Table Of Contents

What Is A Loss Carryback?

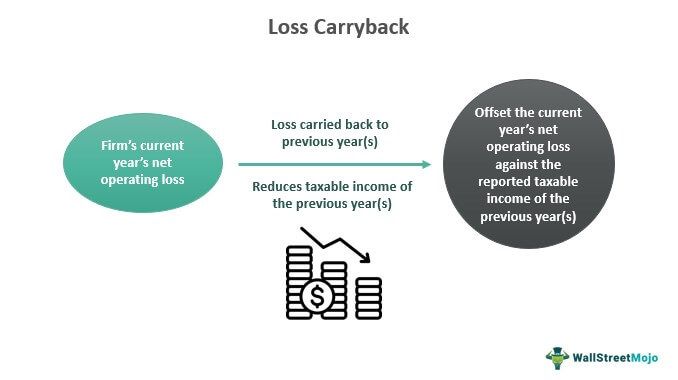

A loss carryback refers to a provision that allows a firm to apply its current year's net operating loss (NOL) to the previous year's tax return or profit and obtain a tax refund based on it. It benefits the firm by reducing the previous year's taxable income and tax liability.

The economic value underlying the loss carryback provision differs from country to country based on the nation's taxation rules and regulations. The provision enables firms to recover from an unexpected loss. In the United States, the provision of carrying back a net operating loss is no longer available for most taxpayers. As a result, NOLs from tax years ending after 2020 can only be carried forward for most taxpayers.

Key Takeaways

- Loss carryback is a provision that allows a firm to apply its net operating loss to a previous year's tax return.

- Applying the current year's net operating loss reduces the tax burden for that prior year and results in the return of previously paid taxes.

- The opposite is the loss carryforward. It allows a taxpayer to move net operating loss to future years to offset the profit that will occur in the future year.

- Carrying back a net operating loss is no longer available for most taxpayers. As a result, NOLs from tax years ending after 2020 can only be carried forward for most taxpayers.

Loss Carryback Explained

Loss carryback is a tax provision by the Internal Revenue Service (IRS) in the US to help businesses apply and receive tax refunds by collating their current year's net operating loss to the prior year's income.

The authority establishes specific loss carryback rules to ensure that it serves the right businesses at the right time. For example, as per the Tax Cuts Jobs Act, farming and insurance industries are given a term of two years for an immediate refund of prior taxes paid through a carryback provision or carried forward indefinitely. But non-life insurance companies still operate through pre-TCJA rules carrying back two years and forward with a period of 20 years parallel to which the 80% limit of one year does not apply.

It was introduced in the Revenue Act of 1918 under the provision of federal income taxes. Initially, it was focused on helping businesses that suffered losses post-WWII. However, authorities understand that specific businesses face changes and are highly dependent on external conditions and aspects like the agricultural sector on weather conditions; therefore, they offer the provision to them.

Throughout the brief history of the tax provision, it has been uneven when its duration was increased, decreased, stalled, and reinstated. Simultaneously to federal laws, state laws have tight monitoring, and strict regulations like the Tax Relief Act of 1997 allow the NOL for only two years for carryback and twenty years for loss carryforward provisions.

This provision changes how a business looks and treats a net operating loss as it helps minimize taxable income. However, there are several restrictions to it. Capital loss carryback is one such restriction stated in the IRC section 382, and it limits the use of NOLs and credits following an ownership change.

The net operating loss carryback period's duration impacts corporation liquidity and marginal tax rates. For instance, increasing the carryback term from two to five years would give the corporate sector more liquidity. According to its proponents, the advantages of the more extended carryback period would primarily benefit the homebuilding, automobile, and financial industries.

NOLs occurring in tax years ending after December 31, 2017, are exempt from the 2-year carryback provision that was in place before 2018. A unique 5-year carryback was allowed under the CARES Act for tax years starting in 2018, 2019, and 2020 given exceptions apply.

Example

Rick owns a company and suffered a net operating loss of $900,000 in 2020. He can carry this loss backward to counterbalance it with the net operating income of the prior years of $400,000 in 2018 and $500,000 in 2019. By doing so, the income and loss would cancel out each other, and Rick can get a tax refund paid on the original income of $900,000.

Since the NOL happened in 2020, corporate taxpayers in this situation can utilize it to offset 100% of their taxable income rather than just 80% of it. Instead of the current 80% limit rule, taxpayers will be entitled to deduct NOLs equal to 100% of their taxable income for tax years beginning after December 2017 and before 2021.

Loss Carryback And Carryforward

| Loss Carryback | Loss Carryforward |

| Loss is applied to the prior year's tax return | Loss is applied to future year's tax return |

| Reduce the prior year's taxable income | Reduce future year's taxable income |

| Reduce tax liability of the previous year | Reduce tax liability for the future year |

| Less duration | Large duration |

| NOLs in tax years starting in 2018, 2019, and 2020 can be carried back for five years. | NOLs arising in tax years beginning in 2018, 2019, and 2020 can be carried forward indefinitely. |