Table Of Contents

Market Makers Definition

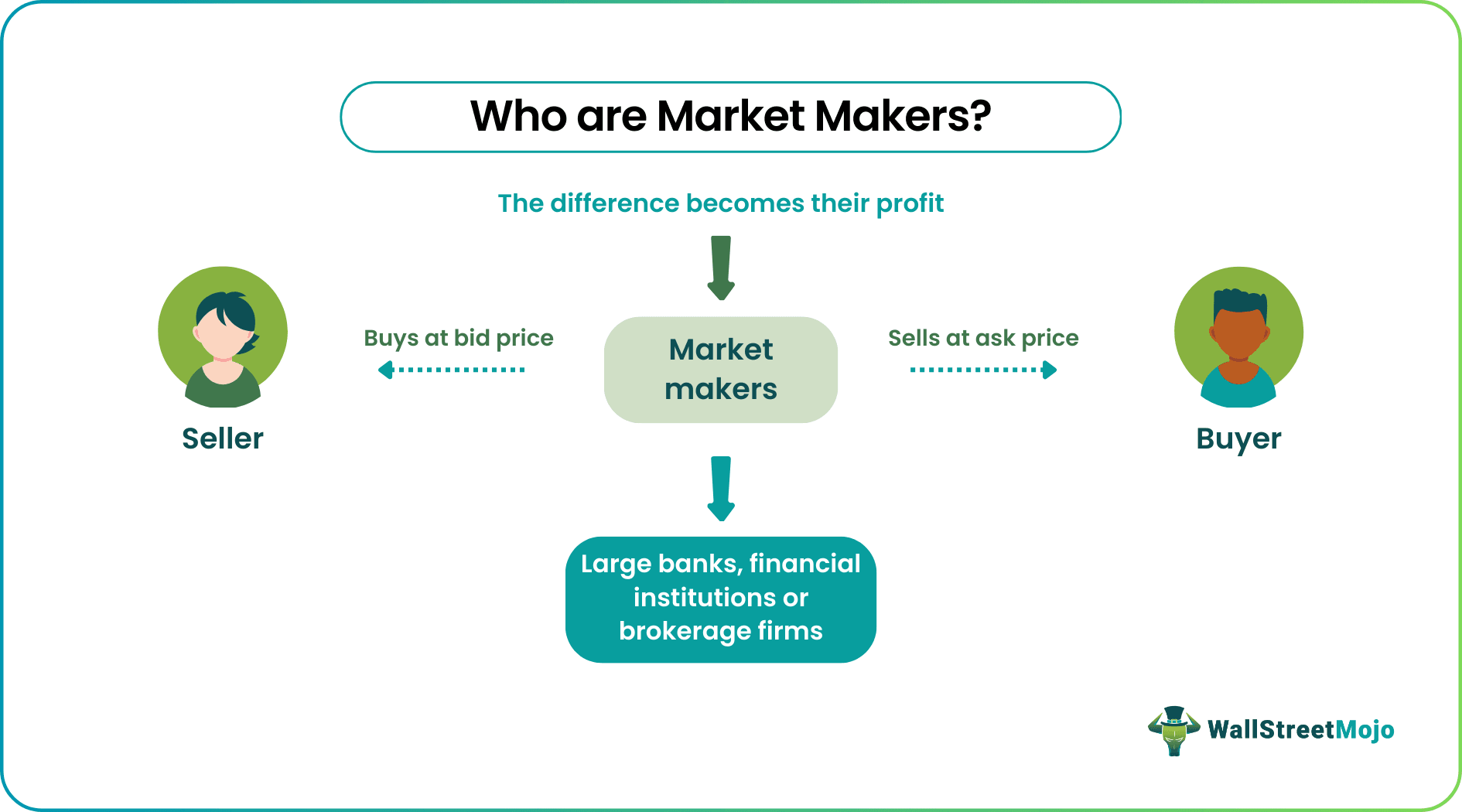

Market makers are individuals or entities that act as a medium of connection between two parties interested in buying or selling shares. They buy the shares from one party at a price, match the requirements of interested traders, and sell the shares to the most suitable individual or firm at another price. As a result, these players tend to make the market more efficient, more viable, and highly liquid.

They are different from brokers who charge a commission to find the right match for the deals. Instead, market players purchase shares at a bid price and sell at an ask price. The difference between the two prices, also termed bid-ask spread, is their profit.

Table of contents

- Market Makers Definition

- Market makers are individuals or firms that act equally on both the buy-side and the sell-side of a financial market to facilitate smoother trade.

- By helping investors sell shares at a bid price and buy from them at an ask price, these market-making entities maintain significant trade volume and active market.

- The difference between the bid price and ask price or bid-ask spread, becomes their profit.

- They are different from the brokers functioning in the market who get paid in commission for each achieved transaction.

Market Makers Explained

Market makers can be investment banks, financial institutions, or brokerage houses. These entities take the responsibility to keep the market active and balanced. The market-making individuals make the market, and their absence might break or lead to the market's collapse. Thus, they play a significant role in increasing the efficiency of the financial marketplace.

A market maker can either be an individual or a member firm of a securities exchange. Through regular purchase and sale of stocks, they ensure the market remains active and liquid. Even when markets are volatile, these market participants ensure being calm and patient to take control over them. This quality enables them to maintain significant trade volume even in the worst scenarios, facilitating smooth trading activities.

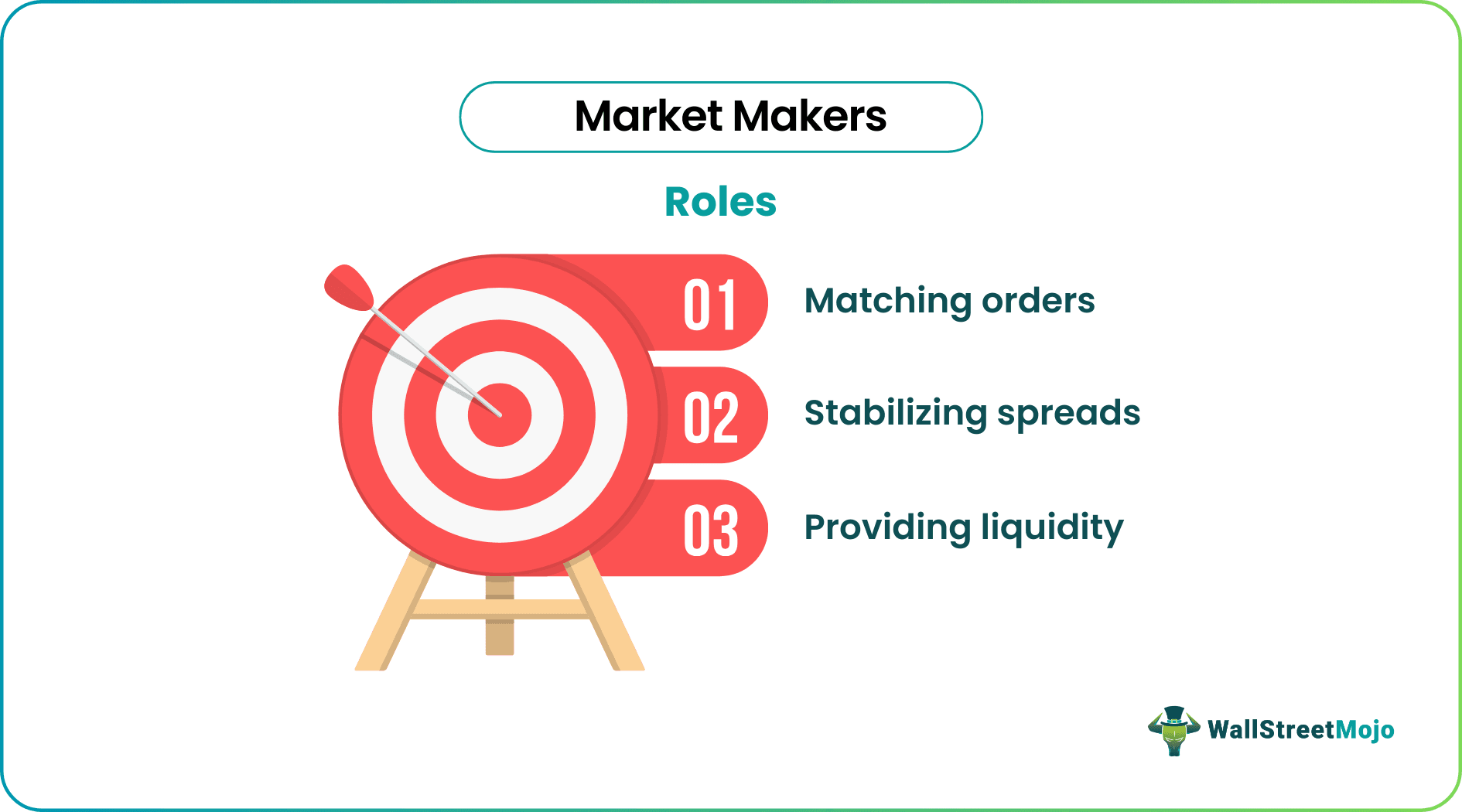

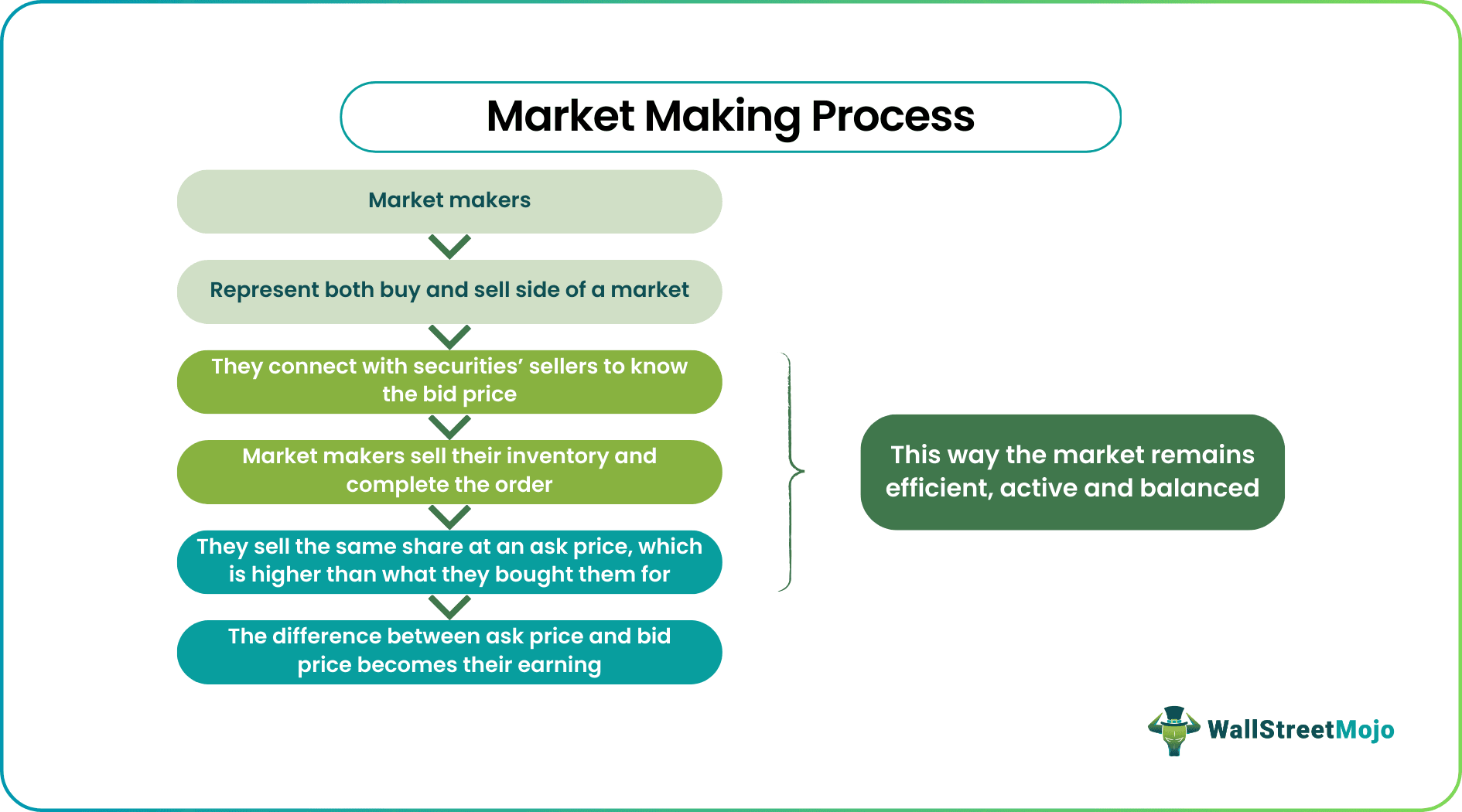

A market makers method is concerned with matchmaking, whereby they find buyers interested in purchasing shares at the ask price at which they are available. Once they find the matches for the volume of shares they bought from sellers, they sell them. These market entities do not purchase one share at a time. Instead, they sell their inventory to complete multiple orders simultaneously. They keep finding buyers for the available securities and continue trading activities without any pause. This is why they are identified as market makers who build the market by keeping it efficient all the time.

These market participants look for the best bid price and provide the most reasonable offer price for the shares, keeping in mind the variations hitting the market from time to time. This way, they ensure traders willingly connect with them to grab the most profitable deals. The rights and responsibilities of these individuals depend on the exchange they are associated with and the financial instruments they deal with.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

The Market Making Process

The market makers strategy lies in the process they adopt and proceed with towards converting an illiquid market into a liquid one.

With the market-making individuals and entities functioning in the market, the sellers and buyers do not have to struggle in finding a buyer or seller for their securities. Instead, they represent both sides of the financial markets. Whether traders show their interest in buying shares or selling them, they tend to support both.

When they meet the sellers of shares with a fixed bid price, they enter as a buyer and purchase the securities. As soon as they own those shares, the ask price is determined, taking into account the market fluctuations. The difference between the cost price of the shares and the selling price is the profit they make. Though the difference between the ask price and bid price for each share is low, the stocks altogether offer huge profits to these market players daily.

The market-making individuals or firms need to comply with the law of the nation they operate in. The stock exchanges work on certain guidelines approved by the regulators of a nation's financial market. The market makers must follow the same to operate as an authorized trading body. In the United States, the Securities and Exchange Commission (SEC) approves and takes care of the legal perspectives of the financial markets.

Market Maker Examples

Let us consider the following examples to understand how the concept works in the financial market:

Example #1 - (Conceptual)

Company X is eager to sell its shares at $90 per unit. Sarah, a market maker, buys a set of shares from the company and fixes the ask price of $90.5 for the same. Ralph comes across the offer and finds it quite reasonable, expecting the market prices to go up significantly in the next few days. Thus, he purchases 100 shares from Sarah. Though the bid-ask spread that becomes her profit is low, i.e., $0.5, she closes and manages a significant earning against a single deal with $50 for selling those 100 shares.

Example #2 - (Market Makers FOREX)

The NSE International Exchange has decided to introduce market makers to offer investors an opportunity to trade in eight stocks listed in the United States - Amazon, Tesla, Meta platforms, Apple, Microsoft, Netflix, and Walmart. They will buy the US shares and issue the receipts, known as NSEIFSC receipts. Earlier, investors traded US stocks through mutual funds or ETFs through US-registered brokers. However, with market-making individuals involved, they can directly buy the US stocks with a DEMAT account opened with National Stock Exchange International Financial Service Center (NSE-IFSC).

Market Makers vs ECN

Investors often use market makers and Electronic Communications Networks (ECNs) synonymously. This is mainly because of the similarities that both these entities appear to share. However, they both are completely different in terms of who they are and how they function.

Market makers are individuals or firms representing buyers and sellers in a financial market. They buy shares at one price (bid price) and sell them for another price (ask price), slightly higher than what they paid. Both the prices are put on their screens. The bid-ask spread is their profit.

These market participants become sellers to interested buyers and buyers to interested sellers. They price the shares as per their best interests.

ECNs, on the other hand, work with respect to market fluctuations. They study the shares and the prices at which they are being traded in the market. The network sets the best bid/ask price for the stocks depending on their study. The brokers match buyers' and sellers' shares and price requirements and become a middleman for further settlement. These networks earn through commissions they receive for each transaction that occurs.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Market makers are individuals or firms that act as buyers for those interested in selling shares and sellers for interested share buyers. As these market participants maintain a good balance in the financial market, they tend to be the best source for keeping the market active and liquid.

The bid-ask spread is the earning for the market making individuals or entities. This spread is defined as the difference between the bid (buy) price and ask (sell) price. Though this differential amount is too low per share, when calculated as a set of shares or stocks, these become a significant figure as a daily income for these makers of the market

The market makers buy shares at a lower price and sell them at a higher cost. The higher this difference or spread is, the more is the earning. Thus, they are believed to be manipulating the price, sometimes as per their interest.