Table Of Contents

Limited Liability Partnership Meaning

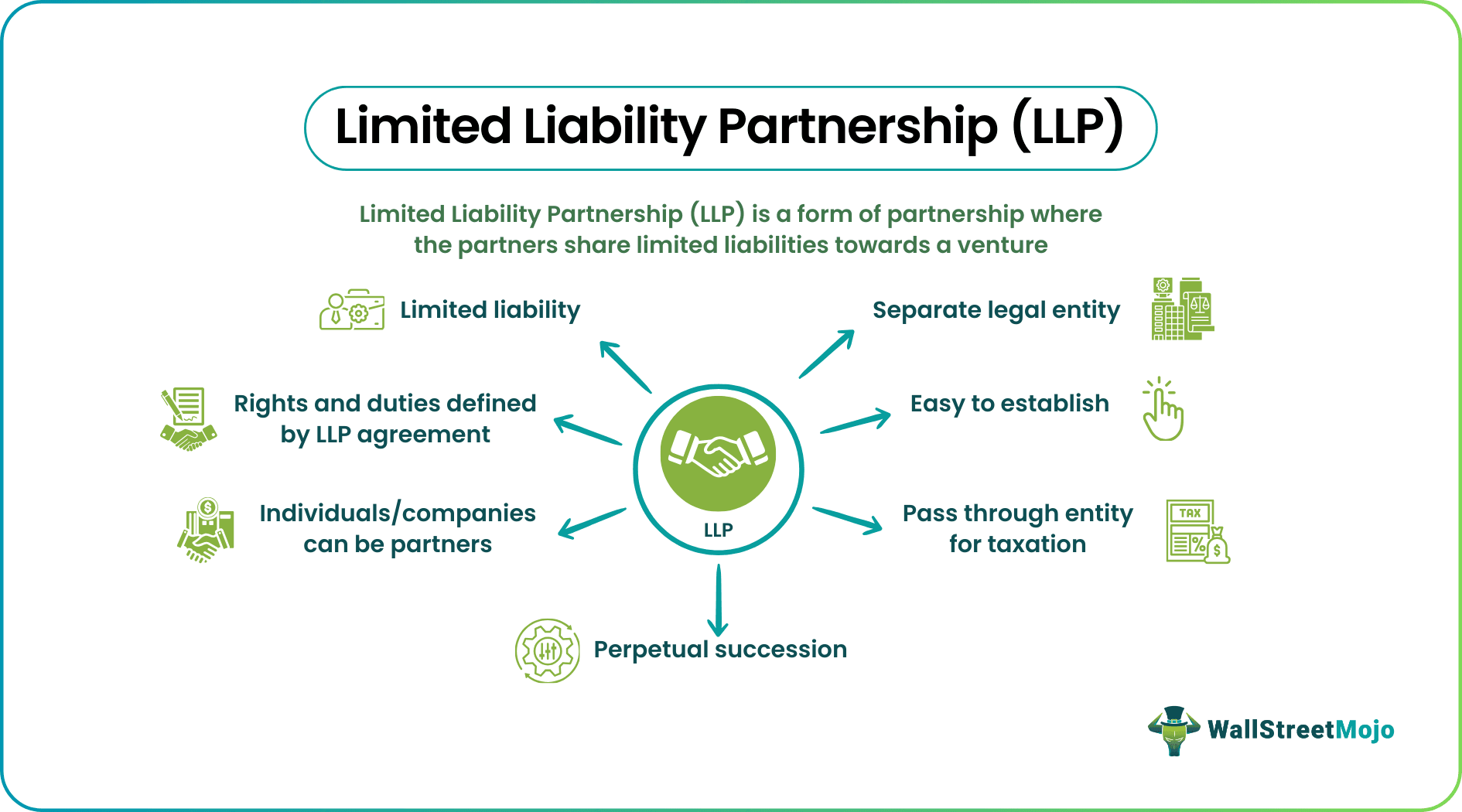

Limited Liability Partnership (LLP) refers to a type of partnership where members share limited liabilities towards a venture, depending on their share of investments. In this business structure, members get their share of profits while enjoying significant relief with restricted liabilities.

LLP helps stakeholders keep off from the disadvantage of a normal or general partnership where the partners are personally liable for the firm’s debt. Instead, it is more like a company with a separate legal existence distinct from its members. This restricts the liabilities of its members. Thus, it is a blend of a company and a general partnership form of business structure.

Key Takeaways

- A limited Liability Partnership (LLP) is a form of partnership where the partners have limited liabilities in a business.

- Partners share risks, costs, responsibilities, and profits based on their investments in the business.

- LLP combines the flexibility of a general partnership with the limited liability of a company.

- In this form of arrangement, none of the partners are responsible or liable for the misconduct or negligence of each other.

- The rules and regulations to form an LLP vary from state to state in the US. It is based on the Revised Uniform Partnership Act (1997) (RUPA).

Limited Liability Partnership Explained

LLP is a partnership firm that has a separate legal existence with its members having limited liabilities. To begin with, members in an LLP distribute the liabilities based on their share of investment in the venture and their personal guarantees, if any.

Therefore, in this form of arrangement, none of the partners are responsible or liable for the misconduct or negligence of each other. Instead, each of them is accountable for their own mistakes.

Furthermore, this business structure is a combination of a normal partnership and a limited company, where the amount of liability shouldered by the company’s shareholders remains limited.

Consequently, this form of partnership setting is common in firms like solicitors and accountants. However, it does not confine to any particular sector. It is quite popular among entrepreneurial initiatives too.

Each US state has its own law regarding the creation of LLPs, which are based on the Revised Uniform Partnership Act (1997) (RUPA). In fact, one can register the LLP by post, electronically, or with the help of firms that help in the LLP formations.

To register a business as an LLP, one must file an LLP certificate with the state. The certificate includes the name of the business, its address, details of the members, business activities, People with Significant Control (PSC) registration information, and a compliance statement.

Once the state certifies the business as LLP, the partners can draft a partnership agreement. This document guides the venture with its operation and functioning. For this reason, it includes details related to the profit-sharing arrangements, the settlement of disputes, and the responsibilities and liabilities of each member.

Features of Limited Liability Partnership

LLP makes members or partners share risks, costs, responsibilities, and profits depending on their investments. An LLP venture must have at least two designated members. However, the partners will mutually decide whether all the members involved would be the designated partners or only a few of them.

The designated members are no different from the rest of the partners in an LLP. However, they have some additional functions to perform, including appointing an auditor, if need be, signing accounts for other partners, acting on behalf of the LLP on dissolution, etc.

As a partnership, the LLP firm is a pass-through entity for taxation. As a result, LLP’s profits are taxed on the partners’ personal income tax returns. Thus, this is to avoid double taxation.

Some of the unique features of an LLP include:

- Separate legal entity

- Flexibility in partnership as partners can easily be let in and let out

- LLP agreement defines the rights, duties, risks, and profit-sharing among partners

- A minimum of two partners must form an LLP

- Members can either be an individual or company

- Partners can choose the level of involvement

- Limited liability, limited risk

- Unaffected by changes in membership

- Profits are taxed on partners’ tax returns

Example

Suppose two doctors, Sam and Rossaine, open a small clinic to treat patients and registers it as an LLP with the name Medicare. Then they make an equal investment to include the tools and equipment required for examining patients and divide the space between themselves.

At the end of every month, they agree to divide the profits equally between themselves as per their partnership agreement. The agreement also details their rights, duties, and liabilities. Thus, they start seeing patients daily.

But one of the patients alleges that Sam adopts malpractices while treating patients and files a legal suit against the clinic Medicare. As Medicare is a separate legal entity, the patient has the right to bring a case against the clinic and make it accountable.

In this case, Medicare and the partner Sam assume unlimited liability. However, if Medicare LLP can establish that Sam’s act was not within its knowledge, then it is exempt from liability. Likewise, Rossaine, with her limited liability, will not be responsible for the fraudulent acts of Sam.

In this case, the LLP agreement between the two doctors becomes invalid as the venture won't exist anymore with just one left to operate.