Table Of Contents

What Is Levered Free Cash Flow (LFCF)?

Levered free cash flow (LFCF) is the amount retained by a company after paying mandatory debts and financial obligations. It is the amount distributed among shareholders in the form of dividends. Alternatively, firms can control the amount for business expansion and generate higher returns.

LFCF can be positive or negative irrespective of a positive operative cash flow balance. However, a positive LFCF gains the investors' trust and increases a company's creditworthiness.

Key Takeaways

- The levered free cash flow (LFCF) is a financial indicator that reflects the money left with a business entity after clearing mandatory debts and financial obligations.

- Even if the LFCF is negative, the company can have a positive operating cash flow. Because sometimes, a negative LFCF is a mere indication of significant capital expenditure. But capital expenditure pays off in the long run.

- On the contrary, Unlevered Free Cash Flow is defined as the money possessed by a company before clearing debts.

- The formula to evaluate the LFCF is as follows: LFCF = Earnings Before Interest, Taxes, Depreciation, and Amortization + Net Change in Working Capital – Capital Expenditure – Mandatory Debt Payment.

Levered Free Cash Flow Explained

The levered free cash flow (LFCF) meaning implies a crucial figure in a company's accounting books. LFCF builds shareholders' confidence—it indicates that money is invested in the right place. Shareholders and investors rely on LFCF to gauge a company's long-term growth and ability to generate profits.

LFCF is the amount retained or distributed among the stakeholders as dividends—after clearing capital expenditure and mandatory debts. Moreover, firms use this money (if retained) for new projects, business expansion, and future opportunities.

The LFCF need not always be positive since it accounts for the deduction of capital expenditure. Capital expenditure can be a significant sum, but it pays off in the long run. Thus, negative levered free cash flow does not affect business operations—operating cash flow can still be positive. But, companies with good LFCF can easily seek credit from external sources. As a result, these companies easily gain the trust of reputed financial institutions.

Many businesses prefer to show levered and unlevered free cash flows (UCFC) on the balance sheet. A major difference between the two is that LFCF accounts for deducting all the mandatory financial obligations, whereas UFCF does not deduct debts.

Thus, LFCF is used by investors and shareholders to determine whether the firm has sufficient money for growth, expansion, and dividend payments. Meanwhile, UCFC is used by creditors and lenders to predict a company's future performance—ability to pay off debts.

Video Explanation Of Cash Flow

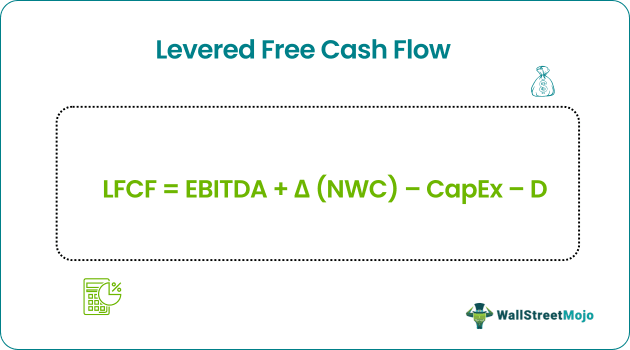

LFCF Formula

LFCF determines the debt-free disposable sum left with a firm after meeting its debt obligations. It is computed as follows:

LFCF = EBITDA + Δ(NWC) - CapEx - D

Here,

- EBITDA is the Earnings Before Interest, Taxes, Depreciation, and Amortization.

- ∆(NWC) is the Net Change in Working Capital.

- CapEx is the Capital Expenditure.

- D is the Mandatory Debt Payment.

Calculation Example

Three years ago, Lauren started a firm called ABC Ltd. with an initial investment of $250,000—out of which $50,000 was borrowed from PQR Finance—repayable in 5 years. The yearly debt payment was $10,800.

The firm purchased a manufacturing plant worth $150,000 in the first year and spent $45,000 on machinery replacement in the second year. The EBITDA for the three consecutive years was $50,000, $125,000, and $270,000. The net change in working capital for three years was $35,000, $12,000, and $60,000.

Now, based on the given values, determine LFCF.

Solution:

Let us first represent the above information on a table:

| Particulars | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| EBITDA | 50000 | 125000 | 270000 |

| CapEx | 150000 | 45000 | 0 |

| Net Change in Working Capital Δ(NWC) | 35000 | 12000 | 60000 |

| Mandatory Debt Payment (D) | 10800 | 10800 | 10800 |

- In the first year:

LFCF = EBITDA + Δ(NWC) - CapEx – D

LFCF = 50000 + 35000 – 150000 – 10800 = -$75800

- In the second year:

LFCF = EBITDA + Δ(NWC) - CapEx – D

LFCF = 125000 + 12000 – 45000 – 10800 = $81200

- In the third year:

LFCF = EBITDA + Δ(NWC) - CapEx – D

LFCF = 270000 + 60000 – 0 – 10800 = $319200

Thus, LFCF is negative in the first year, i.e., -$75800. This was down to high capital expenditure on a manufacturing plant. After that, the company's LFCF increased for the next two years: from $81200 in the second to $319200 in the third year.

Levered Free Cash Flow vs Operating Cash Flow

Although both are financial measures that aid investors and shareholders in decision-making, LFCF differs from the operating cash flow in the following ways:

| Basis | LFCF | Operating Cash Flow (OCF) |

|---|---|---|

| Meaning | LFCF is a firm's money after mandatory debt repayments and capital expenditure. | Operating cash flow (OCF) is an item on the cash flow statement that records the cash generated by the firm from its ordinary course of business operations. |

| Indicates | LFCF measures the company's ability to generate money to pay shareholders or reinvest in the business. | OCF determines the company's efficiency in making cash from its day-to-day business operations. |

| Formula | LFCF = EBITDA + Net Change in Working Capital – Capital Expenditure – Mandatory Debt Payment | Operating Cash Flow = Operating Income + Depreciation – Taxes + Net Change in Working Capital |

| Used By | Common and preferred equity shareholders. | Management, investors, analysts, and shareholders. |

| Impact | A negative LFCF may not affect business operations directly. | A negative operating cash flow affects the business functioning immediately. The firm is unable to meet its expenses from the sales revenue. |

| Accepted by GAAP | LFCF is a non-GAAP financial indicator. | It is mandatory to disclose OCF in company cash flow statements (Mandated by GAAP). |