Table Of Contents

Long-Term Capital Gains Meaning

Long-term capital gains (LTCG) refer to profits generated from the sale of a capital asset. Before selling, the individual must have held the asset for a year or more. The profits are classified as short-term capital gains if assets are bought and sold within a year.

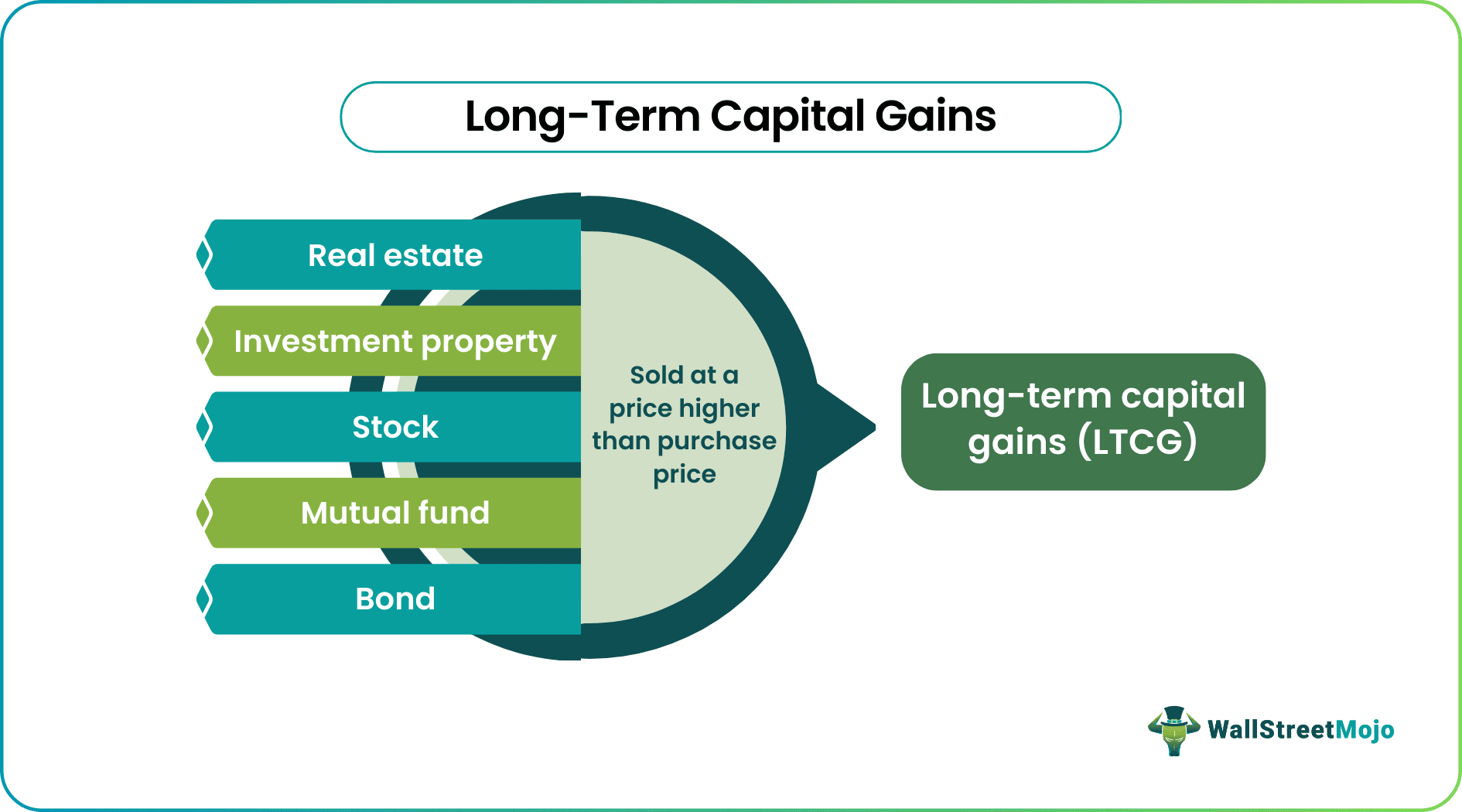

Typically, LTCG assets are either real estate properties or shares in a portfolio. When an individual sells a long-term capital asset, an LTCG tax is imposed on the profits. LTCG taxation depends on an individual’s marital status and taxable income.

Key Takeaways

- Long-term capital gains are the monetary gains realized by selling a capital asset after holding it for a long time. Examples of capital assets include real estate properties, stocks, and bonds.

- LTCG tax rate is lower than the tax imposed on ordinary income. Thus, holding investments for a more extended period is a profitable strategy.

- Individuals can invest in retirement accounts (IRAs) to reduce taxation. IRAs are categorized under deferred capital gains tax—they remain tax-free till the investor withdraws an amount from the account.

Long-Term Capital Gain Explained

Long-term capital gains (LTCG) are acquired by an investor when they sell a capital asset after holding it for a long time. Instead, if an individual purchases and sells an asset within a year, the profit is considered a short-term capital gain.

The government imposes taxation on long-term gains—the tax amount depends on the individual’s marital status and taxable income. The IRS enforces specific rules and regulations that apply to short-term gains. Long-term gains (may also vary from one state to another). Similarly, capital losses are also categorized into short-term and long-term.

LTCG tax rate is lower than the tax imposed on ordinary income (based on the taxpayer’s taxable income). Thus, holding investments for a more extended period is a good strategy. On the other hand, a 28% tax is imposed on the sale of collectible assets—coins, art forms, antiques, and vintage wines. This is irrespective of how long the owner has kept it in possession.

Net investment income tax (NIIT) is a 3.8% tax imposed on high earners—usually high net-worth individuals (HNWIs) or families. NIIT refers to profits generated from investments. But long-term gains from property, real estate, sale of stocks, bonds, and mutual funds are excluded from NIIT calculation. Thus, HNWIs can use long-term gains to reduce NIIT.

An individual retirement account (IRA) is one of the best strategies to reduce capital gains taxation. IRAs help individuals save taxes and grow their income for retirement plans. In most cases, the income earned from an IRA is not taxed until its withdrawal (upon retirement).

IRAs are categorized under deferred capital gains tax. The deferred status applies to investment earnings such as interest, dividends, or capital gains—they remain tax-free till the investor withdraws an amount from the account.

How To Calculate?

To calculate long-term capital gains on real estate, indexation is followed.

Let us assume that an individual bought a piece of land for $45000 in 2012. Then, after a decade, the individual sells it for $99000. In the meantime, the cost inflation index (CII) is monitored, which elevates the purchase cost.

Let us assume that the cost inflation index (CII) is 1.35.

Now, based on the given values, let us calculate the indexed cost:

- First Purchase Cost = CII x Purchase Price

- First Purchase Cost =1.35 x 45000 = 60750

Thus, CII estimates that the land is worth $60750.

Further, let us compute capital gains (LTCG):

- LTCG = selling price - indexed cost

- LTCG = 99000 – 60750

- LTCG = $38250

Therefore, the LTCG tax will be imposed on this amount ($38250).

Long-Term Capital Gains Video Explanation

Examples

Let us look at some long-term capital gains examples to understand the concept better.

Example #1

Let us assume Ross is a married taxpayer. Ross and his wife earn $72000 annually and file for taxes as a couple (with the IRS).

In 2016, the couple bought a stock portfolio worth $90000. In 2022, they will sell the portfolio at an unrealized profit of $135000. Thus, Ross and his wife made the following long-term gain from stocks:

- LTCG = 135000 - 90000 = $45000.

Capital gains are included in the taxable income. Ross and his will be taxed for the following amount:

- Taxable Income = $72000 (salary) + $45000 (LTCG)

- Taxable Income = $117000

For joint filing, if taxable income is between $83,350 – $517,200, a 15% tax is imposed on capital gains. Since the couple earned more than $83,350, a 15% tax will be imposed on their capital gains (LTCG).

Example #2

In 2021, Joe Biden's office proposed to double the U.S. capital gains tax rates to 43.4 % breaking the record and earning approximately $1 million annually. In addition, the U.S. administration proposed to use that money to pay for child care, paid leaves, and early education programs.

Initially, they wanted to raise it to 39.6%, imposing on individuals with an annual income of more than $200,000 annually. Later they raised the tax rate even further, citing the affordable care act.

Taxation

The following table depicts the variation in long-term capital gains taxation based on the individual’s taxable income and relationship status.

Long-Term Vs Short-Term Gains

Let us look at long-term capital gains vs short-term gains comparison to distinguish between the two.

- Short-term capital gain is the profit from selling assets or investments held for a year or less. In contrast, long-term gains are acquired by selling assets held for a year or more.

- Up to 37% income tax is imposed on short-term capital gains. In comparison, the tax imposed on long-term gains is lower—0%, 15%, or 20%.

- Selling a company stock when its price exceeds the purchase price is an example of short-term capital gains. For example, if an Individual purchases share worth $14000 in 2014 and sell them off for $16500 in 2022, that is an example of long-term gains (LTCG).