Table Of Contents

Lower Middle Market Definition

The Lower Middle Market (LMM) is a segment formed by companies ranging from $5 million to $50 million in annual revenue. It forms the lower end of the economy’s middle market, mainly small and medium enterprises. Such companies have outgrown the primary street market and have multiple processes, offices, and operations.

This segment of the market typically is the largest in all world economies as over 90% of the companies fall in this group and, therefore, plays a significant role in depicting the national economy. A primary importance of it is helping investors identify companies with high growth potential along with the risks involved.

Table of contents

- Lower Middle Market Definition

- The lower middle market (LMM) comprises small and medium enterprises with an annual revenue of $5 million to $50 million.

- The classification helps investors gauge the performance and growth potential to make future investments.

- The primary sources of LMM companies are primarily different forms of debt and credit line lending systems.

- When listed as publicly traded companies, they mostly become small-cap and micro-cap stocks trading on the exchange.

Lower Middle Market Explained

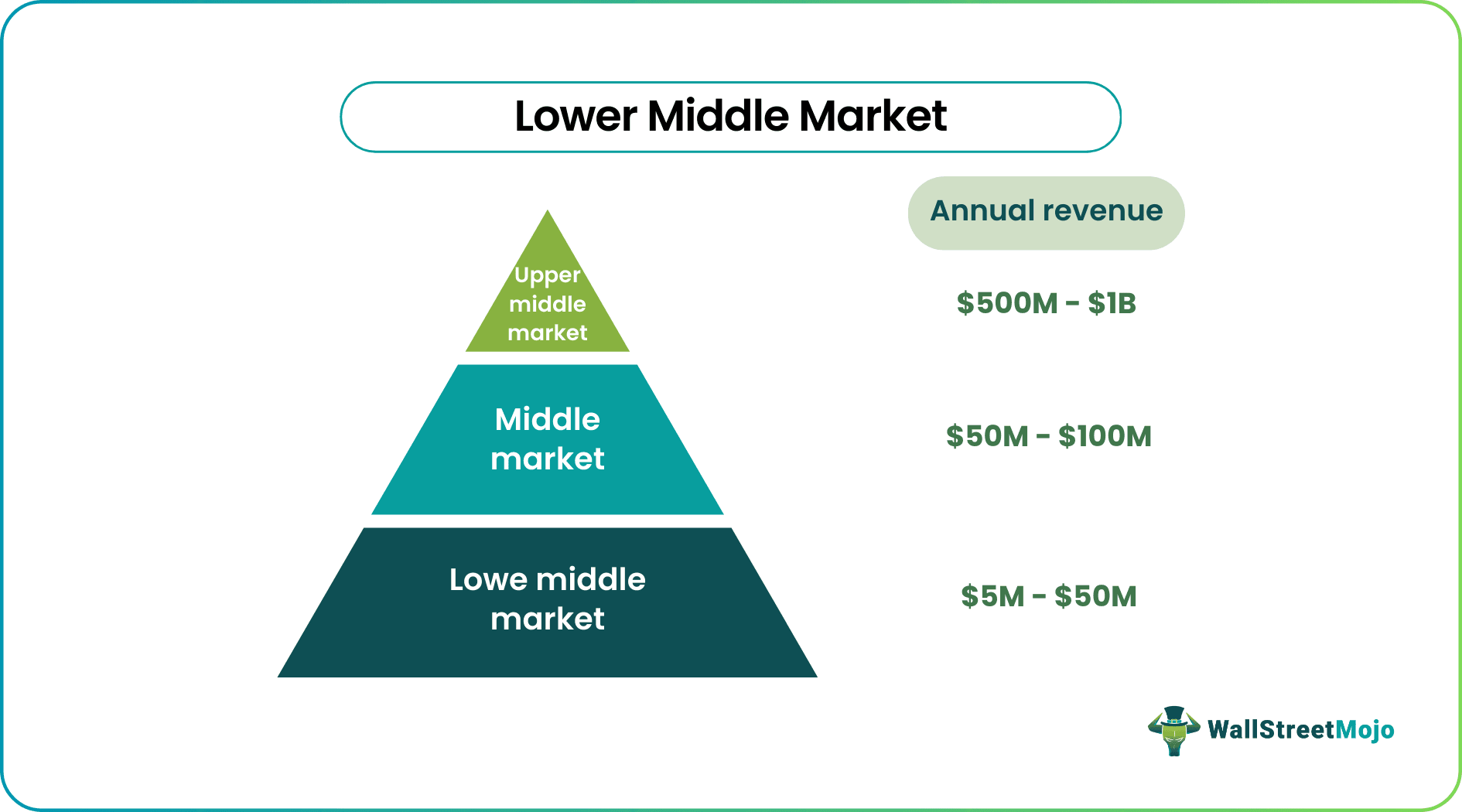

The lower middle market represents the bottom segment of the entire middle market, which represents one-third of the US economy and employs over 48 million people, which is expected to grow even more. The whole middle market is categorized into three segments based on the companies on their annual revenue generation –

- Upper middle market ($500 million to $1 billion)

- Core middle market ($50 million to $100 million)

- Lower middle market ($5 million to $50 million)

There are many lower middle market investment banks and private equity firms that tend to seek good investment opportunities in the LLM segment as it significantly contributes to the US gross domestic product (GDP), plays a crucial role in employment generation, and has a lot more future growth potential compared to firms in other and above segments. In addition, many potential buyers seek the LLM for acquisition targets as it reduces competition and allows them to expand in the market with cost reduction and utilization of resources.

The classification of the middle market allows investors to understand the level of business and yearly performance of a firm. At the same time, lower middle market private equity firms are more interested in this segment because of the variety of firms they get to seek across different sectors and industries. It is not a general case, but most often, the firms operating in LLM are family-owned businesses with the participation of family members. Such firms enjoy high growth rates and play a vital economic role.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Capital Sources

The capital sources for the lower middle market are –

#1 - Bank loans

It is the primary source of capital raising, especially for LMM companies; if they have a strong history of market performance and operations with good prospects, the banks are always ready to offer good loans and lines of credit to such firms.

#2 - Asset-based lending

It is yet another common capital source for LMM firms in which the company assets are used as collateral or security to lift loans or take credit financing lines with a typical ratio of 60% on inventory and 85% on accounts receivable. Even capital assets are used in this form of borrowing.

#3 - Mezzanine debt

LLM firms mostly use it at the time of acquisitions as it uses equity in some form or another; the main advantages of it are negligible or no dilution, mostly favoring family-run enterprises. A combination of equity and debt financing allows the firm to convert equity interest if they default on the loan. Such loans are very flexible and may work out without any collateral.

#4 - Public sector or government sponsorships

It is yet another form of lending where businesses seek monetary help from public and government entities for recapitalization, expansion buyouts, etc.

Examples

Below are two examples of this market segment - one is hypothetical, and the other is from the world news -

Example #1

Suppose Ryan opens a small battery manufacturing company. Since the company is new, it is less in valuation, but Ryan is adamant about offering better products and services. Within three years, the company expanded operations and made a small goodwill in the market. In 2022, the company generated an annual revenue of $9 million.

With such financial reports, Ryan’s company falls in the LMM segment. Although it is a privately held company, many investors are ready to invest in the company because it has enormous potential and is the best fit given that it operates in the automobile industry and, in the long run, has a broad scope for better returns. However, other aspects must be considered before making an investment decision.

Example #2

Monomoy, a private equity firm, has created a new credit fund that introduced a niche in the LMM secondaries. The fund has a value of $300 million and is likely to focus on buying the first lien term loan credits, including the senior secured notes on LMM companies in the secondary market across different sectors. Private credit funds mostly hold these loans for recapitalization.

The company raised its first credit fund in October 2020 at $135 million. Monomoy observes less competition in the LMM as the primary lenders have enormous diversified portfolios. Hence, the private equity firm seeks opportunities in the core sectors.

Lower Middle Market vs Upper Middle Market

The critical differences between lower and upper middle markets are -

- The LMM forms the base segment of the middle market, but the upper middle market (UMM) is the top segment.

- LMM consists of companies with an annual revenue between $5 million to $50 million. In comparison, UMM companies generate a yearly revenue between $500 million and $1 billion.

- LMM is the largest segment of the whole middle market, but the Upper middle market is the smallest category.

- The LMM represents approximately 90% of the business. In contrast, the upper middle market segment only accounts for 1% of the market.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

People and investors are attracted to LMM businesses mainly because of the high growth potential and room for higher returns. The companies in the LMM have a broad scope of operations and need to be more mature; therefore, long-term investments can offer huge returns compared to developed and already-established companies.

According to Forbes, there are approximately 350,000 companies in the US LMM segment. In comparison, the middle market has around 25,000 companies; in the upper middle market segment, there are only a few thousand companies.

Main street businesses, such as restaurants, coffee shops, automobile service centers, and convenience stores, are considered minor compared to the LMM firms. The buyers find such outlets riskier and are sold at lower multiples than LMM companies.