Table Of Contents

Market Efficiency Definition

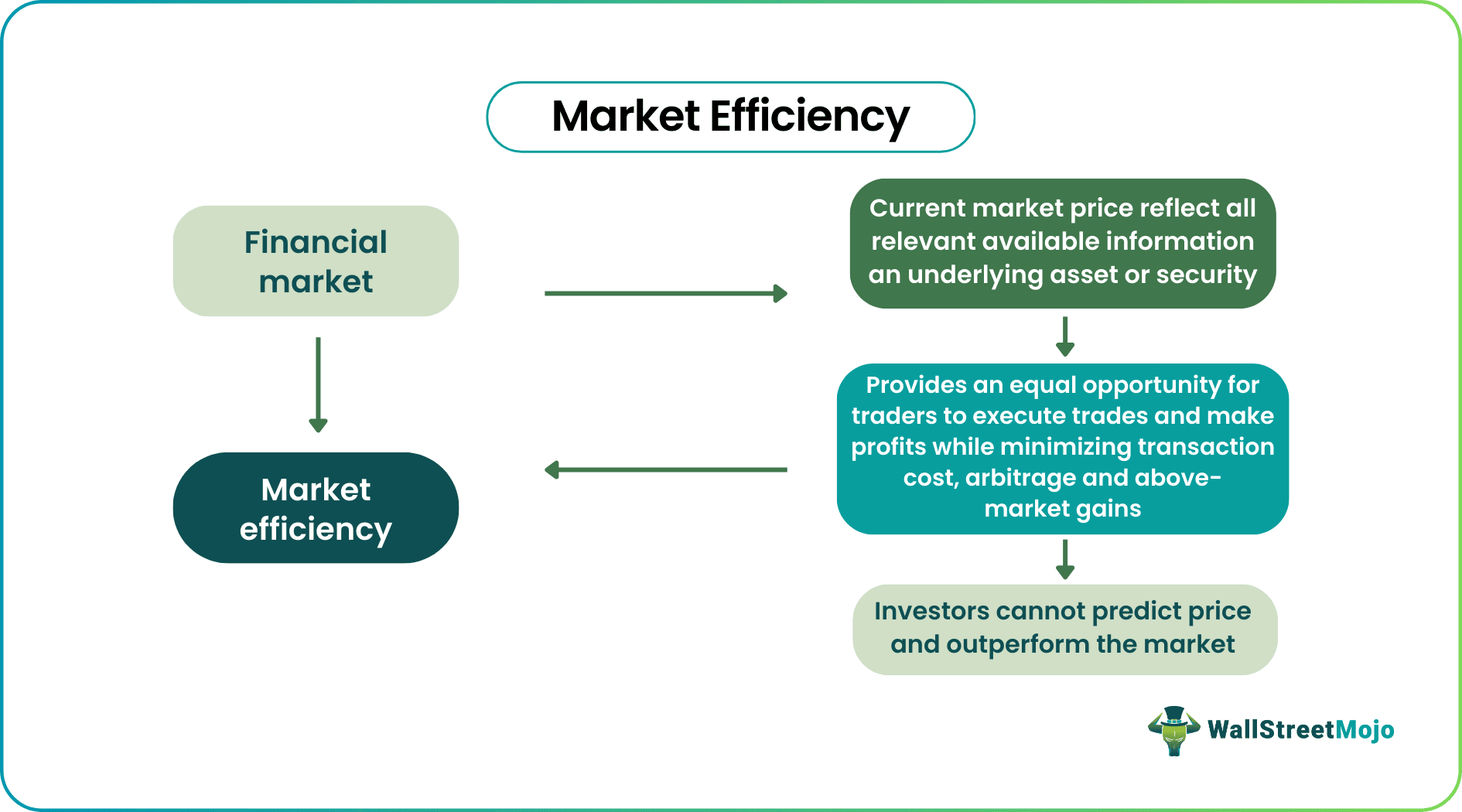

Market efficiency refers to a market where prices represent all relevant financial information about an underlying asset or security. The more information that all market players will have, the more efficient the market is. It, thus, provides an equal opportunity for buyers and sellers to execute trades and make profits while minimizing transaction costs.

The concept is connected with the market efficiency hypothesis, which is based on asset price changes due to the availability of relevant information. Since all traders have access to the same data, they cannot predict prices and outperform the market. Therefore, it plays a significant role in running the asset trade cycle in highly competitive financial markets.

Table of contents

- Market Efficiency Definition

- The market efficiency occurs when current market prices reflect all relevant financial information about an underlying asset or security.

- The more information available to all market participants, the more efficient the market becomes. Access to the same data makes investors unable to predict prices and outperform the market.

- An efficient market gives equal opportunity for buyers and sellers to profit in a liquid and highly competitive market while minimizing transaction costs, the likelihood of arbitrage, and above-market gains.

- The concept is linked to American economist Eugene Fama's efficient market hypothesis in 1970 and is useful in commercial and financial scenarios.

How Market Efficiency Theory Works?

Market efficiency theory finds relevance in business and stock market situations. It is the most effective technique for investors who spend a large sum of money on financial instruments that provide risk-free profits. However, they cannot estimate asset price swings and out-profit others because prices are random and no assets or securities are overpriced or undervalued. The notion is closely associated with the efficient market hypothesis (EMH) that American economist Eugene Fama proposed in 1970.

Investors can profit in an efficient market because they have access to all essential information. Furthermore, they do not have to pay higher transaction cost for trading financial instruments. As a result, it reduces arbitrage or above-market gains in a large, liquid, and highly competitive market.

Financial news, research, social, political, and economic factors, rumors, etc., can influence the current value of an asset or security. In market efficiency, the amount of information accessible about security or asset is eventually reflected in its price. In reality, even if the market appears inefficient, portfolio managers should consider it efficient since it keeps them active throughout the process.

The Sarbanes-Oxley Act of 2002 promoted this trading component and improved the reliability of the information. It gave investors more confidence in security pricing. The market became more efficient as a result.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Features

- Investors cannot use any new information about a security or asset for their benefit.

- The price of an asset or security represents all important information, making it available to all investors trading on various exchanges.

- It is always possible that one market is efficient for a few investors but inefficient for others.

- It provides free access to accurate and comprehensive asset-related data.

- The amount of time it takes for trading to affect asset value reflects the efficiency of a market.

- Investors interested in passive portfolio management select index funds that reflect the stock market's overall performance.

- Transparency in the financial market makes it more efficient.

Market Efficiency Forms

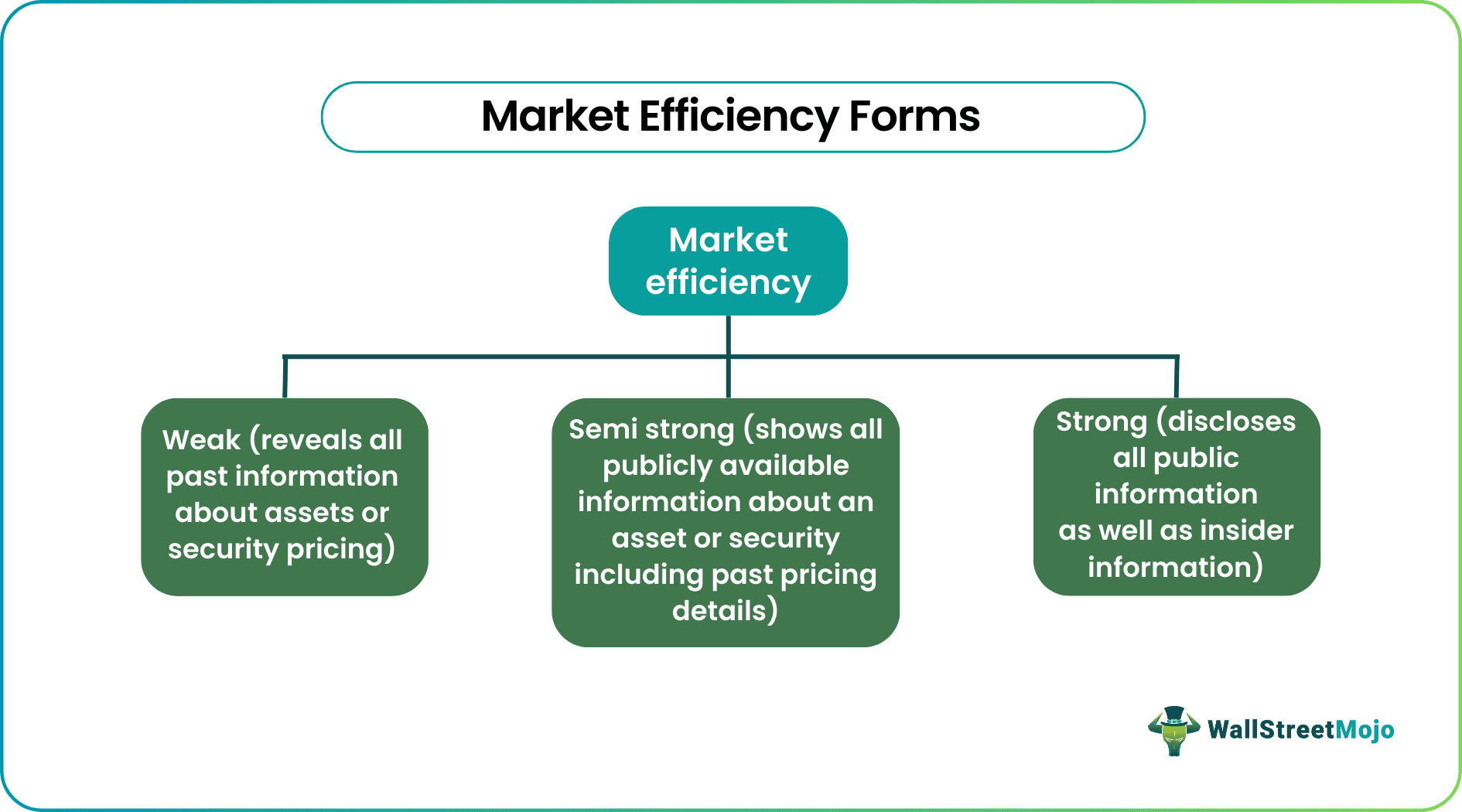

#1 - Weak

This form reveals all past information about asset or security pricing. However, past pricing details reflected in current prices are insufficient to assist investors in determining correct future trading prices. As a result, the weak form market efficiency will only result in asset undervaluation or overvaluation, affecting trade decisions.

#2 - Semi-Strong

It indicates that current prices consider all publicly available information about an asset or security. It also offers previous price details. As a result, it discourages investors from benefitting above the market by trading on the inside information.

#3 - Strong

It is the result of combining weak and semi-strong forms. This form shows market prices based on all accessible information (public, insider, and private). This insider knowledge, however, is neutral and available to all traders. As a result, despite having access to insider information, it ensures that all investors profit equally.

Examples of Market Efficiency

Let us consider the following market efficiency examples to understand the concept well:

Example #1

Assume that companies A and B are up for takeover. These companies' stock values are lenient and stable for a few days, with only minor fluctuations. However, as soon as it was announced that a well-known corporation would be taking over both of them, their stock prices jumped.

In this instance, the takeover announcement adds new information to the current data for the companies’ stocks, resulting in a price change. As a result, the rise in stock prices indicates new positive information to the companies.

Example #2

Mary, a trader, is looking forward to purchasing stocks at a reduced price on one market and selling them at a higher price on another market. This type of trading, known as arbitrage, is the process of profiting from a pricing discrepancy. Unfortunately, even though an arbitrager can make a risk-free return in this situation, the market's overall efficiency suffers. As a result, markets prohibit arbitrage and impose restrictions on acts that impede market efficiency.

Market Efficiency And Market Failure

Market efficiency also plays a crucial role in allocating resources to produce consumer-friendly goods. Resource allocation efficiency refers to a market where the value obtained for goods is equivalent to the predicted value.

Market failure, on the contrary, occurs when resource allocation efficiency is not attained. The market is likely to fail when the price mechanism fails to account for all costs and advantages essential for consumers when buying and using an item. In other words, when price and quality do not match, the market fails. To address market failure, the government enacts legislation, imposes taxes, gives subsidies, offers tradable permits, etc., depending on the nature of the market.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Market efficiency is when current market prices represent all essential financial information about an underlying asset or security. Financial news, research, economic, political, social variables, rumors, etc., can all affect the market value. An efficient market provides buyers and sellers equal access to precise and comprehensive asset-related data, allowing them to profit in a liquid and highly competitive market while limiting transaction costs, arbitrage opportunities, and above-market gains.

The three forms of market efficiency are as follows:

#1 - Weak (reveals all past information about asset or security pricing)

#2 - Semi-Strong (shows all publicly available information about an asset or security, including past pricing details).

#3 - Strong (discloses market pricing based on all accessible public, insider, and private information)

Market efficiency influences the allocation of resources to generate consumer-friendly items. It refers to a market in which the value gained for commodities is equal to the value projected. On the other hand, market failure happens when resource allocation efficiency is not achieved. For example, the market is likely to fail when the price mechanism fails to account for all costs and benefits required for consumers to buy and utilize an item. In other words, the market fails when price and quality do not match.