Table Of Contents

What is the Market Capitalization Formula?

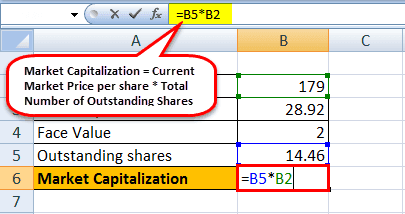

The Market Capitalization formula calculates the total equity value of the company. It is found by multiplying the company's current market price per share with the total number of outstanding shares.

Market Capitalization formula = Current Market Price per share * Total Number of Outstanding Shares.

To use the Market Cap formula, you need to know two things about the company and its stocks:

- First, we have to know how much the company's current share's selling price is on the stock market. The price is not constant and will vary every day and sometimes several times a day. We can get the value from the money control website.

- Secondly, we need to know the number of shares outstanding in the market. The number of shares will vary from company to company. Some large companies sometimes split their shares to increase the number of shares. Therefore the price of each share decreases due to the increase in the number of shares.

Then we calculate the market cap formula by multiplying the current share price by the number of outstanding shares.

Video Explanation of Market Capitalization

Examples of Market Capitalization Formula (with Excel Template)

Let's see some simple to advanced examples of the Market cap formula to understand it better.

Relevance and Use

The market capitalization Formula is the main component when we want to assess a stock because we can calculate the company's value from it. The market capitalization formula gives us the total value of the company.

The market capitalization Formula allows us to compare companies in a similar industry. The market divides the stock into three main categories.

- Small-Cap - Small-cap stocks are usually start-ups companies currently in the development stage. As for the investors, these usually have small to high-risk investments.

- Mid Cap - Investments in mid-cap companies are usually less risky than the small-cap ones. They have a tremendous scope of growth and can return a good investment in 3-5 years.

- Large Cap - Large Cap stocks usually have a safe return as the companies have a good market presence.

Therefore, the market cap formula helps investors understand the returns and risks in the share and helps them choose their stock wisely, which fulfills their criteria of risk and diversification.

We must also remember that the market cap formula only reflects the equity value of a company. The company's enterprise value is a better method as it reflects debt and preferred stock.