.

Emily placed a market-on-open sell order during the designated time bracket on Thursday morning to protect her portfolio. Her objective is to exit her position at the opening price and minimize potential losses from the anticipated decline in the stock price due to the cybersecurity breach.

utilizing the MOO order, Emily aims to act quickly and proactively to address the potential risks associated with the cybersecurity breach. If the market opens as expected and the stock price does decline, Emily can execute her sell order at the opening price and protect her portfolio from further losses.

Advantages And Disadvantages

Understanding the benefits and drawbacks of this trading strategy is essential for investors to make informed decisions.

Advantages

- The MOO order allows an investor to make early decisions in the market.

- It can be placed before the market opens for a time bracket of approximately two hours so an investor has time to make a thoughtful decision.

- MOO orders let investors take advantage of company news, stock reports, global events, and market fluctuations that impact the market to profit and protect their portfolio from potential risks.

- Investors can take chances based on their study, analysis, and anticipation of judging the price movement.

Disadvantages

- Investors need to learn the first print price the market will open with because of market fluctuations impacted by supply and demand.

- There is no guarantee once the market opens, the stock prices will move as anticipated; market fluctuations might go against the investor's expectations.

- It can only be placed during a specific time.

- There needs to be a proper method to predict the opening price of a stock in the market.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The critical difference between a MOO order and a MOC order is that the former is placed before the market opens to get the first print price of a stock as soon as the market becomes active. Still, the latter is set during the busy market session just before closing. MOO orders get investors the day's opening price, but with MOC orders, investors try to get the last available price.

A market-on-open order is unlimited, but LOO is a type of limit order to be executed only when the price meets the set criteria or price line. A limit-on-open order is good for market opening but only for part of the trading session. The investor carefully sets the conditions; the limit order is only executed when met.

When trading orders are placed after or before the regular trading hours, it is called after-hours trades. But MOO orders can only be placed during a specific duration before the market opens for trading. This specific duration varies based on geographical locations.