Table Of Contents

What Is The Lifetime Learning Credit?

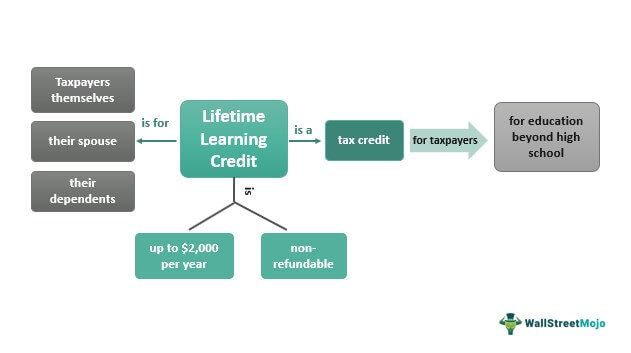

The Lifetime Learning Credit is a tax credit available to eligible taxpayers who are seeking to further their education beyond high school, including college courses or other educational programs. The credit is designed to help offset the cost of tuition, fees, and other qualified expenses.

To qualify for the Lifetime Learning Credit, the student must be enrolled in an eligible educational institution, such as a college or university, vocational school, or other postsecondary institution. The credit can be claimed by the taxpayer or the taxpayer's dependent, such as a child who is enrolled in college.

Key Takeaways

- The Lifetime Learning Credit is a tax credit that can help reduce the cost of postsecondary education for eligible taxpayers.

- The credit is 20% of qualified expenses, up to a maximum credit of $2,000 per tax return.

- To be eligible for the credit, taxpayers must have a modified adjusted gross income (MAGI) below certain thresholds and be enrolled in an eligible educational institution.

- The credit can be used for tuition, fees, and required materials but cannot be used for the same expenses as the American Opportunity Credit in the same tax year.

- Overall, the Lifetime Learning Credit can benefit eligible taxpayers pursuing further education and help make education more accessible and affordable.

How Does The Lifetime Learning Credit Work?

The Lifetime Learning Credit allows eligible taxpayers to claim a tax credit for certain educational expenses paid for themselves, their spouse, or their dependents. The credit is 20% of the first $10,000 in qualified expenses, up to a maximum credit of $2,000 per year.

Offered credit is worth up to $2,000 annually, calculated as 20% of the first $10,000 of qualified expenses paid for the student's education. Also, the credit is non-refundable, which means it can reduce the taxpayer's tax liability but cannot be used to generate a refund if the credit exceeds the amount of tax owed.

The taxpayer must meet certain income requirements to be eligible for the credit. Moreover, qualified expenses include tuition, fees, and other related expenses required for enrollment in eligible educational institutions. Thus, it may include colleges, universities, vocational schools, or other postsecondary educational institutions.

To claim the Lifetime Learning Credit, the taxpayer must determine their eligibility. Hence, the credit is available to taxpayers who have paid for qualified expenses for themselves, their spouse, or their dependents. The taxpayer must also meet certain income requirements, which vary depending on the taxpayer's filing status.

The credit is non-refundable, which means that it can reduce the taxpayer's tax liability but cannot be used to generate a refund if the credit exceeds the amount of tax owed. In other words, the credit can reduce the taxes the government owes but cannot be used to generate a refund.

How To Claim Tax Credit?

To claim the credit, the taxpayer must file Form 8863, Education Credits, with their tax return. Also, this form requires the taxpayer to provide information about the eligible educational institution, the number of qualified expenses paid, and the taxpayer's income.

It's important to note that the Lifetime Learning Credit cannot be claimed for the same expenses used to claim the American Opportunity Tax Credit (AOTC). In other words, the same expenses cannot be used to claim both credits.

Overall, the Lifetime Learning Credit can be a valuable tool for taxpayers looking to further their education. Thus, it can help offset the costs of tuition and other educational expenses, and it may help reduce the taxpayer's tax liability. However, it's important to understand the eligibility requirements and properly claim all qualified expenses on the tax return to ensure the credit is properly applied.

Eligibility

To be eligible for the Lifetime Learning Credit, a taxpayer must meet certain requirements related to their enrollment in educational institutions, expenses, and income. Also, the student must be enrolled in one or more courses at an eligible educational institution. These include colleges, universities, vocational schools, or other postsecondary educational institutions.

Qualified expenses must also be paid for the student's education. Qualified expenses include tuition, fees, and other related expenses required for enrollment.

Additionally, the taxpayer must meet certain income requirements to be eligible for the credit. For example, the credit begins to phase out for single filers with a modified adjusted gross income (MAGI) of $80,000 and married taxpayers filing jointly with a $160,000. In addition, the credit is unavailable for taxpayers with a MAGI over $90,000 for single filers and $180,000 for married taxpayers filing jointly. Also, the student cannot have a felony drug conviction when the credit is claimed.

It's important to note that the same expenses cannot be used to claim the Lifetime Learning Credit and the American Opportunity Tax Credit (AOTC) in the same year. Taxpayers must choose which credit to claim and cannot claim both for the same expenses.

Overall, taxpayers should consult with a tax professional to determine their eligibility and ensure they properly claim all qualified expenses on their tax returns.

Examples

Let us have a look at the examples to understand the concept better.

Example #1

Jasmine is a single taxpayer who is enrolled in a graduate program at a university. During the tax year, she paid $8,000 in tuition and fees for her courses. She also paid $1,500 for books and other materials for her program.

Jasmine's modified adjusted gross income for the year is $75,000, below the phase-out threshold for single filers. Therefore, she can claim the Lifetime Learning Credit for her education expenses.

The credit is 20% of the first $10,000 of qualified expenses. In Jasmine's case, it's $1,700 (20% of $8,000 in tuition and fees, plus 20% of $1,500 is required materials).

Jasmine can claim a tax credit of $1,700 on her tax return, reducing the tax she owes to the government. However, if her tax liability is less than $1,700, the credit cannot be used to generate a refund.

It's important to note that the same expenses cannot be used to claim the Lifetime Learning Credit and the American Opportunity Tax Credit (AOTC) in the same year. Jasmine must choose which credit to claim if also eligible for the AOTC. She cannot claim both for the same expenses.

Example #2

The Lifetime Learning Credit is a tax credit offered by the US government to encourage taxpayers to pursue further education. The credit is designed to offset some of the costs associated with education and to make it more accessible to a broader range of people.

For example, let's say that in a particular tax year, the US government grants $10 million in Lifetime Learning Credits to eligible taxpayers. The maximum credit amount per taxpayer is $2,000, meaning up to 5,000 taxpayers could receive the full credit.

Assuming that each taxpayer claimed the maximum credit of $2,000, the total cost to the government would be $10 million. However, it's worth noting that not all taxpayers eligible for the credit will claim it. Also, not all eligible taxpayers will qualify for the maximum credit amount.

In addition to the cost of the credit, the government may also incur administrative costs associated with administering and enforcing the credit. Thus, it could include the cost of processing tax returns and verifying the eligibility of taxpayers who claim the credit. It can provide a valuable benefit to eligible taxpayers but also comes with costs and administrative challenges for the government.

Lifetime Learning Credit vs American Opportunity Credit

| Parameters | Lifetime Learning Credit | American Opportunity Credit |

|---|---|---|

| 1. Maximum Credit | $2,000 per tax return | $2,500 per eligible student |

| 2. Eligible Students | Any student | Only eligible students in their first four years of undergraduate education |

| 3. Qualified Expenses | Tuition, fees, books, and required materials | Tuition, fees, and course materials |

| 4. Credit Rate | 20% of qualified expenses | 100% of the first $2,000 of qualified expenses, plus 25% of the next $2,000 of qualified expenses |

| 5. Phase-Out Threshold | Begins at $80,000 MAGI for single filers and $160,000 for joint filers. Credit is unavailable for MAGI over $90,000 for single filers and $180,000 for joint filers. | Begins at $80,000 MAGI for single filers and $160,000 for joint filers. Credit is unavailable for MAGI over $90,000 for single filers and $180,000 for joint filers. |

| 6. Refundable Credit | No | Yes, up to 40% of the credit is refundable |

| 7. Can it be used for room and board expenses? | No | Yes, if the student is enrolled at least half-time in a degree program |

| 8. Can it be claimed for the same expenses as the Lifetime Learning Credit in the same tax year? | No | No |