Table Of Contents

Limit Order Definition

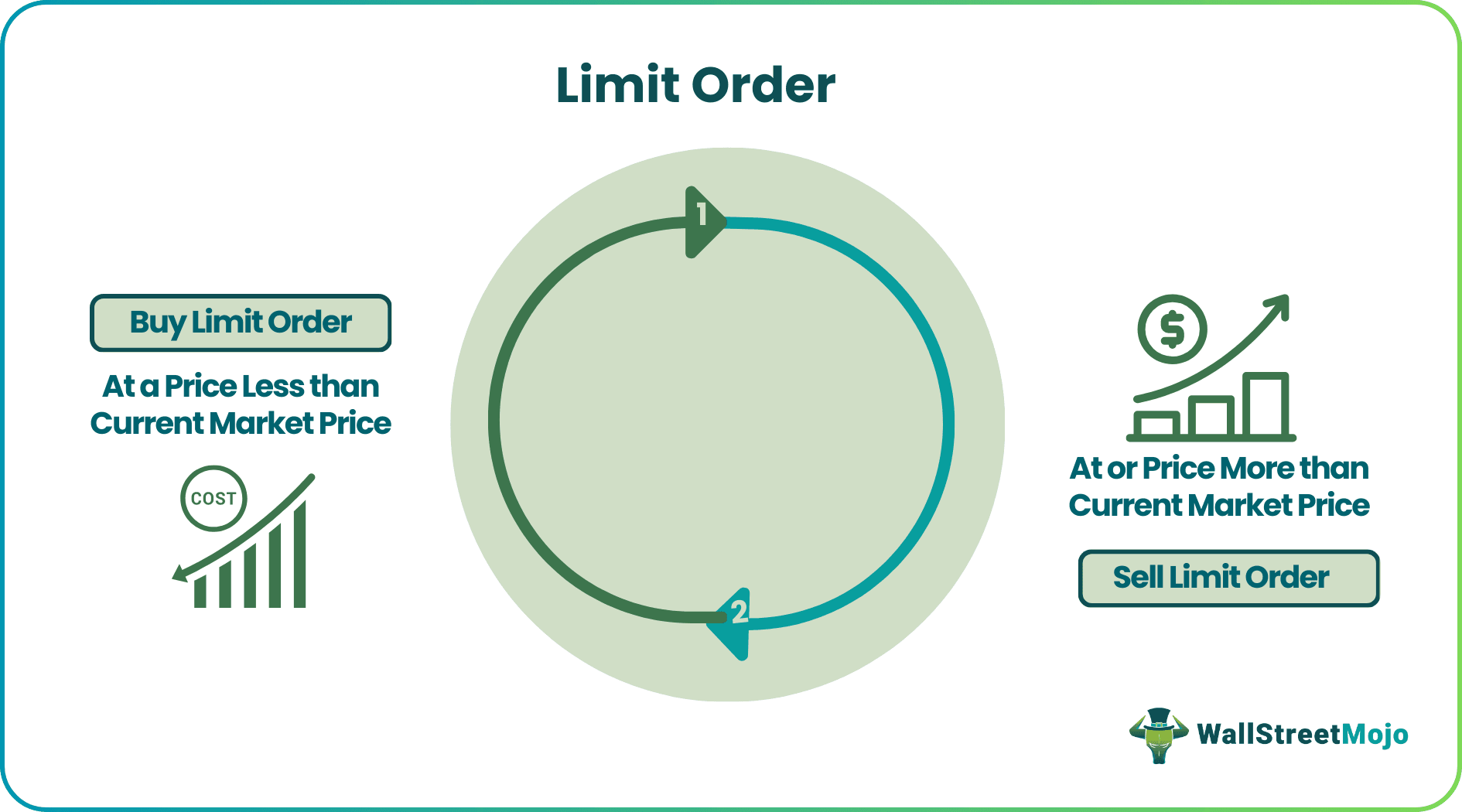

A limit order refers to purchasing or selling the security at the mentioned price or better. So, for example, in the case of sell orders, it will be triggered only when it is at a limit price or higher. At the same time, the buy orders start when it is at a limited price or lower.

It is one of the order types in the share market that allows traders to set the desired price they are willing to buy or sell. It gives a trader more control for executing security’s price than when they are worried about market order during volatility. Traders specify their price using a limit order, whereas they choose a price in the market order market. One can modify them until it executes.

Table of contents

- Limit Order Definition

- A limit order means buying or selling the security at the mentioned price or better.

- Buy orders and sell orders are the types of limit orders.

- The risk with limited orders is that the current price should never decrease within the order’s criteria. In such a case, the investor’s order may not execute.

- Keeping a limit order covers the amount an investor is ready to pay. It always grants precise order entry and is appropriate to traders when it is more crucial to obtain a special price than the trade execution to get filled by the market price.

Limit Order Explained

A limit order for selling or buying allows the trader to pre-determine the price they want to sell or buy. It ensures that price considerations are fulfilled before the trade is executed. It deals primarily with the price of a security. So, if the security’s price is currently resting outside of the criteria set in the limit order by the trader, the transaction does not happen. They can be beneficial when a stock or other asset is thinly traded, has highly volatile, or possesses a wide bid-ask spread where a bid-ask spread is a difference between the highest price a buyer is willing to pay for security in the market and the lowest price a seller is willing to accept for a security.

Placing a buy limit order puts a cover on the amount an investor is willing to pay. It always allows precise order entry and is appropriate to traders when it is more important to get a specific price rather than the execution of trade to get filled by the market price.

The risk with limit orders is that the current price must never fall within the order’s criteria; in this case, the investor’s order may fail to execute.

At times, the target price may reach. Still, there could not enough liquidity to fill the order.

It is featured with price restriction; it may sometimes receive partial or no fill.

All stock market transactions are impacted by certain points like the availability of stocks, the timing of commerce, the stock's liquidity, and the size of the order.

There are always present priority guidelines for such orders.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Types

- Buy Order – One can place a buy limit order at a specified price or lower.

- Sell Order – One can place a limit order for selling at a specified price or higher than it.

Examples

Let us see some simple to advanced illustrations.

Example #1

Suppose a portfolio manager wishes to buy stocks of MRF Ltd. but believes that the current valuation is too high, $833. He wants to buy at a specified price or less.

He instructs his traders to buy 1,000 shares when their price falls below $806. This is a buy limit order.

The traders then order to buy 1,000 shares with an $806 limit. They can begin buying stocks automatically when it reaches $806 or less, or they can cancel the order.

Example #2

Suppose the portfolio manager wants to sell shares of Amazon and thinks that the current price of $27 is too low and is expected to go high.

He can instruct 50% of the shares at a price above $35. Then, it is a sell order in the limit order book, where he will sell the shares only if it reaches $35 and above. Else, he will cancel it.

Advantages

- They let traders enter and exit deals with an exact price. As a result, they can attain a certain predefined goal in a trading security.

- It can be beneficial in a volatile market scenario. For example, when a stock suddenly rises or falls, a trader worries about getting an undesirable price from a market order.

- It can be advantageous when the trader cannot keep regular track of his portfolio but has a specific price in mind. They would like to execute, buy or sell any particular security. They can be placed with an expiration date in the limit order book.

Disadvantages

- It is subject to the availability of security at a set price. Therefore, it prevents the negative execution of trading. But, on the other hand, it does not guarantee a buy or sell action because it will always be executed only when the desired price is attained. In this way, traders can miss an opportunity.

- Traders must correctly enter a limit order for stocks to ensure the goal is to get a specified price. Therefore, it is essential to be the upper hand in the market price. Otherwise, the trade will be filled at the current market price.

- Compared to market orders, brokerage fees for limit orders are higher. The order is not executed if the market price never reaches a high or low as the investor specified. Hence, it is not guaranteed. They are more technical and not straightforward trades; they create more work for the brokers, leading to a higher fee.

- They are unsuitable for aggressive trading techniques because order executions are essential rather than price.

- While using it, the market may not touch the price. Therefore, it is hard to make money in these scenarios.

- It may be challenging to find the actual price and make limit order for stocks suitable for low-volume stocks not listed on major exchanges.

Limit Order Vs Market Order

Limit orders are the ones in which transaction is triggered once the set limit price is hit and market order is execution of order at the current market price. The differences are as follows:

| Limit Orders | Market Orders |

|---|---|

| They are price specific orders. | They are time specific orders. |

| They will be executed once a particular price is reached. | They are executed at market price. |

| There is an uncertainty of execution. | Execution is mostly certain. |

| Proper analysis and more specifications are needed to fix the limit price for buy or sell. | It is easy to set during buy or sell. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A limit order is buying or selling a stock with a control on the highest price one must pay or the lowest price to be obtained, i.e., the "limit price." If the order is filled, it will only be at the particular limit price or better. First, however, there must be execution assurance.

Stop-limit orders depend on trades that blend a stop loss's features with a limit order to diminish risk. Moreover, it permits traders specific authority when one must fill the order, but with no guarantee to execute.

Limit orders have a specific benefit when trade in a stock or other asset is made, even though it is thinly traded, highly volatile, or possesses a wide bid-ask spread which is the difference between the highest price a buyer is willing to pay for an asset in the market and the lowest price a seller is ready to take.

Day-limit orders run out at the end of the current session. It continues over to after-hours sessions. Good-Till-Canceled (GTC) limit orders carry from one regular session to the next until the trader performs or cancels it. Every broker-dealer decides the expiration period.

Recommended Articles

This article is a guide to the Limit Order definition. We explain its differences with market order along with types, examples, advantages and disadvantages. You can learn more about financing from the following articles: -