Table Of Contents

Liquidator Meaning

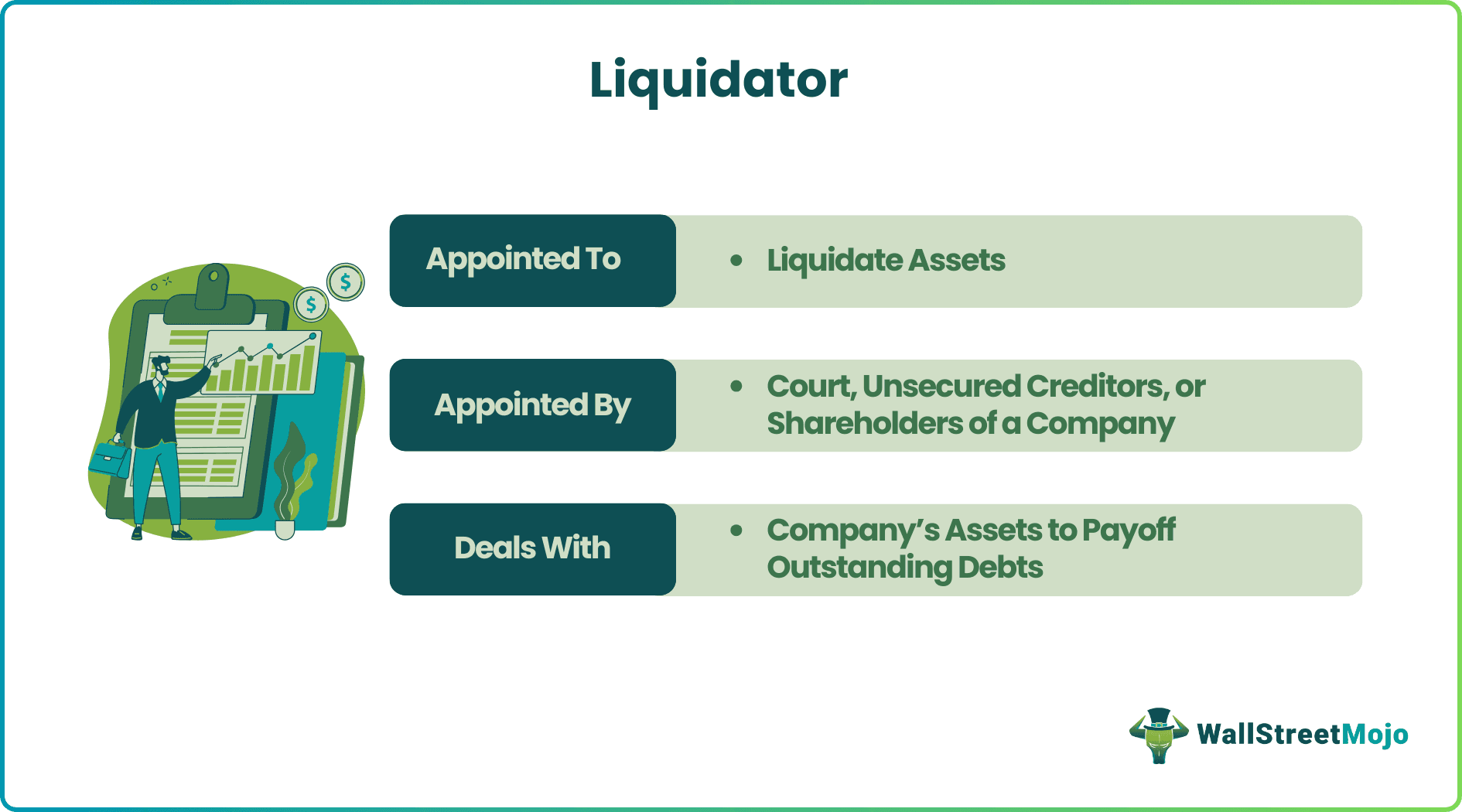

A liquidator refers to an entity appointed to manage the liquidation process of a company. The appointed entity's primary responsibility is to gather the company's assets and settle all claims against the company using the assets.

Closing down a business or company by selling assets to pay creditors and distributing the remaining, if any, to shareholders, usually in a legal manner, is known as the liquidation of a company. It forms the core part of the wind-up process of a company. The entity performing liquidation must be independent and impartial.

Table of contents

- Liquidator Meaning

- A liquidator refers to an entity appointed for a company's liquidation process.

- They are provided with certain rights and duties to take care of a company's winding-up process.

- In a court liquidation, the court appoints the liquidator. At the same time, there are other types of liquidations in which other parties like shareholders initiate the appointment.

- The liquidator fee is not fixed in any state or country. It varies with the complexity involved. Generally, only after the liquidator is paid creditors and shareholders are compensated.

Liquidator Explained

The liquidator or insolvency professional manages many phases spanning from the collection, preservation, and distribution of assets and investigation and reporting about the circumstances of the company’s insolvency. During these phases, the power of key personnel of the company is transferred to the insolvency professional. Altogether, the activities during these phases contribute to the recovery of bad debts.

In a compulsory liquidation or court liquidation, the court appoints the liquidator. At the same time, it is different in the case of Creditors’ Voluntary Liquidation (CVL) and Members’ Voluntary Liquidation (MVL). For example, in Creditors’ Voluntary Liquidation (CVL), the directors decide to close the business and start afresh. In this scenario, the directors initiate the process, not the company’s creditors or court. Hence the directors or shareholders will appoint and pay for an authorized insolvency practitioner to act as the liquidator, and creditors have the right to vote on the same appointment.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Duties of Liquidator

- They represent on behalf of the company or the debtor and take control of all its assets and liabilities.

- They are entitled to investigate financial affairs, check for offenses from the company's side, and the reason behind its failure.

- They have to verify the claims, evaluate the assets of the company, and can settle the claims of all creditors using the company's assets.

- To prepare an asset liquidation report to present.

- From the start to end process, they are answerable to all the company's stakeholders, including the creditors and shareholders.

- If the company faces any lawsuit, court case, or legal proceedings, the insolvency professional appointed has to defend it and be always present when called to represent the company.

- They can draw, accept, make and endorse negotiate instruments in the name and on the debtor's behalf.

Example

Consider an example of a liquidator from Amazon's FBA (Fulfillment by Amazon) liquidation program. FBA Liquidations is intended to recoup value from unused and customer-returned stocks, reduce storage expenses, and decrease inventory disposal. Rather than spending for excess or customer-returned FBA goods removed or discarded, FBA Liquidations has the stock sold through a liquidator.

Sellers can file a liquidation order to Amazon, and Amazon will then find a liquidation bidder or liquidator (liquidation buyer). The liquidation buyer will pay a percentage of Amazon's average selling price (ASP). After subtracting fees from it, Amazon will give the seller a net recovery value. Liquidation buyers can sell liquidated inventory through other online or offline channels. Typically, liquidation buyers are unable to return liquidated inventory to the source. Since those products are already ranked and reviewed, many liquidation buyers feel that it is easier to manage a liquidation business than sell their product and develop a brand image.

Amazon sells to liquidation buyers selected customer returned (defective) merchandise. Since Amazon provides free returns on defective products, even non-defective products are returned under the defective category. As a result, liquidation buyers obtain access to non-defective or in good condition items at a low cost and resell them with little or no reconditioning. Liquidation buyers may offer products at low prices. This inventory liquidation method aids in the recollection of a part of inventory cost.

Remuneration of Liquidator

The liquidator sales and other tasks' remuneration is not fixed in any state or country. It varies with the complexity involved; in other words, it manifests a positive correlation with business size, complexity, and the time taken to complete the process. Generally, only after the insolvency professional is paid creditors and shareholders are compensated.

According to the ASIC website, if an insolvency professional appointed reasonably believes that people associated with the company may have committed violations and there exists no fund source to pay the insolvency professional for their activity to scrutinize further, the insolvency professional can apply to ASIC for funding for further procedures.

Excluding the filing of documents and reports required by the Corporations Act 2001 (Corporations Act), a liquidator is not obligated to expend expenses for the liquidation process unless there are sufficient assets to cover their charges. However, if the firm lacks adequate resources, one or more creditors may agree to compensate a liquidator's charges and expenditures in conducting investigations. In addition, if the liquidation recovers more assets, the insolvency professional or a creditor may seek permission from the court for compensation from funds collected to finance the recovery action by the insolvency professional.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

It is the process involved in closing a business and forms an essential part of the wind-up process. The prime task is to collect the firm's assets and settle the liabilities by selling the assets gathered.

In a court liquidation, the liquidator is appointed by the court. At the same time, it is different in the case of Creditors’ Voluntary Liquidation (CVL) and Members’ Voluntary Liquidation (MVL). For example, in Creditors’ Voluntary Liquidation (CVL), the shareholders will appoint and pay for an authorized insolvency practitioner, and creditors have the right to vote on the same appointment.

Estate insolvency professionals deal with organizing and conducting an estate sale. When a client inherits an estate, clients approach insolvency professionals to manage the complexity involved in properties and its sale.

Recommended Articles

This has been a Guide to Liquidator & its Definition. We explain the meaning of liquidator, Amazon liquidation example, duties, remuneration & estate sales. You can learn more from the following articles –