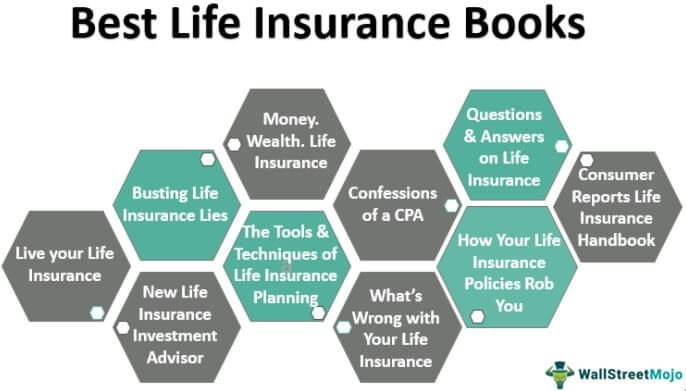

10 Best Life Insurance Books [2025]

- Busting the Life Insurance Lies ( Get this book )

- The Tools & Techniques of Life Insurance Planning, 6th edition ( Get this book )

- Confessions of a CPA: The Truth about Life Insurance ( Get this book )

- Questions and Answers on Life Insurance ( Get this book )

- New Life Insurance Investment Advisor ( Get this book )

- Live your Life Insurance ( Get this book )

- Money. Wealth. Life Insurance ( Get this book )

- What’s Wrong with Your Life Insurance ( Get this book )

- How Your Life Insurance Policies Rob You ( Get this book )

- Consumer Reports Life Insurance Handbook ( Get this book )

Let us discuss each life insurance book in detail, along with its key takeaways and reviews.

#1 - Busting the Life Insurance Lies

38 Myths and Misconceptions That Sabotage Your Wealth

by Kim D. H. Butler and Jack Burns

Book Review:

Let’s start with this best life insurance book about busting myths. Most of us have little idea about life insurance, so we believe whatever information we overhear here and there. This book will give you distilled information about life insurance, which you should’ve known before you turned 30. This information will save you a ton of money and make an excellent protection fund for your family. If you don’t take action now, you must pay much more to get the same protection fund. So, pick this book up (even if you’re more than 30) and act prudently. This book is convenient, and you can immediately implement the lessons. The best way to read this book is to read each chapter, take notes, and see whether you’ve made a similar mistake. If yes, change it; if no, go on to the next chapter and repeat. We recommend this book to bust the myths but expect it to be filled with something other than technical jargon and calculations. This book is written for a layman that speaks to an audience who needs to learn the life insurance basics.

Key Takeaways

- You may have many questions regarding life insurance. For example, you may ask, isn’t life insurance a waste of money? Don’t I lose all my cash when I die? Or should I do life insurance for my spouse and family? This book will answer all of your questions.

- After reading this book, you can read something more technical to understand how to go for life insurance.

#2 - The Tools & Techniques of Life Insurance Planning

by Stephan R. Leimberg, Robert J. Doyle and Keith A. Buck

Book Review:

This book is not fundamental. You need to go deep to understand this book, and it’s required if you want to make a prudent decision. Life insurance seems so easy. When we take life insurance, we call an agent, talk to the agent about our options, and then choose the best. But life insurance isn’t as simple as that. You should pay heed to many other considerations, like compensation and benefits, estate tax, business succession, survivors’ needs, and wealth transfer. You must value each factor equally and decide which life insurance you should take. If you want to avoid all complexities, read this book after reading an introductory book on life insurance. Reading this book will help you with tools and techniques of life insurance planning, and then once you’re convinced with the figure, you can go ahead and talk to your agent about taking the best life insurance.

Key Takeaways

- Compared to any other book, this isn't easy to read because it covers every aspect of life insurance so that you don't get fooled by people who know more than you.

- This book is very comprehensive. You don't need to read another book on life insurance planning if you can chew the information this book has presented.

#3 - Confessions of a CPA: The Truth about Life Insurance

by Bryan S. Bloom

Book Review:

What if you get a book that can show you all the nooks and corners of a permanent life insurance policy and guide you throughout your life? Would you pick up that book and read it? Well, this top life insurance book is the exact solution for any issues related to life insurance. You will get a realistic look at all life insurance policies and an overview from a professional who has been there and seen that. This life insurance book teaches you exact things to prevent your money from slipping away through your fingers and assist you in using your money in other tax-efficient, growth-efficient investment portfolios. You will also learn some fundamental rules of investment like “the rule of 72,” “opportunity cost,” “compound interest,” and so on. Moreover, you will also be able to relate to many real-life examples that help you understand the concepts better. In a nutshell, this is a must-read book before you ever think about taking a permanent life insurance policy.

Key Takeaways

- The author mentions that we have three types of knowledge – “consciously competent knowledge,” of which we are consciously aware, and “consciously incompetent knowledge,” of which we are unaware. Lastly, “unconsciously incompetent knowledge,” which we don’t know that we are not aware of. This book will teach you the third type of knowledge.

- You will learn much about life insurance in this concise volume, making things relatively easy to implement.

#4 - Questions and Answers on Life Insurance

by Tony Steuer

Book Review:

This book will show you exactly what you need to know. After reading this book, many readers have mentioned that this book is truly written for consumers, and the author really cares about the consumers and their interest. Not only will you get a lot of real-life illustrations of how to evaluate an insurance policy and how to understand death claims, but you will also get a lot of answers for all your questions in regard to the life insurance field. If you’re a consumer and you don’t have a clue about what life insurance to take, read this book, and you would know. Reading this best life insurance book will equip you with the tools and techniques required to know to ask your agent the right questions and to do due diligence on your own. Plus, any layman can read this book. It’s lucid, interesting to read, and very much comprehensive. Pick up this book, and read sequentially. Once you complete reading this book, go, talk to your agent, and take life insurance based on your knowledge and prudence. Reading this book will make reading everything else unnecessary.

Key Takeaways

- You will learn the four most important things – how to plan life insurance, keep your policy in force, go for due diligence and company evaluations, and what pitfalls you should look out for before taking a life insurance policy.

- This book is all-in-all for those who need to gain knowledge of life insurance. You will get all the answers you may have in this book.

#5 - New Life Insurance Investment Advisor:

Achieving Financial Security for You and your Family through Today’s Insurance Products

by Ben Baldwin

Book Review:

Once you have a basic idea about life insurance, it's time to see it as an investment and savings tool. If you need to learn about life insurance, this may not be the right book for you. First, realize why you need a life insurance policy, why you shouldn't pay heed to every agent, and why everything said about life insurance isn't true. And then come back to this book. This book is advanced, and if you want to take your life insurance investment to the next level, read this book. This book is written, and any layperson can read this book (but you shouldn't before you ever read an introductory book on life insurance). Besides usual consumers, this book is a perfect guide for those who want to take financial planning as a profession or who already have a few years of experience in financial planning. You will also get to know the details of the life insurance products you can invest in and multiply your money.

Key Takeaways

- This book is entirely based on looking at life insurance from different perspectives. Other than life protection cover, life insurance also can be treated as an investment product. Based on the information in this book, you can buy the right life insurance policy to multiply your money.

- This book covers the pros and cons of internet purchase of life insurance, how to use capital within a policy, an overview of the different stages of life insurance, and so forth.

- This book is entirely based on looking at life insurance from different perspectives. Other than life protection cover, life insurance also can be treated as an investment product. Based on the information in this book, you can buy the right life insurance policy to multiply your money.

- This book covers the pros and cons of internet purchase of life insurance, how to use capital within a policy, an overview of the different stages of life insurance, and so forth.

#6 - Live your Life Insurance

Surprising Strategies to Build Lifelong Prosperity with Your Whole Life Policy

by Kim D. H. Butler

Book Review:

If you have ever asked yourself, "but how would life insurance help me multiply my money other than providing for my death coverage?" this is the book for you. It is a concise book compared to any life insurance guide in the market. But it will help you understand different types of life insurance policies and show you how in creative ways, you can build tax-deferred/ tax-free growth of your money using life insurance policies. The greatest thing about this book is this book shows you how to take advantage of your life insurance while you're still alive, not only for payment to your family after your death. As you can expect, this subject isn't an easy topic to discuss, but the author does a great job of chucking it down into tiny steps so that average readers can understand the concept. Moreover, the author also talks about how to approach life insurance in your 20s, 30s, 40s, and 50s. The author's financial advice regarding life insurance is top-notch and valuable for everyone who would like to multiply their money over the years through life insurance.

Key Takeaways

- It is a very concise guide. All you need to do is go through the concepts in the afternoon. If you read through and apply all you learn from this book, you will never have any doubt about life insurance.

- This life insurance book shows you how to take charge of your financial life in your 20s, 30s, 40s, and 50s.

#7 - Money. Wealth. Life Insurance

How the Wealthy Use Life Insurance as a Tax-Free Personal Bank to Supercharge Their Savings

by Jake Thompson

Book Review:

It is, again, a concise guide on life insurance. But it doesn't talk about the old basic principles of life insurance. Instead, it takes the discussion beyond simply using life insurance as a saving and investment tool. This book will show how the wealthy use life insurance to make more money and receive more tax-free income. Suppose you want to read this book with an understanding of life insurance as a protection coverage tool. In that case, you may feel disappointed because this book assumes that you already know the magnificence of having the right policy to protect your family. It will answer a few burning questions about life insurance, like – what would happen to the cash vault built up after the insured dies? Can grandparents ensure their grandchildren benefit their grandchildren? How can you convert a 401(K) to a lump sum policy? Do death benefits decrease after 7 years? If yes, why, and so on. However, this book will not answer all your questions. You can use a whole life insurance book handy. Also, this book can reference becoming wealthy through life insurance.

Key Takeaways

- You will be able to know how the wealthy use life insurance to create more wealth, reduce risk, and create predictable income, and also how one can earn 300 percent returns by leveraging their insurance policies.

- You will also learn why banks and corporations invest billions of dollars in this one industry and how you can save taxes and make more money using life insurance policies.

#8 - What’s Wrong with Your Life Insurance

by Norman F. Dacey

Book Review:

Let's say you want to read a bible on life insurance. Your only preference is that the information should be relevant. It should tell you everything you need (even the darkest truths) about life insurance. This book is slightly old but can be called the bible of life insurance. Reading this book will make you realize that life insurance has more facets than your agent ever tells you. For every consumer who has been thinking of buying an insurance policy or someone who has been making a living selling life insurance, this book is a must-read. It is the book you should always keep at your desk if you're involved in selling financial products/helping clients with financial planning. This book may seem to you as unfavorable at times because this book focuses on the wrong things in life insurance so that you can make them right as an agent and as a consumer. So, before you ever take life insurance or if you consider taking the second/third one, read this book first. And you would be aware of the flaws of the life insurance market, and rarely would anybody be able to fool you with their clever tricks.

Key Takeaways

- This book is updated and edited per today's life insurance market needs. So, don't put it off just because it was written 25 years ago.

- This book has alerted thousands of Americans over the years from the abuse and greed of the life insurance market. It can help you too.

#9 - How Your Life Insurance Policies Rob You

by Arthur Milton

Book Review:

This book is just an extension of the previous book. This book is a short, sweet guide and will protect you from the deception of the life insurance industry's sugar-coated attacks. It's all good – protecting your family with a life insurance policy, knowing everything about how life insurance planning works, how to use life insurance to your advantage and save tax and make more money, and how you can increase your returns on life insurance. But very rarely do people talk about the pitfalls of life insurance, which you should know as a consumer and as a new life insurance agent. This life insurance book not only talks about the wrong side of the life insurance business but also tells you the history of life insurance, which helps you connect the dots and relate to what the author is trying to explain. If you read the book "What's wrong with your life insurance" along with this book, you won't doubt what type of life insurance you should take. This book will save you a ton of money, and you can save and invest in better instruments than cash-value life insurance.

Key Takeaways

- You will learn the two most essential things in this book –

- First, life insurance agents sell cash-value life insurance only for one reason: to earn a commission.

- Second, you don't need to take cash-value life insurance. Cash-value insurance is just term insurance with a component of savings with a poor earning rate. If you take term insurance, you can invest the rest of the money into other better investment tools.

#10 - Consumer Reports Life Insurance Handbook:

How to Buy the Right Policy from the Right Company at the Right Price

by Jersey Gilbert, Ellen Schultz, and Consumer Report Books

Book Review:

This book is only recommended for some as the content of the book is priceless. This book is a little expensive since it is out of print as of now. If you are very concerned about life insurance and have enough money to buy over $200, this is the only book you should read. With consumer reports, this book will help you decide the right life insurance to take and reject the rest of the policies. This book will also enlighten you about the lies of the life insurance industry and will hand you tools to overcome them. This book would be helpful if you have a family and want to protect their interest. It will save you from the noise and smoke of the industry and will give you distilled information about how to make a move, how to think about a life insurance policy to protect your family, and how never to get stumped by any life insurance agent anymore.

Key Takeaways

- They wrote this book in 1967. Over 400 life insurance policies are rated here to discover the truth from the noise.

- From this book, you will find a lot of reports and articles offered by consumer reports, which will help you decide how much insurance policy to buy and which one to buy among all the options you have.