Table Of Contents

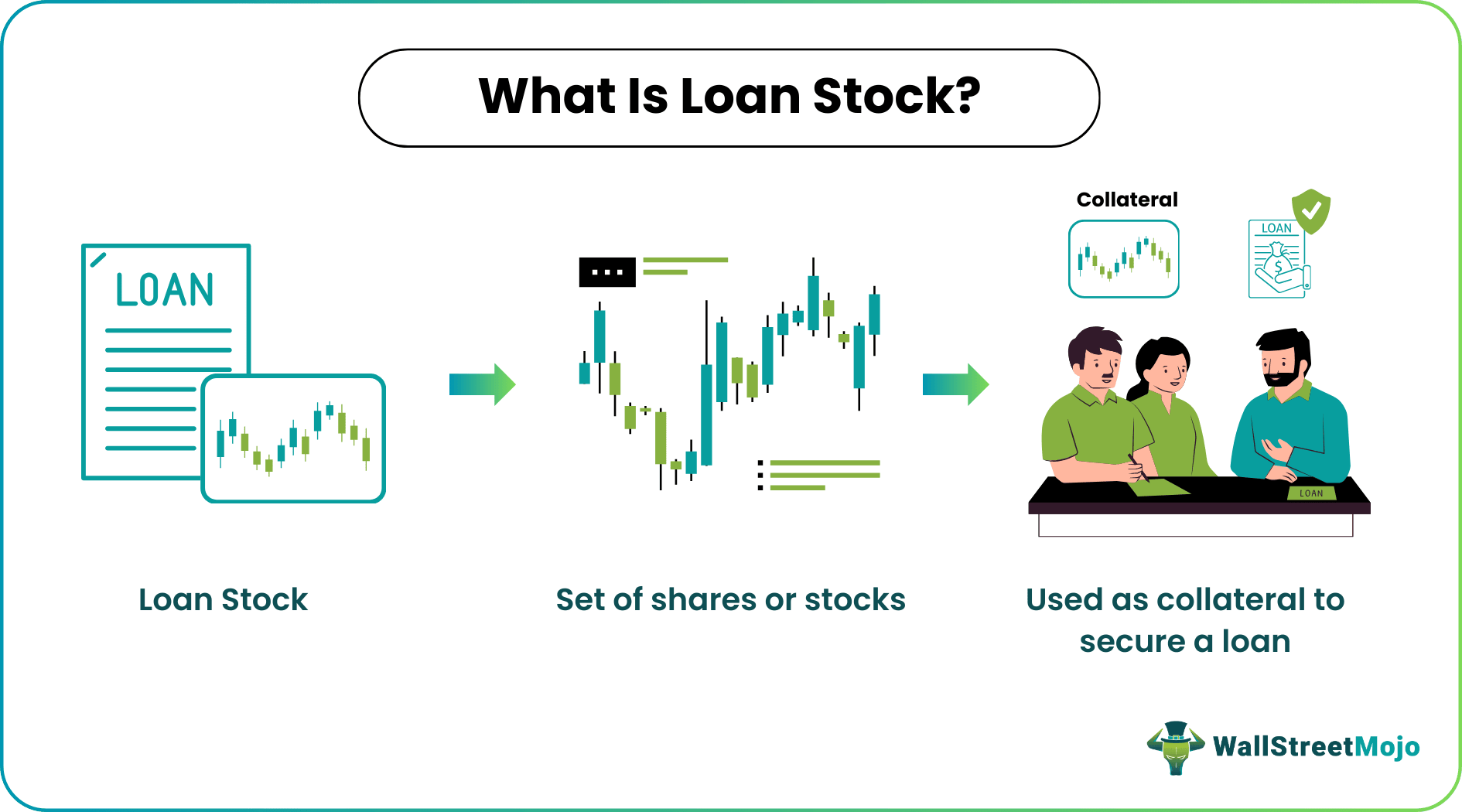

What Is A Loan Stock?

Loan stock refers to the loan in which borrowers with a portfolio of eligible securities, secure capital, or finance from certain investors with the possession of considerable capital in hand. They are equally ready to enter a contractual agreement to park their funds with the respective borrowers in return for securities.

The collateral used to secure a loan is critical and valuable for the lender. The collateralized stocks are public sector enterprises listed on the major recognized stock exchanges. These are unencumbered so that they can be easily liquidated in the market.

Loan Stock Explained

Loan stocks are useful when there are larger fund requirements, for example, to buy real estate properties or take over any running business, etc. Loan stocks are different from securities lending, in which brokers or banks lend the securities to take advantage of the price movements of securities.

For example, in short selling banks lend securities to the investors to book a gain when the security value falls and buy the same at the current lower price and return the security to the bank again.

The lender may consider physical ownership of the collateral security during the loan period. If the borrower defaults on the loan, the lender will keep the collateralized stock with him. The lender is supposed to return the security to the borrower once they pay the loan with interest.

The loan stock, as in the case of standard commercial loans, carries a fixed interest rate. The Loan stock could be secured and an unsecured one. The secured loan stock can also be convertible, provided in the agreement that the loan would convert into equity shares based on the predetermined rate after a specified period or in certain terms and conditions.

Process

- The borrowers needing funds from the lender write a check against the line of credit and submit the same to the wire funds to a bank account. The lending process may require depositing collateral security in addition to the security not previously included in the collateral. The borrower can repay the principal, including interest to the lender, in partial or full terms according to the terms agreed in the contract.

- If the borrower defaults to clear outstanding due to the lender, then the lender has the legal right to sell the security to recover his dues.

- The eligible borrowers in loan stock transactions vary from individual to joint investors. The loan amount in loan stock could vary from $10,000 to $5 million or even more in the case of high net-worth individuals. The maturity of these loans is customized according to the parties' requirements in the transaction. Five years is common maturity in loan stock transactions.

Types

Loan stock options are available in various forms. They exist as secured, unsecured, convertible or non-convertible. However, the most common and widely used forms have been listed below:

- Unsecured loan stocks have higher risk associated. As the name suggests, it is equally risky for lenders as normal loans are for unsecured creditors.

- Convertible loan stocks allows conversion of the stocks to ordinary shares of the firms. These shares are transacted based on pre-arranged terms and within a specified period. It helps obtain fixed interest income at a comparatively lower interest.

- Notes are securities that offer fixed income. It comes with a maturity date and it may or may not be available to be redeemed.

Risks

Let us discuss the risks for lenders and borrowers.

For Lenders

The lenders, when issuing loans, stand to lose if the value of collateralized security falls as the market value of the security is bound to move according to the market factors which are out of control. In such a case, the value of the security offered to secure loans does not guarantee in the long run.

When the value of collateral security falls, these securities become insufficient to cover the outstanding loan amount. Subsequently, the borrower defaults on the loan, then lenders stand to experience the losses as the value of the security is not sufficient to cover the value of the issued loan.

For Borrowers

As borrowers keep their respective shares or any other stocks as security to secure the loan amount, the lender stands to benefit from the transaction in case the borrower defaults on the loan. It increases the chances that the lender will become the business owners as they own the required security with voting rights.

It could be a terrible ordeal for business owners if the lenders have entered into the transaction with the sole intention of gaining ownership of the entire business with associated voting rights.

Loan Stock as Business

Many businesses are running and functioning with the only intention of providing finance on loan stock-based transactions. This business helps secure borrower finance based on securities' value, implied volatility and creditworthiness. Business generally calculates LTV in line with banks and financial institutions when a home's value is assessed before securing a home mortgage.

- Companies that do not have share capital and are limited by guarantee loan stocks are a very important tool to secure finance as they are considered quasi-equity. In these companies, financing through loan stocks is regarded as a long term investment.

- It is generally used by companies formed with the objective of social cause. Loan stock is a low-cost process to finance the project with lower investment.

- Loan stock is ideal for a business with a highly ethical project; it does not seek legal advice, and therefore, it is good for small business organizations.

Following are the critical points to be noted in the case of loan stock:

- The maximum amount that would be issued with loan stock;

- The maturity date when the loan would be redeemed;

- Fixed rate of interest on the amount of loan to be charged;

Examples

Let us consider the following instances to understand the loan stock meaning better:

Example 1

Sarah had 1,000 shares of XYZ worth $10 per share, totalling the share amount to $10,000. Due to some financial crisis, she had been unable to pay back her debts. As a result of this, her corporate image started to ruin. However, to pay back her outstanding debts, she needed a bulk amount.

Thus, she decided to take up leveraged equity loan to clear her financial obligations using her 1,000 shares as collateral. In the long run, the prices per share reach $15, which leads to an increase in the value of Sarah’s portfolio. While the collateral helped her obtain the loans, the same set of shares rise in value simultaneously.

Example 2

According to a report published in October 2023, the stocks securing the student loans have witnessed a fall significantly just before the beginning of the repayments of the student loans after being put on hold for three years. The revelation came following the cancelation of $9 billion of debt acquired by 125,000 student loan borrowers, by the Biden administration. The example above shows how changes in government regulations impact the loan stock options.

Advantages and Disadvantages

Loan stock is the financial instrument that secures a loan taken from another party. In the process, it is the lender who takes the responsibility to provide backup to secure a loan. However, there are some limitations that make these options risky.

Let us have a look at the set of advantages and disadvantages of these options:

Benefits

The different advantages are as follows.

- In today’s dynamic corporate world, every business is in dire need of capital, which business can raise through debt financing or equity financing. In the stock, the finance business keeps shares of its own as security to secure the finance.

- The major benefit for the borrowers is that they are not supposed to repay the lender for the sold shares. Secure finance for new startups is very difficult as they don’t have any credit history. For startups, loan stock is the only option to get the required amount of loan to run the business.

Limitations

The different disadvantages are as follows.

- Selling stocks to secure new finance means the business is giving up partial business with the lenders, including the potential share of future earnings and profits. If the business turns positive and does well compared to its peers, there are chances that the value of the shares of the business will increase further, much higher than the value of the borrowed loan.

- It is a well-known fact that the shareholders have legal and voting rights, which to some extent, limit the actions of the business in their favor. As the lenders become new shareholders, they are expected to take away some portion of profits that would have otherwise belonged to the existing shareholders.