Table Of Contents

What Is Market Manipulation?

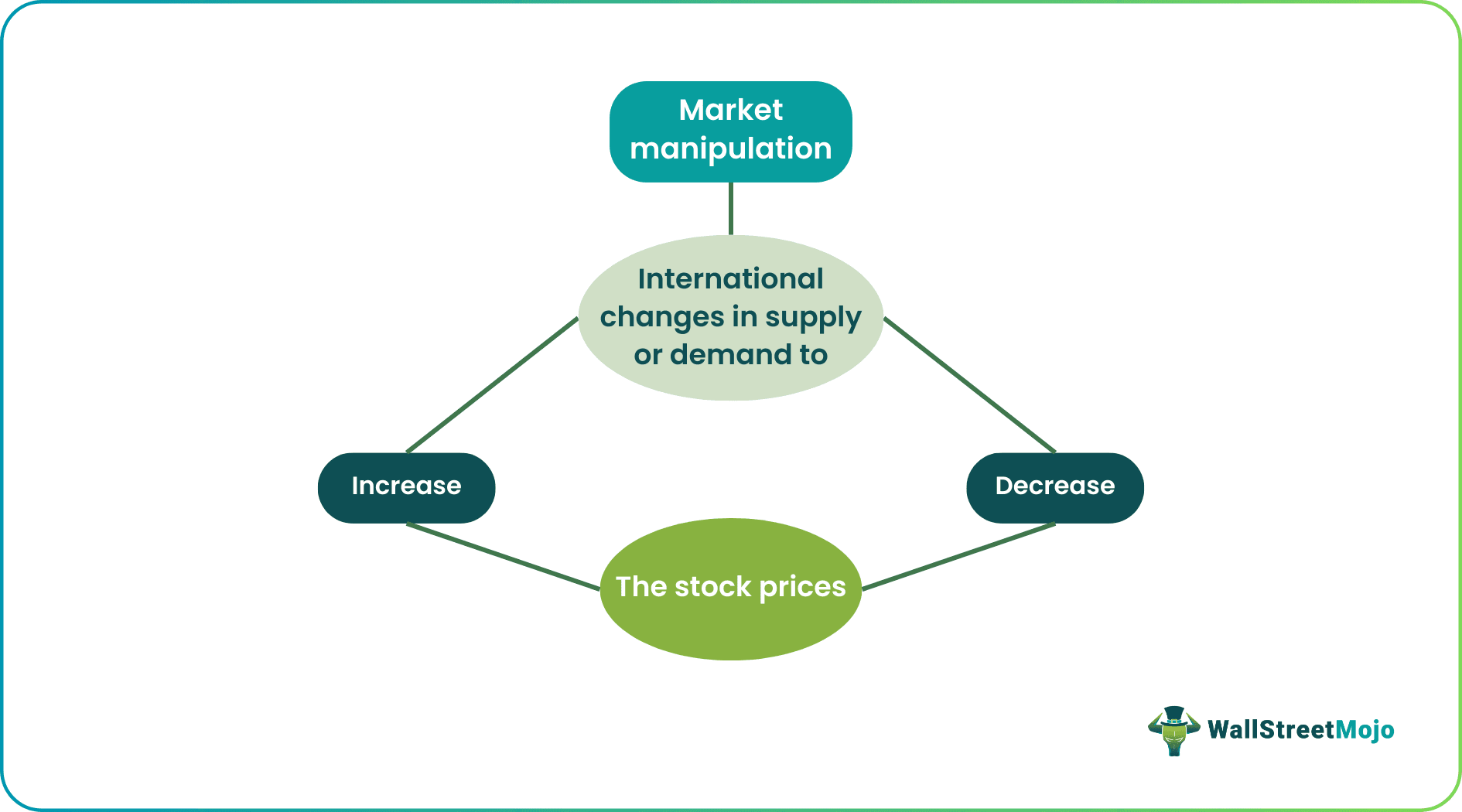

Market manipulation is when someone intentionally attempts to make changes in the supply or demand of an asset. This phenomena is mostly quoted in stock market. Such manipulation can cause stock prices to increase or decrease substantially.

Firm fundamentals play a crucial role in determining the price effects of stock manipulation. For example, identifying suspicious activities, such as distributing incorrect or misleading information about a company, transactions to make a share appear to be traded more frequently, and so on, can assist in identifying it.

Table of contents

- What Is Market Manipulation?

- The purpose of market manipulation is to deceive other market investors and take advantage of share price fluctuations.

- It is difficult to identify and establish that manipulation has occurred. Also, it is more difficult to carry out in more significant and liquid markets.

- The pump-and-dump and poop-and-scoop strategies are typical kinds of stock market manipulation.

- Market manipulation is different from insider trading. The primary difference is the information at play; misleading information in the former one and confidential information in the latter.

Market Manipulation Explained

Market manipulation involves using techniques such as disseminating incorrect information about a firm, engaging in a financial transaction to make security appear actively traded, and rigging quotations, price levels, or trades to make it appear as if there is more or less demand for security than is the case. It is worth noting that there is a more significant potential for market manipulation with micro-cap stocks.

The practice of stock market manipulation to deceive investors by artificially changing the price of securities is known as market manipulation. Most instances of manipulation constitute criminal activity, yet, it can be challenging for regulators and other officials to discover and prove. The goal of market manipulation is always to affect prices to deceive other market players. However, it may also entail demonstrably untrue comments.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

History

It was reported that market manipulation occurred as early as the 17th century when the Amsterdam stock market was established. It most certainly occurred in the Dojima rice futures markets.

Because of the expansion of financial markets, a greater variety of strategies and assets may be used for manipulating prices. In addition, the growing influence of significant traders has increased the number of people who suspect market manipulation, particularly regarding short-selling tactics. The strategies of manipulation addressed various periods, ranging from a few days to several years. However, recent instances have emphasized market manipulation in highly brief periods, with a primary focus on daily price manipulation.

Types

Let us have a look at the types of market manipulation:

#1 - Pump-and-dump

Pump-and-dumping is a typical kind of market manipulation that involves artificially driving up the price of a microcap stock to sell that stock afterward. The term "pump and dump" refers to a method of market manipulation commonly utilized to artificially raise the price of security. The manipulator then sells out, leaving followers with an asset that has been artificially inflated in value. This applies to equities that have a capitalization on the micro-market.

#2 - Poop and Scoop

In it, false remarks intended to disparage a stock are made to purchase the shares at a lower price. Short-and-distort variation is simply a poop-and-scoop scheme carried out by short-sellers to make a profit. Finally, order spoofing is a typical method that involves placing several buys or sell orders intending to move the stock price, followed by the cancellation of those orders once other traders have adjusted their bids or requests by the price movement.

Order spoofing may occur not only in the stock market but also in the bond market, the commodities market, and other markets. As a result, it has enticed employees at huge Wall Street businesses and unscrupulous day traders.

Consequences

The consequences and impact of market manipulation are seen in both stock prices and the company. Manipulated enterprises are typically tiny and have inadequate corporate governance. Most examples of manipulation involve a "pump-and-dump" trading technique and stabilizing operations.

During the manipulation phase, pump-and-dump operations result in substantial transient price effects, heightened volatility, significant trade volumes, short-term price continuance, and long-term price reversals. As a result, they have a significant influence on market efficiency.

The manipulation has little effect on market efficiency in stabilizing scenarios, except that the price decline and abnormal returns of the post-manipulation era are much smaller than those of the pre-manipulation period. Firm fundamentals play a crucial role in determining the price effects of stock manipulation. Manipulation of enterprises with bad fundamentals negatively impacts market efficiency more than manipulation of firms with favorable fundamentals.

Examples

Let us look at the market manipulation examples to understand the concept better.

Example #1

As per the press release of the Securities and Exchange Commission (SEC), a firm named Montgomery Street Research raised $2.5 million via wash trading. The SEC sued the firm in late 2014. The firm's owner, Paul Pollack reportedly manipulated a stock he was selling to investors. Allegedly, after a company hired Montgomery to help with two private placement offers, the firm owner reportedly participated in wash trading. It implies making an asset look actively traded without changing ownership. The SEC reported Montgomery made 100 wash transactions when the sale order followed the buy order within 90 seconds. The SEC claims the price and quantity of securities acquired and sold were substantially identical.

Example #2

A Forbes article cautions readers to be wary of market manipulation during bearish market conditions. It emphasizes to beware of stock manipulation, to pay special attention to security prices that grow or decline more than they often do in the context of 50-day moving averages, and to make judgments by such changes.

If one is aware of the fact that stock manipulation occurs on a very regular basis, one will be more cautious when the market begins to decline. Also, article suggests readers that they should avoid investing in securities that exhibit symptoms indicating manipulation.

How To Prevent?

Preventing market manipulation is not very simple, as multiple entities may be engaged. The game of manipulation is made more difficult by the use of derivatives. It is possible to manipulate an asset by holding a direct position in the spot market and trading in a related derivative.

To dodge or prevent this,

- having a compliance staff knowledgeable about big data and tools to parse it is helpful.

- experts may discover abnormalities and red flags with remarkable regularity if they can analyze the data.

- maintain current knowledge of SEC-published specifics about such dubious activity to inform market participants of potential new risks.

Market Manipulation And Insider Trading

In market manipulation, someone intentionally shares misleading information to influence the price through deceit. In addition, insider trading implies that securities exchange is based on confidential information i.e. information that is not available to the general public.

The firm management, speculators, or so-called "stock market experts" are frequently the perpetrators of market manipulation. These individuals, aim to push up their prices or purchase shares by manipulating the market. Whereas, the person who engages in insider trading is either an employee of the firm, a consultant or has close affiliation with the organization.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Even though it's against the law, people nonetheless often manipulate markets. But unfortunately, the Securities and Exchange Commission cannot adequately document and punish all of the unlawful behavior that is taking on because there is too much of it.

Be aware of robust sales and significant volume gains accompanied by relatively flat prices. Checking information from various sources before depending on it to make financial decisions will help you avoid falling victim to fake news.

Identifying suspicious behaviors, such as spreading false or misleading information about a firm, transactions to make a share appear to be traded more actively, and so on, can help uncover it. In addition, setting up quotations, pricing, or transactions in such a way as to give the impression that there is a greater or lesser demand for security than exists can also be fraudulent.