Table Of Contents

What Is Like-Kind Exchange?

Like-kind exchange, also known as the 1031 exchange, is a transaction or a combination of transactions that prevents the current tax liability under the United States Tax Laws on the sale of an asset because another similar asset is acquired in place of the existing asset.

The bottom line is that when one wants to sell an asset to buy another asset in its place, one should look at the rules mentioned in the 1031 exchange. If the rules are in line with the facts of the individual case, there would be tax benefits that could arise. Of course, there are many pros and cons, and a decision has to be taken, keeping in mind all the factors mentioned.

Like-Kind Exchange Explained

A like-kind exchange is a transaction to defer the capital gain tax arising in the transaction of the sale of an asset when it can be shown that the proceeds are being used to acquire another asset in place of the first-mentioned asset. It is called the 1031 exchange because Section 1031 of the Internal Revenue Code exempts the seller of an asset when the sale proceeds are reinvested in assets of value equal or higher. An exchange will not be considered a like-kind exchange if the asset being bought is the seller's personal property. In all other cases, this would apply.

Usually, when a property is bought or sold, the gain realized in the process is chargeable to capital gains tax. Depending on the period of holding, they are charged with a long-term or short-term capital gain tax. Sometimes, a property is sold to buy another property in its place, i.e., the old property is just being replaced. Sec 1031 of the IRC exempts such transactions in the name of Like-Kind Exchange to cover such transactions.

Features

Like-kind exchange, of course, allows new asset seekers to avoid capital gains tax, but besides this, it has several other characteristics as well that make people opt for it:

- The replaced property or asset must be similar and character to be qualified as a like-kind exchange.

- Another important feature is that one property or asset can be a like-kind asset to more than one property. The Internal Revenue Service says that three properties can be designated as long as they can be closely identified.

- Timing rules apply to the deferred exchanges strictly, i.e., Within 180 days of the transfer of the relinquished property, the taxpayer must receive the replacement property.

Types

Broadly there are four types of like-kind exchange. Namely, simultaneous exchange, delayed exchange, reverse exchange, and continuous or improvement exchange.

#1 - Simultaneous

In such cases, the property sold and acquired is exchanged on the same day. That means the transaction is closed on the same day. Further, there are three ways in which this simultaneous trade can also happen.

- Two-party trade swaps

- Three-party exchange

- Simultaneous exchange involving an intermediary.

#2 - Delayed

It is the most common and preferred type of exchange. In this type, the asset owner sells it and then acquires the replacement property within the time frame (45 days for identifying the property to be acquired and 180 days to complete the sale).

#3 - Reverse

It is also known as a forward exchange wherein the property which has to be acquired as a replacement is acquired in advance, i.e., the property is bought first and exchanged later.

#4 - Construction or Improvement Exchange

Improvements to the property can be made using the tax-deferred dollars for enhancement of the same while placing the property in the hands of a qualified intermediary within 180 days.

Example

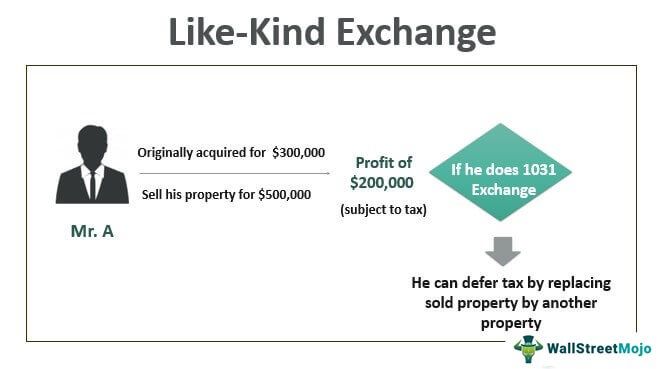

Let us consider an example of Mr. A, who wants to sell his commercial property for $500,000, which was originally acquired for $300,000. This transaction would lead to a profit of $200,000, which would be subject to tax. But, if Mr. A does a 1031 exchange, he can defer this tax by replacing the sold property with another property similar in nature and character (with a 45-day and 180-day period as mentioned in the rules below).

Rules

There are seven primary rules. They are as follows:

- The assets or properties being bought and sold, i.e., the exchange, must be like-kind, i.e., identical in nature and character.

- It is applicable only when an investment or business property is involved.

- The property acquired from the proceeds shall be either of the same value or higher.

- Any boot arising from exchange shall be subject to capital gains tax.

- The taxpayer must be the same, i.e., the buyer of the replacement property and seller of the relinquished property must be the same.

- The property must be identified within 45 days.

- The property must be purchased within 180 days.

Advantages

This kind of exchange has its own set of benefits for owners or buyers. Let us have a look at some of them:

- Introducing this kind of exchange is to avoid paying capital gains tax, and the sale proceeds are untouched before they are reinvested, allowing the earning power of the deferred income tax.

- The very basic advantage would be that of leverage. With the proceeds obtained from the sale, one can buy a more valuable investment property.

Disadvantages

There are multiple merits of the process, but it is not devoid of demerits. Listed below are the cons of link-kind exchange:

- The major disadvantage is the term period of 45 days and 180 days, which is strict. Failure to take ownership will result in a failed transaction. They are identifying the replaced asset, which is similar and has a value equal to or greater than the replenished asset.

Like-Kind Exchange vs Opportunity Zone

| Point of Difference | Like-Kind Exchange | Opportunity Zone |

|---|---|---|

| 1. Property | The property must be similar and character. | The property does not have to be of the same kind. |

| 2. Identification of the like- property | Within 45 days | No such time frame |

| 3. Investment | Entire sale proceeds must be invested. | Only the gain on the sale must be reinvested. |

| 4. Purchase of: Personal Property, Stocks, Partnership Interests, etc. | Not allowed | Allowed |