Table Of Contents

Limited Partnership Meaning

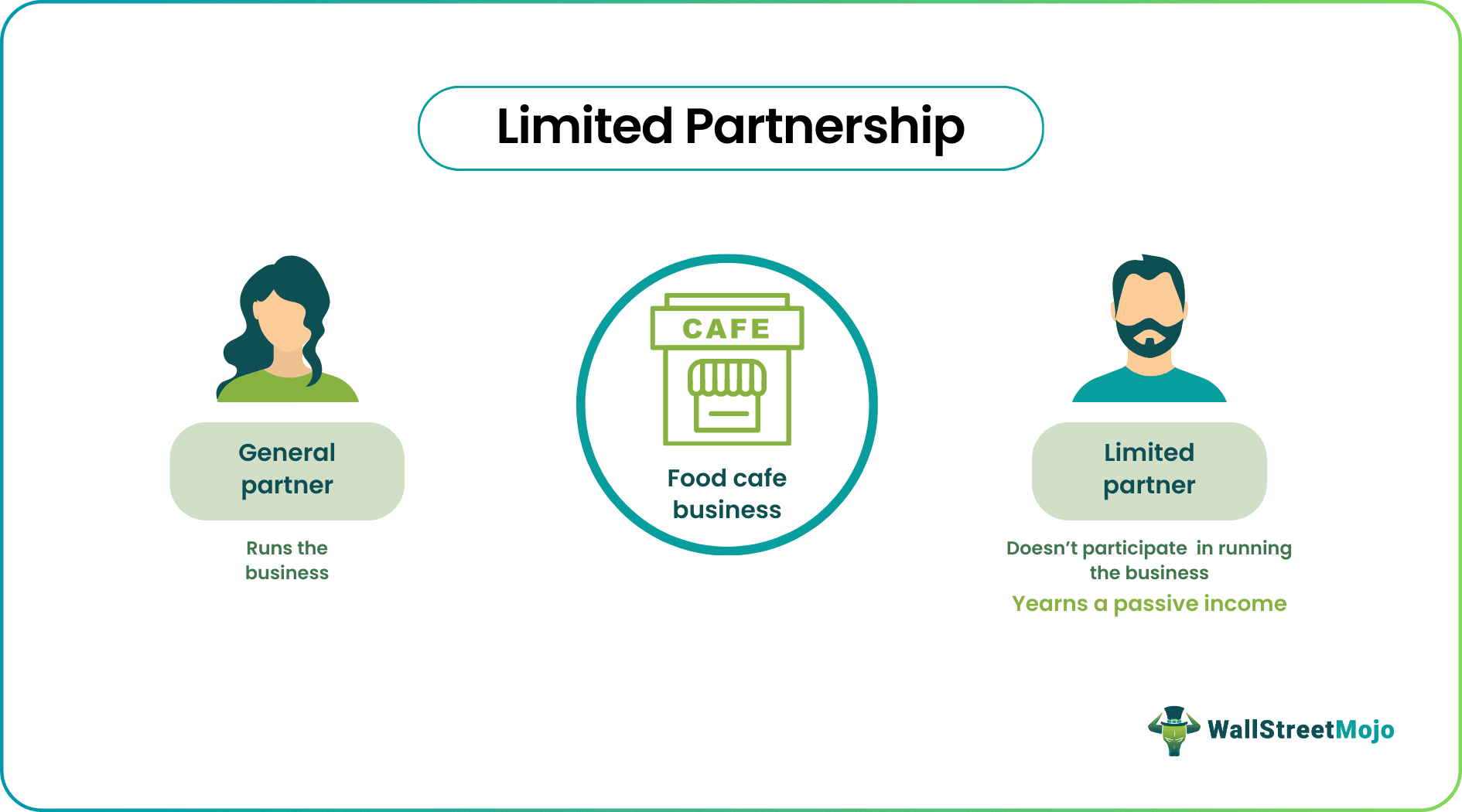

A limited partnership (LP) is a business entity formed by two or more individuals comprising one or more limited partners and at least one general partner. The general partner runs the business, and the limited partners function like investors. This business model works for the real estate industry, small and medium-scale companies, manufacturing firms, and production companies.

A limited partner makes a capital investment in lieu of profit sharing—but their liability is restricted to the investment. Limited partners do not have the legal authority to control decision-making. LPs are considered flow-through entities—investors pay taxes on their ordinary income and not business income. Thanks to pass-through taxation, limited partners avoid double taxation.

Key Takeaways

- A limited partnership (LP) refers to a business model where two or more partners start a company. It comprises one or more general partners and at least one limited partner.

- An LP is the go-to business structure for individuals who receive capital from friends and families. These investors are not burdened with decision-making—financial risks are also limited.

- LP business structure is more complicated than a general partnership and requires more paperwork. As documented in the partnership agreement, the profit-sharing and ownership stake is predetermined.

Limited Partnership Explained

A limited partnership (LP) is a hybrid form of business partnership that comprises general partners and limited partners. LPs are common among capital-intensive enterprises—run and managed by a handful of individuals.

This structure is tailor-made for an individual who plans to start a company but lacks adequate personal capital. Such an induvial can involve friends and family members in a limited partner capacity. These limited partners function as investors who get returns but are not burdened with management responsibility. However, a limited partnership does not suit business owners looking for active participation and control. Especially if they do not require more capital.

Characteristics

Limited partnership agreement is a partnership deed where one or more limited partners and general partners join hands to form a business entity. Now let us discuss its various features:

- In order to create an LP, at least one limited partner and at least one general partner must enter into a partnership agreement.

- The business structure of a limited partnership company is quite complex.

- General partners are responsible for management and operations. Therefore, they hold unlimited liability in the company.

- The legal authority for making business decisions lies with the general partner.

- Limited partners do not have any personal liability. Business liability is limited to the amount contributed by the limited partner. Also, they have no say in the management of the company.

- The limited partners' profit share and ownership stake are predetermined—as documented in the partnership agreement. Most agreements use capital investment as the criterion for profit sharing.

Advantages and Disadvantages

Thanks to Limited Partnership act, a business receives significant capital acquisition without diluting ownership or losing control over business activities. The added number does not cause any chaos, as decision-making lies with the general partner.

On the other hand, though limited partners cannot directly participate in decision-making, they can still provide mentorship or bring new skills to the business. In addition, limited partnerships are considered flow-through entities—for profits or losses, investors pay taxes on their ordinary income and not business income, i.e., pass-through taxation. As a result, they avoid double taxation, which is not the case with stock dividends.

A limited partner has no personal liability, and the maximum loss that can occur is losing the capital invested in the business. Thus, there is no risk to the personal assets of a limited partner. As a result, LP investors consider it a source of passive income—potentially offsetting other losses.

There is a downside to this structure; If the company incurs loss due to the wrong decisions, there can be disputes among the partners. Serious disputes can even breach the partnership agreement. In such a scenario, the general partners are at risk—they have unlimited liability that can extend to personal assets.

Examples

Let us understand the concept of a limited partnership agreement with the help of a couple of examples.

Example #1

Joe runs a food café, and Quin is a business partner. Joe is the general partner, and Quin is a limited partner. Quin has infused $75000 in the business. A part of this sum was utilized to renovate the café, and the remaining money was put into business operations. As a result, Quin received a 10% profit (proportionate to investment). Quin does not participate in running the business but gets a monthly share from the profits.

In 2021, the café made a profit of $125000; Quin received $12500 (10% of $125000) as her share in profit. Quin earns a passive income from the café. Also, Quin’s investment risk is limited to the sum of $75000 that she invested. Beyond that, she is not liable for any business debts. If Joe fails to pay his suppliers and creditors, Quin will not be paying anything to cover the losses.

In a nutshell, Quin's investment has significant growth potential, but the downside risk is limited.

Example #2

In March 2023, the stock markets globally were extremely volatile and fell quite sharply. However, Navitas Petroleum Limited Liability rose 11% after declaring their quarterly results.

Moreover, in the last three years, the stock jumped a staggering 183%. The division of employing the capital had given its owners the ability to also dilute the risk involved in a business, especially a business as capital intensive as the petroleum industry.

Limited Partner Vs General Partner

The business structure of a limited partnership agreement is more complicated than a general partnership. Following are the differences:

| Basis | Limited Partner | General Partner |

|---|---|---|

| Meaning | A business partner whose liability is restricted to the amount of capital invested | A business partner who agrees to share profits, assets, financial obligations, and legal obligations |

| Personal Liability | Limited | Unlimited |

| Profit Distribution | Profit is proportionate to the capital invested | Equal profit sharing among the partners |

| Control / Management | No or little control over business operations | Complete control over the management and decision-making |

| Legal Power | No legal power | Holds superior legal authority in decision making |

| Ownership | As per the partnership agreement | Equal ownership unless mentioned otherwise in the partnership deed |

| Paperwork | Less | More |