Table Of Contents

Market Depth Meaning

Market depth refers to the level of liquidity in a financial market. It indicates the purchase and sell orders volume for a particular asset at different prices. It aims to provide traders and investors with information about the supply and demand for specific support and the potential impact of their trades on the market.

By analyzing it, traders can better understand the price dynamics of an asset. It identifies critical support and resistance levels and makes more informed trading decisions. It is significant in markets where assets trade frequently and with large volumes. For example, the stock or foreign exchange markets.

Table of contents

- Market Depth Meaning

- Market depth provides insight into the supply and demand for a particular asset at different price levels. It allows traders and investors to anticipate market movements and make more informed trading decisions.

- It is usually shown in a chart. The chart shows the number of purchases and the sales orders at each price level.

- It is significant in markets where assets trade frequently and with high volumes.

- A high level of depth indicates a liquid market with many purchasers and sellers. In contrast, a low depth level can suggest a call with less liquidity and more potential volatility.

Market Depth Explained

Market depth is a critical concept in the world of finance and investing. It originated in the early days of stock market trading. Especially when traders would shout out their purchase and sell orders on the exchange floor. As trading became more automated and moved online, market-depth information became more readily available to traders.

Today, it is essential for traders and investors who want to understand a particular asset's supply and demand dynamics. By analyzing charts, traders can see the number of purchase and sell orders at different price levels. They use that information to identify the asset's potential support and resistance levels. This can help traders to make more informed trading decisions and to anticipate market movements before they happen.

It is particularly relevant in businesses that frequently trade assets with high liquidity, such as stocks, currencies, and commodities. This is because the depth level can significantly impact an asset's price in these markets. As a result, traders who can analyze and interpret data can gain a competitive advantage over those who do not.

Suppose there are many more purchase orders than sell orders for a particular stock at a given price level. This would indicate a high level of demand for the supply. This could lead to an increase in the stock's price. Traders who identify this trend early on can purchase the store before the price increases. And sell it later for a profit.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

How To Read?

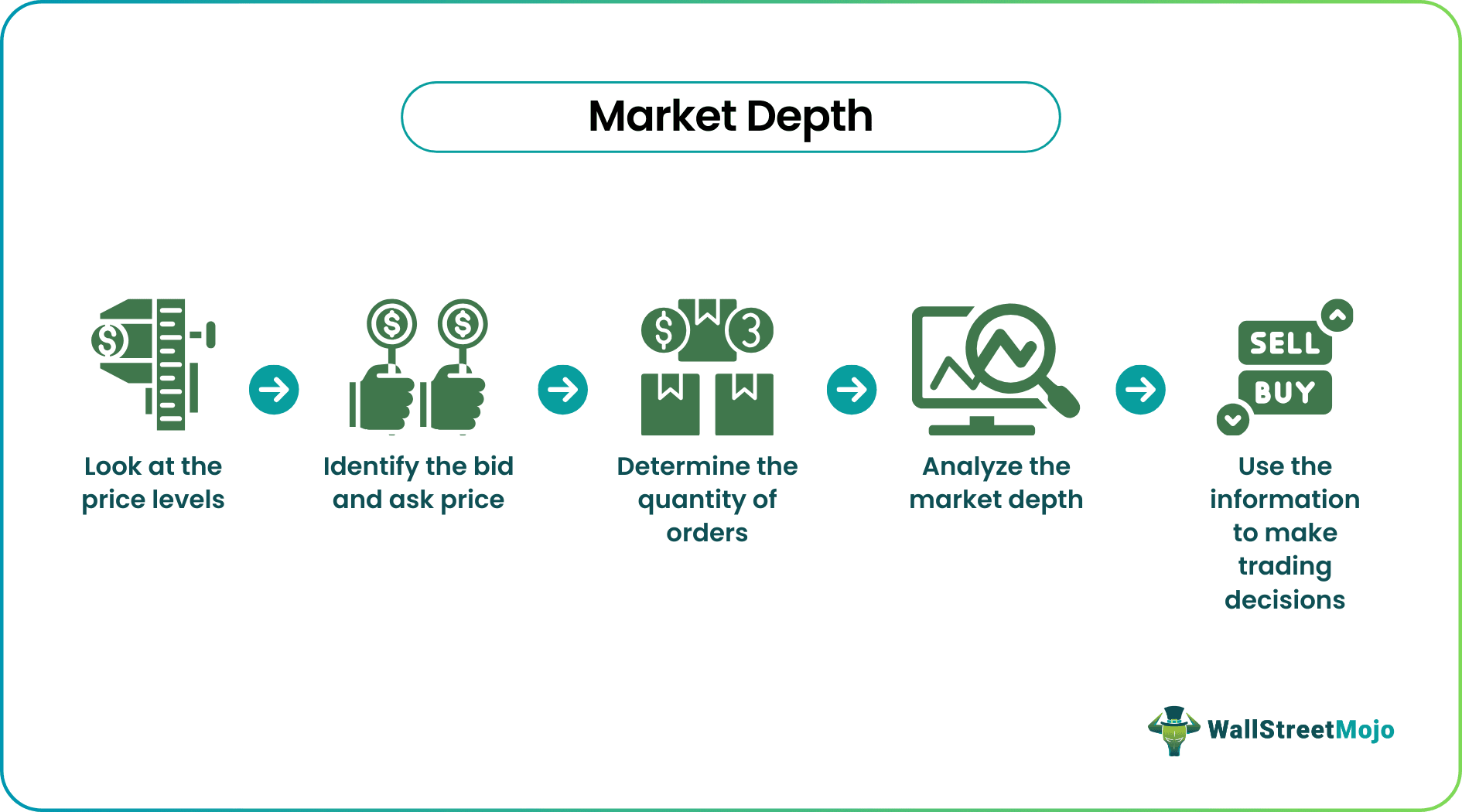

Market depth is typically displayed in a chart or table format, showing the purchase and sell orders for a particular asset at different price levels. The following steps can help you to read and interpret market depth charts:

- Look at the price levels: The chart will typically show the prices at which purchase and sell orders are placed, usually in ascending or descending order.

- Identify the bid and ask prices: The bid price represents the price purchasers are willing to pay for the asset, while the ask price means the price sellers are willing to accept. These prices are usually displayed at the top of the chart.

- Determine the number of orders: The chart typically shows the number of purchase and sell orders at each price level. This information is used to determine the level of demand and supply for the asset at each price level.

- Analyze the market depth: The chart can identify the asset's critical support and resistance levels. Support levels are price levels with a high demand for help, which can prevent the price from falling below that level. Resistance levels are price levels with an increased supply level for the purchase, which can prevent the price from rising above that level.

- Use the information to make trading decisions: The market depth chart can inform trading decisions. For example, if there is a high level of demand for an asset at a particular price level, a trader may choose to purchase the purchase in anticipation of the price rising. Conversely, if there is a high supply level for sale at a particular price level, a trader may choose to sell the asset in anticipation of the price falling.

Chart

A market depth chart, also known as a level 2 market data chart, represents the supply and demand for a particular asset at different price levels. The chart typically displays the purchase and sell orders for the purchase, along with the prices at which these orders are placed.

Here are the critical elements of a market depth chart:

- Price levels: The chart displays prices at which purchase and sell orders are placed. Depending on the chart, these price levels usually list in ascending or descending order.

- Bid and ask prices: The chart displays the bid price. It is the price the purchaser is willing to pay for the asset, and the ask price is the price sellers are willing to accept. These prices are present at the top of the chart.

- Quantity of orders: The chart displays the purchase and sale orders at each price level.

- Market depth: The chart can analyze the market's liquidity level. A high level of market depth indicates a liquid market with many purchasers and sellers. In contrast, a low market depth level can suggest a call with less liquidity and more potential volatility.

- Time and sales data: Some market depth charts also display time and sales data, which shows the price, quantity, and time of recent trades for the asset. This information identifies trends and market sentiment.

Depending on the trader's needs, market depth charts display different levels of detail and information. In addition, some diagrams may include additional features, such as order book depth, which provides more detailed information about individual purchase and sell orders.

Examples

Let us understand it in the following ways.

Example #1

Suppose a trader purchases ABC Company shares at $100. The market depth chart for ABC Company shows that there are 50,000 shares available for purchase at $100, but only 10,000 shares available for sale at $101. This indicates that there is strong support for the stock at $100 but that there may be resistance at $101. Therefore, the trader may decide to place a purchase order at $100 to take advantage of the strong support level.

Example #2

In April 2021, the market depth of the cryptocurrency market was in the news due to a sudden drop in the price of Bitcoin. Market depth charts showed a large number of sell orders at around $30,000, which caused the price of Bitcoin to drop by over 40% in hours. Traders who analyzed the market depth charts and anticipated the sell-off may have been able to sell their Bitcoin holdings before the price dropped, minimizing their losses.

Market Depth vs Top Of Book vs Order Book

Market depth, top of the book, and order book are all essential concepts in financial markets, but they differ in their level of detail and the information they provide. It offers insight into the supply and demand for an asset, top-of-book data provides a snapshot of current market conditions, and order book data provides a detailed view of the supply and demand for the purchase at each price level.

Here are some key differences:

- Level of Detail: Market depth provides a more detailed view of the supply and demand for an asset than the top-of-book data, which only shows the best bid and ask prices. Order book data provides the most detailed view, offering all purchase and sell orders at different price levels.

- Timing: Market depth and top-of-book data are in real-time, reflecting the most recent changes in the market. Depending on the data source, order book data is usually late.

- Accessibility: Market depth and top-of-book data are usually available to all traders on trading platforms or market data feeds. Access to order book data is subject to restriction for certain types of traders, such as high-frequency traders or market makers.

- Analysis: Market depth helps identify trends and support/resistance levels in the market, while top-of-book data helps make quick trading decisions. Order book data provides the most comprehensive view of the market, allowing traders to analyze the liquidity level and other market participants' behavior.

- Applications: Traders use market depth to make short-term trades based on market trends and patterns. Top-of-book data is helpful for traders who want to execute trades quickly and at the best price. Order book data is helpful for traders who wish to understand the supply and demand dynamics of the market and make informed trading decisions based on that information.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Traders use market depth to make short-term trades based on market trends and patterns. While it can provide valuable information for long-term investors, other factors, such as company fundamentals and macroeconomic trends, maybe more critical for long-term investment decisions.

Market depth can vary between different financial markets depending on the liquidity and trading volume of the traded assets. Generally, more liquid and heavily traded markets will have higher levels of market depth than less liquid and less traded markets.

In theory, market depth data is subject to market participants who place fake orders to create the appearance of demand or supply for an asset. However, this is generally illegal and subject to enforcement by regulators. Market-depth data from reputable sources are typically reliable and accurate.