Table Of Contents

Market Index Meaning

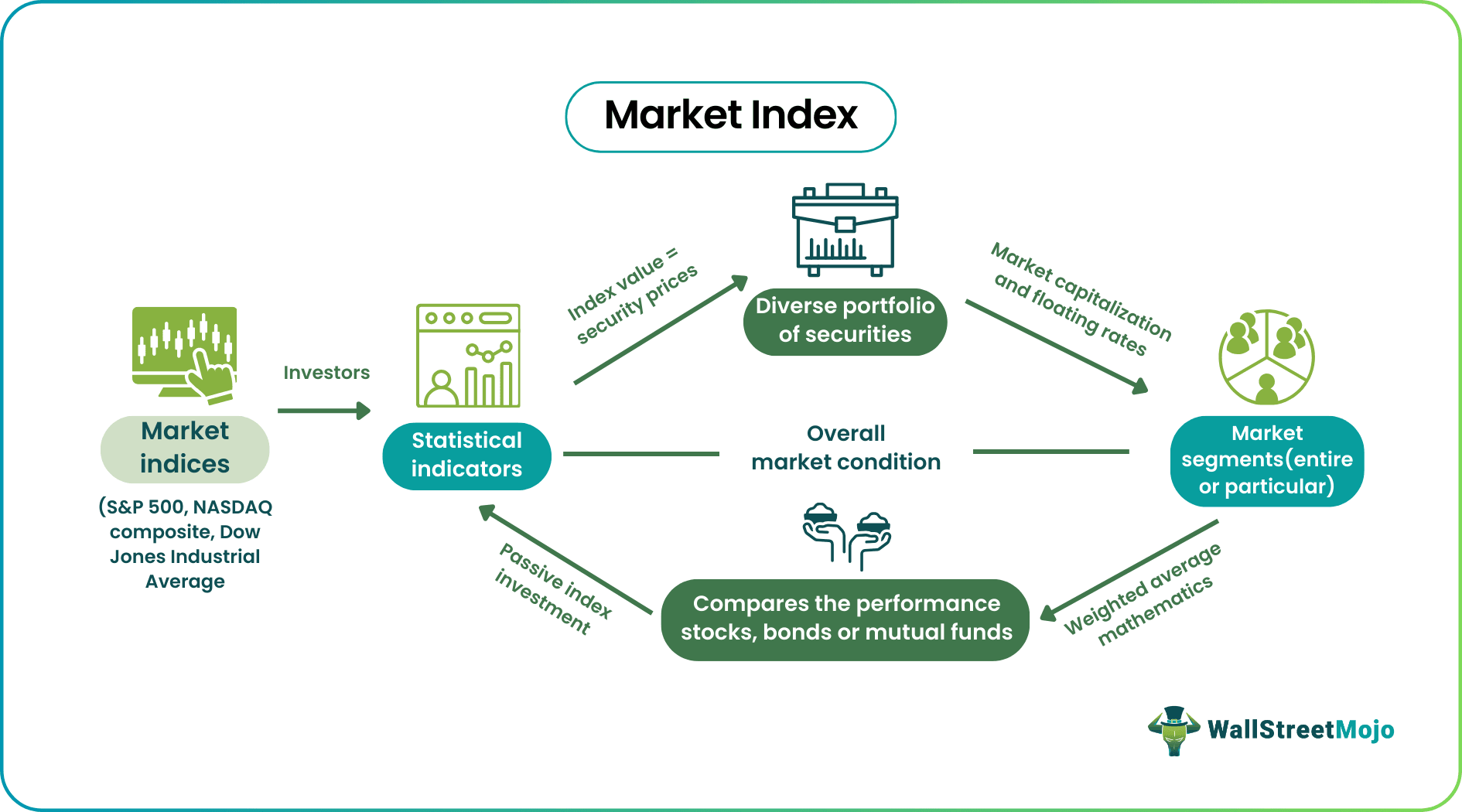

A market index tracks the performance of a diverse selection of securities that make up a significant part of the financial market. It serves as an indicator of the overall financial market condition by listing the historical and real-time trends in different market segments.

The rates of stocks, bonds, or mutual funds determine the value of an index. It factors into variables like market capitalization and floating rates of underlying securities to provide an overview of the financial market. The weighted average mathematics used to calculate the value of the market index helps investors make an informed investment decision. Also, they can use the diverse portfolio of securities as a benchmark for making further investments.

Table of contents

- Market Index Meaning

- A market index global is a statistical indicator, giving investors a comprehensive view of the performance of different stocks in a particular sector or market.

- The most reputed and trusted market indices in the U.S. financial market are Dow Jones Industrial Average, S&P 500, and NASDAQ Composite.

- Among various methodologies used to calculate indices, weighted average mathematics is the most commonly used one.

- Some indices, such as the NASDAQ Composite, concentrate majorly on a specific market or sector. These thus assist investors interested in purchasing stocks from companies in that sector.

How Does Market Index Work?

A financial market allows investors to make a profit from market volatility that occurs frequently. It is also a place where investors can track and compare the performance of stocks, shares, and other securities. Investors can get an overall picture of the price performance of stocks in a particular sector or economy by using market indices. As a result, they will stay informed of how the market index stocks perform and determine whether they should invest in any.

You are free to use this image on your website, templates etc, Please provide us with an attribution link

For example, parents are often perplexed about choosing a good school for their children. Usually, the city school management authority indexes the aggregate performance of the schools for a given academic year. And it is likely to assist parents in making an informed decision about choosing the right school.

The market index global operates similarly. It tracks the performance of investment securities and allows investors to pick the best option. In short, fund managers can make smarter investment decisions in the future, resulting in higher returns.

The figures derived from sudden changes in the price and position of the underlying securities are the figures on which a market index is based. Different indices use different methods to determine these values, but the most common approach is weighted average mathematics.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Types of Stock Market Index

Every investor should be familiar with the three most commonly used and trusted indices, including Dow Jones Industrial Average, S&P 500, and NASDAQ Composite.

Dow Jones Industrial Average

It is a price-weighted index that shows variations in the prices of a particular group of market index stocks. It hosts a wide range of indexes, ranging from sector indices to global stock indices. The former category covers specific industry stocks such as technology, energy, and others. Foreign market stocks or investment holdings are part of the latter group.

It tracks stocks from the 30 largest blue chip corporations in the United States based on market capitalization. Dow Jones Industrial Average is also one of the most reliable indices. It helps money managers track market volatility and make investment decisions based on that information.

Standard & Poor's 500 Index (S&P 500)

It is a market-cap-weighted market index, and its components are valued based on the overall market value of its outstanding securities. The S&P 500 market index tracks the performance of equities from 500 leading, publicly traded U.S.-based corporations, typically finance and technology companies.

It utilizes the free-float market capitalization weighted method to calculate the value of shares from a variety of industries. The calculation considers adjusting the market cap of a company by the stocks available for public trading.

NASDAQ Composite

It is an index that measures the performance of the stocks traded on the NASDAQ Exchange. The stocks listed here represent different types of companies, including technology and finance.

NASDAQ Composite lists over 3,000 companies registered within and outside of the U.S. In that way, it is unique from NASDAQ 100 and Dow Jones Industrial Average. It is also the most preferred indicator for knowing the exact state of the technology sector if an investor wants to invest in the stocks of a tech giant.

Real World Examples

- During a talk with her colleague Shelly, Kristy learned about the stock market investment and shared her desire to invest in the S&P 500 index. Shelly explained that an investor should not invest directly in an index, i.e., a portfolio of stocks. Instead, she advised Kristy to invest in the related funds, including index funds, mutual funds, and exchange-traded funds (ETFs). She also recommended Kristy purchasing index funds as a beginner. It means if the index shows an upsurge, it will automatically increase the value of the index funds, making Kristy eligible for better returns and vice-versa.

- Matt invested in Vanguard VOO ETFs, one of the most popular S&P 500 index funds. When the stocks rose in value, he was willing to sell some of his holdings to earn a profit. He talked about it with his friend Joseph, who told him that he had invested in the fund rather than in single company stock. As a result, he will be entitled to a portion of the gains. To profit from the rising value of stocks, he would need to invest in the market index stocks of a specific company. And he could then sell them as the value appreciates.

Market Index As Benchmark

Market indices serve as a benchmark in guiding investors to make an informed investment decision. It provides a consolidated view of how the stocks of different companies are performing in the market. By knowing the stock growth in a market index, investors can estimate when the asset would outperform other stocks.

- As money managers keep an eye on the indexes by observing the overall market situation, the exposure to investment risk decreases.

- Investors can conclude that investing in stocks losing their market share will be a foolish move.

- Investors also get the option of making segment-based investments, such as in emerging markets and stocks.

- Paying close attention to the index allows investors to make informed investment decisions and build a diversified portfolio.

- In addition to tracking historical market trends, money managers can focus on the latest investment trends to generate higher returns.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.