Table Of Contents

Market Anomalies Meaning

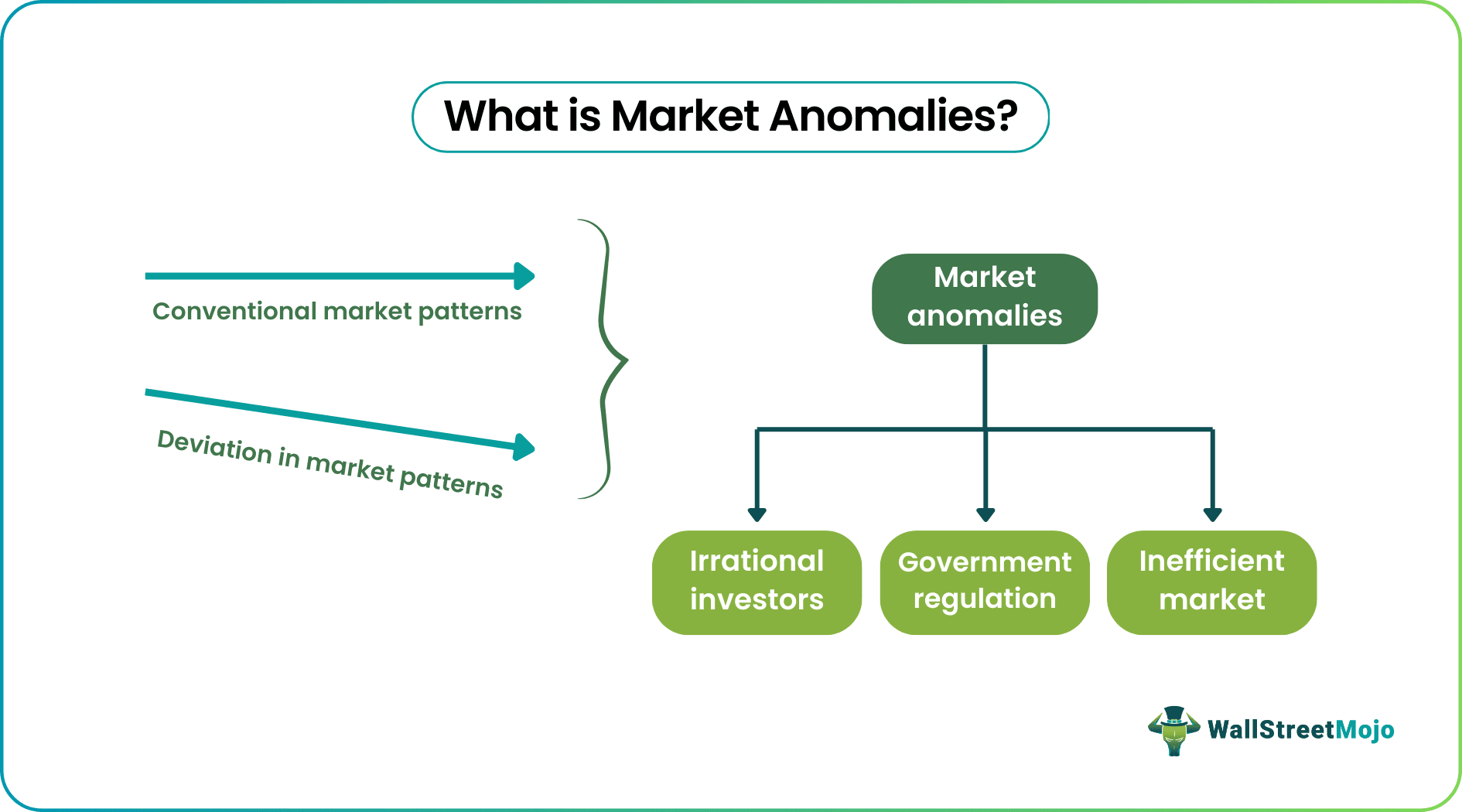

Market Anomalies refer to the temporary or permanent trading pattern in financial markets inconsistent with prevailing economic theory. It can be caused by inefficient markets, irrational investors, and government regulations. Exploiting them may help an investor in profit generation, risk mitigation, and enhanced decision-making.

Diverse investors like retail, hedge funds, and institutional investors use anomalies. Hedge funds capitalize on the anomalies actively through their extensive research abilities and detailed trading strategies. Momentum effect and value effect are the two prominent market anomalies. Investors deploy momentum-based exchange traded funds (ETFs) or value index funds investments to exploit anomalies for yield.

Table of contents

- Market Anomalies Meaning

- Market anomalies are deviations from efficient market conditions and can be exploited for profit, risk mitigation, and better decision-making.

- Investor behavior, market imperfections, regulatory policies, chance, excessive confidence, herd behavior, bias toward familiar patterns, market obstacles, unequal access to information, and tax regulations can cause it.

- The types of market anomalies are time-series anomalies (January effect, weekend effect, turn-of-the-year effect, momentum effect, and mean reversion) and cross-sectional anomalies (value effect, size effect, quality effect, and low-beta effect).

- The effects of such anomalies include momentum effect, value effect, size effect, earnings surprises, calendar anomalies, behavioral biases, post-earnings announcement drift, and liquidity anomalies.

Market Anomalies Explained

Market Anomalies are defined as behaviors or patterns in financial markets deviating from the normal course of movement under efficient market conditions. Such anomalies manifest as pricing discrepancies, abnormal returns or persisting statistical patterns over time. These anomalies may last for a long time or be short-lived. These may also be country or market-specific or become a global phenomenon.

The 2013 economic sciences Nobel laureate Eugene F. Fama introduced market anomalies in the 1960s through the famous efficient market hypothesis (EMH). EMH states that asset prices can reflect all market information. Nonetheless, it could not explain many patterns present in asset returns. It comes into play when certain factors like market inefficiencies, information asymmetry, investor behavior and government regulations influence the market. These factors underscore the limitations of conventional finance theories.

Nevertheless, it has implications like exploiting pricing inefficiencies plus creating abnormal returns. Traders and investors use various strategies to their advantage. The anomalies do not persist indefinitely as the market participants arbitrage away the abnormal returns. It can also allow producing alpha or excess returns above the benchmark return.

They also help reduce risk so investors can make better investment decisions. In the financial world, it led to the development of special investment products like value index funds due to the value effect. Its size effect has resulted in the developing of other financial products like small-cap stocks.

Efficient market anomalies, prospect theory, and stock market anomalies have long intrigued security analysts and capital market participants. Moreover, financial market anomalies challenge the principles of efficient markets, as they reflect patterns that seemingly contradict the notion of all available information being instantly incorporated into asset prices.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Causes

One cannot explain all the causes of market anomalies in full. However, listed below are some of the major causes of it:

- Investor conduct: Cognitive biases like herd mentality, overconfidence and representative heuristics make investors behave irrationally.

- Market imperfections: The assets whose price may be wrongly attached get exploited when markets are inefficient. Transaction costs, asymmetric information, and friction lead to it.

- Regulatory policies: Often, government laws result in arbitrage due to distortion in market prices.

- Probability: A small change may be responsible for anomalies in stock markets that grow significantly statistically.

- Excessive confidence: Sometimes, the overconfidence of traders in predicting future returns results in purchasing overvalued assets and selling devalued stock causes it. Hence, anomalies in the market arise.

- Collective behavior: Investors follow their herd mentality to copy others in trading popular assets despite being overpriced.

- Bias toward familiar patterns: Investors may compare the present happening to some events that happened in the past and act accordingly instead of critically analyzing the event. As a result, they may belittle the risk of current events and make wrong trading decisions.

- Market obstacles: Bid-ask spreads, and transaction costs are market frictions that do not allow investors to take benefit of mispriced assets.

- Unequal access to information: Some investors may have more information on market trends than others.

- Tax regulations: Due to tax laws, investors are bound to sell or buy particular assets at special times during the year, creating anomalies.

Types

Conventional economic or market models rarely explain anomalies in the market. But still, more research is being done on it, and investors are using it to make profitable trading. Hence, let us know two major types of market anomalies as shown below:

Time-series anomalies – These anomalies resemble patterns of asset returns occurring over time. It has been sub-categorized as follows:

- The January effect: In January, stocks usually outperform.

- The weekend effect: On Mondays, stock underperforms.

- The turn-of-the-year effect: Small caps usually outperform in the first few weeks of a new year.

- Momentum effect: Any security that had outperformed in the past tends to do so in the future due to the momentum gained.

- Mean reversion: Any asset that has continuously outperformed or underperformed the security market for a long time generally returns to the mean shortly.

Cross-sectional anomalies: These are those patterns that exist in a wide set of assets at a single point in time. It has been divided into the below sub-types:

- The value effect: Sometimes low-priced stocks, called value stocks, outperform high-priced stocks, called growth stocks.

- The side effect: Large-cap stocks underperform as compared to small-cap stocks.

- The quality effect: At other times, stocks having strong financial ratios and low leverage, called high-quality stocks, drastically outperform low-quality stocks.

- The low-beta effect: High-beta stocks having high volatility underperform in contrast to low-beta stocks with low volatility.

Examples

Let us take the help of a few examples to understand the topic.

Example #1

Suppose Paul, a seasoned trader, closely monitors the activities on the Wooduland trading exchange. In the case of XYZ stock, he discerns an intriguing trend. The company consistently delivers robust earnings reports and receives positive news regarding its growth potential. Nonetheless, its stock's price remains significantly undervalued compared to its industry peers.

This disconnection between market valuation and fundamental performance clearly manifests a market anomaly. Paul seizes the opportunity to acquire XYZ shares at a discounted price. He firmly believes that the market will eventually correct itself and recognize the company's true value.

Example #2

In 2022, a market anomaly challenging the norm emerged: commodities and the US Dollar were simultaneously on the ascent. This exceptional situation, characterized by a strong inverse relationship, prompted significant inquiries. Typically, we observed only marginal gains in the Dollar or specific commodities, but presently, both are experiencing substantial upswings. The robust uptrend in commodity prices commenced in 2021, with the potential for a considerable 65% to 75% loss if the parabolic arc is breached.

Meanwhile, the US Dollar exhibits signs of a possible triple top, warranting a subsequent backtest. This anomaly fosters market uncertainty, which is attributed to intricate market dynamics and conflicting forces. It's a distinctive, intricate circumstance where market complexity fundamentally accounts for its peculiarity.

Effects

It is very important to know the effects of market anomalies to trade profitably without loss and mitigate risks. Various market anomalies and their effects on investors are briefly summarized in the below table:

| Market Anomaly | Effects |

|---|---|

| Momentum Effect | It has a higher risk of having short-term outperformance when suddenly momentum reverses. |

| Value Effect | Value-oriented investors have the potential to get higher long-term returns. |

| Size Effect | Investors can get better returns when they allocate funds to small caps. |

| Earnings Surprises | It gives unpredictable reactions while providing trading opportunities per earnings forecasts. |

| Calendar Anomalies | During particular calendar durations, investors get short-term gains |

| Behavioral Biases | Emotional decisions give an ample chance to exploit price inefficiencies in the market. |

| Post-Earnings Announcement Drift | Earnings announcements concerning possible gains allow one to adjust portfolios. |

| Liquidity Anomalies | It leads to portfolio construction to manage risk excellently by considering the liquidity factors. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

No, market anomalies do not always disappear immediately upon identification. They often persist for extended periods. This persistence can be attributed to the influence of investor biases and cognitive limitations, which are challenging to rectify. However, as more investors become aware of these anomalies, their profitability in exploiting them may diminish over time.

Engaging in trading based on market anomalies carries various risks:

- There is no guarantee that these anomalies will persist.

- As more investors become aware of these irregularities, their exploitative potential may diminish.

- Trading costs such as fees and slippage can erode your profits.

Anomalies within an efficient market are situations that the Efficient Market Hypothesis (EMH) cannot explain. The EMH posits that stock prices incorporate all available information, consistently outperforming the market challenge. Nevertheless, anomalies in efficient markets suggest the presence of inefficiencies that investors could exploit.