Table Of Contents

What Is A Line of Credit Calculator?

A Line of Credit Calculator is a tool that can be used to calculate the amount of interest that is due on the line of credit loan taken by the borrower and is different from the normal loan calculation. A line of credit loan calculator allows individuals and entities to know how to utilize their resources and what changes to make to ensure paying off the outstanding amount.

The line of credit interest can be calculated using simple interest instead of compound interest. In the above discussion, we have taken average balances and calculated interest, mostly adopted by the banks. In conclusion, a line of credit can be useful for short-term purposes instead of term loans.

How Does A Line of Credit Calculator Work?

Line of credit calculator has been designed based on a formula that could allow borrowers to have a clear view of the outstanding amount to be repaid over a period, especially the interest amount. These calculators can be used to serve multiple purposes, including the calculation of length of time for which one is eligible to receive the financing.

A line of credit can be called a revolving credit account. It has a borrowing limit that shall be set by the lender, similar to having a credit card account. But the caveat here is that one doesn't receive an amount in a lump sum, which is usually the case with traditional commercial loans. Instead, the borrower will borrow the amount only when he makes purchases, which can be used for any business purpose.

There is no specific formula to determine the monthly amount. The lender or the credit institution can determine the payment size that shall depend upon factors such as the outstanding balance, the interest rate, and the terms of the line of credit. These features make a line of credit an attractive choice while borrowing for a shorter duration.

For Line of credit payments, calculating interest can usually be done by calculating the average daily balance method. The credit institution or the lender shall figure out the average balances during a period of billing and will charge interest that would be a proportion of the rate of interest (per annum) calculated for the billing period, based on the number of days.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Components

When calculating the line of credit payoffs, one needs to enter a few details to get accurate results. Given below, are some clear explanation of all important terms related to the calculator, which requires to be entered in the tool:

Terms – This refers to the number of year for which the loan has been taken.

Mortgage amount – Total amount of the loan. The loan amount that has points will be more compared to the loan that does not have points.

Interest rate – The annual rate of interest for the borrowing without the purchase of the discount points.

Points – They are like prepaid interest which the borrower may use to pay off some amount as down payment, which will bring down the interest rate and monthly instalments. Each of such points cost 1% of the loan amount.

Formula

The formula for calculating the Line of Credit that most financial institution uses per below:

A is the amount of each purchase made during the billing period

Wherein,

How To Calculate?

One needs to follow the below steps to calculate the interest amount.

Step #1: First of all, determine the interest rate proportionately, which is called a periodic rate and the same can be done by dividing the annual rate of interest by 365 and multiplying the same by the number of days in the billing cycle, which is usually a month and that would be 30 days.

Step #2: List all the purchases made during the billing cycle. One now needs to multiply every purchase amount by the number of days remaining in the given billing cycle period and divide this output by the number of days in the billing cycle, which is usually a month, and that again would be 30 days. This result would average new purchases.

Step #3: Figure out the account's opening balance and add up the value arrived in step 2, which shall be the average balance for that billing cycle period.

Step #4: Lastly, to calculate interest outflow, multiply the value arrived in step 3 by the rate of interest that was derived in step 1, which would be the line of credit payment of interest.

Example

Let us have a look at the following instance to understand the proper usage of the line of credit calculator:

Mr. X has been running a business in the town for nearly a decade, has been renowned for his quality, and has created goodwill in the market. However, in recent times he has been facing difficulties in finding the short-term requirements due to the huge investment done in the plant and machinery of the firm. The branch manager learned about this and provided his proposal for a line of credit.

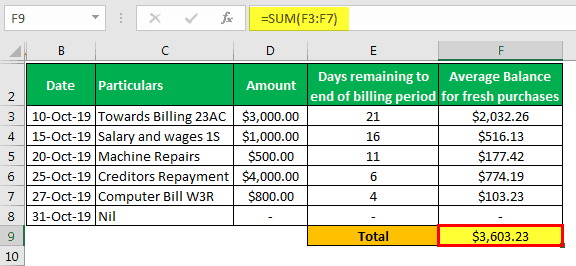

The product impressed Mr. X, and he decided to proceed with it. It has been two months since he used this facility, and he currently has an outstanding balance of $12,500. For the current billing period, he has done the following transactions:

| Date | Particulars | Amount |

|---|---|---|

| 10-Oct-19 | Towards Billing 23AC | $3,000.00 |

| 15-Oct-19 | Salary and Wages 1S | $1,000.00 |

| 20-Oct-19 | Machine Repairs | $500.00 |

| 25-Oct-19 | Creditors Repayment | $4,000.00 |

| 27-Oct-19 | Computer Bill W3R | $800.00 |

| 31-Oct-19 | Nil | - |

The Bank charges 13.39% as the annual interest rate, and the billing cycle is decided monthly.

Based on the given information, you must calculate the line of credit interest payment for October 2019, assuming this bank uses the average daily balance concept.

Solution:

Since there is no fixed formula to calculate interest on the line of credit, it depends from bank to bank, and here they are charging based on the average daily balance concept.

First, we need to calculate the average daily balance.

∑ (A*N/n)

Now we have two parts to the formula; first, we shall determine the average of new purchases as per below:

Calculate the Days remaining for the end of the billing period.

Then we will multiply each balance by the number of days remaining and divide it by 31, which is nothing but the number of days in October.

And will add them up to get the total average balance.

We will calculate the rate of interest applied to calculate the interest payment amount. 13.39% is the annual rate, and if we divide the same by 365 and multiply the same by the number of days in Oct, which is 31. Therefore the rate of interest per month will be 13.39% / 365 * 31, which is 1.14% for the Oct billing period.

Calculate of interest payment amount using the following formula,

Interest payment = * i

- =($3603.23 + $ 12,500) *1.14%

- = $16,103.23 * 1.14%

- = $ 183.13

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.