Table Of Contents

What Is Lockbox System?

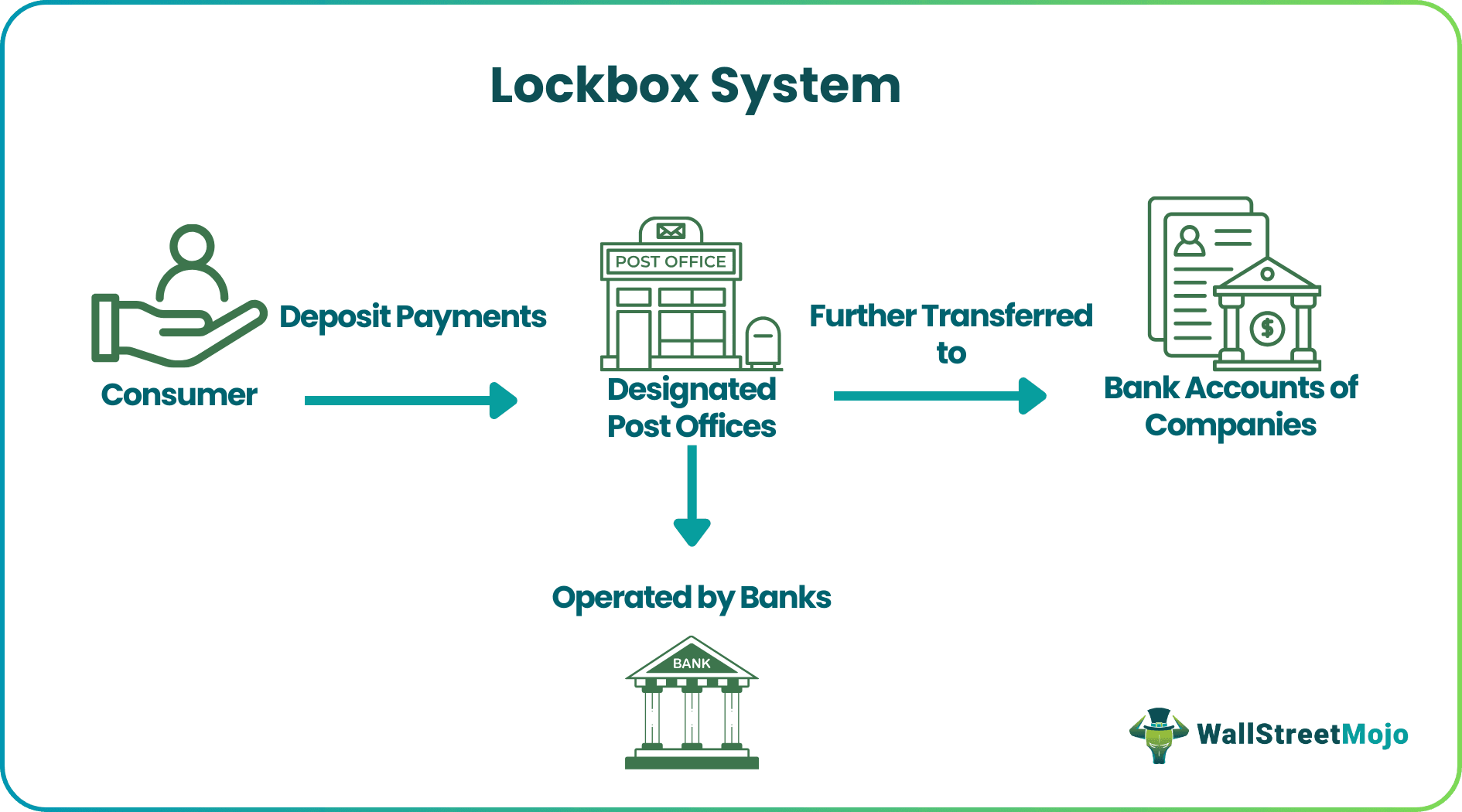

Lockbox System refers to services intended to speed up the collection of paper-based payments and give accurate payment details to update accounts receivable records. A third-party processor (often a bank) that receives, opens, and processes payments on behalf of a business or government offers lockbox services.

These services have the potential to improve payment and posting accuracy. It also increases staff productivity and improves cash flow by shortening the processing time between the deliveries of mail and depositing payments. It is made possible by relieving staff members of the labor-intensive processes of manual mail handling, making daily deposits, and manually posting payments.

Table of contents

- What Is Lockbox System?

- The lockbox system definition refers to a cash management strategy where a bank provides a specific mailing address (the lockbox) for its clients.

- In this system, creditors direct their debtors to send payments directly to a post office box. This box is regularly emptied by the bank handling the creditor's account.

- Funds are deposited directly into the banking system, bypassing the creditor's accounting department.

- This method enhances the accuracy of payment posting, thereby reducing errors, speeding up processing times, and increasing staff productivity.

How Does Lockbox System Work?

The lockbox system is a cash management strategy. The lock box is a mailing address the bank offers its clients. The customers can then instruct their clients to remit their checks to this postal address. These lockboxes may be positioned to minimize postal time as well. Under this method, the creditor requests that its debtors submit their payments straight to a post office box routinely emptied by the creditor's bank. The money is paid immediately into the banking system without going through the creditor's accounting division beforehand.

Bank lockbox systems are used to reduce the length of their payment cycles by making use of geographically dispersed lockbox locations. Banks can receive checks and remittance advice and save the images as Tagged Image Format (TIF) or Portable Document Format (PDF) files. Many corporate Cash Application Departments employ staff members who sit in front of two screens. One is to see checks and remittances downloaded from bank portals, and another is with an ERP session to match and apply the cash manually. It is done by posting the cash received in lock boxes. Typically, the lockbox service is offered on a pre-payment basis. If there are a lot of little payments, lockbox banking's costs can quickly surpass any benefits.

Economies of scale serve as the foundation for lockbox systems. It becomes costly and time-consuming for each customer to process their accounts receivables. Instead, the bank could create a sizable accounts receivables department that works on behalf of all of their clients and passes along the advantages of economies of scale in exchange for a charge! It led to the development of the lockbox system.

Examples

Let us understand the concept with the help of some hypothetical and real-world examples.

Example #1

To determine whether a business should opt for a lockbox system, consider the following metrics:

- Average Number of Daily Payments: 100

- Average Size of Payment: $10,000

- Savings in Mailing and Processing Time: 2 days

- Annual Rental for the lockbox: $2,000

- Bank Charges for Operating the Lockbox: $50,000

- Interest Rate: 15%

Calculation of increased collected balance due to lockbox:

- The lockbox system accelerates collections, leading to an additional amount being collected and available earlier.

- Calculation: 100 payments/day × $10,000/payment × 2 days = $2,000,000

Calculation of annual interest savings:

- The annual benefit of the lockbox is calculated by annualizing the interest savings from the additional amount available earlier.

- Annualized Interest Savings = $2,000,000 × 15% × (2/365) = $16,438.36

- This figure represents the additional interest earned annually due to having an extra $2,000,000 available for two days across the year.

Annual cost of the lockbox:

Total Annual Cost = Annual Rental + Bank Charges

= $2,000 + $50,000 = $52,000

Decision making:

- Compare the annualized interest savings with the annual cost of the lockbox.

- In this case, the annual interest savings ($16,438.36) is less than the annual cost ($52,000).

- Therefore, setting up the lockbox may not be financially beneficial based on these figures alone. However, consider also the non-quantifiable benefits like internal processing savings and improved cash flow management.

Example #2

Brightree, a leader in cloud-based patient management software specifically designed for post-acute care, has recently unveiled its latest offering: the lockbox service. This innovative system is aimed at transforming how home medical equipment (HME) providers handle their financial transactions. By automating patient-pay services, the lockbox is engineered to significantly expedite the revenue cycle for these providers.

Its primary advantages include a notable increase in cash flow and a substantial reduction in the time staff spend on managing accounts. Moreover, this system is adept at minimizing errors, which is crucial in financial transactions and billing processes. This innovation underscores Brightree's commitment to delivering cutting-edge solutions that address the specific needs of the post-acute care market.

Advantages

Below are some of the advantages of the lockbox system:

- Streamlined payment processing: The lockbox system significantly expedites payment processing. Employees are relieved from the tasks of matching payments to invoices, recording transactions, and physically sending them to the bank. Payments are sent directly to the bank and deposited into the company's account, enhancing efficiency.

- Efficient and speed delivery: Banks leverage specialized zip codes to ensure rapid delivery through the postal system. Upon receipt, checks are removed from their envelopes and processed—either recorded or converted into digital images. They are then encoded, endorsed, and introduced into the check-clearing process. This system minimizes processing and availability delays as banks can process checks even outside of standard public operating hours.

- Reduced processing time and quick access to funds: The lockbox system shortens the duration required for funds to become available to the company. Since companies can have multiple lockbox locations, customers can send their payments to the nearest one, ensuring quicker processing and depositing of payments, thereby improving the company's cash flow.

Lockbox System vs Concentration Banking

In the realm of financial management and cash flow optimization, each one of them offers distinct mechanisms and benefits for managing receivables and streamlining financial operations. Let us delve into a comparative analysis of these two systems to understand their functionalities and differences.

| Key points | Lockbox System | Concentration Banking |

|---|---|---|

| Meaning | Under a lock box system, customers are instructed to mail their payments to special post office boxes known as lock boxes. These are catered to by neighborhood collection banks, as opposed to sending them to corporate headquarters. | A company may establish collection centers (banks) across the nation To avoid postal delays; this is known as concentration banking. This strategy minimizes the time required for dispatch, collection, etc., as the collection centers are close to the debtors. |

| Process | The local bank retrieves the check from the lock box once or more per day. The bank then deposits it immediately into the company's local bank account and provides the firm with those details. | The business may advise its clients to mail their payments to a local bank or collection center rather than the central office. The regional collection center deposits the checks it has received into a local bank account for collection. |

| Associated charges | Each check processed through the system is subject to a fee from the bank. The lock box system must provide benefits that outweigh its increased costs; otherwise, the company would be better off without it. | It should be emphasized that concentration banking also entails a cost. It may be in the form of the minimum cash balance required with the bank or the minimum charges of maintenance of a current account. |

Frequently Asked Questions (FAQs)

In a lockbox system, client payments are not sent directly to the business but to a designated post office box. The bank manages this box. The bank personnel retrieve payments from this box, process them, and then deposit the funds directly into the business's or company's bank account. This system streamlines the collection and processing of payments.

While lockbox banking offers efficiency, it can have downsides:

· Cost considerations: Often, lockbox services are charged on a per-transaction basis. For businesses receiving a high volume of small payments, the cost of using a lockbox service might outweigh its benefits.

· Security risks: There have been instances where checks were stolen or forged. While such incidents are less familiar with modern security measures, the system's safety is still reliant on the integrity and reliability of the personnel handling the payments.

Beginning with the establishment of a lockbox account at a bank, a company instructs customers to direct their payments to this designated address. The bank handles the collection, processing, and depositing of these payments, providing detailed reports to the company. Subsequently, the company updates its financial records, an approach particularly beneficial for businesses managing a high volume of checks from a broad customer base.

Recommended Articles

This article has been a guide to what is Lockbox System. Here, we explain the concept along with its comparison with concentration banking, advantages, & examples. You may also take a look at the useful articles below –