Table Of Contents

Process of M&A (Mergers and Acquisition)

The M&A Process is a multi-step process and can be short depending on the size and complexity of the transaction involved. Mergers and Acquisition strategies are part of company operations. Two entities combine their assets fully or in part to form a new entity or function as one or the other.

M&A transactions happen regularly, and sometimes they take the shape of friendly transactions, and sometimes they are hostile. They help companies grow in the same industry and expand into new industries. The process of M & M&A transactions can be lengthy or short, depending on the transaction's complexity and size. The period may also depend on the regulatory approvals required.

M&A Explained

Mergers and acquisitions (M&A) are strategic maneuvers in the corporate world, often shrouded in complexity but fundamentally simple. These financial transactions involve the consolidation of two companies, where one entity acquires the other, or both entities combine to form a new, larger organization.

In a merger, two companies of roughly equal size unite to create a single entity. This fusion typically occurs when both firms believe that together, they can achieve more significant economies of scale, expand market reach, or improve their overall competitive advantage. It's a collaborative effort where the synergies between the merging companies can lead to enhanced efficiency and profitability.

On the other hand, an acquisition transpires when one company, known as the acquirer, takes over another company, the target. This can happen for various reasons, such as gaining access to new markets, acquiring valuable assets, or eliminating competition. The target company, once acquired, may either continue to exist as a subsidiary under the acquirer's umbrella or be fully integrated into the acquiring company.

Corporate mergers and acquisitions are driven by a myriad of factors, including the pursuit of growth, cost savings, diversification, and market domination. While they can present opportunities for expansion and profit, M&As also come with risks and challenges, such as cultural clashes, integration hurdles, and financial strains. Therefore, careful planning, due diligence, and a deep understanding of the objectives are crucial for a successful M&A.

Types

The choice of M&A type depends on the specific goals and circumstances of the companies involved. These various types of M&A transactions allow companies to pursue different objectives. Let us understand them through the detailed discussion below.

Types of Mergers

- Horizontal Merger: This involves the combination of companies operating in the same industry and at the same stage of the production chain. The aim is to reduce competition and expand market share.

- Vertical Merger: In this case, companies within the same industry but at different stages of the production process merge. This helps streamline operations, reduce costs, and enhance supply chain efficiency.

- Conglomerate Merger: This merger combines companies from unrelated industries. It's often driven by a desire to diversify risk and expand into new markets.

Types of Acquisitions

- Friendly Acquisition: This occurs when the target company willingly agrees to be acquired. It's typically a smoother process, with both parties working together to complete the transaction.

- Hostile Takeover: In this scenario, the acquiring company pursues the target company despite initial resistance. It often involves significant negotiation and sometimes even a proxy fight to gain control.

- Asset Acquisition: Instead of acquiring an entire company, the acquiring company purchases specific assets or divisions of the target company. This can be a strategic move to enhance the buyer's existing business without taking on unnecessary liabilities.

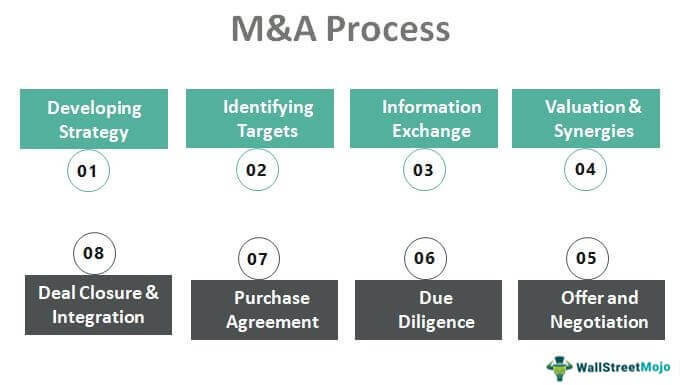

8-Step Process

Let us discuss the step-by-step process of implementing mergers and acquisitions strategies through the discussion below.

#1 - Developing Strategy

TheM&A process starts with developing a strategy that involves various aspects. First, the buyer identifies the motivation behind the mergers and acquisitions transaction process, the type of transaction they want to conduct, and the amount of capital they are willing to spend for this transaction. These are some factors that the buyer considers while developing the strategy.

#2 - Identifying and Contacting Targets

After the buyer has developed the M&A strategy, they start identifying potential targets in the market that fit their criteria. Finally, a list of all potential targets is made, and the buyer starts contacting the targets to express interest in them. The main purpose of this step is to obtain more information about the targets and measure their level of interest in such a transaction.

#3 - Information Exchange

After the initial conversation goes well and both the parties have shown interest in going ahead with the transaction, they begin the initial documentation, which generally includes submission of a Letter of Intent to officially express interest in the transaction and signing a confidentiality document assuring that the proceedings and discussions of the deal will not go out. After that, the entities exchange information such as financials, company history, etc., so that both parties can better assess the deal's benefits to their respective shareholders.

#4 - Valuation and Synergies

After both sides have more information about the counterparty, they begin an assessment of the target and the deal as a whole. The seller is trying to determine a good price that would result in the shareholders gaining from the deal. The seller is trying to assess a reasonable offer for the target. The buyer is also trying to assess the extent of synergies in M&A that they can gain from this transaction in forms of cost reduction, increased market power, etc.

#5 - Offer and Negotiation

After the buyer has completed their valuation and assessment, they submit an offer to the shareholders of the target. This offer could be a cash offer or a stock offer. The seller analyzes the offer and negotiates for a better price if they feel that the offer is not reasonable. This step can take a long time to be completed because neither party wants to give the upper hand to the other by showing their hurry to close the deal. Another common hindrance at this step is that sometimes, there could be more than one potential buyer when the target is a very attractive entity. So often, there is competition among the buyers to offer a better price and terms to the target.

#6 - Due Diligence

After the target has accepted the offer from the buyer, the buyer begins due diligence of the target entity. Due diligence consists of a thorough review of every aspect of the target entity, including products, customer base, financial books, human resources, etc. The objective is to ensure that there are no discrepancies in the information provided earlier to the buyer and based on which the offer was made. If some discrepancies come up, it could lead to a bid revision to justify the actual information.

#7 - Purchase Agreement

Assuming that everything has gone well, including the government approvals and no antitrust laws kicking in, both parties begin drafting the final agreement, which outlines the cash/stock that would be given to the target shareholders. It also includes when such a payment would be made to the target shareholders.

#8 - Deal Closure and Integration

After the purchase agreement has been finalized, both parties close the deal by signing the documents, and the buyer gains control of the target. After the deal's closure, the management teams of both entities work together to integrate them into the merged entity.

Regulations

Corporate Mergers and acquisitions are subject to a few regulations. Let us understand them through the explanation below.

- Antitrust - M&A processes are very closely regulated because they hold the potential to disrupt a fair and just market. M&A transactions need government approval to go through. If the government feels that the transaction is against the public interest, they will put Antitrust Regulations in place and disapprove of the transaction.

- Laws - Various laws have been put in place to monitor the mergers and acquisitions transactions process and ensure that they are not against the public interest. For example, the Williams Act requires a public disclosure if a company acquires more than 5% of another company.

Recommended Articles

This article has been a guide to the M&A process and its definition. We discuss the eight step process, types and its regulations in detail. You can learn more about mergers & acquisition from the following articles –