Table Of Contents

What Is Lump Sum Tax?

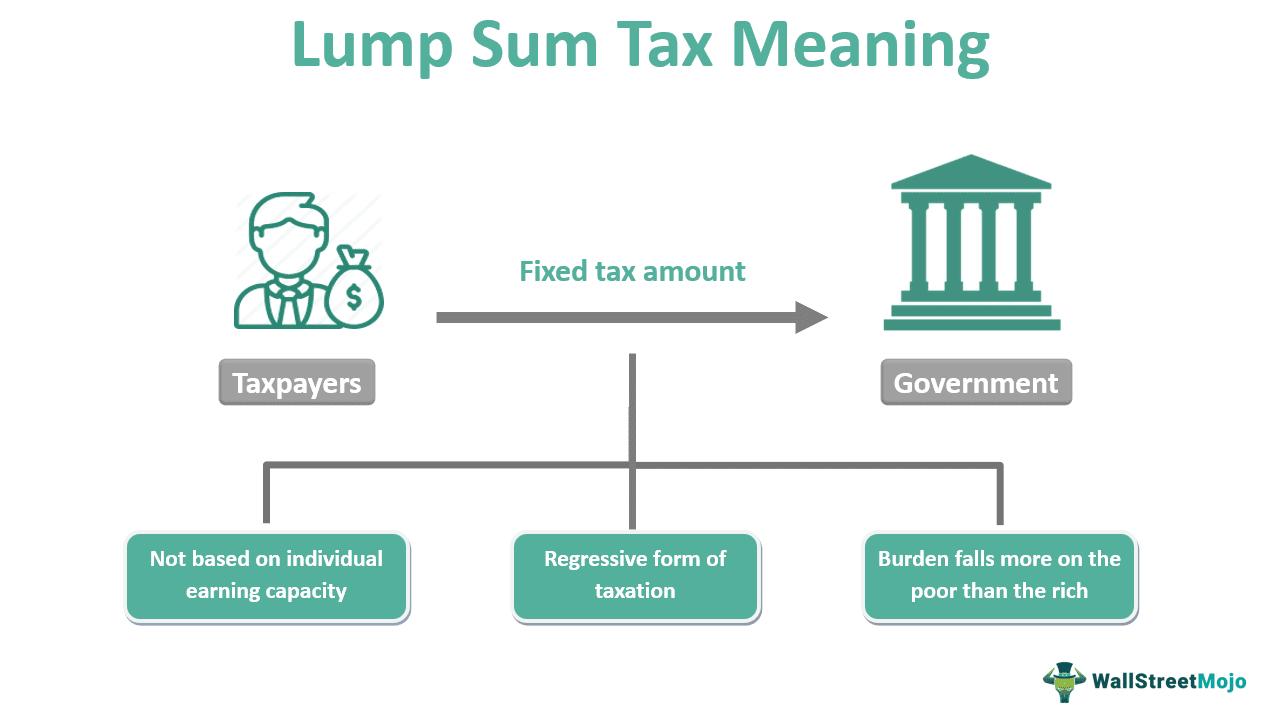

A lump sum tax is a tax imposed on an economy as a fixed amount. The degree of income of individuals has no impact on this sum. Also referred to as a poll tax, the tax rate has the same value for everyone who pays this tax.

It effectively raises revenue without incurring efficiency costs and accomplishes distributional goals. Therefore, there is no distortion of choice because taxpayers' actions do not impact the amount of tax paid. Consequently, there is no deadweight loss during the imposition of these taxes.

Key Takeaways

- Government levies the Lump sum taxes at a fixed rate irrespective of an individual's income and therefore falls under a regressive tax system.

- This taxation is based on anticipated living costs instead of real income and assets. This implies that the calculation does not need to report effective worldwide earnings and assets.

- Switzerland has lump sum taxation. However, different socioeconomic capabilities and wealth distributions across regions make it highly challenging to manage taxes.

- Hence, it is not a preferred choice of tax collection in many countries.

- One can calculate the taxable amount by multiplying the lump sum annual amount with the applicable rate.

Lump Sum Tax Explained

A lump sum tax is levied on an economy as a fixed sum, whose amount is unaffected by the taxpayer's activities or income. It is referred to as a poll tax when the amount is the same for every taxpayer. However, consumer differences in lump sum taxation exist. For some consumers, they may even be harmful. A negative lump sum tax is referred to as a lump sum subsidy.

Redistribution occurs due to the differentiation of lump sum taxes among taxpayers. Due to their effectiveness in generating revenue and meeting distributional demands, these taxes play a crucial part in the taxation system. Furthermore, the choice remains intact since taxpayers cannot change the level of a lump sum tax by altering their behavior. This enables decentralization of first-best allocation while raising money and achieving redistribution without incurring efficiency costs. On the other hand, the distinction of lump sum taxes among taxpayers necessitates the imposition of taxes based on some fixed attributes.

This method of taxation does not have excellent acceptance because of the widespread belief that those with more financial means should pay higher taxes and because it is politically unacceptable to charge people with low incomes disproportionately high amounts of money. In addition, the prevalence of diverse socioeconomic capacities and wealth distributions makes it challenging to administer, and thus people rarely use this taxation in real-world applications. However, Switzerland is one nation that uses this type of taxation.

The country uses expenditure-based taxation to assess income and wealth. This tax is based on the total annual cost of living that the taxpayers spend on themselves and their dependents. The law also specifies minimum values for the assessment base and a minimum calculation. It states that the tax must be less than the tax on certain gross income and wealth computed using the regular tax rate. This income can comprise any revenue derived from Swiss sources. In addition, it includes any income for which the taxpayer is claiming relief from foreign taxation under a double taxation agreement signed by Switzerland.

Formula

Lump sum tax calculation requires multiplying the annual amount by the applicable tax rate.

Therefore the formula for calculating lump sum tax is as follows:

Tax amount =Lump Sum Annual Amount * Applicable Rate

Calculation Example

Check out this example to gain a better idea of lump sum tax. Dan has a lump sum to his name and heeds to tax it. The amount is $10,000, and the tax rate is 7%. Then the lump sum tax calculation will be 10000*7/100, and therefore the taxable amount will be $700. This amount will be deducted irrespective of which income tax slab he falls into.

Lump Sum Tax vs Per Unit Tax vs Income Tax

#1 Lump Sum

They are taxes levied at a fixed rate regardless of the tax slab the individual falls into, and the tax rate cannot be altered by any means. Property taxes are an example of the same.

#2 Per unit tax

One can calculate a per-unit or specific tax as a fixed sum for each unit of a good or service, such as dollars per kilogram. As a result, regardless of the product's price, it is proportionate to the specific quantity sold. When it is simple to gauge how many units of a particular goods or services one sold, per-unit taxes are efficient administratively. This tax type includes excise taxes. Lump sum tax rates do not grow in size with output, in contrast to a per unit tax assessed per unit.

#3 Income tax

An income tax is a charge levied against individuals or businesses (taxpayers) about their earnings (commonly called taxable income). In most cases, one calculates the income tax by deducting a tax rate (predetermined by law) from the amount of taxable income. The type of taxpayer and the type of income are two factors that can affect the tax rate. Unlike lump sum tax rates, income tax is calculated proportionately to the individual's income.

Disadvantages

Lump sum taxes are levied at a fixed rate irrespective of an individual's income and therefore fall under a regressive tax system. In such a system, the poor have to pay just like the rich, except the rich will have the capacity to bear the rates, and the poor have to suffer.

Furthermore, various socioeconomic capabilities and wealth distributions make managing it highly challenging. Therefore this taxation system is not prevalent in many countries.