Table Of Contents

Levy Meaning

A levy is a lawful process where a debtor's property is seized when the debtor cannot pay for the outstanding debts. It differs from liens as the lien is only a claim against a property to obtain the payment, whereas a levy is an actual takeover of the property to fulfill the debt.

Thus, it refers to the legally imposed rule of seizing away of the property against which the borrower has taken a loan in case of non-repayment of installment. But before imposing the rule, a due notice is given to the borrower and then the action is taken to ensure recovery of the borrowed amount.

Levy Explained

A levy is a legal process performed by a bank or taxing authority. It is slightly different from the lien as it is only a claim against a property to get the payment, whereas, in the levy, there is an actual takeover of the property to fulfill the outstanding debt. In this process, a bank or taxing authority is granted the right to seize the debtor's property, which can be both tangible and intangible. Tangible assets in case of levy on property may include cash, house, car, etc., while future wages come in intangible.

Levy on property works as follows –

- Warning: Levy is done only when the creditor cannot get the money back even after trying. So, the debtor is warned that the creditor will take legal action against such debtor. In such a case, no further warnings are given by the bank or taxation authority.

- Option to Dispute: The debtor has the chance to dispute a levy. By doing so, the debtor can reduce the actual amount of money that can be taken by the creditor or can even avoid it.

Process

Let us look at the process followed in case of imposition of levy and the various rules to be followed regarding the same.

- The IRS has to first determine whether any financial obligation is pending for the borrower’s side. If yes, then what is the extent of the obligation, up to what time period it is pending and what kind of obligation it is all of which will determine the offender levy.

- The IRS examines the tax; the payable tax bill is sent to the debtor as demand for the debt payment.

- If the debtor pays the tax bill, no further action is taken against the debtor; however, if the debtor does not pay, which may be due to some financial problem, then implications will follow.

- The IRS will send the debtor a notice about the purpose of the levy, usually 30 days before its process. The notice can be sent through the mail or delivered to the debtor's house.

- The IRS then sends the debtor a warning about the involvement of the third party, if any. The IRS communicates with the third parties to collect the debtor's tax liability.

- After the above is done, if it is noticed that still the obligation is remaining unpaid by the borrower, and the notice period expires, then the credit agency or the lender proceeds with the legal action. The action may be in the form of a court order a judgement that will give the lender necessary permission to enforce levy.

- The next step is the process of seizing of the asset, which may be property or bank account, wages, etc, which ever may satisfy the obligation and meet the amount to be returned and also the levy cost. Due to the legal permission, the agency can proceed with the procedure.

- Finally, the borrower is notified about the seizing of the asset. They may be granted a period within which they may apply for appeal or ask for relief from the court, which may again depend on the law of the jurisdiction.

Thus, the steps mentioned above for offender levy are the usual process followed in the concept. However, if the asset seized is able to compensate for the loss of fund due to non-payment of loan amount, then the process concludes there. But if it does not, then there may be an additional procedure to collect more amount.

Example

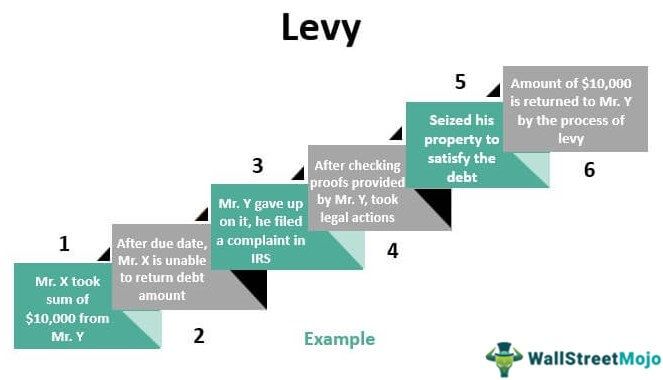

A levy is done by the bank or taxation authority such as the Internal Revenue Service (IRS). They might seize the property of the debtor to fulfill the debt. For example, Suppose Mr. X took $10,000 from Mr. Y, but even after the due date, Mr. X cannot return the debt amount. When Mr. Y gave up on it, he filed a complaint to the IRS with some legal proof. After checking the proof provided by Mr. Y, the IRS took necessary legal actions against Mr. X and seized his property to satisfy the debt. Thus, according to the levy law, the amount of $10,000 is returned to Mr. Y by the process of the levy.

How To Stop A Levy?

- Payment of Debts: If the debtor makes the debt payment before the property is seized, it can be stopped. However, it is not possible when the debtor is not in a financial condition to pay.

- Agreement of Payment with a Creditor: When the debtor makes the creditor negotiate an agreement of payment, the levy can be stopped.

- When it is declared that the Creditor made a Mistake: When a mistake is found on the creditor's side, it can be stopped.

- If the Statute of Limitations Expired: A statute of limitations means the creditor has to collect all the debts before the expiration of the statute of limitations, and if such a period is over, then the levy will be stopped.

- When the Funds in the Account of the Debtor are declared Protected: There may be some funds in the debtor's account which can't be used for levy, such as child support funds, social security funds, etc. Such types of funds are safeguarded against levies.

When Will The IRS Issue A Levy?

When the debtor cannot pay the debt even after being notified for any reason, it is final. The only option left for the IRS to satisfy the debt is then the IRS will send a notice of levy to the debtor 30 days before it and after fulfillment of the four main requirements. Then the IRS may levy the debtor's property, which can be done by levying the intangible property such as wages, dividends, retirement accounts, accounts receivables, life insurance, etc., as well as tangible property such as a car or house of the debtor.

Levy Vs Tax

Both the above terms refer to the some sort of financial obligation or different aspects of it. Let us understand the difference between them in detail.

- The former refers to the process of collecting or seizing of property or fee against the inability to meet some payment or financial obligation by a borrower or a party to a contract, which also involves a levy cost. But the latter is a payment that the government, or any authority collects from all individual citizens and corporates as charge against the usage of any public property of getting any government benefit or earning profit.

- The former is actually a compensation for the loss that the lender may incur if there is non-repayment of debt by the borrower. But the latter is a payment for getting benefits and is a compensation for loss.

- The former ensures that the lender does not lose funds in the form of bad debts and the latter ensures that there is a cash flow in the form of revenue earned from the collection of tax, which is used to fund for infrastructural development.

- It is a type of legal enforcement of lending rules, and the latter is a normal method of financing for infrastructural development.

- The former is not meant for all people but only those who are actually under the obligation of meeting a periodical payment. The latter is for all citizens residing within a jurisdiction.

Thus, the above are some important and noteworthy differences between the two financial concepts.