Table Of Contents

What Is Marginal Tax Rate?

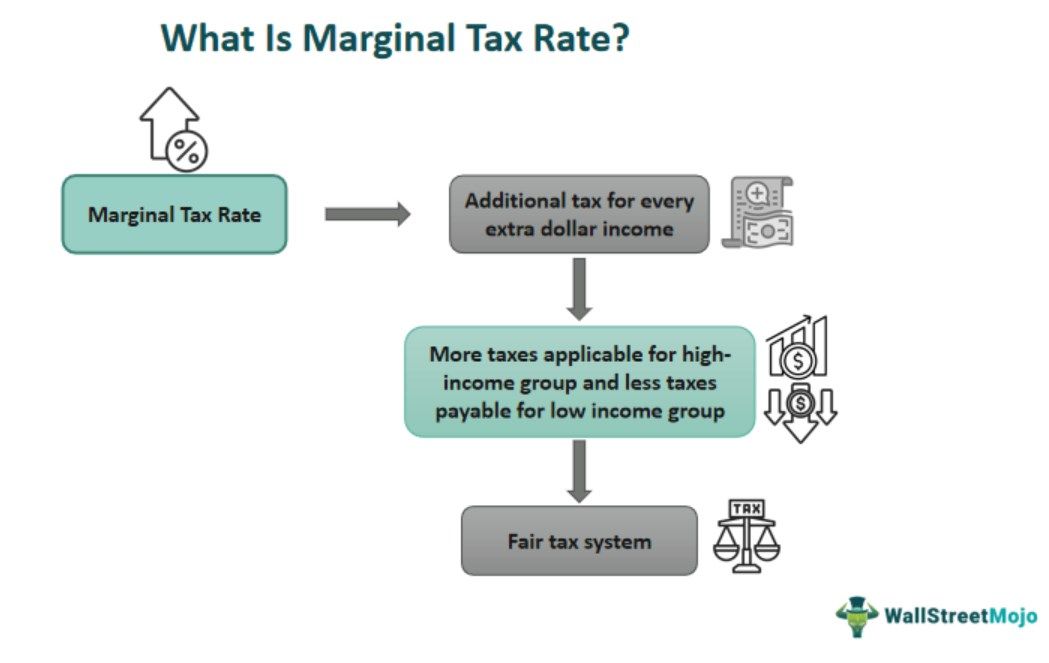

A Marginal Tax Rate can be defined as a progressive tax structure where the tax liability of an individual increases with the increase in the amount of income earned during a financial year. It is the addition to the taxable income with respect to every dollar of increase in the earning.

Through marginal tax rate, the individuals who fall in the lower section of the society and have lower income, they pay a lower tax rate on the taxable income. In contrast, an individual with a higher income will have to pay a higher tax rate on the taxable income.

Marginal Tax Rate Explained

Marginal tax rate refers to the tax rate that mark changes in the taxes levied on one’s earning. This rate increases the taxes to be paid with the increase in the earnings of individuals or entities. As a result, the ones with more income pay more taxes and vice-versa. This way, the taxes are determined with respect to the income level, thereby making it easier for individuals and entities to pay them conveniently.

As the marginal tax rate indicates an increase in the income earned whenever, there is a corresponding increase in the tax rate that has to be paid, it facilitates a fair tax rate among the citizens based on their income. It is different from the flat tax rate, which applies to all income groups across. It is calculated based on the income bracket in which the individual or the organization falls. The marginal tax rate allows several adjustments to taxable income, like deductions and exemptions.

In the U.S., taxpayers are bifurcated into seven brackets based on their taxable income – 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Since the U.S. follows a progressive income tax pattern, as the income increases, so does the income tax. But this doesn’t mean that the people in the highest bracket pay the highest rate on all of their income.

The seven income tax brackets and their bifurcations:

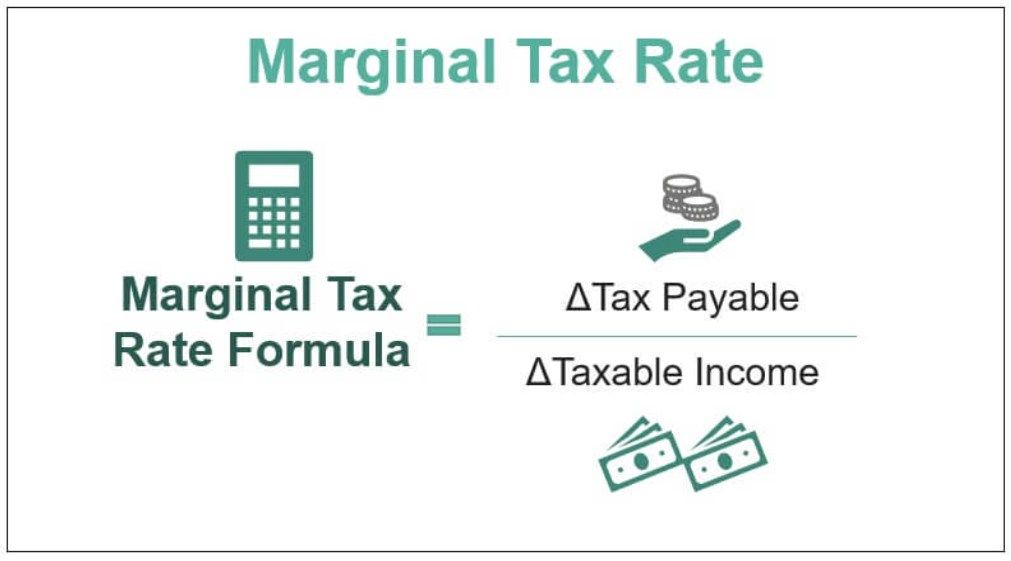

Formula

The mathematical expression on which the marginal tax rate calculator works and also individuals use to calculate the taxes on their income is:

Marginal Tax Rate = ΔTax Payable/ ΔTaxable Income

Alternatively, the Marginal Tax Rate Formula is as follows:

Total Income Tax = Taxable Income(n) x Tax Rate under a Tax Bracket(m) + Taxable Income(n+1) x Tax Rate under a Tax Bracket(m+1)... So on

Examples

Let us consider the following instances to understand the marginal tax rate meaning and calculation better:

Example 1

Countries have different rates in their income range, but the crux remains the same. If a person falls in a higher tax bracket, he will need to pay the tax rate applicable to all the lower brackets and the tax bracket in which he falls. The marginal tax rate calculation example below would give a better understanding.

The taxable income for John, a single resident of the U.S., is $82,000 for the year 2018-2019; the marginal tax rate for his income, according to the tax brackets mentioned above, will be 22%. If he were to earn an extra $501 of taxable income, he would be upgraded to the next tax bracket, which in this case, would be 32%.

So, for $82,000 his tax would be:

Tax for income range $0-$9,525 @10%

- =$952.50

Tax for income range $9,526-$38,700 @12%

- = $38,700 - $9525

- = $29,175 x 12%

- = $3501

Tax for income range $38,701-$82,500 @22%

- = $82,000 x 22%

- = $18,040

Total tax = $952.50 + $3501 + $18,040

- = $22,493.50

If John were to receive a bonus of $15,000 by the end of the tax year, his marginal tax would be 24%. In this case, he would need to make arrangements for a deduction to reduce his taxable income and increase the pre-tax contributions. Sounds confusing?

Simply put, he will need to look for alternative investment options like life insurance cover, taking a car/home loan, or making charitable contributions that would eventually bring down his taxable income.

Example #2

Marc, an individual aged 28, earned $1,00,000 during the financial year 2018. Calculate Mark’s Income Tax liability if the following is the given taxation system in the U.S.

Will Marc be taxed at the highest tax rate, i.e., 30%?

What is Marc's effective tax rate?

Sol - No, Even if Marc has earned $10,00,000, his entire income will not be taxed at the highest tax rate but will be calculated as given below,

Therefore, the calculation of this formula will be as follows.

Marc’s effective tax rate= (Total Tax Payable/ Total Taxable Income)

= ($2,47,500/$10,00,000) x 100

Marc’s Effective Tax Rate will be –

- Marc's Effective Tax Rate = 24.75%

Example #3

Louis and Emma married and assessed disclosed taxable income of $ 1,50,000 during F.Y. 2018. With the help of the below tax brackets, calculate their tax payable if they are filing a joint return as married filing jointly.

Sol - Since Louis and Emma opted for Married Filing Jointly, the tax will be calculated according to tax brackets given for this category, and tax liability will be calculated as follows:

Total Tax Payable

- Total Tax Payable = 24,879

Therefore, the calculation of this formula will be as follows.

= Tax Payable/ Total Taxable Income

=($24,879/$1,50,000)

Marc’s Effective Tax Rate will be –

- Marc's Effective Tax Rate = 16.59%

Example #4

Calculate Mr. Marc's (unmarried) tax liability supporting more than half of family expenditure for full F.Y. 2018 with a taxable income of $12,00,000 with the help of given tax brackets.

Sol. Since Mr. Marc is unmarried and supports more than half of his family expenditure, he is eligible to file an Income Tax return as head of household. Tax brackets applicable will be as follows:

Total Tax Payable

- Total Tax Payable = 408,912.00

Therefore, the calculation of this formula will be as follows.

= Tax Payable/ Total Taxable Income

= ($4,08,912/$12,00,000) x100

Marc’s Effective Tax Rate will be –

- Marc's Effective Tax Rate = 34.08%

Advantages

The feature of the marginal tax rate to establish a fair tax system reflects how beneficial it is for citizens. Let us have a look at some of the benefits in brief below:

- The tax burden is shifted to the higher income group.

- Protects the taxpayer; the tax will go down when income goes down.

- Governments earn more from Marginal tax.

Disadvantages

Though there are multiple advantages of the marginal tax rate, there are flaws as well which one must be aware of. Let us have a look at some of the limitations of these tax rates:

- Discourages business expansion as higher income would attract higher taxes.

- It is unconstitutional as it does not treat the citizens of the same country equally.

- The highest-earning citizens of the country may leave to avoid paying higher taxes.

Marginal Tax Rate vs Effective Tax Rate

Both are rates applied to determine the taxes to be paid by citizens with respect to or irrespective of their income. Let us look at the difference between marginal tax rate and effective tax rate, also known as average tax rate, below:

- The marginal tax rate is the rate applied to one’s current income to calculate the tax to be paid, while the effective or average tax rate is the average rate applied to the income of all taxpayers to calculate the taxes.

- While the marginal tax rate is the rate determined based on one’s income level for tax calculation, the average tax rate acts as per the tax brackets specified by the Internal Revenue Service (IRS). The tax is calculated on an average rate for all.

- The marginal tax rate increases taxes for higher income citizens and lowers the same for the people earning low or belonging to lower income level. On the contrary, the effective tax rate calculates taxes for people based on the average tax rate. The tax amount is same for both high income and low income groups based on the tax brackets.