Table Of Contents

What Is Margin Trading?

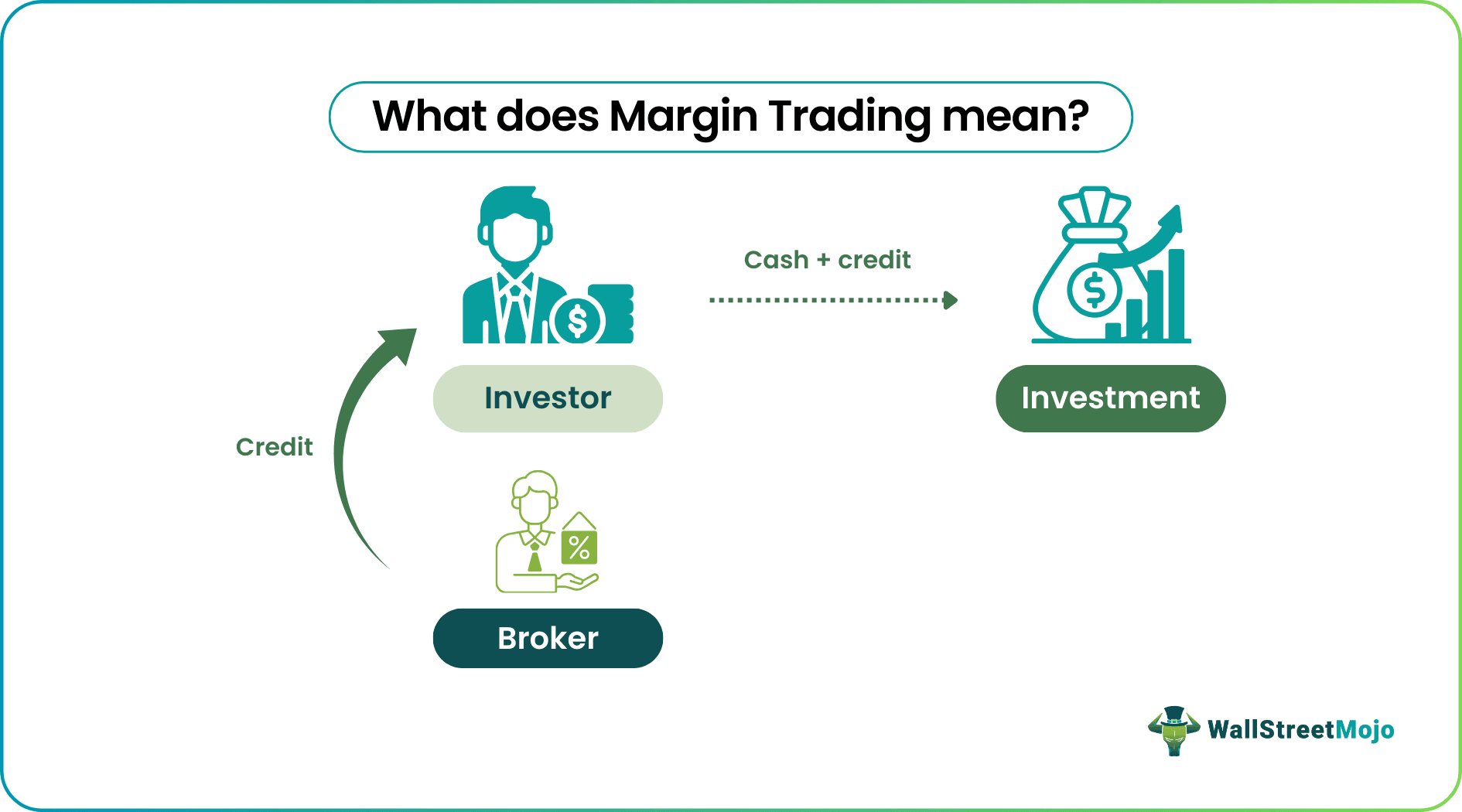

Margin trading or margin buying refers to buying securities and investments or entering into a derivative contract with cash borrowed from the brokerage firm. Here, the securities function as the collateral. Investors must pay regular interest on the credit, as with any loan.

To buy to margin, investors should have a margin trading account. Margin refers to the difference between the market price and the loan amount borrowed, i.e., the account balance left. Margin buying can be especially advantageous if the investor believes that a particular security will bring significant returns.

Table of contents

- What Is Margin Trading?

- Margin trading can be referred to as purchasing a financial instrument with credit from the broker.

- In most cases, the investor should pay for a minimum of 50% of the investment, and the rest will be financed by the broker based on the investor’s creditworthiness and the investment itself.

- An important feature is that the securities are used as collateral against the credit. But this can be an issue if the investment doesn’t perform well and will end up amplifying the investor’s losses.

Margin Trading Explained

A margin trading facility is a great way to finance the purchase of exceptional stocks. Usually, experienced investors have a diversified portfolio and many investments in it. They invest and make profits, and the cost of investment keeps moving from one security to another. It is possible that, at times, they come across a promising stock but only have partial funds to finance the purchase. In such cases, they can approach their broker and have them cover a portion of their investment cost, provided they have an existing margin trading account.

The broker then collects regular interest from the investor, similar to any loan. However, the repayment can be flexible, depending upon the broker. For example, some collect the interest as a share of profits. But this can put them at risk if the investment starts underperforming later. Under-performance or non-performance of an investment is a serious issue, as the investment is the collateral.

If its value starts declining, the broker will demand that additional securities be added to the account to secure the loan. If investors fail to do so, the broker will liquidate the other investments and make up for the credit offered. Thus, the risk and loss are fully borne by the investor alone, and they will lose all the investments.

Thus, investors must ensure they choose the right instrument and exercise extra care before moving on to a margin trading facility. It is an attractive option, but it might not always work for the best. They should be alert and ready to secure the credit and other assets if the investment bought to the margin fails. The investment should be good enough to pay for their interests and give them a higher profit.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Here are a few examples to understand the concept of margin buying.

Example #1

Doug is an investor who has been investing with brokerage firm X for many years. He had been watching the AutoZone Inc. (AZO) stock for a while. So, right before his retirement on May 2022, Doug decided to purchase the stock to margin. The stock was priced at $1839.62 on May 18, 2022. He paid $950 from his cash account, and his brokerage firm lent the rest. The stock has since fared well and, in June 2022, crossed $2000.

Example #2

Robinhood Inc, the American financial services company, recently reported revenue of $361 million in the third quarter (Q3) of 2022. It was a jump from the previously estimated $355 million. The margin trading interest rate hike doubled the net interest revenue to $128 million. The margin trading interest rates for Robinhood Gold customers jumped to 5.75%, while for non-Gold customers, it rose to 9.75%. The firm expects the fourth quarter's net interest revenue to increase by around $25 million from Q3.

Pros & Cons

Margin buying is one of the most important developments in stock trading. Nevertheless, like two sides of a coin, it has merits and demerits. Let’s take a look at these in brief.

| Pros | Cons | |

|---|---|---|

| It can help finance the purchase of promising stocks. | Not all stocks qualify for margin buying. It depends on the performance. | |

| Investors can capitalize on the leverage. | Investors have to maintain a minimum margin. Further, they have to pay at least 50%. | |

| Offers more flexibility in terms of loan repayment. | In case of losses, other securities might be subject to forced liquidation. The credit increases the investor’s purchasing power. | |

| The credit increases the investor’s purchasing power. | The cost of investment is high |

Margin Trading vs Leverage Trading vs Spot Trading

Check out the main difference between margin trading, leverage trading, and spot trading:

- Margin trading is a type of leverage trading as margin gives the investors leverage. Leverage means borrowing to purchase an asset or to finance an activity. It can be seen in trading, business, real estate, etc.

- The main difference between margin and leverage is that firms require a certain minimum margin and an initial margin. They would be paying for at least 50% of the purchase. In leverage, though, this need not be the case. Though there would be a minimum investment from the investor’s side, a third party may finance the majority portion. For example, mortgage.

- Another difference is the collateral. Any credit requires collateral. In margin buying, the investments are the collateral. Any asset can be a security for the creditor in leverage trading – property, deposit, and even investments.

- Further, there is an inverse relationship between margin and leverage. Higher the margin (balance amount in account), the lower the leverage.

- Spot trading is an altogether different concept. A financial instrument is immediately delivered in spot trading at a specified spot date. The main difference is that spot trading requires full payment from the investor towards the purchase, whereas margin trading requires the investor to pay partially.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The investor approaches the brokerage firm to buy a certain investment. The broker authorizes the purchase if the investment qualifies for margin buying, and the investor can undertake at least 50% of the cost.

Yes. A majority of Islamic scholars state that margin buying is against Sharia. Islam says people should not sell something they do not possess (purchased in an existing loan). Thus, selling an investment bought to a margin with an existing debt will be considered halal.

It depends on the investment. If the investment is promising and can give more than satisfactory returns, it will qualify for margin buying. It will offset the cost of investment and the interests the investor pays.

No. Margin buying is a type of leverage buying. In the former, the investor pays an equal or major portion, while in the latter, the creditor pays the majority portion.