Table Of Contents

What Is The Market Approach?

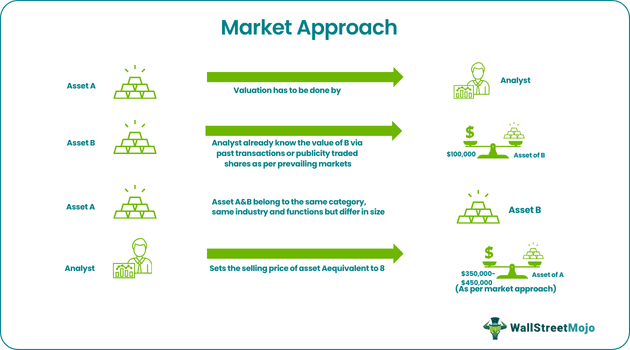

The market approach refers to the valuation method deployed for determining the appraisal value of any specified asset, whether tangible, intangible or securities, value. One conducts a market approach based on selling prices of related and similar assets within the area. It calculates the real value of any asset as per prevailing market rates in the locality for selling it.

It has become the simplest, most straightforward, and most powerful asset or business valuation method. As a result, it forms an integral part of process evaluation and 409A valuation of private and public companies. However, it becomes accurate only when huge data for comparison is available.

Key Takeaways

- A market approach is a valuation method of any given asset set in the market. A valuator determines the price of an equivalent asset or transaction amount used for mergers or acquisitions of a similar asset.

- Knowing the market price of any tangible or intangible asset is beneficial.

- The two different market approach methods to business valuation include Public company comparable & Precedent transactions.

- The main benefit is the real-time verifiable date for price determination, and the lack of similar companies or assets for determining the price is its prime drawback.

The Market Approach To Business Valuation

The market approach means a unique valuation method that allows one to determine the actual value of any asset based on other similar asset types having similar features. For example, the market approach valuation method can calculate the actual price of any tangible or intangible asset like securities and real estate. For this purpose, one studies the recent sales transaction that has taken place for a similar asset to that of the asset under consideration, like mergers and acquisitions.

One can understand the asset market approach to business valuation in real estate. Other than this, privately held companies have no shares to trade publicly. Most often, investors use it for valuing companies within a similar activity group, revenue growth, potential growth, and market base. The surveyors scan the recent and past transactions of companies of similar groups that adjusted assets since no two assets' values are the same.

One important aspect of the market data approach is the usage of prices of assets rather than the size of assets adjusted for quantities. One can also use the past selling price of the company's share to calculate the exact value of the company fairly. The total market approach is quite useful in specific business value determination. It also aids an analyst in setting an appropriate offer or asking price for a business to make a business purchase.

The method is also important to determine the amount of taxes a firm must pay to the tax authorities. Moreover, the approach of valuation facilitates conflict resolution during legal suits. Finally, in case of the buyout of a business, the partners can set their share of the sales revenue sales using this method.

Market Approach Methods

One can use multiple market approach methods in valuation. However, only two prime market approach types are used widely. They are the following -

#1 - Public Company Comparable

Under this method, assessment metrics of companies that get publicly traded get used to ascertain the price of a company under consideration for getting its value. However, most companies do not trade publicly, so one cannot know their value. Therefore, most public companies' data need experts to perform the selection, application, and adjustment of data for comparison with the subject company.

#2 - Precedent Transactions

It is based on the assumption that transaction value is readily available for all companies. An analyst can then use these companies to set prices for a subject company. The process involves knowing the complex transaction involved during mergers and acquisitions. Analysts can have the data for such transactions from public or private deals. Moreover, only transactions related to similar and comparable companies can get considered for this.

Example

Let us look at a market approach example to understand the topic. Let us assume that there is a property with person A. A want to sell it at a good price. To determine the rate of his property, A will visit all the houses listed or not-listed to know the price. A will look into the following:

- Those properties have the same size and features as A's property

- The proximity of all other properties with A's property

- The type of locality of other properties as compared to A's

- Price of all these properties.

Therefore, if A finds that the property that is most similar in size, feature, and location has a certain price, then A will set the selling price of its property accordingly.

Advantages And Disadvantages

Advantages

- The evaluation method gets based on simple yet straightforward calculations.

- One uses public data that is real, verifiable, and not speculative in this method.

- The method does not take the help of subjective forecasts.

- One can easily find similar companies for comparison based on size.

- Up-To-Date market pricing represents the overall market situation, performance assumption, current shareholder sentiments, and industry perspective.

- Moreover, all subjective estimates or forecasts get eliminated using goal-oriented and comparable information from the market.

Disadvantages

- It becomes difficult to identify similar-sized comparable companies or transactions.

- Appropriate numbers of comparable companies or transactions may not be present to apply the method.

- The method remains rigid in its approach.

- There gets a question raised on the quality and quantity of data for comparison and evaluation.

- Many privately held companies do not disclose their sizes or transactions.

- Public listed companies differ greatly in other aspects besides size and transaction concerning private companies.