Table Of Contents

What Is Marginal Cost Of Capital?

The marginal cost of capital is the total combined cost of debt, equity, and preference, taking into account their respective weights in the real worth of the company, where such cost shall denote the cost of raising any additional capital for the organization, which aids in analyzing various alternatives of financing and decision making.

The weighted average cost of the new proposed capital funding is calculated using their corresponding weights. The marginal weight implies an additional source of funds among the total proposed budget. If any company decides to raise other funds through various sources, funding has already been done earlier. Therefore, the additional raising of the fund will be in the same ratio as earlier.

Key Takeaways

- The marginal cost of capital is the total combined cost of debt, equity, and preference, considering their respective weights in the company's actual worth. It helps in analyzing different financing alternatives and making informed decisions.

- The marginal cost of capital is the cost of raising an additional dollar of funds through equity, debt, and other sources.

- The marginal cost of capital increases in slabs and not linearly. This means that as a company raises more funds, the cost of raising additional funds will increase at a non-linear rate.

Marginal Cost Of Capital Explained

The marginal cost of capital is the cost of raising an additional dollar of a fund by way of equity, debt, etc. It is the combined rate of return required by the debt holders and shareholders to finance additional funds for the company.

The marginal cost of capital schedule will increase in slabs and not linearly. For example, a company may finance a defined portion of new investment by reinvesting the earnings or raising the majority by debt and/or preference share to maintain the target capital structure. One can do the reinvestment of earnings without hampering the cost of equity. But, when the proposed capital exceeds the consolidated amount of retained earnings and debt and/or preferred stocks raised to maintain the target capital structure, the cost of capital will also increase.

Therefore, the marginal cost of capital will be the same as that of the weighted average cost of capital which is the average cost of using both equity and debt having weights by their respective proportion in the capital structure.

But in the real scenario, in case of marginal cost of capital schedule additional funds might be raised with different components and/or other weights. In this, the marginal cost of capital will not equal the weighted average cost.

Thus, we see that when the organization tries to raise capital, it needs to assess if the new investment will generate returns which is more than the marginal cost of capital. If it is more, then the investment decision is profitable and indicates more value generated for stakeholders. The opposite will not prove to be wise in terms of financial decision taken by the management.

Organizations always try to maintain a balance between equity and debt in order to maximise value addition through minimum cost. The calculation for marginal cost will help in attaining this objective.

Formula

It is to be noted that the calculation and evaluation of the concept can change depending on factors such as the type of company operations, the industry or sector and also the current market conditions. The financial landscape keeps changing continuously and it is necessary to accumulate updated data for the calculation of the same. Let us try to understand the formula used for the calculating marginal cost of capital.

Marginal Cost of Capital = Cost of Capital of Source of New Capital Raised

The weighted marginal cost of capital formula = It is calculated in case the new funds are raised from more than one source, and it is calculated as below: -

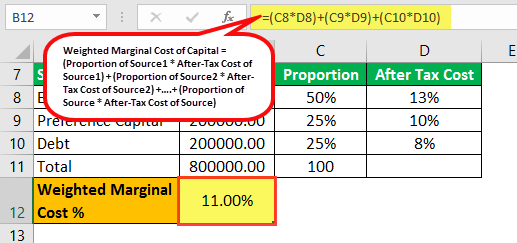

Weighted Marginal Cost of Capital = (Proportion of Source1 x After-Tax Cost of Source1) + (Proportion of Source2 x After-Tax Cost of Source2) +…. + (Proportion of Source x After-Tax Cost of Source)

Examples

Let us understand the concept of calculating marginal cost of capital with the help of some suitable examples.

Example #1

A company's present capital structure has funds from three different sources: equity capital, preference share capital, and debt. Now, the company wants to expand its current business. For that purpose, it intends to raise funds of $100,000. The company decided to raise capital by issuing equity in the market. According to the company’s present situation, it is more feasible to raise money through the issue of equity capital rather than debt or preference share capital. The cost of issuing equity is 10%. What is the marginal cost of capital?

Solution:

It is the cost of raising an additional fund dollar through equity, debt, etc. For example, in the present case, the company raised funds by issuing the additional equity shares in the market for a $100,000 cost of 10%, so the marginal cost of capital of raising new funds for the company will be 10%.

Example #2

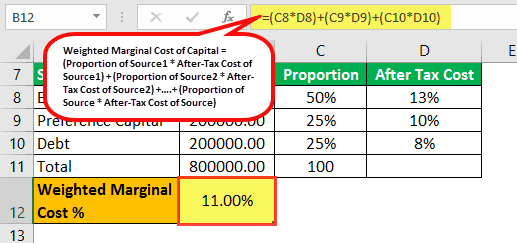

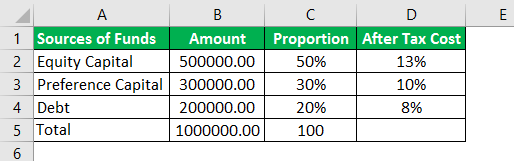

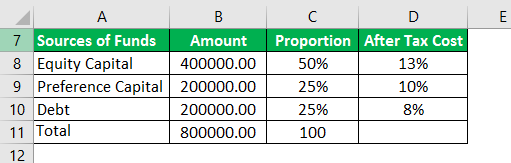

The company has a capital structure and the after-tax cost as given below from different sources of funds.

The firm wants to raise the capital of $800,000 further as it plans to expand its project. Below are the details of the sources from which the money is raised. The after-tax cost of debt will remain the same as in the existing structure. First, calculate the marginal cost of capital of the company.

Solution:

Calculation of the weighted marginal cost of the capital: -

WMCC = (50% * 13%) + (25% * 10%) + (25% * 8%)

WMCC = 6.50% + 2.50% + 2.00%

WMCC = 11%.

Thus, the weighted marginal cost of the capital of raising new capital is 11%.

Please refer to the given Excel template above for detailed calculations.

Problems

Some of the disadvantages of marginal cost of capital in financial management are as follows:

- It ignores the long-term implications of raising a new fund.

- It does not aim to maximization of shareholder wealth, unlike the weighted average cost of capital.

- This concept cannot be applied to a new company.

- The concept is overall a complex process requiring different assumptions. Such complex procedures can result in errors and complication in understanding if not handled properly.

- Since it is better suited for funding projects that are incremental in nature, the funding needs are small. So large scale decisions may not use this method where major changes in capital structure is needed.

- The assumptions are sensitive to certain factors like interest rate fluctuations, investor sentiments or market conditions. Small variations in these factors can make major variation in the value calculated in the marginal cost.

- The assumption in the theory of marginal cost of capital in financial management may not be applicable practically all the time. Some problems like information asymmetry , market frictions or transaction cost can create discrepancy in the calculation of the same.

- The concept treats each source of financing separately and independently. However, there are interactions and synergies between them different capital sources. Due to this simplified approach, the complexities are not always addressed.

Solutions

Some of the solutions and positive sides of the concept are as follows:

- It aims to change the overall cost of capital by raising one more dollar of the fund.

- It helps decide whether to raise further funds for business expansion or new projects by discounting the future cash flows with a new cost of capital. Since in this concept, the incremental cost of capital for each extra unit is considered, it helps in getting a more precise understanding and assessment of the cost implications. Thus, the investment selection is more specific and unambiguous.

- It helps decide the new funds to raise and in what proportion.

- The concept takes into account the change in debt and equity mix leading to capital structure change. This is a very flexible approach and is very helpful for entities looking to adjust their finance mix and plans to be aligned with their company goals and plans for future growth and expansion.

- The analysis done using this process is project or investment specific. This helps in evsluation of the particular investment to understand whether the return will be more than the cost.

However, the approach provides valuable insight into the incremental cost of capital raising process. Even though it has various advantages and limitations, it continues to be widely used in conjunction with other methods.

Marginal Cost Of Capital Vs Weighted Average Cost Of Capital

Both the above concepts are related to corporate financing and widely used in the financial market for evaluation of cost for raising capital in organizations. However, they have different meanings and usage. Let us study the differences.

- The former refers to the additional cost that the entity may incur if it tries to raise additional unit of capital, whereas the latter refers to the average cost incurred for raising finance from various sources.

- The former takes into account the changes in the cost of both debt and equity with change in the capital structure, whereas the latter helps in evaluating the overall cost of capital.

- The former helps in determining the cost of funding using a particular type of capital whereas the latter uses a discount rate to assess the viability of an investment opportunity.

- The former is incremental in nature, evaluating the addition cost, whereas the latter provides a perspective that is wider and includes the overall cost.

Both the concepts are extremely valuable and essential in the financial market and companies looking to raise capital for funding its operations. They help the management take informed business decisions while funding its projects and investment opportunities.