Table Of Contents

What Is A Margin Call?

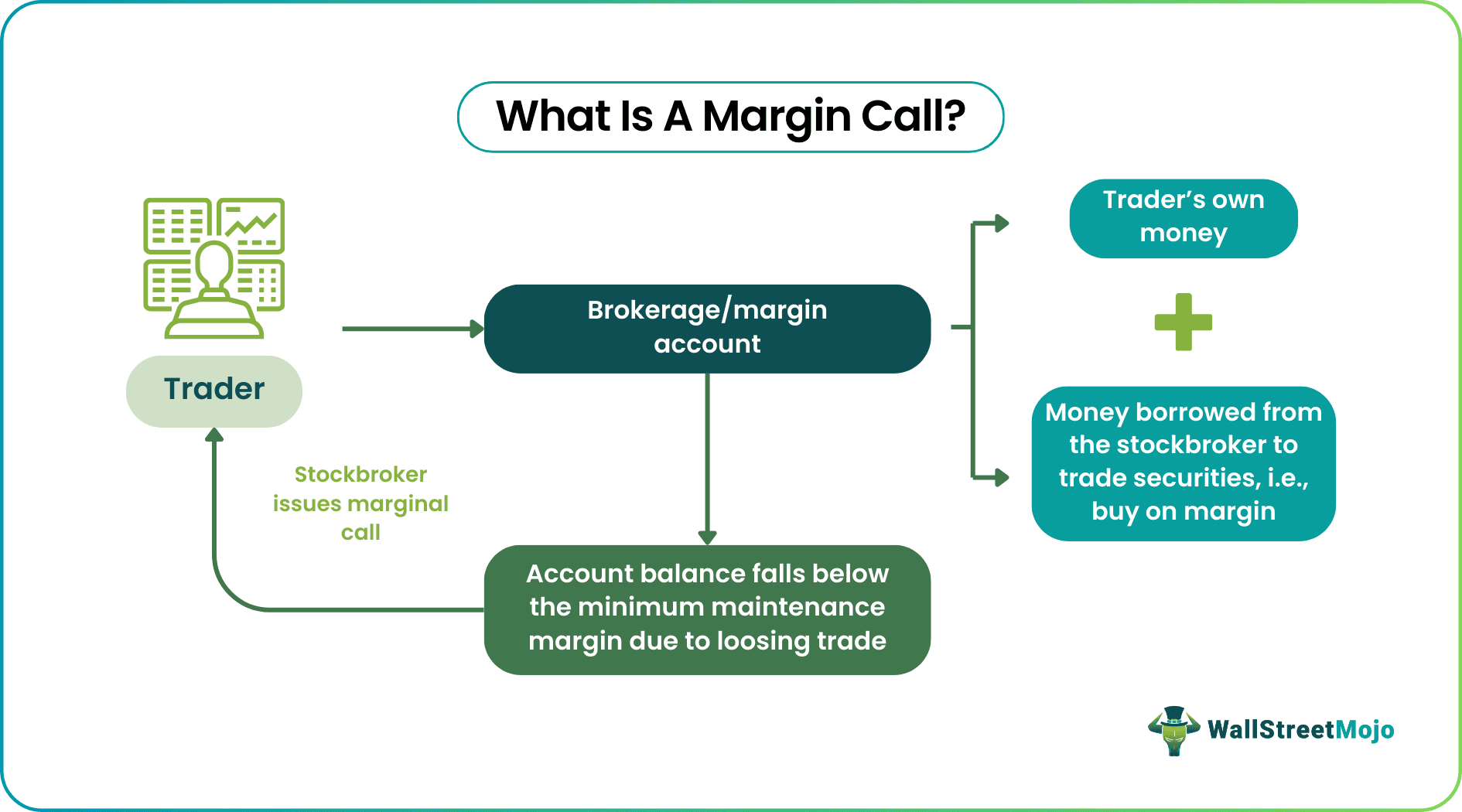

A margin call occurs when the stockbroker notifies the trader about the brokerage account balance falling below the minimum maintenance margin. A margin account is where the trader deposits their funds plus the money borrowed from a broker to acquire securities.

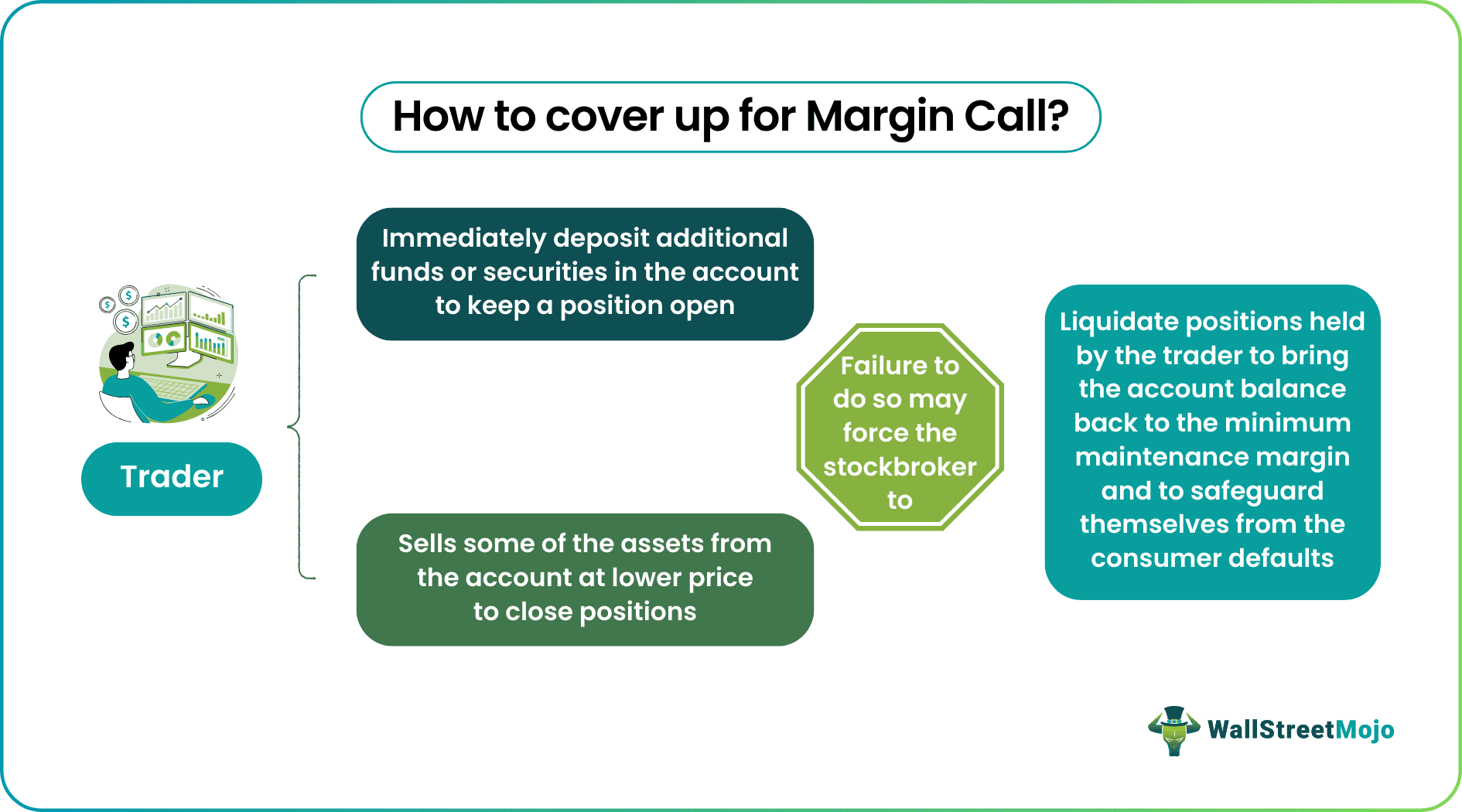

Upon getting the alert, the trader must immediately deposit additional funds or securities into the account to keep a position open. They can also choose to sell some assets to close positions. It will, thus, assist them in meeting or reducing the maintenance margin criteria. Failure to do so, however, may force the stockbroker to liquidate positions held by the trader. It will help bring the account balance back to the minimum maintenance margin.

Table of contents

- What Is A Margin Call?

- The stockbroker issues a margin call to the trader when the brokerage account balance falls below the minimum maintenance margin. It applies to traders who borrow funds from the broker to trade securities, i.e., trade on margin.

- To keep a position open, the trader must promptly deposit additional funds or securities into the account or close positions by selling some assets from the account. If the trader fails to do so, the brokerage firm may liquidate the trader's positions.

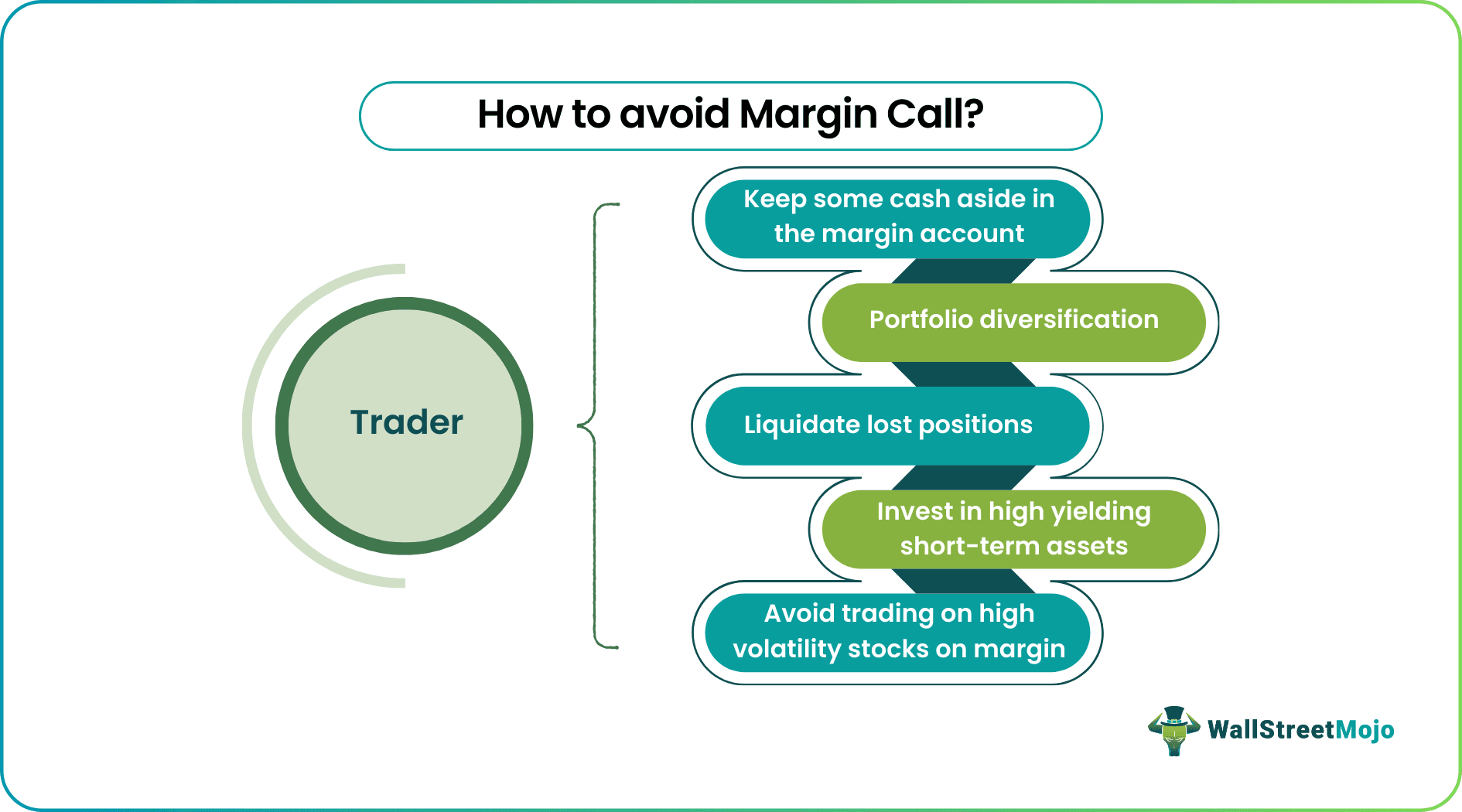

- Keeping cash aside, diversifying portfolios, selling lost securities, investing in high-yielding short-term assets, and avoiding trading high-volatility stocks on margin are popular ways to avoid getting a warning call from the stockbroker.

Margin Call Explained

A margin call triggers when the margin account balance falls below a specific limit. The stockbroker decides this threshold for investors who borrow money from them besides depositing funds themselves to purchase securities, called buying on margin. It means purchasing new equities while holding existing ones as collateral. However, this strategy can result in higher returns and more investment risks. As a result, different stockbrokers have different margin requirements depending on the account, trade, and security type.

When investors purchase a financial instrument with the expectation of a future increase in stock value, they are more likely to buy further collections to maximize their gains. In this situation, they borrow money from a stockbroker and use it to acquire more company stock, assuming that the price will rise. It is a loan secured by collateral and managed through a margin account. When margin call stock prices fall short of investors' expectations, the account balance is debited.

The difference between the value of the assets held by the brokerage or margin account and the money borrowed from the broker is the trader's equity. Stockbrokers typically set a minimum fixed amount that the portfolio must hold. When the equity falls below that maintenance margin, the brokerage firm will issue a margin call.

The trader must deposit this minimum sum in cash to ensure that the collateral requirement is met and the stockbroker does not feel betrayed at any point. However, if the trader fails to maintain the minimum account balance or the maintenance margin, the broker will sell their positions to ensure their borrowed amount is still secured. It is a tactic used by brokerage firms to safeguard themselves from consumer defaults.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Maintenance Margin Requirements

A margin call meaning is a message warning trader to maintain the required minimum balance, also known as maintenance margin, in their accounts. It will give stockbrokers confidence in the collateral provided as security for the loan.

- The United States Federal Reserve Board’s Regulation T sets the initial margin requirement, which has remained at up to 50% since 1974.

- The New York Stock Exchange (NYSE) and the U.S. Financial Industry Regulatory Authority (FINRA) require investors to keep the account's maintenance margin to at least 25% of the total value of securities bought on margin.

- Stockbrokers can decide how much to lend to investors to buy fresh stocks. It, depending on their requirements, averages between 30% and 40%.

Calculate Margin Call

It is simple to calculate a margin call or the amount that would cause stockbrokers to warn traders to maintain a minimum level for account maintenance. Initial and maintenance margins are the two types of margins that must be met.

Margin Call Price = (Original Purchase Price) * {(1-Initial Margin) / (1-Maintenance Margin)}

Where:

- The original purchase price is the total value of securities in the account,

- Initial margin is the minimum amount a stockbroker lends to the trader to buy the asset,

- Maintenance margin is the minimum level of equity required in an account to avoid a warning call.

Practical Examples

Let us consider the following margin call examples to get the hang of the concept even better:

Example #1

Wendy buys stocks worth $6,000. She had $3,000 cash in hand while she borrowed the rest of the money on margin, i.e., $3,000 from the broker. The margin requirement as fixed is 30%. However, the margin call stock price dropped by 40% to $3,600, against her expectations. While the price fell, the broker's lent amount remained the same, i.e., $3,000.

Equity left for Wendy = Current value of securities she holds in the account - the amount she borrowed to trade

i.e., $3,600 - $3,000 = $600

So, the equity percentage = $600/$3,600 = 16.67% (which is lower than the minimum margin requirement of 30%)

Wendy must have at least $1,080 in equity in her brokerage account to meet the minimum maintenance margin demand (30% of $3,600 = $1,080). But she will be short $480 in this case. It is when the broker may issue a warning call to meet the maintenance margin requirements.

The firm will require her to make an additional deposit equaling the alert amount. She can also sell part of her stocks, matching the warning sum divided by the minimum maintenance requirement. So, in this case:

$480/30% = $1,600

Wendy will need to sell $1,600 in assets or deposit $480 in cash to meet the 30 percent minimum maintenance margin requirement.

Example #2

Joe buys $100 worth of stocks of a company with a 50% initial margin and a 30% maintenance margin. He uses $50 in cash and borrows the remaining $50 from a stockbroker.

Using the margin call formula above, he gets:

Margin Call Price = ($100) * {(1-50%) / (1-30%)}

= $71.43

When the limit exceeds $71.43, Joe will receive a warning call. He will begin the process of depositing the required amount as soon as possible.

Avoiding A Margin Call

Traders should avoid getting to the point where their brokers have to notify them of a lowering balance suggesting a decline in the value of securities held in the margin account. As a result, it is best to keep the minimum balance without allowing brokers to issue a warning call. If it happens, the investor has three options to maintain the minimum margin level:

- Deposit more cash in the account

- Transfer additional or unmargined securities in the account

- Sell some of the securities held in the account at lower prices

However, here are a few ways that traders must try to avoid getting a margin call:

- Keep a cash amount aside in the margin account besides what they invest in buying margins.

- Diversify portfolio by trading bonds, equities, derivatives, and commodities. It will offset the loss in one asset with gains from other securities while reducing the risk of decline in asset value.

- Liquidate losing positions.

- Set own maintenance margin criteria that are higher than the one set by the stockbroker.

- Invest in high-yielding short-term assets.

- Avoid trading high-volatility stocks on margin.

- Keep a close eye on the margin account.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Margin call refers to a warning issued by the stockbroker as soon as the margin account starts to run short of funds. It is a message triggered to ensure the trader has the minimum balance maintained in their account for the stockbrokers to rest assured of the security they have received against the loan. This minimum balance is the account's maintenance margin.

Though margin call is an alert for traders, it might not be a good thing for traders. It signifies the negligence of investors and thereby stains the portfolio of individuals as investors. Moreover, missing out on maintaining the minimum margin account balance compels brokers to force-sell investors' positions.

The common ways of avoiding a margin call are:

#1 - Having extra cash in the margin account.

#2 - Liquidating losing stocks.

#3 - Maintaining a diverse portfolio.

#4 - Investing in short-term assets with high yields.

#5 - Avoiding margin trading in high-volatility securities.