Table Of Contents

What Is Liquidation Preference?

Liquidation preference is a clause that states the order of payment from the realization of assets if the entity loses its corporate status and becomes bankrupt. It protects the invested amount by the preferred shareholders in case the entity goes under the liquidation process, whether voluntary or involuntary.

It is a type of protection offered to shareholders and is often used by venture capitalists in case the business fails, but it depends on the level of participation rights. The liquidator has to analyze the loans, assets and creditors’ preferences to make decisions during this process.

Key Takeaways

- Liquidation preference refers to a clause that shows the payment order from the realization of the assets if the entity loses its corporate status and becomes bankrupt.

- The types of liquidation preference are multiple, participating liquidation preference, straight or non-participating liquidation preference, and capped liquidation process.

- It plays the role of insurance for investors. They must liquidate when the company cannot meet its target or fails in its venture. Hence, the investors guarantee funds; they get their invested amount.

How Does Liquidation Preference Work?

The liquidation preference clause decides the process of distributing the investors’ claims based on preference and rights by a company that is bankrupt or will be sold. In the case of venture capital liquidation preference is greatly used.

Liquidation, in layman’s terms, is the end of the company. It also means transferring the company to other hands or selling the business. In liquidation, the company needs to cash all its assets, pay off the liabilities, and distribute the funds to various claimants, including investors, as per the liquidation preference term sheet. Venture capital investors generally use this clause to protect their investments.

Therefore, during liquidation, it is necessary to decide the order of payout, which the liquidator does after careful analysis of the company’s assets and liabilities as well as investors’ interests.

Overall, the investor preference clause helps the investor protect their investments in case of liquidation of the company, where the proceeds are quite scarce. Otherwise, it allows the investor to clock some extra gains when its profits liquidate and is more than sufficient to cover expenses.

Steps

The following steps give more details about the process:

- First, the liquidator must check whether the investor is a preferred investor or common stockholder such as an employee or other stakeholders. He will be entitled to receive the receipts as other shareholders share them.

- Then, as per the liquidation preference clause the liquidator must consider the multiple allotted to their invested capital. Multiple denotes what would receive the investment times if the company exists. Generally, it ranges between 1-3, and If no multiple is attached, the investor would not be able to get its share of proceeds based on the process.

- It is necessary to whether the preferential investor has a participating right. Participating rights entitles the investor to share the proceeds in addition to its preference and as a common stakeholder based upon the percentage of his holding. And, if the investor is also a participating right holder, they will receive the additional amount. Otherwise, they will only receive the funds for liquidation.

Types

Multiple types are floating in the market. Some of the types as per the liquidation preference term sheet are covered below:

- Liquidation preference multiple is one of the most favorite ways investors protect themselves in case of liquidation. It states the amount one would repay in multiple of the capital invested by the investors. For example, someone invested $1 million, and liquidation preference is 1. Then, if adequate funds generate from liquidating the entity, he will receive his initial investment back, i.e., $1 million.

- In the case of participating liquidation preference, investors would receive an additional amount from the equity ownership after paying.

- In straight or non-participating liquidation preference, an investor with a preferred stock with a non-participating preference is eligible for a higher return in the following options. He can either convert his preferred stock into common stock and receive proceeds or only his entitlement from preferred stock.

- The capped liquidation process is also widely used. Here, the investor and entity get equal benefits. If an investor has this preference, he will be eligible to receive the preference amount and the additional amount from common equity. Still, his earnings would be capped to a limit, as mentioned in the contract.

- Some of them do exist based on seniority, too, such as: -

- When a clause is introduced based on seniority level in the contract, the last tranche of investor preference would consider over the earlier ones in repayments.

- In the case of pari-passu seniority, the proceeds would be equally distributed to all the investors with this preference in the ratio of their investments if the receipts cannot be paid back in full.

- One more type of seniority preference is known as hybrid or tiered seniority. Again, the investors are pooled together and paid according to the pari passu principle.

Examples

The following examples will help in understanding the concept.

Example #1

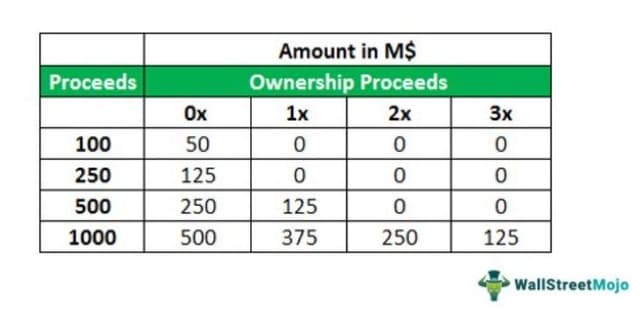

Let us assume a Venture Capital Group has invested $250 million for a 50% share in the business. It has a non-participating preference in the ratio of, say, 0:1:2:3 of its investment value. Later, the company was acquired for $100/250/500/1,000 million. The venture capitalist would be entitled to the proceeds as follows: –

In the above example, In the above example, venture capital liquidation preference is such that it is entitled to a share in the proceeds or has a participating share, one will pay the additional share after the process. As a result, the Venture Capital Group would receive the ownership proceeds as per the following formula: -

Share of Venture Capital Group = (Total Proceeds – Liquidation Preference) * Share of Venture Capital Group

Example #2

The Bank Of America has made fourteen separate but simultaneous offers by BofA Securities, Inc., which will buy $1.5 billion in cash as a safe liquidation preference regarding depository shares. This offer has specific terms and conditions in the Offer to Purchase document of BofA Securities, Inc.

You can download this Liquidation Preference Excel Template here – Liquidation Preference Excel Template

Advantages

This preference acts as insurance for investors. It must liquidate if the company cannot meet its target or fails in its venture. Hence, the investors prefer or guarantee funds; they get their invested amount.

Disadvantages

The safe liquidation preference is applicable only when a company goes into liquidation due to bankruptcy, recapitalization, or does merger and acquisition, etc. But the investor preference is unsuitable if the company takes out an Initial Public Offering. In this case, all the preference shareholders generally convert to the common shareholders.